Venture-building helps South Africa’s MobiLife bring insurance to underserved families

Fewer than 12% of South Africans have life insurance, amounting to an insurance gap of over R30 trillion. Low uptake is driven by low trust insurance, weak product innovation, and uneven access. Recognizing an opportunity, Frank Schutte launched MobiLife in 2015 as the first provider to offer insurance 100% via mobile. Only a few years later, the startup now provides affordable, accessible, and appropriate insurance products to over 150,000 South Africans.

The barriers to insurance uptake in South Africa, especially among low-income populations, have been numerous. To start, iOL reports that most South Africans view life insurance as expensive and inaccessible, while others point to a trust deficit given exploitation of the lower-income segments by insurance providers. Even when South Africans do pursue insurance, they find inflexible, inaccessible insurance products that are characterized by slow claims processes, high costs, and overly generic offers. Together, these factors mean that insurance value propositions rarely appeal to low-income individuals. Furthermore, they are rarely offered the opportunity to purchase as insurance is primarily sold face-to-face via agents, who tend to target wealthier demographics given their commissions are tied to premium size.

In this environment, MobiLife has leveraged South Africa’s extensive mobile phone penetration (over 80%) to offer key customer-centric product differentiators like:

Furthermore, MobiLife’s Never-Lapse feature ensures that customers remain covered even if they have paid as little as a single premium in a year. Instead of allowing the policy to lapse when a premium goes unpaid, MobiLife simply adjusts the payout amount, thereby delivering on their promise to always cover their customers.

Early challenges

When they launched in 2015, MobiLife had already developed an innovative, impactful product, but they struggled with uptake. When they joined Catalyst Fund in 2017, they had recruited 5,000 users but only 30% had actually paid a premium, meaning that the sales process was not converting. Given these numbers, Schutte was worried that finances were becoming tight, and that low uptake was preventing him from demonstrating proof points to investors.

When Omidyar Network sponsored MobiLife to the Catalyst Fund, the startup joined the accelerator’s third cohort. Upon joining the program, MobiLife received $100,000 in grant capital, giving them just enough runaway to stay afloat and go on to close their Series A three months later. In Schutte’s words,

“Had it not been for the grant money, the startup would not be where it is today.”

Venture-building support helps MobiLife improve messaging and sales

In addition to providing much-needed grant capital, Catalyst Fund worked with Schutte and his team to redesign the messaging strategy and sales processes to drive conversions, helping to propel MobiLife to their current success.

MobiLife’s founders had been in the insurance space for over a decade and understood the product well, but they were facing challenges with product uptake. Two years after launch, MobiLife had sold fewer than 5,000 policies, and their digital marketing campaigns suffered from low conversion rates.

Catalyst Fund joined the effort knowing that serving customers with low and variable incomes is always a challenge, but that building trust in a new financial services brand is the key. The team executed three sprints to help MobiLife move towards product-market fit. The first sprint, customer research, pointed to strategies for increasing trust among sales leads. The second, a series of messaging workshops, helped refine MobiLife’s core messages to better resonate with customers. The third sprint, focused on sales conversions, led to improvements in the agent and customer onboarding processes.

Sprint 1: Customer research to articulate value proposition

MobiLife’s product was not generating sufficient sales leads or conversions, so the team needed a better understanding of how customers felt about their core value proposition. A quick review of customer feedback calls suggested that people misunderstood product features, and these misunderstandings were leading to lapsed policies. Addressing these communication gaps was not straightforward since sales operations were distributed among several call centers, leading to quality and compliance problems. These inconsistencies were causing further disruptions, and turnover was high as contracts with cell centers were being terminated and new ones initiated.

