IndiaStack can help India recover from COVID-19, but execution is critical

COVID-19 has quite literally brought the world to a halt. Like many, the Indian government moved decisively and in stages. A three-week lockdown of the country that began on March 25 has since been extended thrice, to the end of May. The lockdown resulted in some unintended consequences: over 100 million migrants trying to get home, many on foot; farmers struggling to get their produce to market; and millions of jobs lost (CMI data says over 110 million people are without work, and the lockdown cost 27 million youth their jobs in April alone).

In an attempt to flatten the curve, the economy has also flattened. But the good news is that both the government and the private sector have stepped up their game and are fortunate to have an existing digital infrastructure on which to build their responses. IndiaStack, a world-class tech and data infrastructure that puts India among the most digitally-forward governments in the world, has been at the center of COVID-19 responses, enabling digital transfers, data-driven targeting, and the growth of e-commerce.

While the Stack is clearly an unparalleled foundation for government and private sector responses to COVID-19, executing on its advertised capabilities will be the true test of its effectiveness; early signs are good but there are challenging times ahead.

What is IndiaStack?

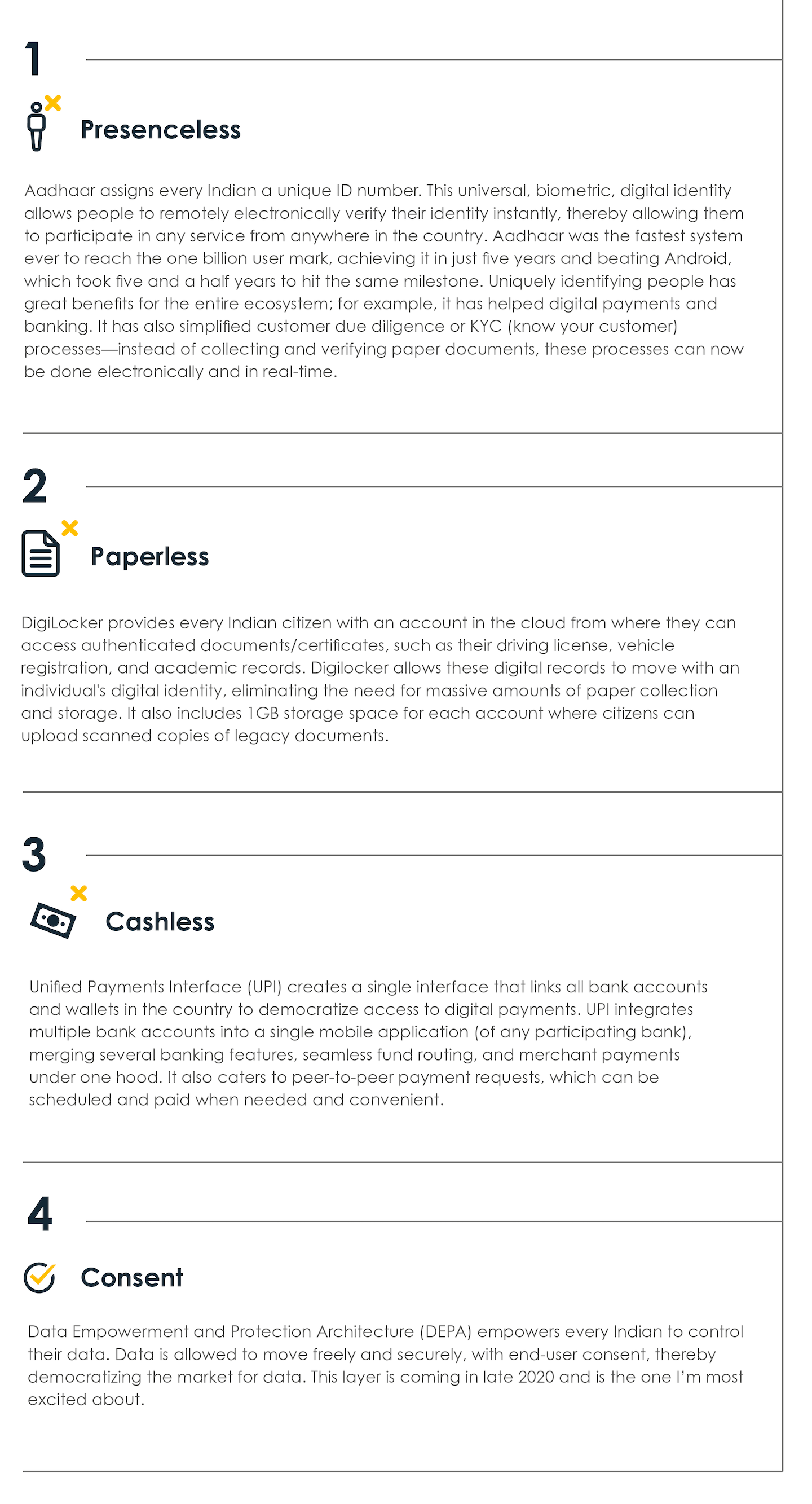

IndiaStack is a set of APIs that allows governments, businesses, startups, and developers to utilise a unique digital infrastructure to solve India’s hard problems and enable presenceless, paperless, cashless service delivery with consent.

