Artificial Intelligence, Machine Learning and Financial Innovation

The Case for AI for Financial Services in Africa

Artificial Intelligence to Augment Ability

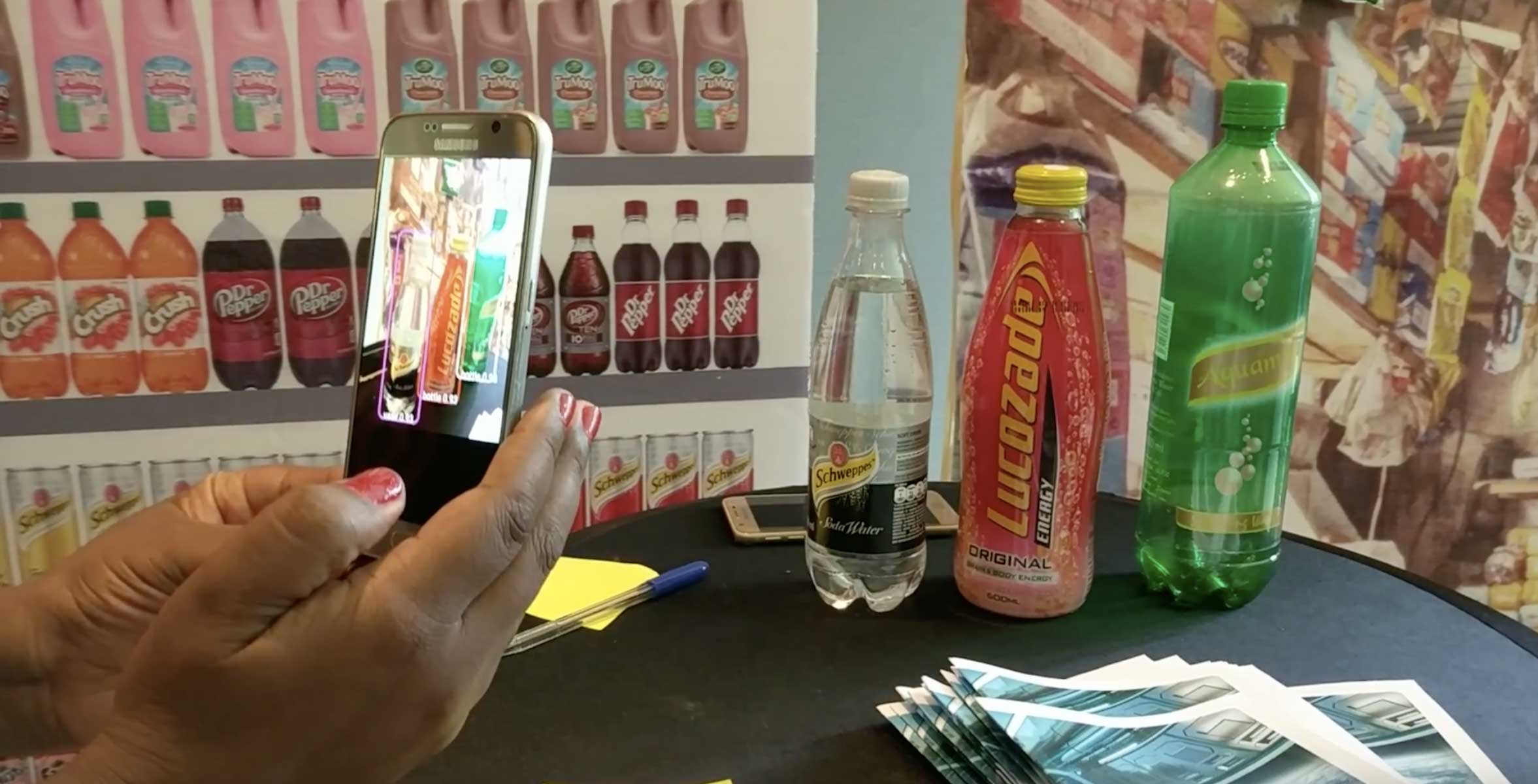

A PAYGo provider no longer has to conduct a lengthy field visit to assess whether to enter a new market. Instead, they harness their own data along with contextual data like access and usage of mobile money agents to analyze the business case. SME retailers no longer struggle with inventory management and restocking their shelves in a timely manner. Rather, they use a product recognition app to automatically notify their wholesaler when they need more inventory. Banks no longer have to conduct lengthy analyses to decide whether to make a loan to a small business. Alternately, they use satellite imagery to assess the business’ size and regular customer base to make a quick, low-cost decision on creditworthiness. These are just a few of the potential uses of artificial intelligence (AI) and more specifically, machine learning (ML), to change the landscape of financial innovation across sub-Saharan Africa.

