Machine Learning Meets Credit Scoring: How it Can Help Reduce Loan Delinquency Costs

In a previous analysis, we laid out the machine learning process we conducted for Destacame.cl, a company of the Catalyst Fund, which provides alternative credit scoring to underbanked consumers in Latin America. For a firm like Destacame.cl, the investment in predictive algorithms for credit scoring is a no-brainer. It is an inherent part of their digital product and data-driven business model, and can be seamlessly incorporated. But what about for a brick-and-mortar financial institution that is just beginning to explore digital or more sophisticated technology applications? How should the financial service provider and its leadership weigh the potential benefits against the initial investment in high-tech credit scoring?

Let’s look at this question from the perspective of a mid-size financial institution that provides low-income clients with non-collateralized loans. We’ll demonstrate that credit scoring optimizes three business layers that improve the overall bottom line for financial institutions.

BUT FIRST, HOW SHOULD LENDERS THINK ABOUT THE COST OF DELINQUENCY?

Before we can start modeling the impact of credit scoring, we start first with understanding the financial institution and the workings of its business. A business case typically “bakes in” all manner of revenues and expenses associated with a particular service that a financial institution provides. These inputs and outputs are distributed over various units, such as accounts and transactions, that can be combined with the various incomes and expenses to arrive at the profitability associated with the service’s activities. In the following case, we focus on the elements directly affected by credit scoring.

There are three primary sources of financial “costs” associated with delinquent loans:

- Write-offs from bad loans. After a certain period of time and effort chasing down delinquent loans, the financial institution must make the call and recognize that an outstanding loan amount is irrecoverable. The result is loss of capital and loss of income from that capital.

- Delayed interest income. When a client misses a payment, expected cash flow from both principal and interest is delayed. While some financial institutions have the ability to charge interest for each day of delinquency, those with less sophisticated portfolio management systems can only expect repayment of the original amount. Interest is temporarily forgone as trapped principal is not actively earning income.

- Delinquency servicing expenses. Compared to maintaining a current loan, a delinquent loan requires significant amounts of time and effort. To recover the loan, field officers and staff from the financial institution often must make multiple visits to the client — and sometimes even travel to other parts of the country to track down borrowers who have literally run away with the money. Any legal proceedings add even more expenses.

Financial institutions must negotiate these tradeoffs in managing the costs. Some lenders are persistent and try to work with delinquent clients for up to two years. They might eventually recover loans others would have written off, but they incur significant expenses in the recovery process. Less persistent lenders run the risk of signaling to potential clients that it’s “easy” to get away with non-repayment.

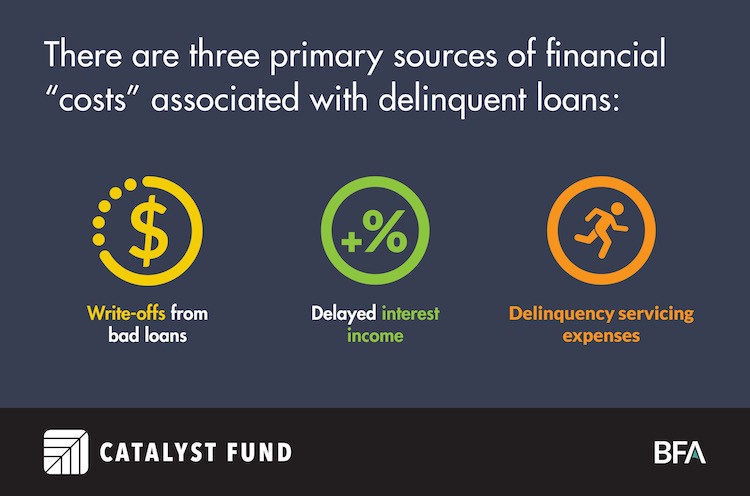

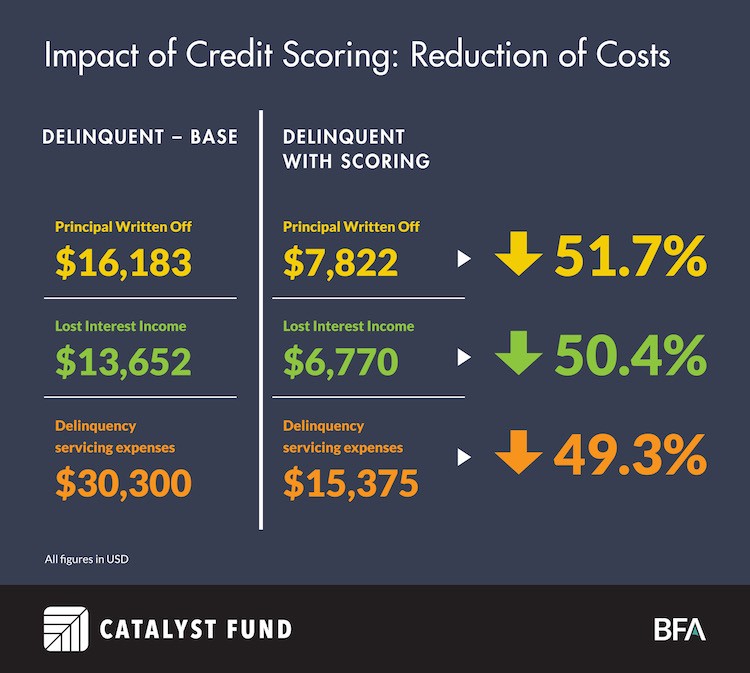

Below is a simulation of a portion of the business model that BFA built to analyze the impact of credit scoring during the Destacame.cl engagement. The figures are representative of a mid-size financial institution that provides microloans, with a not insignificant delinquency problem.