The four distinct layers of IndiaStack are:

Over the past few years, IndiaStack has laid the foundation for the government to drive a digital banking agenda, and with positive results: since 2014, 384 million new bank accounts have been opened under the Pradhan Mantri Jan Dhan Yojana government scheme. Furthermore, using the Aadhaar payments bridge system, the government has launched over 430 schemes (both new and existing subsidy schemes) to provide subsidies digitally.

These efforts have also driven digital banking uptake in the private sector. As of October 2019, digital payments in India had surpassed a billion transactions per month. This milestone reflects the tremendous growth of services offered by some of the world’s biggest companies including US giants like Walmart, Amazon, and Google, and Chinese giants like Alibaba (Ant financial) and Tencent, all battling for supremacy.

As all attention has turned to COVID-19, IndiaStack has provided a useful foundation for both public and private response measures, though they are currently being executed in silos.

Government COVID-19 response is growing, but execution is troubled

The first priority for the government is cash transfers, given the immediate fall in income experienced by the most vulnerable. In the second week of April, the International Labour Organization (ILO) estimated that 400 million workers from India’s informal sector are likely to be pushed deeper into poverty due to COVID-19, potentially doubling poverty rates in India. These estimates pointed to the urgent need for cash transfers to ensure basic needs can be met, as people are unable to work.

Fortunately, given the IndiaStack, the government is well positioned to make direct benefit transfers (DBT) directly into people’s bank accounts using digital transfers. To that end, the Finance Ministry unveiled a INR 1.70 lakh crore (~US $22 billion) economic package over two months ago, on March 26, to provide free food grain and cooking gas to the poor for the next three months.

Amidst calls for a stimulus package of at least 5% of GDP to reboot the economy, Prime Minister Narendra Modi recently announced an additional INR 20-lakh-crore (~USD 263 billion) stimulus package (among the largest in the world) on May 11, equivalent to about 10% of India’s GDP. He noted that the package aims to make the country self-reliant (given stalled trade) and revive the stalled economy.

There are several questions as to whether these packages will be effective. The first is whether the package is large enough. While the measures are many, experts have asserted they are insufficient. On April 10, the Right to Food Campaign (in reference to the original package) said the current economic package is “hugely inadequate” in responding to the need, adding that free grains and pulses have not yet reached most states. The original package was just ~1% of India’s GDP, whereas the United States stimulus package amounts to ~15% of their GDP. The additional measures certainly increase the stimulus but questions still remain as to whether it will be sufficient.

The second question about efficacy is whether this and other relief efforts will be adequately delivered and distributed. This is where the IndiaStack comes in, and it should – in theory – enable excellent execution. Unfortunately, there have already been operational issues in its delivery; for example, 2 million people in 3 states were denied rations due to Aadhaar issues. Additionally DBTs have been plagued by several exclusion errors such as inability to access the formal financial system, administrative errors in identity documents, errors in Aadhaar seeding, last-mile bank linkages, authentication failures and poor targeting and denial of welfare benefits for needy households – all of which need to be urgently ironed out.

To improve execution, government needs to err on the side of inclusion. Ensuring access to all, even at the cost of lessening controls, will be critical. Now is not the time to decide someone who has spent two hours in a queue is ineligible for aid because of bureaucratic errors or inadequacies. In these challenging times, let us assume that those who are not needy will self-select out by not joining the queue. In addition, government needs to do more to stamp out black market racketeering. Alekh Sanghera, CEO of Catalyst Fund portfolio company farMart, has suggested the government consider a Universal Basic Income as an alternative to managing a myriad of schemes.

Even with these issues, India has leapfrogged many developed countries in creating a digital infrastructure, and this foundation provides the government with several options for targeting and delivering relief. In contrast, where this infrastructure doesn’t exist, relief is delayed and erroneous. For example, most Americans are receiving their US$1,200 payments via paper checks sent in the mail, many of which haven’t arrived due to postal issues, even as others have received it twice and some non-citizens have received checks too. With the IndiaStack foundation, this pandemic is India’s chance to get its priorities right and help get people back on their feet, potentially making a huge dent in poverty rates. As Banerjee and Duflo have pointed out, it needn’t be a catastrophe.

Private sector COVID-19 response is making extensive use of IndiaStack

While the jury is still out on whether the government will be able to take advantage of the IndiaStack superpowers, the private sector efforts seem to be showing more promise. Now that no one wants to transact in cash or in person, on-demand services such as grocery delivery and restaurant delivery are gaining major market share, all on the back of UPI payment rails. The potential for uptake is seemingly limitless, and innovative startups have been at the forefront of bringing the benefits of digital commerce to people trying to maintain social distancing.

“The Fintech opportunity is remote – and it’s NOW!” Sanjay Swamy, Managing Partner – Prime Venture Partners, April 2020

For example, one such service is StoreSe, a new grocery ordering platform launched for apartment communities in Bengaluru and other cities across India. StoreSe was built within days of lockdown, and they partnered with major offline retailers and cab drivers via leading cab aggregators to help people get their hands on essential items by enabling smooth and quick deliveries. Integrating into UPI to collect payments was a critical piece of the puzzle. In the first seven days of operations, StoreSe ensured over 95 percent fill rates (average percentage of items delivered for every order), along with a guaranteed delivery within 24 hours.

