You started off with a hunch about the problem you’re solving and how your solution might make life easier for your target customers. But how much do you really know about these customers, their behaviours, and their pain points? Though not always cheap or easy, user research is the best way to find data-driven answers.

Conducting user research is the best way to be sure your solution will be valuable to your target audience and to figure out best how to offer it, describe it, price it, and pretty much everything else. You need to go out into the field and learn as much as you can about whether and to what extent the problem exists, who feels the problem most, how people describe the problem, what their preferences for use are, and whether they might pay for a solution.

You can use a variety of quantitative and qualitative methods to better understand your customers. For instance, quantitative research could be used to map demographic factors (such as age, gender, income, geography or occupation) to usage or needs, and, when combined with psychographic and behavioural data (like attitudes, opinions, values, and product usage data), help you decide who your target segments are. Qualitative research, on the other hand, includes open-ended questions, conversations, and observations to glean customer aspirations, frustrations, rationales, and preferences. In most cases, this can take the form of in-depth, in-person interviews, phone interviews, or focus groups.

Before you go into the field, you need to know the questions you want answered, i.e. the hypotheses you want to test. These questions/hypotheses help guide your research.

Regardless of the research methods you use, you need to first be as specific as possible when describing your target customer, their objectives and their pain points, to inform the questions you will ask. Without a specific and narrow customer segment, you risk delivering a solution that’s too general and broad—one that doesn’t solve a problem that is big enough for anyone.

User research can be costly, depending on the level of resources you have internally. If you have a strong sales force and user-centered field team, you may already have the right internal talent to conduct proper research and glean insights re: users’ experiences and preferences. However, if your team has not done field research before, you will need to bring in external experience. Consider consulting strategic advisors or hiring qualitative researchers and starting with a small sample of qualitative interviews.

In either case, we have found that experienced qualitative researchers are truly invaluable in helping you distill valuable insights about your customers and understand what is working and what is failing. A good researcher will carefully observe usage, identify friction, and probe for potential solutions. Daily rates for such researchers can range from $100 to $1,200 a day depending on their skills and context.

User research should begin as soon as you identify a pain point, passion, or problem worth solving that you might have a solution for. It should be done regularly and throughout your company development journey. Evaluate your environment and capabilities to choose methods that will help you better understand the problem you are tackling. You should start with research when you’re building your MVP and whenever you’re adding a new product feature. Equally, if you have already built something solid, but it hasn’t gained the traction you were hoping for, user research can help you take a step back and understand why; what users say might just surprise you.

It depends on the type of user research you pursue—quantitative research will help you describe the market opportunity, segment your base, and paint a broad, high-level picture of usage patterns. Qualitative research, on the other hand, is conducted with smaller sample sizes and often uncovers user aspirations, frustrations, rationales for certain behaviors, the language they use to describe the problem and solution, and their preferences in more detail. It is more useful for understanding motivations, barriers, and opportunities for your value proposition.

User research and investigation methods are incredibly valuable for building a solid understanding of the customer pain points and problems, and the market opportunity. Evaluate your current environment and capabilities to choose an approach that will help you better understand the problem you are tackling.

One popular approach is design thinking – a process, mindset, and approach to solving complex problems that puts people at the forefront. Also known as Human-Centered Design, it is based on a philosophy that empowers an individual or team to design products, services, systems, and experiences that address the core needs of those who experience a problem. This approach relies on both qualitative and quantitative methods.

Qualitative research allows you to get a deeper understanding of your customers and their needs, as well as to get one-on-one feedback. Speaking to 10 potential customers will give you a good idea of where you are and where you should be going. Quantitative research, on the other hand, is for scale – for example, if you have identified a problem by talking to a few customers, and now you want to find out how widespread that particular problem is.

