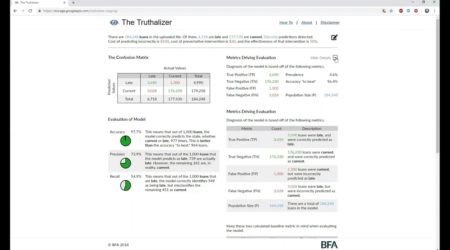

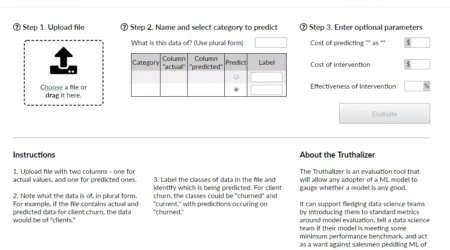

Ashirul is a Managing Principal Consultant at BFA Global. He is the head of the firm's quantitative analytics practice and oversees BFA's team of delivery specialists. His areas of focus include financial health, customer segmentation, product design, digital financial services, digital transformation of incumbents and fintech partnerships. He has worked on projects such as the Catalyst Fund, GAFIS, FIBR and OPTIX, and with partners in Latin America, East and West Africa, and South and South East Asia.

Prior to BFA, he worked at a Boston-based financial services company focused on emerging markets, an impact investment firm in Los Angeles and microfinance institutions in Bangladesh. Ashirul has a PhD and MALD in Development Economics from The Fletcher School at Tufts University and a BSE in Computer Science with a focus on Artificial Intelligence from Princeton University.