How Can Insurance Help Smallholder Farmers?

Catalyst Fund Learning Agenda Series #3, WorldCover

The Reality of the Low-Income Customer

Robert is a father of four and lives in the rural areas at the outskirts of Tamale, in northern Ghana. He lives off his one hectare of land where he grows maize and groundnuts. He sells part of it to the local market and eats the rest with his family. Like many of the 475 million smallholder farmers around the world, he faces constant threats of droughts or other weather hazards that can destroy his family’s main source of subsistence: Crops. Ninety percent of farmers in Africa have no access to crop insurance or other safety net.

Climate risks exacerbate smallholders families’ vulnerability. When there is drought, farmers lose more than just their income. They lose their ability to pay school fees for their children, go see the doctor at the nearby village and feed their families.

Insurance can help increase smallholder families’ resiliency in the event of an adverse shocks and allow them to consider and make more risky investments. Yet, many farmers generally struggle to see the value or entirely trust insurance products and many products remain financially inaccessible to them.

The Opportunity

WorldCover addresses this problem by providing farmers with simple and affordable microinsurance policies, insuring their crops against the risk of drought. Microinsurance and farmers receive rapid payout in cases of drought during the crop growth period. WorldCover ran a full pilot project in 2015 among Rice and Sorghum farmers and signed up a significant number of farmers, with many more committed.

The Challenge

Working with our investee WorldCover, together, we seek to answer:

- How can WorldCover leverage mobile channels to improve the customer relationship? Would clients trust mobile?

- How can micro-insurance providers design products that engender sufficient trust and create more value to consumers?

Catalyst Fund has a dual mandate to (1) to help early stage inclusive fintech startups gain traction, offer seed capital and technical assistance, and (2) answer major questions that the industry has about whether fintech startups are leading to systemic change in the financial inclusion ecosystem.

The Test

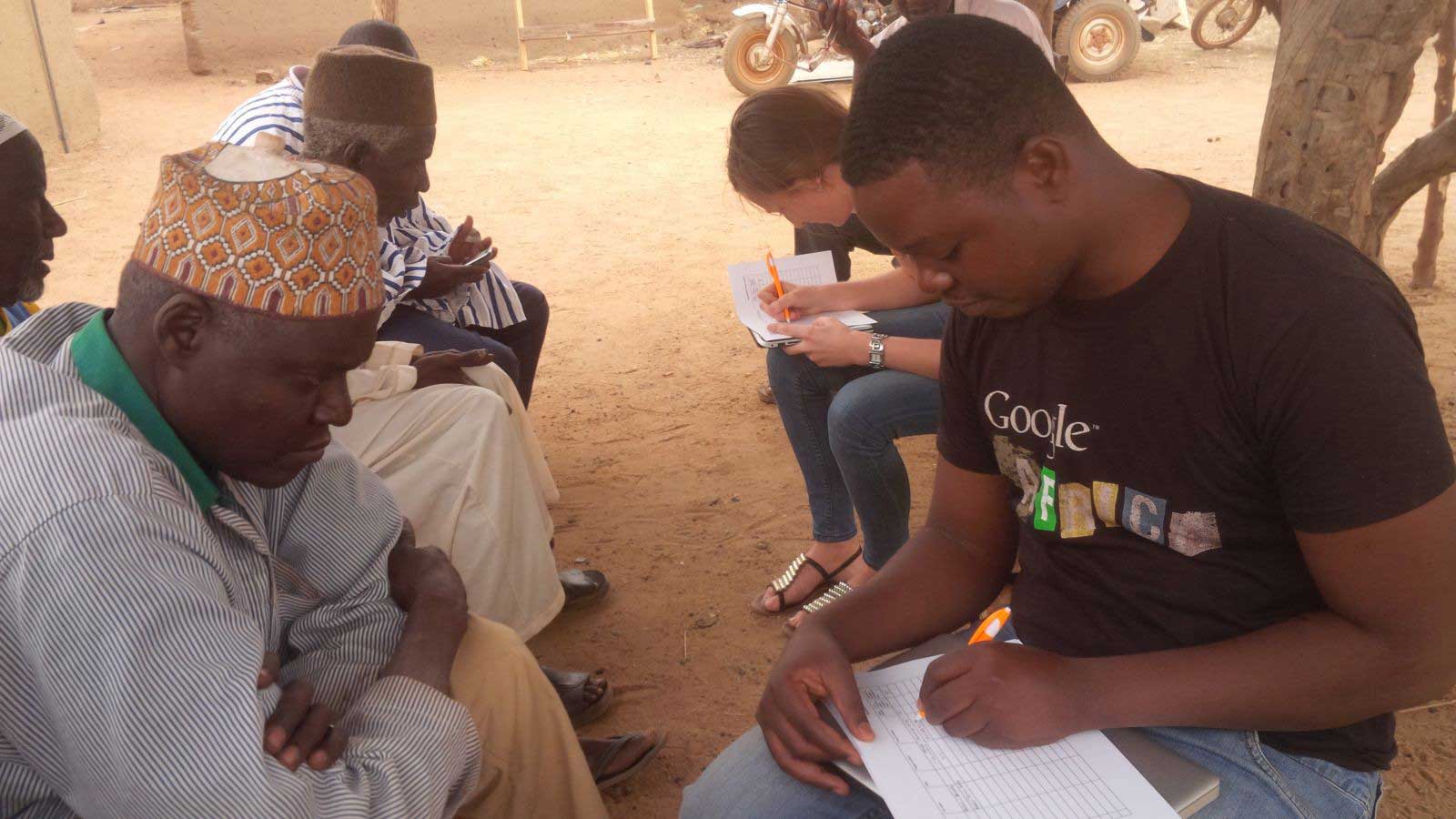

The Catalyst Fund team and WorldCover have decided to focus their engagement on conducting deep user research with farmers in Ghana to understand all details of their lives and their relationship with insurance. The research phase will culminate in a series of workshops to tweak the value proposition and improve the overall experience of farmers, hopefully leading to higher retention. WorldCover has also recently focused more and more on mobile channels and want to make it integral part of the service. The team will interview different customer profiles, pushing to understand reasons for take up, renewal and referral, and the farmers’ comfort with mobile technology. By nature, insurance products are typically out of sight and out of mind. By adopting a customer journey mapping approach, the BFA team will gather evidence to answer such critical questions and brainstorm with WorldCover staff.

The Impact

WorldCover has the potential to truly change Robert’s and his family’s life. The research conducted with Catalyst Fund will allow them to serve Robert’s and other farmers like him with appropriate products and channels, reducing their risks and expanding opportunities. WorldCover’s vision is to expand their microinsurance services until every human can manage their greatest risks! They believe no adult or child should suffer under the weight of threats beyond their control, and are determined to prevent this, one insurance policy at a time.

Follow our work with WorldCover by signing up to the Catalyst Fund Newsletter. We’ll be sharing our lessons learned so stay tuned.