Making waves: Cynthia Wandia embodies the best of female fintech entrepreneurship

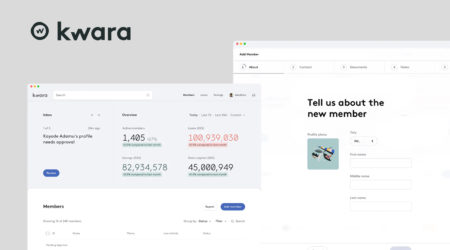

Cynthia Wandia is the CEO and co-founder of Kwara, an accounting and business management SaaS for SACCOs in Kenya. Given she grew up alongside the explosive growth of M-Pesa, it may not be surprising that she has spent her career finding ways to leverage technology for inclusive growth.

As a woman, Cynthia is a rarity among fintech startup CEOs, even though research has repeatedly documented the positive characteristics of women leaders. To start, women leaders generate greater profits and bigger stock price returns. Furthermore, many studies have found that indicators of leadership talent favor women and that men should actually be learning leadership from women.

These findings resonate with our team as our months of working closely with Cynthia and her team provided endless examples of how she herself embodies these characteristics. In our work with Cynthia, we saw her demonstrate three critical qualities on a daily basis: relentless dedication to the team, inspirational leadership, and prioritizing investment in people.

To start, women have been found to put the team ahead of the self, a quality that we saw Cynthia embody time and time again. For example, like Monica Saccarelli, CEO of Grao, Cynthia recruited a co-founder long after she had launched the business. She recognized that bringing on a leader with equal say and standing was good for the organization overall, even though such a counterweight might challenge her own leadership and glory.

Particularly at tech companies, when too much is centered on the founder, it is a sign that the tech may be fragmented. In recruiting Co-Founder David Hwan, Cynthia’s priority was to find someone as invested in the team as she was; she wanted someone who would also put them team above the self. Cynthia remembers that David asked a lot of tough questions, but they shared the same vision and he instantly connected with her team, and that helped them get along. She says, “He’s now easily the best thing to have happened to the company.”

We’ve seen that Cynthia also embodies another strong leadership quality common among women: they are more likely than men to motivate through inspiration, aligning their team with meaning and purpose rather than oversight. For Cynthia, what binds her team together is their collective passion to find innovative solutions to problems that are worth solving.

SACCOs have traditionally operated manually even as they have provided financial safety nets for low-income Kenyans. As SACCOs have grown in number and transaction volume, there is a pressing need for them to digitize and offer transparency and accessibility to their members. Kwara helps bridge the gap between the SACCO boards and their members, to provide members with real-time, accurate information about their accounts. As CEO, Cynthia keeps the team focused on this objective, a feeling that was echoed by a Catalyst Fund intern who recently joined Kwara. He said, “Cynthia really showed me how working in a company that has a strong purpose can be meaningful and motivating.”

Finally, like other women leaders, Cynthia is careful to cultivate, coach, and develop her team members, rather than treat them as instruments of the business. She says that “by humbly realizing the limits of my knowledge,” she tries to pave the way for team members to be the experts in their areas of work, and “safely try, explore and experiment” until they get it right. This environment which fosters learning and curiosity is what has helped Kwara craft successful experiences for junior talent to support their evolving business needs. They’re currently designing a young professional traineeship program that provides career growth opportunities in customer success.

Furthermore, this foundational team culture helped them weather the onset of COVID-19 with all hands on deck to quickly launch Pronto, a scaled-down version of their digital banking platform product that allows SACCOs to approve loans and savings accounts online.

In all, Catalyst Fund’s portfolio includes 5 startups with female CEOs. Time and again, we have found that these remarkable leaders provide evidence of research findings that attest to the strength of women leaders.

As such, we’re working on more representation and diversity in our own portfolio, though we recognize that there is a systemic issue that may take shape as early as middle school. However, as a market enabler and thought leader, we’re constantly learning and ideating on ways to reduce perceived bias and enable warmer relationships between founders and investors – particularly among women. We offer ongoing ideas and questions for other practitioners to consider:

- Philanthropic capital has a role to play in reducing perceived risk for follow-on funding, and this is particularly crucial for female founders with whom the investor risk appetite is even lower. How else might we unlock similar capital flow for female founders?

- Enablers such as Catalyst Fund can act as “market correctors” and help influence investor bias, particularly when investors are looking for founders who look like them (only 12% of venture firms and angel groups have women in investment decision-making roles). How might we help VCs reduce this perceived bias toward women?

- Research shows that surprise questions can throw women off, especially when it feels like founders and investors have less in common. How might we enable these warmer introductions?

- COVID-19 has already exacerbated the gap for female founders when it comes to accessing capital. Data shows that the top resource for them is connections to investors. How might we collectively use our networks to enable these connections for female founders?