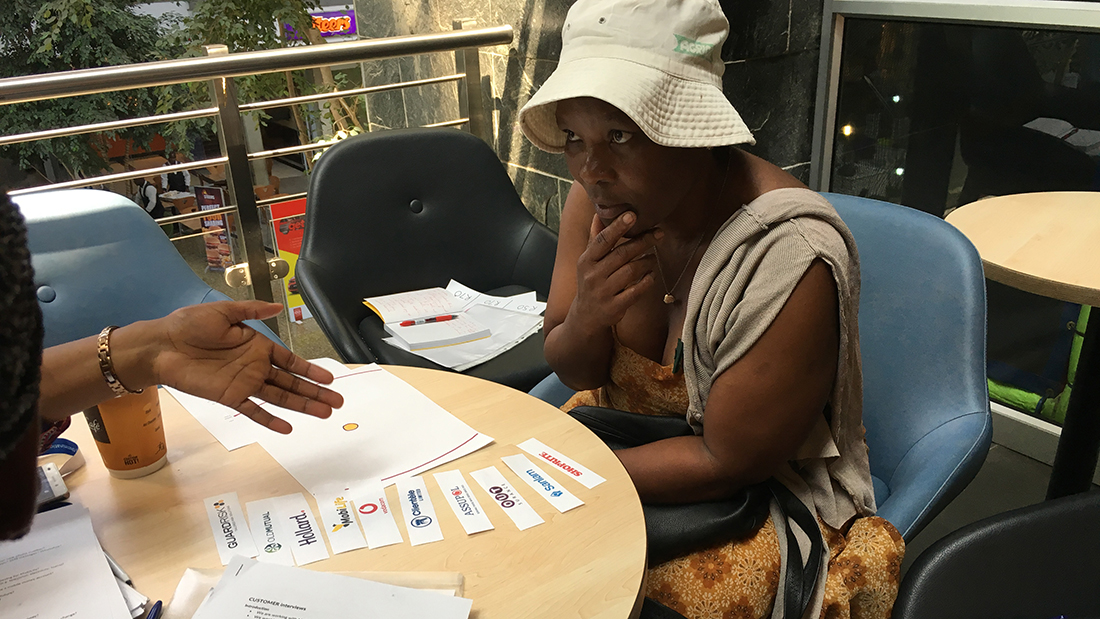

To start unraveling this problem, BFA Global field researcher Anne Gachoka, and UI/UX specialist Gabriel White traveled to South Africa to conduct fieldwork, develop personas and generate customer insights.

Their initial research indicated that, contrary to expectations, the startup’s powerful value proposition was acting as a double-edged sword. Potential customers understood the benefits but were also worried the product was “too good to be true”. The offer was not believable, and customers did not know the brand enough to trust it. Anne and Gabriel realized that MobiLife needed to build trust with users and potential users for them to believe the value proposition.

To understand where MobiLife could build trust, the Catalyst Fund team leveraged insights from the field research and used the customer journey mapping framework and the Design for Trust toolkit. They mapped key touchpoints spanning the breadth of the customer journey; from when leads first heard about MobiLife, to interactions as they were deciding whether to purchase, to validation of their decision to buy. The team even included touchpoints with acquired users who were looking to renew, change, or cancel their policies.

Next, they developed strategies for MobiLife to deploy at each of these touchpoints to engender and augment trust. One key opportunity they surfaced was the need for more consistent messaging across the customer journey. At the time, customers were hearing about MobiLife from a variety of sources: sales agents, marketing campaigns, the corporate website, call centers, etc. However, the language and messages at each of these outlets tended to vary, thereby eroding trust with new and potential users.

This realization launched the second Catalyst Fund sprint: developing a consistent messaging vocabulary to be used across the touchpoints that would resonate with users.

Sprint 2: Revamp messaging to build trust across touchpoints

Interviews in the field with existing and potential customers made clear that MobiLife’s core product benefits and features could offer incredible value to underserved, vulnerable populations. However, the Mobilife messaging was not connecting. Although many people felt “underserved” by existing products in the market, they did not understand the benefits of MobiLife.

For example, the brand’s “Simple. Bright. Mobile” tagline led customers to believe that MobiLife was a startup about mobile phones. While it certainly is 100% digital, MobiLife’s core message about insurance was absent. Catalyst Fund helped MobiLife re-think this tagline to communicate their key product offering in the simplest way possible. Today, the startup’s tagline reads, “easy life cover @ great price.”

Furthermore, as a new brand, depending on purely digital interactions was not building trust sufficiently, so the team needed to find a way to balance digital and human touchpoints. While digital allowed for higher margins, it also led to lower conversion rates. In contrast, agent models delivered higher conversion rates but lower margins.

Catalyst Fund helped MobiLife develop a tech-and-touch approach that maintained its mobile-first identity, while also deploying physical touchpoints at key moments in the user journey to engender trust and convert leads. For example, the team realized that human touch was particularly important early in the journey, but that more digital touchpoints could work as customers became familiar with the product.

In particular, interaction with trained insurance agents was more important during initial sales steps as users developed familiarity with the product. They needed to ask questions in real time to better understand product features and benefits. The team also recognized the need to show the physical address of the MobiLife office to help customers feel secure in that they could always reach a human establishment if needed. Once customers had been on-boarded, they could be transitioned to primarily digital interactions to manage their policies and pay premiums.

Sprint 3: Improve agent and customer onboarding

As part of field research, Anne and Gabe also shadowed MobiLife’s sales agents, who were largely responsible for customer acquisition. The team realized that agents were facing two key challenges: 1) interpreting MobiLife’s products and explaining them to customers, and 2) using the onboarding app. These challenges were hampering the sales process, leading to low conversion rates.

To start, the agents seemed unable to fully explain the product’s benefits to potential customers and struggled to answer their follow-up questions. They didn’t understand MobiLife’s call-center follow-up processes and could not coordinate with the call center staff to answer questions from potential users.

