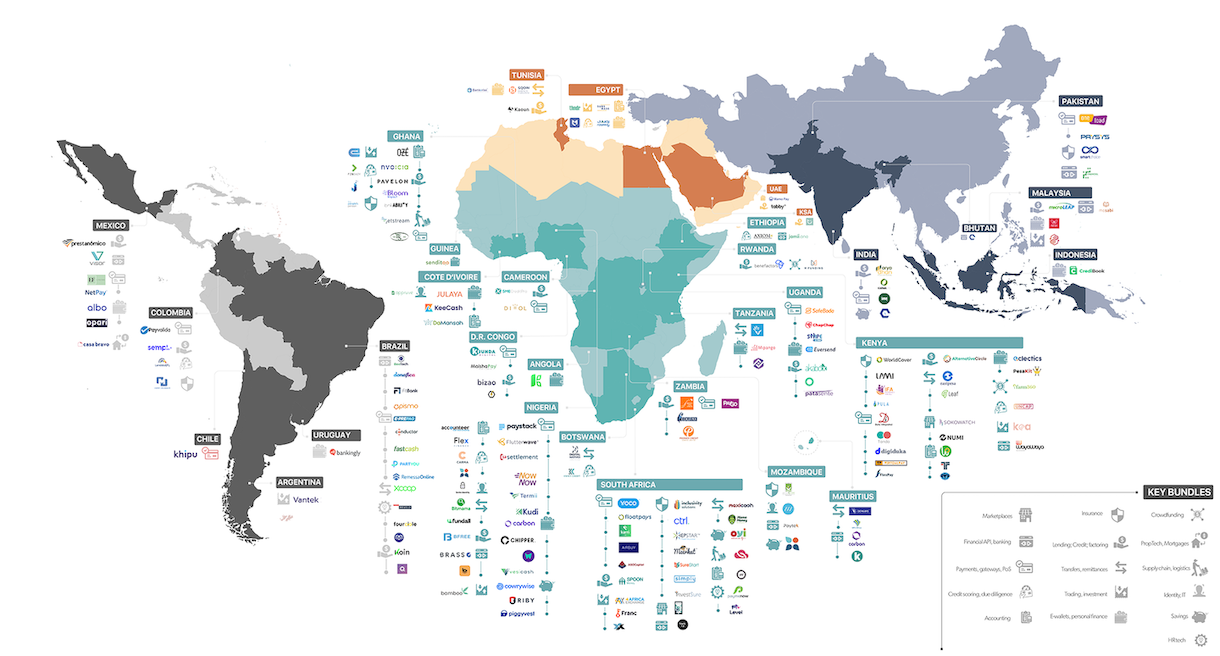

Insights on investment trends, business model innovations and reach of fintech solutions in emerging markets

Evaluates investment flows across Africa, Latin America and South Asia, and across product categories over the last 5 years

Evaluates trends across business models and product types, analysing common acquisition and distribution strategies, revenue models and investor appetite for product categories

Analyzes which users fintech startups are actively reaching and what proportion of their customer bases represent underserved segments

Fintech investment has increased across emerging markets over the last five years, totaling $23B across regions. However, funding by region is unequal. The number of pre-seed and seed deals is increasing, but the average size of these deals also varies across regions.

While a large proportion of payments companies are small (<1000 users), more than half in our sample have >10,000 users. In contrast, nearly half of credit companies have <1,000 users, and < 20% have >10,000 users. In general, there are startups in all product categories that are reaching scale.

Investment remains concentrated in a few product categories, particularly payments and credit, though the landscape of innovative solutions is increasingly diverse. In Latin America, neo-banks have received the lion’s share of investment for the past five years.

Though still nascent, embedded finance solutions offer promising opportunities for reach and inclusivity. Most investors surveyed agree or strongly agree that, “embedded finance solutions can deepen access to financial services and improve consumer financial health among underserved segments.

Startups in the sample that serve large proportions of women tend to be large, indicating that as companies scale, they serve a higher proportion of women users. In particular, savings/investment startups are more likely to report higher proportions of women users.

DOWNLOAD

Insights on investment trends, business model innovations, and reach of fintech solutions