Stress Testing in Crisis: Helping Cooperatives Adjust Financial Projections during COVID-19

The COVID-19 crisis has required major and rapid action at all levels of society and the economy. As of this writing there are over 120,000 official cases in Mexico, where BFA Global and Metlife Foundation have launched FinnSalud, a 3.5 year program focused on financial health. This crisis has introduced a wide range of uncertainties impacting life and the economy that are difficult to predict. Financial institutions focusing on low- to moderate-income populations are particularly vulnerable during this period due to increasing liquidity constraints, and have critical roles to play in ensuring their clients can weather the crisis. Few financial service providers (FSPs) were prepared to design and execute contingency plans that account for the unique dynamics at play with the COVID-19 crisis, so many can benefit from an agile scenario planning exercise with a focus on the pandemic. Financial institutions should leverage these as a starting point for stress testing their business model and financials. This blog explores how BFA Global has supported cooperative financial institutions in Mexico as they face the crisis with tools that enable financial projections and preparation.

Portfolio stress testing is a risk management best practice. The basic idea behind stress testing is to simulate how a financial institution’s portfolio and financials would perform against a set of possible futures to identify and gauge risks, giving management insights to understand and mitigate vulnerabilities. The global reach and immediate impacts of the COVID-19 pandemic creates both an urgency to deploy this process and places FSPs in a context for stress testing without a similar past experience from which to draw lessons. BFA Global has been working with two Mexican savings & credit cooperatives as part of the FinnSalud program. These organizations serve a client base that is largely low- to middle-income and offer a suite of products that includes savings, term deposits, loans, payments, insurance and others. In the wake of the COVID-19 pandemic, there are key risks related to (i) the portfolio, (ii) the operation and (iii) the level of capital that may affect the situation of cooperatives. We have developed a Guide of Operational Suggestions and a Stress Testing Model to help cooperatives better prepare to navigate through this crisis.

Setting the End-Client Context

Before jumping into the financial modeling side of the stress testing process, we found it helpful to build an informed view as to the potential drivers and changes in behavior by the FSP’s end-clients. Concurrent to the stress testing process, BFA Global has researched the impact of COVID-19 on financial health in 8 markets, including Mexico. This research indicates that incomes are already impacted and expenses have increased, putting significant pressure on cash flow, among many other new challenges.

Among the eight countries studied, Mexican small businesses and entrepreneurs have access to an extremely limited cash and asset cushion to draw from, and face the highest pressure to potentially close their enterprises if the shutdown continues for an extended period of time. Insights from this research and interactions with our cooperative partners led to multiple factors that we have had to incorporate into our thinking and the stress testing process:

- Cash flow pressure will reduce members’ ability and willingness to dedicate limited resources toward loan repayments.

- Restrictions on movement will make it more difficult to interact with existing clients, and reduce their ability to visit branches.

- Reduced income will force many people to draw on savings to meet immediate needs.

- FSPs may need to close branches and limit or cease field operations by loan officers and/or agents.

Stress Testing Model for Cooperatives

With support from MetLife Foundation, BFA Global has developed a stress testing tool that is now open-sourced and can be accessed here. This model considers three phases of the coronavirus crisis:

| Propagation

The adverse effects on economic activity begin to be felt |

Peak

Large part of the population is confined to their homes and few economic activities are carried out |

Post-crisis

The economy begins to open to the new normal |

While developed within the Mexican cooperative context, this tool and process can be useful to a wider range of financial institutions grappling with the COVID-19 crisis globally. The model calculates key performance indicators (KPIs) for each risk category with different levels of intensity.

