3 tips to help startup founders decrease time spent fundraising

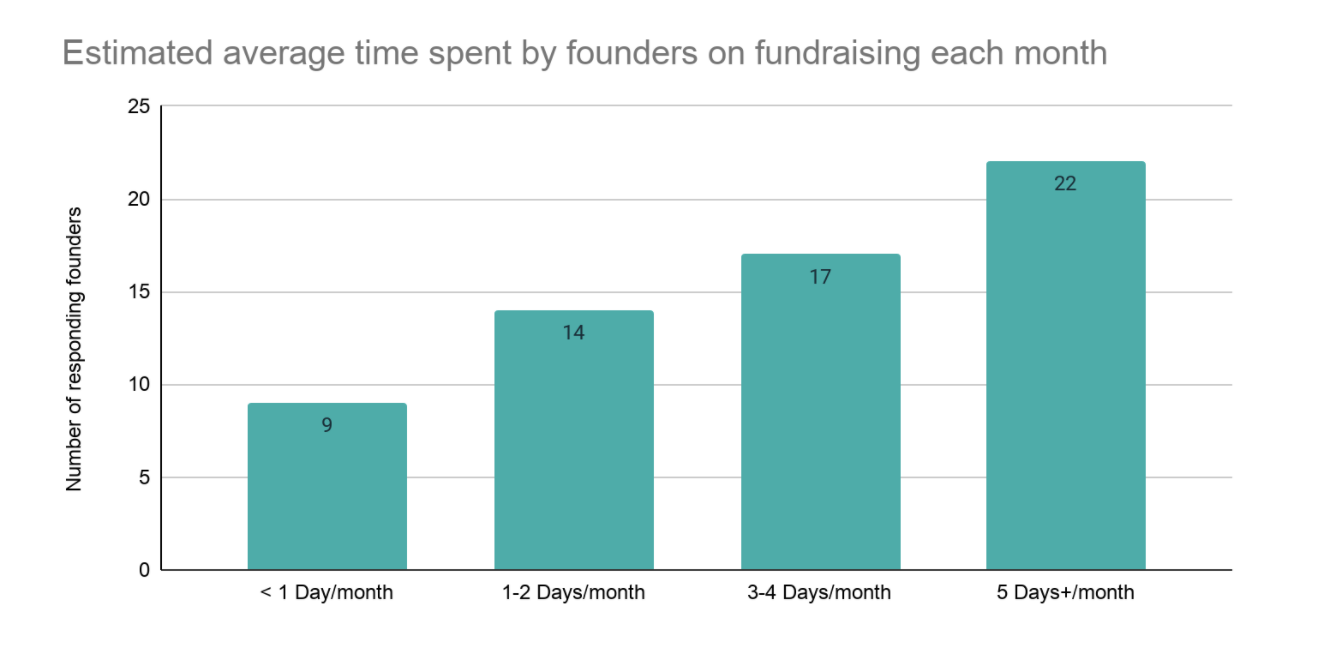

A web survey of over 60 startup founders in Africa in April 2021 found that close to two-thirds of founders spend at least three days per month on average fundraising. That amounts to close to two months spent each year, just on fundraising. Not building, not talking to customers; only pitching, talking to investors, working on pitch decks, building data rooms, and going through due diligence. Half this group (one-third of surveyed founders) actually spend five days or more a month on fundraising activities, that’s close to 12 weeks or one-third of a year.

A couple years ago, the pool of funding and active investors deploying capital in Africa was quite limited; Partech Ventures estimated that African startups received 560 million dollars in venture capital in 2017. Given the limited amounts available, fundraising was a real marathon that could easily require several days per week of effort and up to a year to close a round.

Fortunately, the situation is improving. According to my research, by 2019, around 200 different investors signed cheques to startups in Africa. This number has since grown 75% year-on-year to reach more than 350 in 2020 and in the first five months of 2021, I have already counted close to 300 active investors (source).

As the investment market has matured, available amounts are greater but investor expectations have also increased. Founders of early-stage fintech startups in emerging markets should optimize their fundraising methodology to reduce time spent, and increase their chances of success. Here is how:

1. Build and use a “fundraising CRM” tool

As a founder, when was the last time you had to browse through long chains of emails to find feedback an investor provided on your pitch deck? The reality is that email is a poor way to organize your engagement with investors.

Founders often struggle to keep track of conversations with investors because they are focused on building their product, talking to their customers, and managing their team. While this focus makes sense, without a structured approach and tools in place, fundraising efforts can become inefficient and time-consuming. The solution is a structured tool or customer relationship management (CRM) system to track all the information linked to fundraising efforts following these three steps:

1. Build a framework: Use Notion, Airtable or simply a Google Sheet/ Excel to create a format with the following columns: Investor name, firm, email, country, website, number of deals completed over the past couple years, amount of sector specific (fintech for instance) investments, relevant portfolio companies (same sector or geography or maturity stage as yours), typical ticket or deal sizes, type of preferred investment (SAFE, debt etc.) and then the information to track interactions

- Priority level (e.g., from 1 to 3)

- Whether you have contacted them yet

- Status (intro requested, meeting, pitch, demo, investment offer, termsheet, etc.)

- Last interaction date

- Status details: what was the last thing discussed/agreed upon

- Next steps

2. Populate the CRM: Enter all the information you have on relevant investors; this is time consuming, but important. This information will be a mix of what you already know about investors you’ve talked to as well as information from external sources. Consider the following options to populate your CRM:

- Information aggregators like Crunchbase or CB Insights

- Industry reports, like our State of Fintech in Emerging Markets report, which maps the most active investors as well as recent deals in the fintech space in emerging markets.