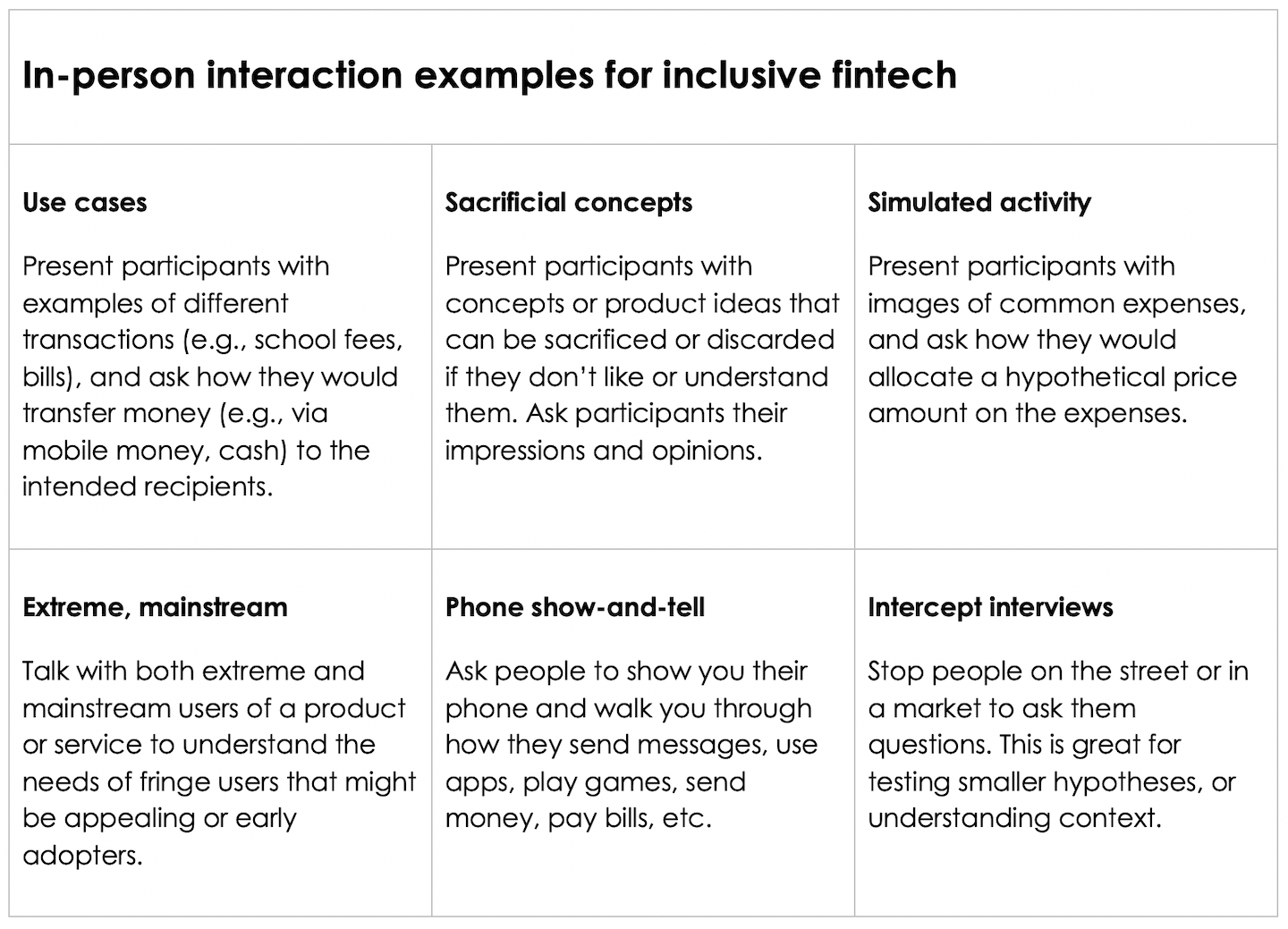

Qualitative research uses open-ended questions, conversations, and observations to glean customer insights and understand aspirations, frustrations, rationales, language, and preferences. These can take the form of:

In contrast, quantitative user research relies on statistical analysis of numerical data. This can include analysis of existing datasets (see below for inclusive finance data resources), or analysis of newly-generated data, which can usually by conducting a survey and inputting responses to create a dataset. If you decide to collect new data, you can speak to individual users with the help of numerators, use a web survey tool like SurveyMonkey or Decipher, or work with a specialised 3rd party to help you design and implement your survey in person, or via call, text message, or the web.

| In designing your survey instrument, try to make use of existing modules and questions so that you can benchmark your results against larger datasets. The following resources have instruments that you can use as templates: |

Once you’ve collected and cleaned your user research data, you can turn it into meaningful insights that can help your team better understand your target users and make them more concrete and relatable. Note there is a crucial difference between findings and insights. For example, “10% of people have smartphones” is a finding, but what does it mean? Is access a problem? If so, that’s an insight.

Before you go further, go back to your research questions/hypotheses and map your findings against them—include quotes, so that you don’t forget exactly what was said, in the language your customers use. Next, take a step back and look at what your findings are telling you and why they might be the case—these are your insights.

Even if you discover the opposite result to what you were expecting, it’s still a result. A negative result could be useful, for example, to help you understand if the product is moving in the right direction or if you are missing something.

Some tools for organizing research findings include:

Customer personas: A persona is a hypothetical archetype based on real people that represents your core target customers, or a segment of your target customers – typically it encapsulates your lowest hanging fruit. Building and referring back to a persona can help to ensure everyone in the company is aligned with the same target customer, and all products and marketing materials are designed to speak to them and to meet their specific needs. The key is to incorporate specific characteristics of a number of different people into one portrait.

Good personas should fit on a single page and include:

Customer empathy maps: An empathy map is a collaborative tool teams can use to gain deeper insight into their customers. Much like a user persona, an empathy map makes customers more concrete and relatable. The map can represent a group of users, such as a customer segment. It is a good idea to complete an empathy map after the user research phase, before jumping into developing your value prop and identifying product requirements. It is a useful tool for distilling and organizing qualitative data from interviews, focus groups, etc.

Customer journey map: Customer journey maps capture each step in an individual’s journey using a specific product or service. You can generate a map for each persona you developed for your target customers. This tool is best leveraged with the full team present, so you can capture and synthesize knowledge, especially from those with experience in customer-facing interactions.

The customer journey mapping process includes:

Insights can help you identify and improve your product, your processes (e.g. customer service), and your value proposition, as well as to gain a better understanding of your customers. Now what? Turning these insights into action items is absolutely essential.