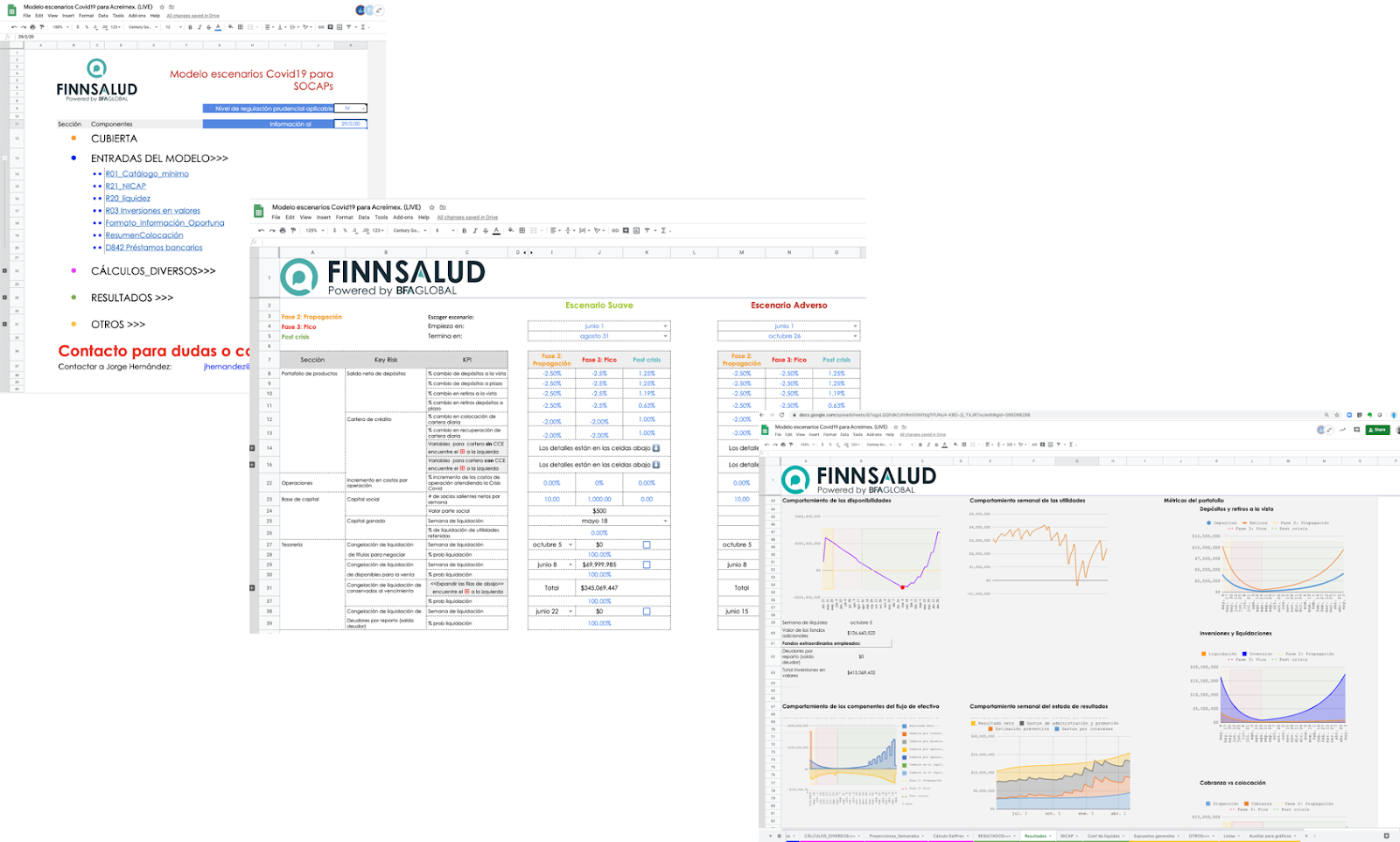

Stress Testing Model views

The primary components of model include:

- Inputs – Primary data fed into the model includes financial statements; historical amount of inflows and outflows, such as deposits and withdrawals from savings and current accounts and term deposits; average loan disbursements and payments; as well as effects of some government measures. Some of the regulatory reports that the cooperatives are required to send to the Comisión Nacional Bancaria y de Valores (National banking and securities commission) – minimum catalog, investments in securities, bank loans, liquidity ratio and capitalization requirements – are also used as inputs, as well as the timely information on COVID-19 impact on the portfolio.

- Calibration – After loading these inputs into the model, FSPs are given options to set the timeframes for each phase of the crisis, and calibrate the input variables for the two scenarios under four dimensions: 1) institution’s portfolio (loans, savings, term deposits); 2) change in operations due to COVID-19; 3) capital; and 4) treasury assets liquidity management.

- Outputs – From the initial situation, the model calculates on a weekly basis the balance sheet, income statement, available cash balance and regulatory indicators of the liquidity ratio and the level of capitalization according to the conditions that the cooperative expects to face.

Deploying the Stress Testing Model with FinnSalud Cooperative Partners

We began the stress testing process with FinnSalud partners in late April as Mexico entered Phase 3 of the coronavirus pandemic, with government measures enacted to promote social distancing, further reduce movement, and restrict non-essential economic activity to lower the risk that the country’s health system could be overwhelmed. In the Mexican cooperative context, we considered two COVID-19 impact situations: a soft scenario and a worst-case scenario. Given the immediate impact of the pandemic and corresponding restrictions on financial health, our stress testing with cooperative partners focused on a few key variables: 1) non-performing loans as a percentage of overall portfolio, growth (or reduction) in client base and issuance of new loans, and 3) member savings, as measured by average weekly amount of withdrawals per client, and the percentage of the client base making a withdrawal each week. This focus was driven by the fact that these variables largely drive bottom line impact and, more importantly, cooperatives’ cash flow and liquidity levels.

While the stress test outputs and exact results will be different for each institution, we found a few insights that could help the broader financial inclusion and financial health sectors, and other FSPs as they embark on a similar journey.

- Expect a dip in revenue. Through multiple scenarios we saw NPL as a percentage of portfolio grow to over 50% within a month of projected lockdowns. This massively reduces interest income for the FSP. An initiative deployed by the Mexican regulator was to allow FSPs to continue recognizing interest during the crisis, while actual payments by consumers are not realized in the same period. Based on our observation thus far, this benefit would accrue to one out of four debtors.

- Focus on liquidity. Across multiple scenarios, deposits are expected to decrease while withdrawals increase consistently over the first few months of the lockdown. While it may seem counterintuitive initially, FSPs may be best served in the medium and longer terms by making it easier for clients to access savings, to a certain point. As an alternative to withdrawing funds from savings or current accounts, cooperatives might, for example, enable access to funds via loans with special interest rate conditions or loan terms.

- Prioritize digitization. As with most parts of the global economy, cooperatives have had to shift part of their teams to remote work and, for those who are able to, also interactions with clients to digital and remote channels. This brings an urgent need to quickly identify and deploy digital tools to support the internal workforce in executing components of their jobs remotely. And as movement restrictions more or less halt all new client sign-ups, FSPs will need to explore shifting field officers over to a remote customer care function temporarily.

We don’t know what the future holds as this crisis continues to unfold, but we do know that building robust financial projections is essential for FSPs. At BFA Global, we hope that the stress testing tool and suggested operational guidelines will assist financial services partners to be as well-prepared as is possible in the face of such uncertainty. Ultimately, their preparation and resilience is essential to the 8 million low and moderate-income Mexicans who rely on financial cooperatives’ strength for their own resilience.

All opinions are BFA Global’s. Our funders are not responsible for the information presented herein, nor for its use.