To date, most of these startup success stories have been concentrated in urban areas, among middle and upper class consumers, and larger, digitally-savvy retailers. However, startups are looking for ways to bring the benefits to low-income, rural populations as well:

- BharatPe, an India-based payments company, which offers offline retailers and businesses (including SMEs) the ability to collect payments digitally (primarily via UPI), recently launched two new features in its app to avoid the need to touch handsets in order to check transactions. BharatPe expects to disburse loans of around INR 700 crore (~USD 92 million) also via UPI in the next five months, as the demand for capital by shopkeepers is set to rise.

- Catalyst Fund portfolio company FarMart, a customer service app for agri-input retailers, is working to provide seeds and other inputs as grants via their merchant network to migrant laborers who have returned to their villages, so they can start farming. FarMart is leveraging UPI to disbursed funds electronically.

- Another Catalyst Fund portfolio company, Chennai-based payAgri, is seeing increased demand from farmers who rely on their digital platform to sell their produce directly to buyers. PayAgri connects farmers with retail businesses and provides them financing with a goal of optimizing the agriculture value chain. Since the outbreak, farmer producer companies, government authorities and e-commerce platforms have all asked payAgri to step in to aggregate fresh produce from farmers and deliver it to consumers.

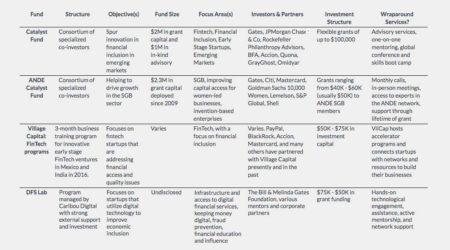

While it is still early to comment on these efforts, these are exactly the types of innovations impact investors and donors should be supporting to enable market access and growth among farmers and SMEs. Agile, inclusive fintech startups are well-positioned to create new solutions that meet people’s needs, but they need resources and support to do so.

Similar challenges to executions will arise in the private sector as they have in the public sector, but startups are culturally set up to resolve issues at a fast pace, as they live and die by how well they execute. As such, I anticipate that startups will be well able to adjust and resolve problems as they arise, thus increasing their chances of not only surviving the crisis but taking advantage of the opportunities in front of them.

It is also worth mentioning that startups will not be able to do their valuable work if there is not financing available to fund their growth, pivots and testing. As investment flows dry up given uncertainty and risk aversion, many startups with good ideas lack the funds to iterate, roll out, and expand. Catalyst Fund startups are demonstrating the power of this kind of innovation, and we are supporting them as they find new ways to benefit the underserved. For example, Catalyst Fund is supporting Sokowatch, a cohort company from 2018, in leveraging its e-commerce platform to get food and essential goods to the most needy in Nairobi.

Looking forward, can COVID-19 drive the next wave of UPI adoption?

Indian digital payments took off when the government pushed demonetisation in 2016, driving the first wave of digital adoption (with UPI acquiring over 100 million users and accounting for over half of all digital payments in India). Can COVID-19 drive the next wave?

At an ecosystem level, one major barrier to keeping money digital and promoting digital payments is user experience on over 500 million feature phones in India (which accounted for less than a million out of over 1 billion UPI transactions per month). On the face of it, UPI was designed for smartphones (e.g., UPI handles are like email addresses, for example yourname@icici or MobileNumber@icici), leaving most users with feature phones struggling with the syntax. As a result, this population tends to withdraw funds immediately and transact in cash.

Pre-COVID-19, initiatives were underway to find solutions with the NPCI rolling out a challenge to expand UPI to feature phones, in collaboration with startup incubator CIIE.CO and the Bill and Melinda Gates Foundation. Recently, three winners were announced. However, adapting the UPI platform for feature phones is not going to be an easy task, as account addressing conventions were designed for smartphones. That said, such retooling is absolutely essential to keeping the money digital and allowing feature phone users to participate in the wider digital ecosystem that is growing at a fast pace.

Another barrier is adoption of digital payments among MSMEs, who pay as much as 4% for a one-day working capital loan. So far, nearly 50% of MSMEs have adopted digital tools for business processes, payments and online sales, but those were easiest-to-reach stores, in urban areas and with smartphones. To reach the remaining half, additional investment will be needed to overcome several critical business challenges such as credit deficits, unskilled labour, complexity of taxation, and merchant education. The recently announced Facebook-Reliance Jio partnership plans to target MSMEs and could help, but it will not be easy.

Now that both private sector and government response efforts have been announced, it’s all down to execution — will the benefits of these response efforts reach their intended targets? And more importantly: can the government and private sector, particularly nimble start-ups work together to solve some of these challenges and demonstrate the power of digital stack? IndiaStack has been 10 years in the making and with over a billion users has achieved unprecedented scale. How the history books remember India’s COVID-19 response thanks to its digital infrastructure will all depend on execution.