The opportunity for PAYGo in Latin America

The Pay-as-you-go (PAYGo) solar market is a $1.75B market serving over 420 million users, with over 30% annual revenue growth, and it is responsible for dramatically expanding access to solar home systems across Africa.

Given this success, PAYGo models are now being deployed in other regions and with a variety of other high-value assets. Upon preliminary analysis, we are hopeful that there is an equally strong opportunity for PAYGo to act as a powerful enabler for access in Latin America, as it has in Africa. We look forward to exploring this hypothesis in more depth with one of our new portfolio companies, Graviti, a PAYGo provider bringing affordable solar water heaters to families in Mexico.

At first glance, the opportunity for PAYGo in Latin America (LatAm) might not be abundantly clear, as penetration of basic services like clean energy and water is generally higher in LatAm. However, there are still a significant number of people in need of technologies that are PAYGo-appropriate, suggesting a different kind of opportunity. Moreover, Latin American families have higher incomes, greater financial literacy and are more accessible to providers, thereby suggesting greater potential profitability for PAYGo providers in LatAm. To meet the PAYGo opportunity and succeed in enabling underserved families in LatAm to access life-improving technologies at an affordable cost, providers will need to adapt their models to an environment with more competition for financial services.

The need for PAYGo-appropriate technologies

To date, PAYGo has powered access to technologies that replace utilities like energy and water, which many households in Africa still lack. In sub-Saharan Africa, 46% of the population does not have access to any form of modern electricity, and many more have unreliable access due to frequent power cuts. Similarly, only 14% of households in sub-Saharan Africa have clean cookstoves. Alternatives and substitutes for these utilities are poor: kerosene, candles and open fires are the most common, but they produce low-quality light, cause indoor air pollution and can cause house fires. This situation is unlikely to improve, as expanding infrastructure to reach rural populations will be expensive and could take many years to complete. As such, PAYGo-financed solar energy systems are a good alternative that meets important needs for customers.

In contrast, 98% of the population in LatAm already has access to electricity, and 87% has access to clean cooking technology. The need for some essential services in LatAm has been met to a much higher degree than in Africa.

That said, there is still a vast opportunity to apply PAYGo models to LatAm-specific challenges. For example, Latin Americans need better solutions for hot water, a deeply-appreciated service in the cooler climates of LatAm. Many families rely on liquified petroleum gas (LPG)-powered water heaters, which can be expensive over time, as they have a short lifetime and require frequent replacements, so they are not well-suited for low-income segments. In contrast, solar hot water systems have a longer lifetime, don’t require municipal infrastructure such as piped gas and don’t have the challenges that come with using LPG canisters.

Such heaters are particularly well-suited for PAYGo channels since solar water heaters are prohibitively expensive – they roughly cost 3-4x more than LPG systems but are cheaper over the lifetime of the system. If families can find a solution for the upfront costs, such heaters will save money for them in the long run.

Beyond water heaters, PAYGo methodologies can be applied to any technology that can be controlled remotely and that has very high upfront costs. For example, operators could consider financing smartphones in LatAm – an aspirational technology with significant benefits to customers in terms of access to information and economic opportunity. Smartphones are a good fit for PAYGo because they can be remotely shut off in the case of non-payment and have an up-front cost that can be too high for low-income customers. Globally, companies such as PayJoy are already using PAYGo to finance smartphones. 80 million Latin Americans are projected to begin using smartphones in the next 4 years, as penetration into lower-income segments grows.

As Internet of Things (IoT) technologies advance, many more devices and technologies will be connected to the internet (and could therefore be shut off in the case of non-payment) and can therefore be included in PAYGo models. These opportunities could include access to clean water, biodigesters for cooking and some electricity needs, transportation (e.g., electric scooters or bikes) or livelihood-enabling technologies like farming or irrigation equipment.

Enabling a better environment for profitability in LatAm

Not only are there appropriate needs and devices in LatAm, higher incomes, but greater financial inclusion and better unit economics means a larger, more profitable market.

In sub-Saharan Africa, an estimated 68% of the population, or 675 million people, live on less than $3.20 a day. While they may want and need these technologies, many cannot afford them outright and have little flexibility to increase their expenditure in order to access better, more aspirational solutions. PAYGo models were designed to match customers’ cash flows and expenditures – allowing customers to pay daily or weekly and at a price point that matches their current spending.

