Case study: Destacame experiments to improve credit approval rates, debt collections, and credit scores

Challenge

How do you react when the basic value proposition of your startup is not delivering?

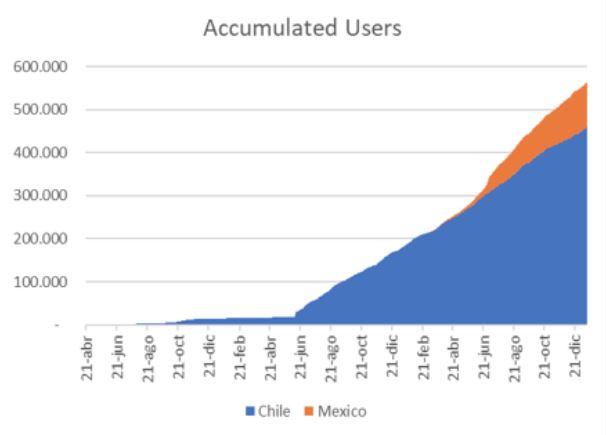

Destacame was originally conceived as a free online financial management platform that allows people to take control of their financial data, to improve financial capabilities, and improve access to better financial products. Destacame targeted middle-income, working adults, and operated functionally as an alternative credit scoring company using non-financial data to serve that mission.

Destacame built alternative credit scores for users based on non-financial data, but when users would apply for credit products, primarily with larger banks, the rejection rates were sky high. The purpose of financial empowerment was rebutted by the rejection of Destacame users when applying for credit.

Action

Destacame had built relationships with financial institutions who used the platform to offer financial products to individuals. Leveraging those relationships, Destacame received feedback from a credit bureau executive that pushed them in a new direction. Destacame needed to show the users their other, traditional credit scores to further educate the users about the state of their financial health.

In June of 2016, Destacame added the option for users to view their traditional credit score with apprehension. The Destacame value proposition was to use data outside of the traditional score and feared users would their frustration with poor conventional credit scores at Destacame, the messenger. The fears were unfounded as the user experience explained in simple terms what the issues were for reducing credit scores. Armed with this new knowledge, users began to ask for further information and aid on improving their credit score. A large detriment to a credit score is overdue debt and Destacame logged growing demand via customer support for a way to settle their old debts in order to access better credit products.

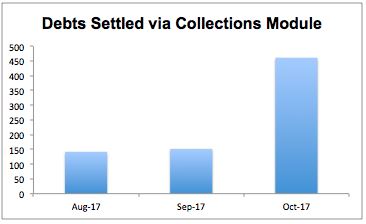

This led Destacame to launch their collections module in August 2017. By signing contracts with financial institutions to additionally act as a collection agency, Destacame added the simple collections module to the existing platform. This added a new revenue stream to the Destacame business model. When users view products with outstanding debt within the platform, they have an option to resolve and settle the debt via a three-click process.

- Users view their products with outstanding debt

- Users view an offer of discounted settlement from the debt-holding financial institution

- Users gives consent for Destacame to share their current contact information with the financial institution and to be contacted to resolve the debt at the rate within the offer

Contracts with financial institutions are required to display the offers. Therefore, the more contracts with large firms in the credit industry, the better Destacame serves its user base.

Three months after the module launch, Destacame signed contracts with three new financial institutions, allowing users to repay outstanding debts in order to increase their credit score.

Result

The three groupings each required a tailored solution, which were explored and tested via lean experimentation:

- 10x increase in approval rates for credit applications via the Destacame platform, from 1% to 10%

- New revenue stream for Destacame

- Written-off debt recovered for partner financial institutions

- Improved credit scores for Destacame users

Destacame views this collection module as a simple fulfillment of their mission statement to their users and a great addition to their value proposition for financial institutions. By working towards greater transparency and financial literacy, Destacame achieved a benefit for all parties involved; users have access to better financial products and knowledge, while financial institutions are gaining access to more clients and recovering written-off debt.

Assessing Product-Market Fit

How do you know if you are ready to start investing in growth or if you need continue pushing toward product-market fit?