Why we invested: Power brings holistic financial wellness to employees and gig workers in Kenya

Fintech startup Power aims to help workers across Africa take control over their financial well being and relieve finance-related stress, with initial launch expected in Kenya soon upon regulatory approvals. As fintech solutions have permeated the Kenyan landscape, there are still concerns about Kenyans’ level of financial health and well-being. Recent reports note that while 83% of Kenyans have access to formal financial services, only 22% are financially healthy, down from 39% in 2016.

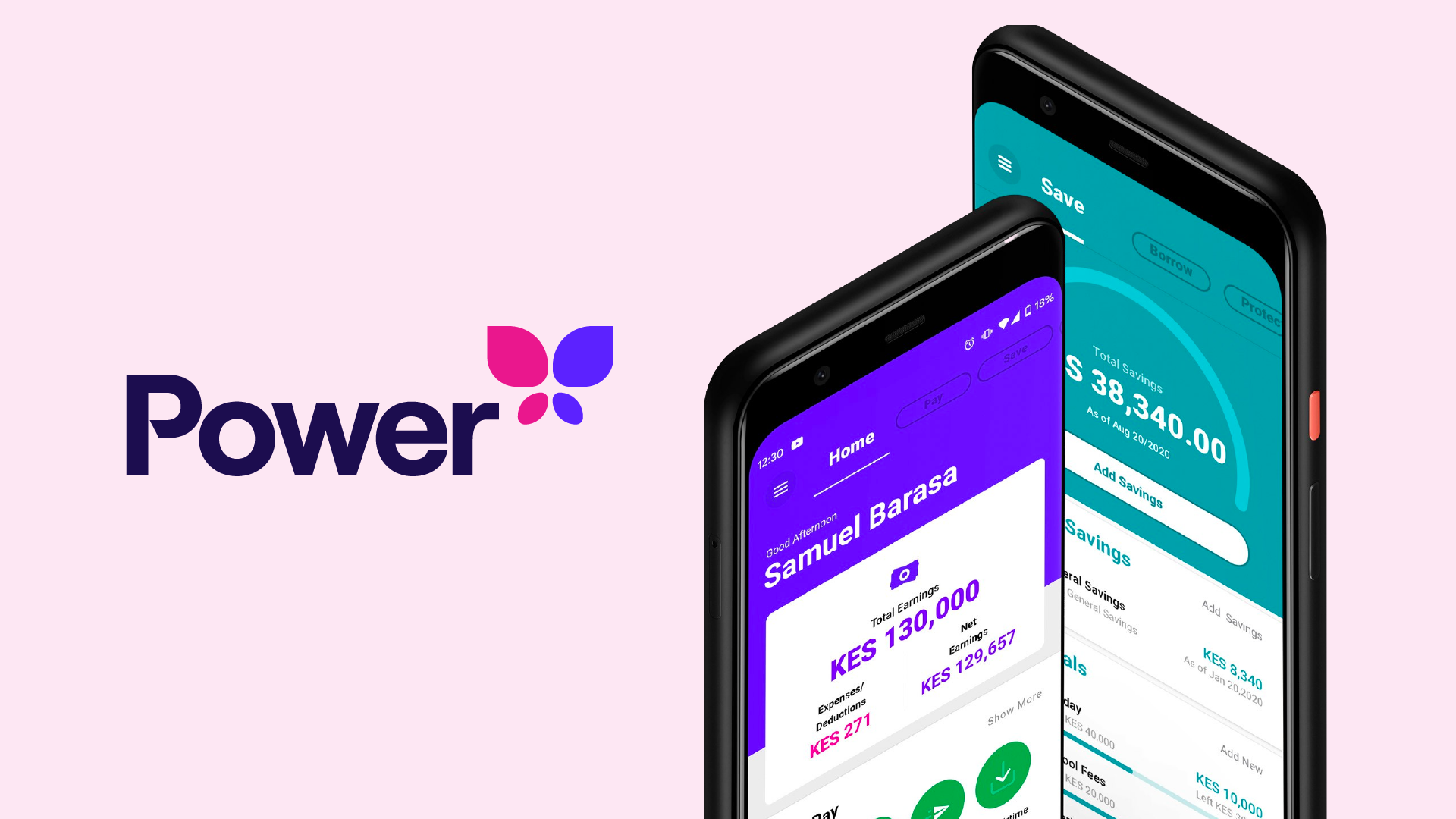

Power seeks to alleviate this situation by working with regulated financial service providers to provide Kenyans, and eventually workers across Eastern and Southern Africa, with a holistic, financial wellness solution. The offering includes four key elements that allow users to: protect themselves against financial shocks via tailored and affordable insurance products; pay for everyday expenses such as electricity, airtime and groceries via early access to already earned wages; save via a secure interest-bearing savings account; and borrow based on the digital financial profiles they build by using the app.

