Meet Catalyst Fund’s Newest Game Changers

Introducing the newest cohort of Catalyst Fund

Fintech innovations are breaking new ground every day. We are in awe of the new fintech products and services that meet the needs of low-income customers in emerging markets. If you have been watching the fintech space, you know there is a lot to be excited about and also growing concerns about whether we are “losing sight of poor customers in the excitement around tech and innovation”.

At Catalyst Fund, we are excited to announce the four newest members of our accelerator program that are breaking new ground in providing solutions that are relevant for the poor. These four startups were accepted into our latest cohort because of their intentional focus on low-income customers, their unique value propositions that create meaningful products and services that are relevant to them, and for their deliberate use of technology to reach customers living in low-tech, low-trust, low-resource, last-mile environments.

Examples include a free, cross-border, interoperable mobile money platform in Sub-Saharan Africa; flexible health loans and health credits provider, in Africa; an advanced, tech-enabled communication platform for traditional financial institutions in Southeast Asia and Africa; and a savings and investment platform for low-income people in Latin America.

Meet these four game-changing innovators and follow their progress on our blog:

1. Turaco provides low-cost, simple, accessible insurance products to low-income customers who struggle to cope with financial shocks. With insurance payments as low as $2, Turaco leverages the growth of mobile financial services to provide hospital cashback to customers who were treated at any nationally accredited hospital in the regions where they operate. Turaco is solving the problem of insurance for low-income people.

In Sub-Saharan Africa, 14.2 million people are pushed into poverty due to health expenses since the vast majority lack access to insurance to help cushion these shocks. Most low-income people struggle to manage their expenses from one day to the next, and expenses from illness and health problems can be catastrophic. The opportunity is huge: in Kenya alone, fewer than 22% of the population has insurance and the total addressable market in Africa is roughly 89 million Africans.

Turaco partners with businesses to provide accessible insurance products to blue-collar workers as a B2B service. The payments are automatically deducted from employee salaries, improving employee retention and leveraging the employee-employer relationship to build trust in Turaco.

2. Chipper Cash enables free, peer-to-peer (P2P) mobile money transfers across Sub-Saharan Africa regardless of carrier or mobile money provider. Chipper’s affordable product creates profound value for low-income customers by allowing them to easily transact instantly without a fee.

Chipper’s services benefit low-income people in Sub-Saharan Africa who work as migrant laborers throughout the region. These people struggle to send money home, which their families depend on to pay rent, utilities, and tuition. Although mobile money accounts in the region totaled 277M in 2016, high transfer fees and lack of interoperability make remittances difficult. The response to Chipper Cash has been remarkable; since its launch in 2017, they have on-boarded over 40,000 customers in Ghana, Kenya, Tanzania, Rwanda, and Uganda. Chipper is committed to significantly improving access to critical financial services to over 1 billion people living in Africa.

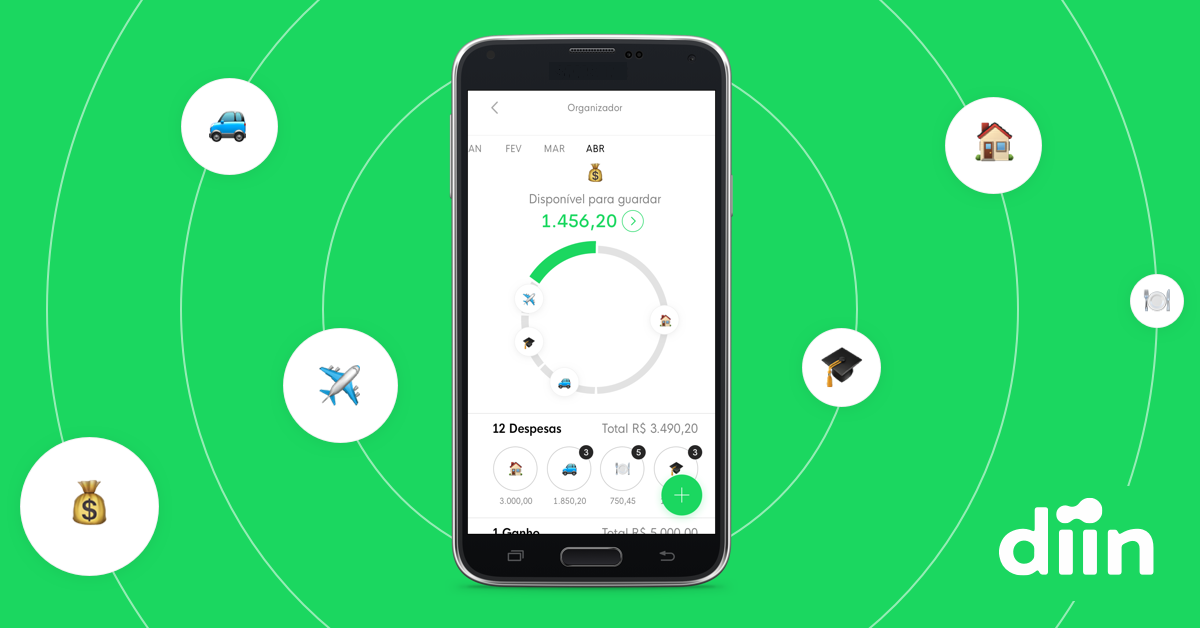

3. Diin is an investment platform for low-income Brazilians that incorporates customer-centric, behavioral nudges to maintain frequent contact with its users. Specifically, Diin helps users set savings goals, create a savings schedule, offers financial management tips, and invests clients’ savings in public bonds and other funds to provide returns to clients.

By reducing decision-making responsibilities, Diin has created an appropriate product for first-time savers. Low-income people struggle to save money as they balance urgent expenses and low, inconsistent incomes. However, Diin, is out to change this narrative to build a strong savings culture among the middle- and low-income population in Brazil, starting in Sao Paolo. Moreover, minimum investment amounts are extremely low (as low as USD$0.25), giving customers peace of mind as well as financial returns. Diin is determined to change their customers’ relationships with money!

4. Salutat is a customized communication platform that helps traditional financial institutions improve customer-relationships and customer engagement. Salutat uses advanced technology to help traditional financial institutions better understand and connect with low-income users through a more appropriate communication tool.

As digital-lending fintech companies in emerging markets are growing and offering user-experiences that customers want, brick-and-mortar microfinance institutions (MFIs) are struggling to keep up and are losing customers. Salutat enables personalized, two-way chats with customers, and organizes chats sent via WhatsApp and Facebook Messenger into formats ready for analysis. Salutat uses behavioral science to enhance conversations between loan officers and end-customers, reducing the need for many face-to-face interactions and phone calls. This decreases the service cost and improves service levels.

As the newest companies to join Catalyst Fund’s acceleration program, we look forward to enabling their growth and journey toward product market fit using our proven strategies and tools. We will help them refine their value proposition, develop relevant proof points that investors want to see, and share the AAA (appropriate, affordable, and accessible) framework to help them assess their potential for impact and inclusiveness.

Low-income customers in emerging markets have growing needs and demands that need our attention. These startups are filling this gap with impactful tech-enabled solutions that meet those needs. We’re thrilled to welcome them to our growing portfolio of inclusive fintech startups! Learn more about our other startups at https://catalyst-fund.org/cohorts.

Read more about these companies on TechCrunch’s feature of Catalyst Fund.