How social entrepreneurs can strike partnerships with big companies

Image: REUTERS/Krishnendu Halder

It can take a lot of effort to get partnerships with big companies off the ground.

Sebastian Ugarte, CEO of inclusive fintech startup, Destacame, had started to lose hope. For the tenth time, a customer relationship manager at one of the largest banks in Chile had told him to present his partnership proposal to yet another colleague, in another department, in another building.

For the tenth time, a customer relationship manager at one of the largest banks in Chile had told him to present his partnership proposal to yet another colleague, in another department, in another building.

Over the previous six months, Sebastian had been to the bank’s offices many times to meet with various relationship managers, VPs, heads of business development, even top management and CEOs. While the value of the partnership seemed compelling to everyone he talked to, Ugarte still did not have a signed contract.

He was trying to structure a partnership in which Destacame’s technology would harness alternative data to assess the creditworthiness of potential borrowers, who were previously invisible to the formal banking sector. Using electricity or water bills as a form of data for credit histories, Destacame would enable the bank to reach bottom of the pyramid customers at lower acquisition costs.

At the Catalyst Fund — which supports fintech social enterprises in Latin America, Southeast Asia and Africa — most of our 15 portfolio companies are fintech social enterprises, like Destacame, that seek to partner with financial institutions to reach lower-income customer segments in emerging markets.

These arrangements allow each partner to capitalise on their strengths. The startups offer flexible and agile processes to improve user experience, while the banks bring robust infrastructure, large customer bases, and recognised brands.

We have seen many such partnerships emerge across geographies, such as Kopo Kopo and Diamond Trust Bank in Kenya and Uganda, or Artoo and Ujjivan in India, whose collaboration serves small retail merchants or micro, small and medium-sized enterprises (MSMEs) with appropriate financial tools to grow their businesses.

While the opportunity is clear, the bad news for growing social enterprises is that closing a technology partnership is time-consuming and risky. It took Ugarte nearly 10 months to get the partnership contract signed, and it could have taken longer.

Some social enterprises may be able to endure the long time horizons, but for many early-stage ventures, investing in a partnership with a larger, better-resourced player, with extensive due diligence and decision-making processes, may be a deal-breaker. These delays can be a death knell for early ventures that do not have the time or capital.

Based on our experience at Catalyst Fund, here are some tips for tech social enterprises looking to partner with large companies:

1. Know the partner’s deadlines

Identify the big milestones, internal projects and timelines of the organisation. When does the budget year start and end? When does the board meet? When are big decisions made? Understanding the organisation’s deadlines will help make sure you get your deliverables in time for important events and key moments.

2. Make sure you’re talking to the right people

Understand who’s who in the organisation and adjust your pitch depending on the person sitting in front of you. An IT manager will care about very different things from a CFO, CEO or an HR manager. A one-size-fits-all presentation is not going to be compelling. Use targeted approaches to cultivate champions in the organisation who can drive the partnership forward.

It’s important to figure out not just the #1 decision-maker but also #2, and #3 and #4 decision makers. Atikus, a tech startup offering a suite of digital loan management tools to financial institutions in Rwanda, learned that staff turnover is frequent at smaller financial institutions in emerging markets and having several supporters within the organisation also reduces the risk of the process derailing with employee churn.

3. Offer pain relievers, not vitamins

Understand each decision maker’s pain points and how far they are willing to go to relieve them. Remember that “vitamins” or performance enhancers, are less urgent and will entail a longer sales process. In many large corporations, employees are focused on their own targets and pains, and they are not empowered to go the extra mile for institutional goals.