Power and its banking partners connect to employers and work platforms used by salaried or gig workers to offer employees the opportunity to improve their overall financial wellness, building their digital financial profiles and credit scores, and eliminating debt.

Impact

In Kenya, access to digital consumer credit has become ubiquitous, with reports of “breakneck growth in mobile lenders and alarming levels of defaults and delinquency.” Combined with “aggressive sales tactics, abusive debt collections, and unacceptable levels of debt stress,” digital lending has been causing alarms about the negative impact of such credit on low-income consumers. Such consumers may lack digital credit profiles and feel they have few alternatives to access credit, leading to vicious debt cycles with little recourse for resolution.

Power aims to provide a responsible, more holistic answer to the financial needs of workers, from health coverage that extends to family members, to liquidity to smooth income for purchasing daily expenses, to savings accounts to build assets. Their suite of four solutions working with regulated financial service providers is designed to move low-income workers forward on a journey toward better financial health.

Power’s offering takes into account a variety of potential end users, including online gig workers, delivery drivers, construction workers, domestic workers, hospitality workers, and more. They partner with major banks and insurance providers to offer safe and secure savings, lending, and insurance products, and distribute via gig platforms and employers, thereby accessing thousands of low-income workers.

Innovation

Power’s innovation lies in their holistic approach that gives users the chance to manage their finances in a seamless, intuitive manner. The Power platform will include:

- Pay

Pay offers users early access to already-earned wages through a direct connection with their employer or gig work platform. Users can access their wages anytime, and they are then automatically deducted from their next payout. Employees can choose to use their advanced wages to pay for common expenses like airtime and electricity tokens, at reduced rates, or they can choose to cash out or send money to a wallet or bank account of their preference.

- Protect

Power connects workers to affordable, tailored insurance products for customers as well as their families and dependents. The insurance products cover a range of risks, from basic health cover, to maternity, accident and funeral cover, to vehicle and property insurance, depending on the needs of the users and the nature of their work.

Power also offers financing options so that users can access cover immediately with no upfront cost, and pay for an annual plan conveniently over three, six, or nine months. For drivers in particular, who are required to insure their vehicles to join particular platforms, Power’s Protect offers a more comprehensive and affordable insurance alternative.

- Save

The Power platform enables banking partners to offer a fully digital, safe and secure way for users to build savings, even gathering automated contributions from their wages or from alternative sources straight into an account at the bank. Saving through the Power platform enables users to begin building a credit profile so they can access larger loans in the future. Savings requires no minimum balance, has no monthly fee, is interest bearing, and can be accessed at any time, instantly.

- Borrow

Based on data gathered via usage of the Power solutions, integration with the credit bureau, verification of individual’s income, and other alternative data points, Power can generate a loan limit for customers that is appropriate and affordable. Each individual will have access to a unique offering, with different loan tenures, pricing, and amounts, depending on the profile of the customer, aiming to ensure individuals borrow within their means and avoid over-indebtedness. In partnership with regulated banks and lenders, the Power platform offers users access to small loans at affordable rates, with repayments deducted from future earnings.

Each of these offerings contributes to improved financial health, and enables users to access the full range of digital financial services via a single platform.

Individuals can access Power on their own without linking income to begin saving or to add an income source manually. This initial activity will enable them to start building a digital financial profile and subsequent credit score, eventually providing greater access to more formal sources of credit.

Beyond this innovative approach, Power’s app also leverages behavioral economics to encourage savings habits in users, enabling them to set their own savings goals, from saving for a new laptop or a health expense, to owning their own vehicle. All actions taken on the platform contribute towards growing to their digital financial profiles.

Growth Potential

Gig workers in particular are accustomed to navigating digital platforms as a source of income. As smartphone penetration continues to rise across Africa, customers also increasingly leverage digital services for their daily financial needs. By integrating with platforms customers are already using, Power can access thousands of users at a time and bring all of their financial services needs together in a single app that more appropriately meets their requirements.

Through their holistic offering, Power aims to reduce finance-related stress, improve worker productivity and enable more low-income consumers to gain control over their financial lives.

The Catalyst Fund model delivers outsized success compared with other accelerator programs. We accelerate startups that excel on three fronts:

- Impact: Catalyst Fund startups deliver (or, in the case of B2B firms, facilitate the delivery) of life-changing products and services to underserved populations. These can include financial services like loans, savings, insurance, and investment, but also access to productive inputs or essential services such as energy, sanitation, and water.

- Innovation: Our startups are pioneering game-changers that are innovating new products and business models. They drive the sector forward by demonstration effect and via the learning that Catalyst Fund documents and shares.

- Growth potential: Catalyst Fund startups are distinctively investment-worthy, developing businesses that are scalable, with high growth potential. Our startups are selected by an Investor Advisory Committee, who have deep experience in emerging markets and nominate high-potential startups, and then sponsor and mentor them through Catalyst Fund. As a result, our startups raise more funding than startups from other accelerators.