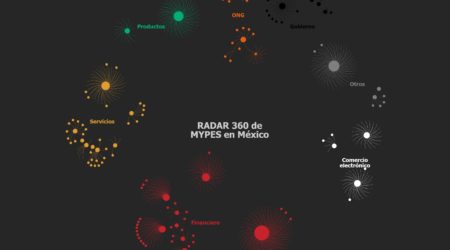

Radar MYPE: Visión 360 del ecosistema empresarial en México

El Radar MYPE se desprende de los hallazgos del libro blanco titulado: “”Caminos hacia la resiliencia de las MYPES”,...

Por qué nos asociamos: Tienda Red está construyendo la resiliencia de las tiendas familiares de México a través de soluciones tecnológicas

El corazón del comercio minorista de México se encuentra en miles de tiendas familiares. Alrededor de 1 millón de...

Why we partnered: Tienda Red is building the resilience of Mexico’s mom & pop shops through technological solutions

The heart of Mexico’s retail commerce lies thousands of mom-and-pop shops. Around 1 million micro and small enterprises (MSEs)...

Good, bad, or nill? Evidence of the impact of digitalization on MSEs in Latin America

In the ever-evolving landscape of business, digitalization has taken center-stage as an effective catalyst for growth, efficiency, and resilience...

Razones para colaborar. Techreo está ampliando el alcance de las Mypes a través de una plataforma de comercio electrónico de canal cerrado

La venta de productos y servicios a través de plataformas en línea demostró ser un herramienta crucial para apoyar...

Webinar y presentación: ¿Bueno, malo o nulo? Evidencia del impacto de la digitalización en las MYPES

Conocer qué dice la evidencia existente sobre el impacto de la digitalización en las MYPES. ¿Realmente conduce a la...

Webinar: Good bad or nill? Evidence of the impact of digitalization on MSEs

Understand what the existing evidence says about the impact of digitalization on micro and small enterprises (MSEs). Does it...

¿Las Neo-Cooperativas como los próximos disruptores del sector financiero? Un experimento conceptual

In English Durante la pandemia de COVID-19, las cooperativas financieras mexicanas han continuado prestando sus servicios a casi 8...

A creative approach to startup financing: Graviti combines grant, debt and equity investment, linked to impact outcomes

It took Catalyst Fund portfolio company Graviti only two months to raise a debt round that will finance 600+...

How fintech startups should pursue B2B partnerships

For many fintech startups, particularly those in the insurtech space where high levels of trust are essential, business-to-business (B2B)...