However, as the model has matured, PAYGo providers have realized it is difficult to reach profitability by targeting the lowest-income segments. In response to low repayment rates and a drive for stronger unit economics, PAYGo providers have reduced payment flexibility for customers by requiring a minimum monthly payment, increased the monthly price and moved up-market into higher-margin services and technologies. As documented by off-grid energy experts, most PAYGo providers in Africa no longer target the poorest customers.

In contrast, the income profile of households in middle-income countries in LatAm may be more suitable for PAYGo. Only 11% (66 million) of people live on less than $3.20 per day, and another 15% (96 million people) live on less than $5.50 per day. In Latin America, there are fewer people in the lowest-income bracket, where PAYGo is out of reach and where business models have been unable to reach profitability. There are more people in a slightly higher income bracket who can afford higher monthly fees and a shorter payback period but still can’t purchase technologies outright.

In particular, these households are better able to pay over shorter payback periods, meaning customers may be less likely to experience payment fatigue and default on their loan compared to customers in Africa. The technology lifetime is more likely to outlast the payback period, and customers can be sold additional technologies simultaneously, thereby improving their customer lifetime value to the PAYGo providers. As well, higher-income customers are more likely to have their basic needs met, so they are looking to more aspirational appliances to be financed by PAYGo, potentially opening up new revenue opportunities.

In addition, costs for customer acquisition and post-sales support are likely to be lower in LatAm. Only 19% of the population lives in rural areas, compared to 60% in Africa, making it easier and cheaper to physically reach customers for delivery, installation and servicing. Furthermore, the use of social media is higher in LatAm, giving PAYGo providers access to a marketing and customer acquisition channel that is less expensive and more data-driven and targeted than many traditional channels. Finally, LatAm has nearly two times the penetration of smartphones compared to sub-Saharan Africa, with an estimated 62% of mobile connections, making it more affordable and seamless to exchange information with customers and simplifying the repayment process. These factors could significantly drive down the unit economics of after-sales customer service and payment support, and can add value through the greater depth of customer data and insights provided by smartphones.

The Graviti Team

A more competitive financial services environment

While the context for profitability is more favorable, Latin Americans have greater access to financing than families in sub-Saharan Africa, meaning that PAYGo providers will face greater competition from financial services providers.

In Africa, 57% of the population in sub-Saharan Africa is unbanked, and 86% work in the informal economy. This means traditional financial service providers lack access to historical data and employment information to analyze a customer. Customers in this segment are also unlikely to have immovable collateral to securitize the loan and don’t have a credit record to inform the lending decision or to be used as a consequence for non-payment.

In this environment, PAYGo models use alternative data for credit scoring, remote meters to control access and distributed sales and customer services models to serve these customers. Together, these mechanisms allow PAYGo providers to provide financing to those unserved by others.

Families in LatAm face some of the same challenges in accessing finance, but to a lesser extent. In LatAm, 46% of the population is estimated to be unbanked and 40% in the informal economy. The financial system in LatAm more broadly is also stronger – nearly every country in LatAm has a full-file (comprehensive) credit bureau, and FICO scores for customers are widely available (compared to only about half of the markets in sub-Saharan Africa).

In this environment, one of the key challenges for PAYGo providers in LatAm will be competition. The presence of credit bureaus and credit scores means that one of the core advantages of PAYGo – alternative credit scoring – is less of a differentiator in Latin America. The existing infrastructure enables other credit solutions and competitors to take market share, including credit cards and asset-financing through large retailers such as MercadoLibre and Elektra. For example, these retailers already offer a wide variety of products on credit, have a large presence throughout LatAm and are well-known by customers, so PAYGo providers will encounter a more crowded and competitive market.

Despite competition, the PAYGo proposition could still prosper in LatAm. Unlike other providers that must rely on publicly-available data, PAYGo providers have proprietary credit scoring models and the ability to remote shut-off appliances to ensure loan repayment. These additional tools, together with higher financial literacy and formal employment, could allow PAYGo providers to develop more accurate credit scoring models and use credit bureaus as an additional consequence on non-payment. Both could lead to lower default rates and higher profitability for PAYGo providers in LatAm.