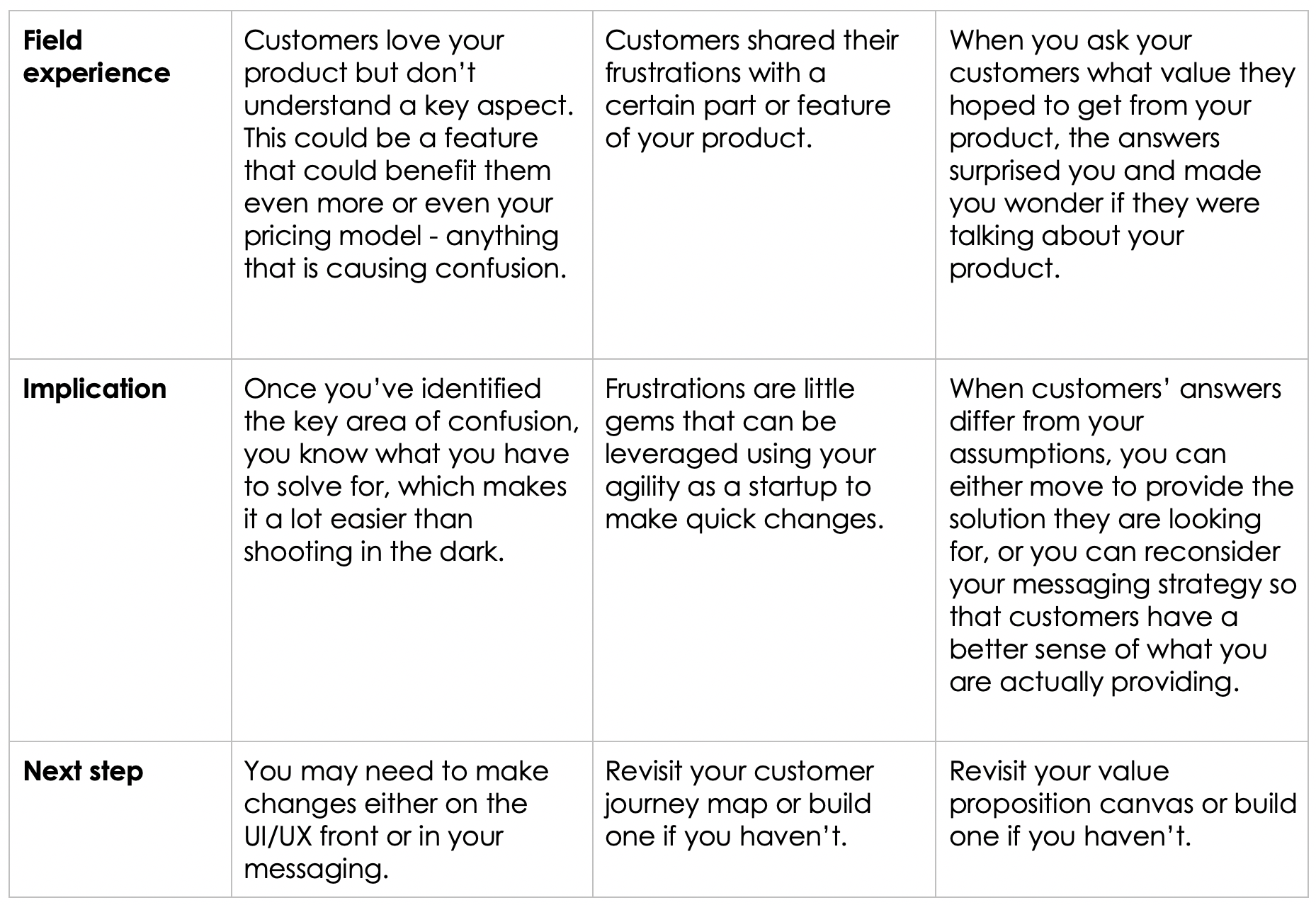

This table can help you think about how to act on findings from user research:

The goal is to integrate user research and insights to build a “product improvement engine” in your company. What this means is that you should talk to your users and watch them use your product, on a regular basis, organize your findings into insights—and take action. Then do it again and again, until you reach product-market fit. If you improve your product 5% every week, it will really compound!

Don’t fall into the trap of doing this once, fixing a few bugs and then thinking you’re done. You will only end up stagnating.

“If you do not build a product users love, you will eventually fail.” —Sam Altman, former President of Y Combinator and now CEO of OpenAI

Mexican PAYGo provider Graviti was able to harness user research to better understand what marketing messages were landing and why. These insights improved their marketing strategies and dramatically reduced CAC.

How to measure NPS an explanation from Wikipedia

Wootric is a tool to help you measure and monitor NPS

Learn more about Human-Centered Design from IDEO and download their toolkit.

For B2C businesses:

CGAP’s Customer Experience Workbook is a super in-depth guide that will really help you map out everything you need to understand your customers.

For B2B businesses:

You can create Ideal Customer Profiles (ICP) instead of personas to define an ideal customer by more than four factors (company size, industry, geography revenue, pains, needs, etc.)

Building your ICP watch Ryan Williams, VP of Sales at Leadgenius talks about: Ideal Customer Profile, Buyer Persona, How to find leads using various tools, Org mapping, Buyer’s journey, typical buying process, Ideal Client and Qualification Frameworks.