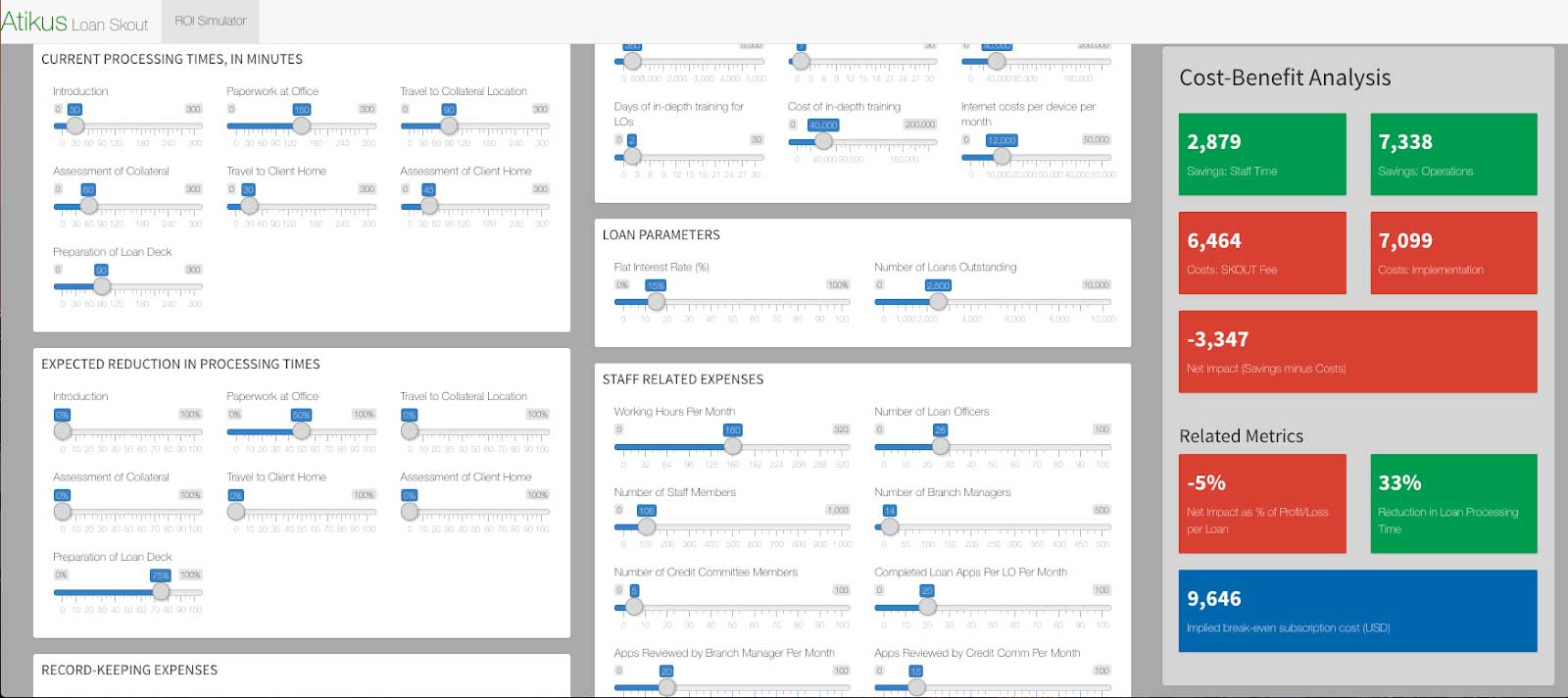

4. Show impact on the bottom line

Make sure you have a strong business model to demonstrate positive impacts on the bottom line. Does your startup help lower operational or overhead costs? Increase opportunities for cross-sell and upsell? Increase customer’s lifetime value and retention? Decrease risks? For example, Catalyst Fund worked with portfolio company, Atikus, to build an ROI simulator that illustrates the impact of their product on a client’s bottom line.

5. Show, don’t tell

Startups are often on the weaker end of the bargaining table, so strengthen your hand by demonstrating past experience, giving live demos, showing evidence of your ability to deliver, and illustrating your understanding of bank processes and regulations. Identifying the risks for your partner and demonstrating how robust your solution is will de-risk the decision for them.

6. Speak their IT language and offer a painless integration experience

Integrating technology with legacy systems can be nightmarish because startups need to tweak their products for each client, or go as far as building a fully customised solution. Destacame, for example, provides tailored solutions to its partner banks, which adds time and cost to partnership development but ultimately keeps the partner satisfied.

Show that you understand the implications of a technical integration and potential overhaul of systems. Provide as many details as possible on the implementation roadmap, IT requirements, time to integration, and any technical changes the partner might need to make to benefit from your product or service. Show that you are flexible and how you will resolve friction points and bumps in the process.

7. Help predict internal changes

Show how your solution will affect the bank’s internal processes, management, and staffing, so leaders know the implications of adopting your solution for all parts of the firm; if re-training will be needed, new jobs, or fewer jobs, etc.

8. Be prepared for long time horizons

Our CEOs report that partnerships with incumbents can take a very long time, which can be a deal-breaker for startups that do not have sufficient resources. A large corporation will likely have to work up the approval chain and get inputs from several people within certain timeframes, before being able to embrace innovation.

For example, Atikus took over a year to convince a financial institution to pilot their solution. Knowing their own limitations, Escala Educacion ruled out any institution with complex processes and lengthy internal approvals when they were searching for a partner in Colombia. They first approached a large bank, but quickly switched to a more nimble savings fund to build a partnership to extend long-term educational savings plans to middle-income families in Colombia.

Finally, a word of caution: not all partnerships are valuable. Startups need to carefully understand the potential of a collaboration by analysing mutual benefits and determining which processes and priorities will dominate the relationship. Our partner, Accion Venture Lab, offers additional strategies for “Enterprise Sales for Fintech Products and Services.”

Destacame learned from its initial partnership challenges and now has over 26 bank partners in Chile and Mexico, more than 500,000 users, and its numbers keep growing. We hope to see many other tech ventures like them thrive with successful partnerships for social innovation that significantly improve the lives of underserved populations.

(Originally published on World Economic Forum)

![[Press release] Catalyst Fund announces its latest cohort of companies bringing inclusive fintech solutions to underserved communities](https://bfaglobal.com/wp-content/uploads/2021/07/Crop2Cash2-450x250.jpg)