Furthermore, although many financing options exist in the market, customers struggle to use them because fees and interest rates are extremely high. For example, 50-60% annual interest rates are common, and in some cases loans are offered at above 100%. This has made over-indebtedness a challenge among many households in LatAm, for example in Mexico and Brazil. PAYGo providers can typically offer considerably lower interest rates to customers – for example, through better repayment rates via the meter or via better selection criteria through innovative credit scoring models.

In addition, customers in LatAm have a strong understanding of credit products and may be better able to recognize the advantages of PAYGo, thereby boosting the sales process. PAYGo providers have the opportunity to disrupt the current loan market and quickly acquire a large customer base looking for better financing options.

The combination of high interest rates and financial literacy means that many are skeptical of formal financing options or choose not to finance new purchases to avoid taking on more debt. This creates an additional opportunity for PAYGo providers to help over-indebted households rebuild their credit scores via more flexible PAYGo debt or refinance existing debt. Innovative PAYGo scoring and screening solutions can be used to identify customers with poor credit scores, but who are otherwise likely to pay. The flexibility and affordability of PAYGo financing, along with the meter to provide a reminder and consequence for non-payment, can set up this excluded segment for successful repayment. This repayment data can then be fed back to credit bureaus to rebuild credit histories for these customers, recovering their access to formal financial services.

In all, there is a significant population in LatAm that lacks access to affordable financing to purchase aspirational, life-improving technologies that can be connected to a remote meter. This suggests a substantial opportunity for PAYGo providers in the region, especially since profitability factors such as affordability and operational costs are more favorable in Latin America.

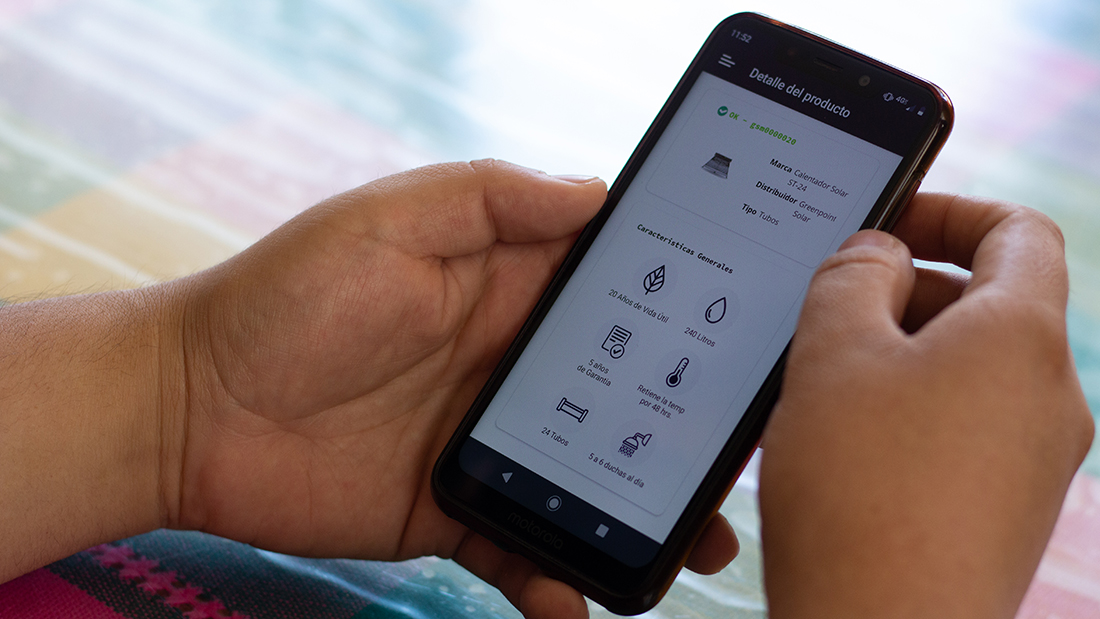

Graviti, a Catalyst Fund portfolio company that leverages PAYGo models to expand access to solar water heaters for families in Mexico, will give us a front row seat to the way innovators can adapt in order to succeed in LatAm. The startup uses a prepaid meter, similar to those used in African solar home systems, to turn off access to hot water when a customer hasn’t fulfilled their repayment obligations. However, their pioneering credit scoring methodologies account for the particularities of the Mexican market. We are proud to support Graviti, one of the first companies bringing PAYGo to solar hot water systems, and among the first PAYGo providers in LatAm. We look forward to sharing news of their progress in the coming months.