Navigating economic storms: Understanding resilience in Mexico’s MSE

Carmen, the owner of a small craft store with no employees, demonstrated remarkable resilience in the face of rising inflation. Recognizing the importance of adaptation, she implemented digital tools to expand her market, creating an online store to sell her products. This decision, financed by her savings, not only offset the impact of inflation but also attracted new clients.

On the other hand, Maria, who ran a medium-sized grocery store with one employee, struggled when she lost her leading supplier of raw materials. Inflation and lack of access to an emergency loan further complicated the situation. Without the necessary tools and support to adopt digital strategies or find supply alternatives, she was forced to increase prices, eventually driving away customers and tanking her business. These contrasting stories highlight that not only the level of income and the size of the companies determine the success or subsistence of micro enterprises but also that resilience and adaptation in businesses are decisive, especially in times of high uncertainty.

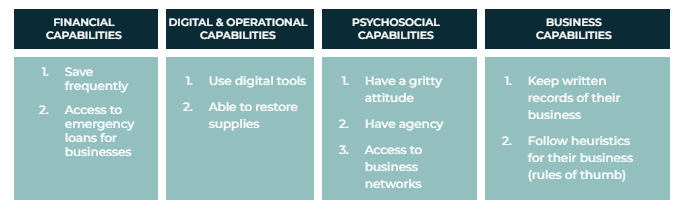

The ability to manage and recover from emergencies or unexpected expenses defines whether a micro and small business (MSE) is resilient, but measuring and improving that resilience is complex because it depends on a set of strategies, from saving money in the mattress to more sophisticated techniques, such as purchasing insurance against theft. Therefore, we decided to develop a framework to measure resilience by considering four capabilities: financial, operational and digital, business, and psychosocial.

The framework measures financial capabilities through financial inclusion and savings behavior; digital and operational capabilities are analyzed based on the adoption of digital tools and the ability to find input suppliers. Entrepreneurial capabilities are approximated through rules of thumb or heuristics to manage businesses and record keeping in crucial aspects, such as sales, debts, or bill payments. Finally, psychosocial capabilities are evaluated based on access to business networks, grit, agency, or sense of control.

In September 2023, we surveyed 400 microbusinesses to assess their resilience as part of the Strive program learning agenda. The program asks questions such as: What level of resilience does a Mexican MSE have? How does the resilience of an MSE vary depending on the demographics of the owner? What are the emergencies that MSEs usually face? What are the most common survival mechanisms used when facing a crisis? How effective is savings in promoting a rapid recovery? compared to other mechanisms?

The survey revealed six insights about surveyed MSEs.

- MSEs face emergencies often, as all indicated having suffered an unexpected expense equivalent to at least 25% of their profit in the past year. Low demand, illnesses, and price increases were the main challenges to a steady income.

- Unexpected expenses or emergencies were acute in six out of 10 companies when enterprises indicated their income had dropped by at least half. Moreover, one-third reported not having recovered from that adverse event, and another third said recovery took between one and six months.

- The predominant strategies for managing and overcoming unexpected expenses are using savings, reducing business expenses, reducing household expenses, extending work hours, and resorting to loans. Savings and loans are the most effective mechanisms for a speedy recovery. These aspects highlight the need for formal, affordable, and accessible financing options, as well as increase savings to build resilience.

- The research found a positive association between resilience, as measured by the time it takes to recover after an unexpected expense, and MSEs run by younger people and those with higher levels of education. Over 80% of businesses that recovered in less than a week had at least one employee. Profits and the size of the business were also positively correlated.

- We built indices to understand the robustness of each pillar and compare them with each other. The scale of these indices ranges from 0 to 100, in which a higher number means a more robust capability, from a scenario of 0, in which MSEs don’t possess any degree of capability under evaluation. The surveyed MSE obtained better results in the pillar of psychosocial capabilities. MSEs scored 69 in the psychosocial pillar. In particular, the grit and agency achieved scores above 65. These results compare favorably with those in financial capabilities (41 points), digital and operational capabilities (39 points), and entrepreneurial capabilities (50 points). These should not be surprising since more than half of the microbusinesses surveyed survived Covid.

- Adopting more digital tools was positively associated with accelerated recovery from unexpected expenses. In particular, MSEs that use at least three digital tools manage to recover faster.

The report Navigating Challenges: Assessing MSE Resilience in Mexico explains this research in more detail. It is relevant as it seeks to promote focused interventions and specialized solutions to strengthen the resilience of Mexican MSEs. BFA Global is applying this framework with different Strive Mexico program allied organizations. These efforts aim to make Mary’s story an exception.

This research is part of the Strive Mexico program, generously supported by the Mastercard Center for Inclusive Growth.