Furthermore, they found it difficult to use the onboarding app given connectivity and performance issues. Beyond technical issues, they also struggled with the app’s user experience, so could not help customers navigate it. For example, the team observed buttons that did not work, as well as agents taking notes on their palms because the app did not allow for additional notes.

To better empower sales agents, Catalyst Fund suggested several activities; to start, that MobiLife hold mentoring sessions with agents and develop digital training and testing tools sessions to build their confidence in speaking about product features and benefits. The team also recommended that MobiLife organize regular quizzes and check-ins with agents to help address their questions and resolve communication gaps with the call-center staff. The agents were also equipped with paper-based info flyers that customers could keep and study before making a decision.

To improve the onboarding app, Catalyst Fund prototyped an entirely new experience for agents and tested the new prototypes in the field. The team delivered a usability report for the existing app to help MobiLife iron out inefficiencies and smoothen the onboarding process for both agents and customers. We suggested the team also think about an “interactive brochure” feature in the app to support a more natural flow of conversation or a guided walkthrough that sales agents could narrate.

Finally, the team also suggested a number of technical improvements to the app. For example, Catalyst Fund recommended that repeat logins be remembered by the device to cut down on extra steps for agents. They also suggested the team consider re-architecting the sales application process so that most of the application data and functions were cached on the device and server requests only be used to download or upload unique data, such as quotes or application form details. Finally, they suggested re-architecting the process so that customer data could be saved locally and then uploaded to the server when network conditions were more favorable.

Post Catalyst Fund innovation

In the years since their Catalyst Fund acceleration, MobiLife has introduced two innovative insurance products into the South African marketplace: FoodSurance and Funeral Place.

Funeral insurance policies are popular in South Africa and play an important part in meeting the burial expenses incurred in the loss of a family member. However, if the deceased is the family breadwinner, the consequences on the family they leave behind can be devastating. “What happens to the family after the funeral? Who will put food on their table?” asked Schutte. MobiLife’s innovative FoodSurance product provides the policy’s beneficiaries with a weekly grocery voucher for up to five years after the passing of the breadwinner. The vouchers are delivered via SMS and can be redeemed at the leading supermarket chains in the country. These vouchers ensure that vulnerable families stay nourished after a traumatic loss.

While the company’s Funeral Plan policy is more traditional, it is uniquely designed for the underserved population. Lower-income customers tend to have highly variable disposable income – which means that they sometimes don’t have the cash to pay their insurance premiums. Given this variability and the subsequent lapses in payments, the insurance industry cancels nearly five million policies each year due to non-payment. “Traditional product design simply doesn’t match the financial realities of consumers,” says Schutte.

In response, MobiLife has introduced a unique feature called Never-Lapse, which allows customers to skip premiums whenever they need to, without the risk of the policy being lapsed or cancelled. Cover reduces for a period – proportionate to the premiums skipped – but increases again in the future as premiums are resumed. Never-Lapse has been massively successful in retaining customers within the product for much longer, and protecting families more effectively.

MobiLife today

Since Catalyst Fund’s work with MobiLife, the business has grown substantially. The challenges of building a new brand and serving lower income consumers in a cost-effective manner remain, but the insights and learnings gained from the three sprints resulted in lasting changes to the company’s onboarding process.

A pivotal moment for MobiLife’s growth trajectory came in late 2018. MobiLife’s product innovation, agile technology platform and unique approach to the market attracted the interest of South Africa’s largest bank. The bank took a minority stake in the business to gain access to the innovation and technology platform. Since then, the bank has introduced Never-Lapse into its own funeral product, which is now administered by MobiLife on its own platform. The FoodSurance product has also been approved for rollout into the bank’s retail branch network in early 2021. MobiLife’s innovations are now a fundamental part of the bank’s overall customer value proposition and have driven sales of more than 1,000 policies per day – a true reflection of a successful partnership.

Looking ahead

Partnering with established financial services brands that have achieved scale and a significant footprint have been the key to MobiLife’s success. The team continues to pursue additional opportunities to export MobiLife’s technology platform and product innovations to other markets on the African content. In addition, MobiLife is actively developing partnerships with other fintech startups and retail distribution brands in an effort to bring innovative, better-working insurance products to underserved markets across the continent.

At Catalyst Fund, we are proud to have contributed to MobiLife’s success in serving vulnerable populations and look forward to MobiLife’s ongoing success.

As Schutte notes, “Entrepreneurship is a lonely journey, and you need to remain very close to your values and purpose to get through the tough times. There were quite a few occasions where we came within an inch of closing our doors. The support – both financial and otherwise – that we received from the Catalyst Fund has allowed us to succeed where otherwise we would have failed. We are deeply grateful.”