WHAT IS THE IMPACT OF DELINQUENCY?

Once we model out the delinquency and write-off specifications noted above, we find the impact on the business case as follows:

For this simulation, the base case demonstrates that the impact of delinquency is of the same magnitude (from 1.4 to 3 percent) for all three “cost” levers. Losses from write-offs are greater than from lost interest income. Interest repayments are front-loaded in P+I installments at the start of the loan life cycle and lenders really are recovering mostly principal at the end of the cycle. Loans also tend to become delinquent later in their life. The prospect of funds lost through write-offs should be considered as significant as funds lost through foregone income. This phenomenon of loss of principal is often underappreciated in practice, as focus is often on the income forgone from delinquency and the costs to make those loans current. Finally, delinquency servicing costs take away a full 3 percent from the bottom line of the portfolio and not just the delinquent loans.

HOW DOES CREDIT SCORING IMPACT THE BUSINESS CASE OF A CREDIT PRODUCT?

To quantify creditworthiness, the financial institution’s credit scoring process looks at previous credit history, income stability and related financial behaviors, among other factors. It uses techniques that range from logistic regressions to random forests, and each new or existing client is ultimately assigned a probability of default. This score is typically combined with on-the-ground due diligence — and only then does the financial institution decide whether to extend credit.

Intuitively, we see how credit scoring helps the financial institution reduce all three “costs” by bringing down its overall level of delinquent loans. Credit scoring should identify a better pool of loan customers at the start of the loan cycle, resulting in better or less risky business for the lender.

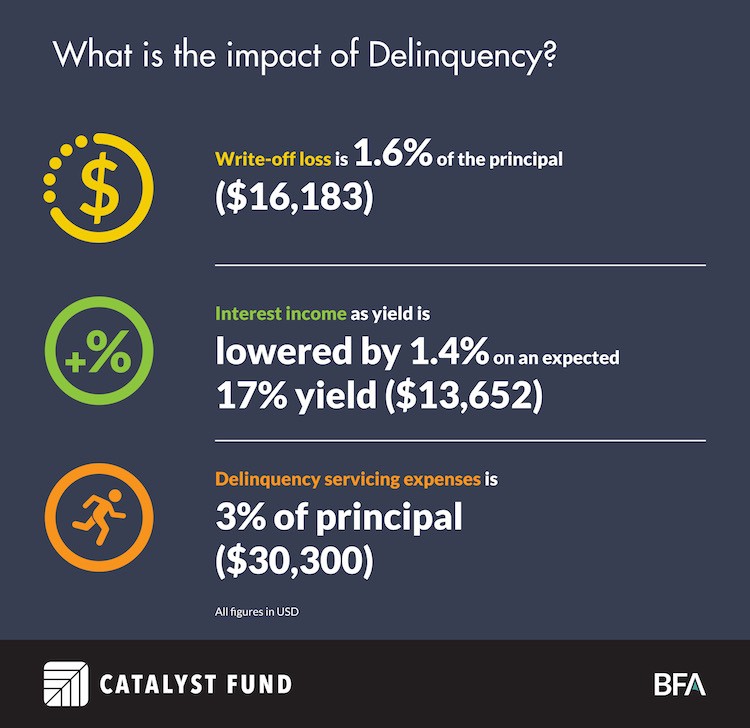

THE LOAN PORTFOLIO WITH DEFAULT AND CREDIT SCORING

Now, we expand the base case with a credit scoring algorithm from the model. We assume a true positive rate (TPP), or sensitivity, of 50 percent. That is, 50 percent of loans that eventually become delinquent are identified as delinquent. This number falls in the range of around 35 to 65 percent for TPPs of credit scoring models deployed.

The impact of proper credit scoring crosses all three “cost” levers since it has the effect of depressing delinquency levels overall and results in reduction of all costs associated with delinquency, as well as a reduction in the number of loans that become delinquent.

CREDIT SCORING — SPECIFIC IMPACT ON ‘COSTS’

As expected, most expenses halve themselves in the credit scoring model. Given the parameters, this also has the impact of turning the net present value (NPV) positive, suggesting that the discounted cash flows from the product have turned positive — a clear and attractive incentive for proper credit scoring.

Note that the reduction is not exactly 50 percent across the board as the month-to-month impact cascades, principal payments are back-loaded and delinquency requires repeated contacts.

NEXT STEPS FOR ORGANIZATIONS DEPLOYING CREDIT SCORING ALGORITHMS

By targeting delinquency-prone loans at acquisition and eliminating a significant proportion of them, credit scoring helps an organization address all three “cost” levers associated with bad loans — deferred income, recovery costs and write-offs. However, we often see discussions of the impact of machine learning credit scoring tools on the first, sometimes on the second, and seldom on the third. Financial service providers would do well to keep all three in mind, as the impact is often in similar orders of magnitude.

Thus, lending organizations can extend this exercise in two ways:

- Apply a predictive algorithm on loans to identify those that will eventually be written off. It is sometimes the case that clients whose loans are written off have a different profile than those who simply fall behind for some of the time. Surgically targeting these loans will allow write-off mitigation on top of what comes proportionately through delinquency mitigation.

- Reset the inflection point where delinquent loans are earmarked to be written off. This inflection point is typically when institutions decide it is no longer “worth it” to chase a delinquent loan. As noted earlier, there are two major considerations to this — how much it costs to chase a loan, and what signal it sends to borrowers if recovery efforts are relaxed. By being able to generally reduce but also exactly quantify the cost of recovery versus the cost of write-off, as well as the potential impact of signaling, organizations can decide to double down or ease off on recovery, because the overall reduced delinquency gives it the breathing room to do so.