- For Africa specifically, sites like Disrupt Africa or Weetracker can be a good source. I have also built this tracker that might be of help.

- Social media, and in particular, LinkedIn might be your best source for populating your CRM and zeroing in on the right person to speak to at each investor level.

3. Prioritise investors and track engagement: Once the CRM is built and populated, the next step is to prioritize the top investors you want to engage. This will depend on a number of factors (e.g., the amount you want to raise, your location, previous talks you’ve had with investors in the ecosystem). Create a shortlist of 20-30 target investors that match your needs and profile.In terms of engagement tracking, our recommendation is to go one step further and share your fundraising CRM with a few specific parties so that they can also track progress on your behalf. These can include early angel investors, close advisors, and accelerator programs (e.g., Catalyst Fund is doing this with some of our portfolio companies).

2. Don’t speak with investors… all the time

A call with a passionate investor can be extremely useful for early-stage startup founders to gather feedback and guidance. However such calls also come at a cost. The time it takes to prepare for the call, fine-tune the pitch, run the call, and follow-up by email with next steps (always a good practice). It can be hard to balance the effort such calls take with a need to keep in touch with investors for when you need to fundraise (or when they are ready to invest).

Our recommendation is to have regular calls with only 2-3 investors who provide extremely valuable support and input. For the rest, a good way to save time and keep investors engaged is to create a monthly (our recommended frequency) or quarterly investor/ stakeholder update email. Each time you talk to a new investor, be sure to add them to the mailing list along with your existing investors so that you aren’t creating too many channels of communication. Such update emails should include:

- Metrics/ KPIs – A couple lines (or graph) on the monthly progress against 2-3 critical metrics e.g., revenue (MRR, ARR), customers, etc. A simple dashboard on Google Sheets with these metrics might also be appropriate.

- Asks/ needs – Put a few bullet points about things you’d love these stakeholders to help with. For example, “We are looking to recruit a Head of Sales, here is the JD (link), please share with your network”. This would also be the place to celebrate and thank people in the group for help they’ve given.

- Bad news/ challenges – Share some challenges you have faced (operations, recruitment, market issues etc.) and how you have overcome them. For example, you might talk about how the COVID crisis has affected your operations that month.

- Good and great news – It’s important to celebrate. This is the place to share good news about recruiting, sales, operations, communication or fundraising, for instance.

- Conclusion – Remind readers of the few things you need support with or input on.

3. Only fundraise when you need to and are ready

Once you have your CRM and investor monthly updates, plan for fundraising itself. Tech entrepreneurs tend to use the concept of sprints for tech development all the time, but rarely apply this approach to fundraising efforts.

After working with over 40 emerging markets inclusive fintech startups, we have realized that allocating a little bit of time each day to fundraising is very inefficient. Founders should allocate time to fundraising activities when, and only when, they need money to scale.

Look at your growth objectives, your monthly net cash burn, and your runway to establish an amount to raise (usually around 18 months of runway), and build in a timeline for the fundraising effort. In our experience, in most emerging markets, it takes around 3-6 months between the first call with investors and the day the round closes. As such, you should kick-off your fundraising sprint around 6-8 months before you run out of funding. If you are fundraising for 18 months of runway and start 8 months in advance, that still should leave you with at least 10 months to take a break from fundraising.

Once you have the timeline, and your (short) pitch deck and data rooms ready, allocate time for your “Fundraising Sprint”. Elizabeth Yin, co-founder and general partner at Hustle Fund, a silicon valley-based pre-seed venture fund, shared this rule of thumb about fundraising sprints: “5-100-500. Over 5 weeks, meet with 100 investors to close $500k in your seed round. If you want to close $1m, double all of these numbers.” Yin’s rule is for a Silicon Valley environment; but in emerging markets, due to a more limited number of investors, I believe a better rule is 3-30-300: over 3 weeks, meet with 30 investors to close $300k+ in your pre-seed or seed round. According to Crunchbase, there are over 25,00 active investors in the U.S. while that number is just above 600 in Africa, 2,500 in India and 1,000 in Latam. It should take about three weeks to speak to at least 30 investors; during this period founders should dedicate their time entirely to fundraising efforts and delegate tasks to other team members. We suggest these three steps:

1. Prepare: Ensure you have the following materials, all proofread and checked.

- Pitch deck

- Data room

- Financial model (no broken formulas) in the data room

- CRM with 30 prioritized investors

- Pitch Q&A cheat sheet – ensure you have a couple potential questions from investors already prepped

2. Reach out: You should use your network, but also send cold emails.

- 60 second email – draft an email that summarises your pitch deck and can be read by investors in no more than 60 seconds (try it!). You may or may not share your pitch deck in that first email (I’d recommend not to, so that interested investors ask for it and engagement gets a head start).

- Warm intros – ask your stakeholders to make warm introductions where possible. Ideally you’d want to draft an easily forwardable email for them (building on your 60-second email, mentioned above).

- Reach out to the 30 investors you prioritized in your CRM in the same week. In the small impact investor community, individuals talk to each other, so it is better to inform them all about your fundraising at the same time.

3. Meet: Have many conversations with your target investors without allowing for large gaps between engagements.

- Schedule meetings during those three weeks only. Using a tool like Calendly can save time for yourself and for investors.

- Follow-up after meetings to potentially answer more in-depth questions with data, etc.

- Track progress on your CRM.

In sum, if you want to save time fundraising:

- Build and use a fundraising CRM

- Create and sign up all your stakeholders/investors on a monthly updates email

- Pack your intensive fundraising efforts over 3-4 weeks (3-30-300 rule)

Remember good investors really want founders to spend their time building the startup and talking to customers, not courting investors.