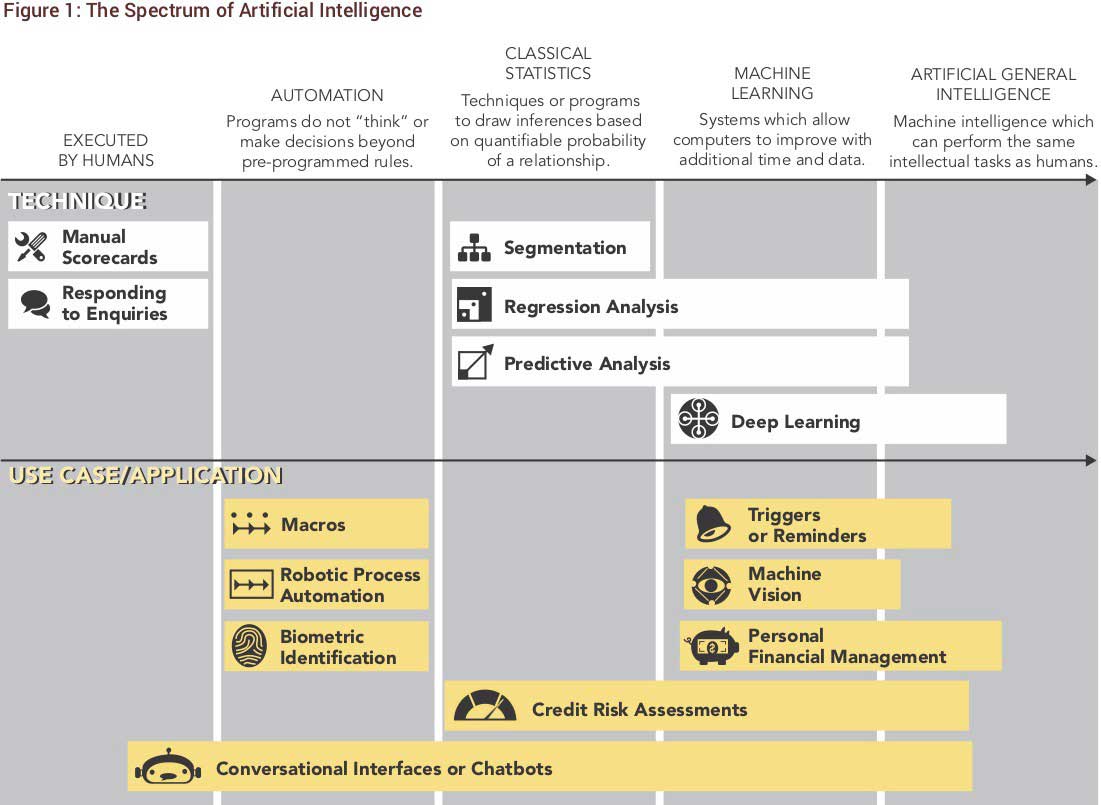

While digitization of the financial sector is inevitable, the use of data insights remains limited for now to generate cost savings through operational efficiencies, increase revenues through tailored product offerings, and differentiate through more customer-centric products in African markets. AI is one tool that can help financial institutions or PAYGO companies to leverage data towards these goals. The definition of AI is a moving target, but FIBR is focusing on applications that are already being automated, such as Robotic Process Automation (RPA) and ML, rather than Artificial General Intelligence which is still in its infancy. As much as possible, FIBR focuses on AI which can augment rather than imitate human intelligence, expertise and craftsmanship.

The Use Cases of AI in Financial Services in Africa

At FIBR, we are exploring these possibilities of AI applications with our program partners, and we are starting to see compelling, if early stage, examples elsewhere in the market in the areas of credit risk management, conversational interfaces or chatbots, personal financial management, and machine vision or speech recognition.

A Current Snapshot of AI in Sub-Saharan Africa

For credit risk management, several institutions are already using AI to make lending decisions. Branch and Tala, for example, utilize a wide range of data including behavioral information from phones, device details or call logs, demographics, social media information, airtime purchases, and financial transactions, to provide small credit directly to consumers. Both consider themselves ML-first in their approach. Others, like Lulalend, based out of South Africa, utilize ML to lend to small businesses by assessing the business’s health, predicting future income, and determining a business’s credit worthiness from several sources of data, including bank transactions and accounting platforms.

Conversational interfaces are another area where we see exciting innovations for expanding financial inclusion. While these can be particularly challenging in African markets given the breadth of local languages and dialects, a number of companies, such as FinChatBot, Teller and Kudi.ai, are tackling this challenge head-on given the potential benefits.

DataProphet, a South African company which provides B2B consulting and AI solutions to companies in multiple industries, has identified customer support to be the second largest cost of servicing customers and a key area for cost reduction in order to scale to larger volumes of clients. For this reason, it is working with insurance companies to manage customer inquiries with chatbots. Chatbots have the immediate benefit of streamlining data collection and other routine tasks, while in the future, they should make financial transactions more engaging for customers.

What’s Next? Practical Superpowers for Financial Services Providers

While these are just a few of the early examples coming out of the continent, we believe the spectrum of possible applications for AI to set institutions apart from competitors and to win over customers with thoughtful and relevant applications is an open field for incumbents and entrepreneurial financial providers. Many of the algorithms or technologies exist but are not yet available in practical forms which make them relevant to the needs of the partners we work with or to the customers or frontline employees that we wish to empower. Through the FIBR AI Gallery, we showcase AI applications for PAYGo companies and MSMEs that are available with the technology today, and that are in use or developed by BFA from scratch.

We encourage financial providers or PAYGo companies to think of these technologies as an opportunity to extend “practical superpowers.” In our new report, we outline the questions that executives should consider to integrate AI into their businesses and provide an AI readiness framework to effectively incorporate these technologies into their operations on a day-to-day basis. This is an exciting time for financial providers to consider and explore the value of AI to their businesses while better serving customers.

Want to learn more? Read the new report and explore the FIBR AI Gallery.