Can ‘PAYGo Finance’ Connect Investors to Low-Income Customers?

The Rise of a New Asset Class

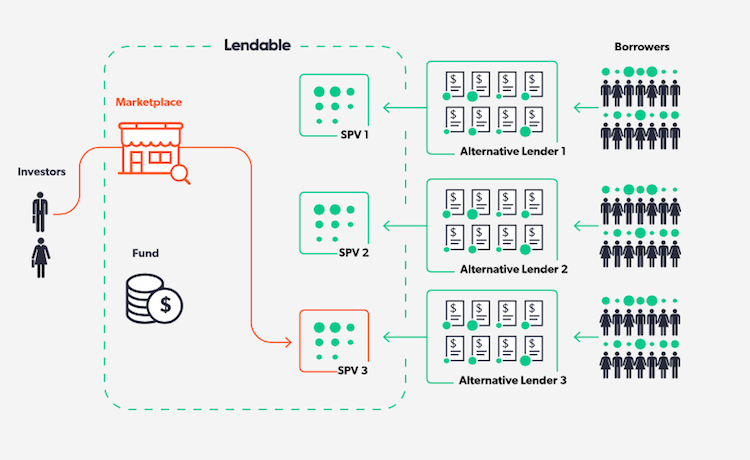

Alternative lenders in East Africa are connecting underbanked consumers with affordable, asset-backed financing that allows them to own productive assets, access credit and link to a range of pay-as-you-go services (PAYGo or PAYG), including energy. Notably, U.S.-based Lendable Inc. has pioneered a marketplace lending platform that connects these alternative lenders in East Africa (non-financial operating companies that use digital payment systems) with impact and institutional debt investors.

Lendable helps alternative lenders scale up their operations through access to technology-enabled structured financing deal services, including deal origination, due diligence, standardized documentation, payments administration and post-deal reporting. The company also facilitates customized deal pricing around principal, yield, duration and currency for alternative lenders and investors. So far, Lendable has structured financing for solar panel (click here for a related post) and motorcycle leasing companies in East Africa, where it estimates that, by 2020, the alternative lender market will reach USD $15 billion.

THE POTENTIAL MARKET FOR SOLAR ENERGY

Structured asset-backed financing has strong potential to bring clean energy to residents of developing countries. According to recent estimates, 1.2 billion people — about one-sixth of the world’s population — live outside their country’s electrical grids. Currently, approximately 1 million people benefit from off-grid solar power — that’s less than 0.1 percent of those living off-grid. The potential of this untapped market is considerable. When households access solar energy and move from candlelight to electric lighting, or from polluting wood- and coal-burning stoves to electric stoves, their quality of life is greatly enhanced. Access to off-grid solar power may also prompt them to acquire refrigerators, radios and televisions. The potential of these improvements and the associated reductions in climate-affecting pollutants could provide significant benefits to low-income individuals, their communities and their countries.

A MARKETPLACE LENDING PLATFORM TO CONNECT LENDERS AND INVESTORS

The Lendable approach to data analytics builds predictive models on the probability of repayment of the receivables it finances on leased assets, such as solar panels and motorcycles. The platform approach offers several innovative vehicles for lenders and investors:

- A forex (FX) buffer. Since Lendable investors finance in U.S. dollars while the underlying loan portfolios are in local currency, the company offers lenders the opportunity to set a foreign currency depreciation buffer that absorbs FX risk on each deal, before that risk affects repayment of foreign debt financing. To limit FX risk, lenders pay a higher interest rate on their financing.

- Flexible terms for lenders. Three pricing options are designed to optimize the interest rate offered as a function of the advance rate, i.e., the amount of funding advanced on the receivables financed. The greater the advance rate, the higher the interest rate lenders pay — and vice-versa.

- Real-time loan-level MIS for investors. Real-time management information system (MIS) reports provide loan-level granularity. Lendable links its risk engine to client management information systems, and through a trusted third-party local service provider like a telecom, payment aggregator or payment gateway, tracks assigned receivables payments in real time.

- Risk engine for analysis and pricing. Lendable has developed strong predictive capabilities on the likelihood of repayment of individual receivables. Through its sophisticated risk engine, receivables are cherry-picked and assigned to their investment vehicles as collateral for debt financing repayment. Results are highly encouraging so far. As of March 2017, Lendable has run its risk engine on 300,000 loans created by seven lenders and all results have fallen within the model’s confidence band. The average error at nine months of transaction performance was just 1 percent.

RISE OF A NEW ASSET CLASS: PAYGO FINANCE

Providing alternative lenders with structured debt financing could potentially give rise to a new asset class of PAYGo receivables. To constitute an asset class, PAYGo receivables would need to:

- Be recognized as a distinct asset class

- Give rise to a market of sufficient size

- Offer asset diversification

- Produce consistently high portfolio quality

- Offer investors risk-correlated returns

If successful in raising funds from investors at scale, the Lendable approach could bring financing for low-income individuals full circle. A predictive, risk-based approach would allow for low-touch methods with customers that financial services providers can use to originate and manage portfolios. To scale the platform, Lendable would need to ensure robust performance in its underlying receivables portfolios and operate in countries where an enabling environment would attract investors.

The latest FIBR Briefing Note “Lendable: Case Study of a Marketplace Lending Platform in East Africa” elaborates further on the new platform and PAYGo financing as a new asset class. In the past months, we have been working with Lendable through FIBR, a project by global consulting firm BFA, in partnership with Mastercard Foundation. FIBR brings together fintechs and banks to partner on using networks of small businesses to deliver digital financial services to low-income customers. The PAYGo sector and the data generated could advance fintech solutions for low-income customers using the FIBR approach. Thus, we will continue to explore PAYGo finance in the coming months.

Learn more by following @BFAGlobal on Twitter.

Author Jim Kaddaras is an international lawyer and consultant in the development finance field