Why we invested: PocketFin empowers women banking agents to improve access to digital financial services in India

Traditionally, Indians are well known for their savings habits, both in terms of financial savings, which account for over 40% of household savings, and holding wealth in the form of assets such as gold. The average Indian household allocates ~11% of their wealth to purchase gold assets every year. During lockdown restrictions in the country last year, households curtailed spending amidst growing uncertainty, which led to a cumulative ”extra” savings of USD $200 billion. Unfortunately, without easy access to appropriate bank accounts, the savings of rural households remains stored in cash, or in assets like gold, land and livestock.

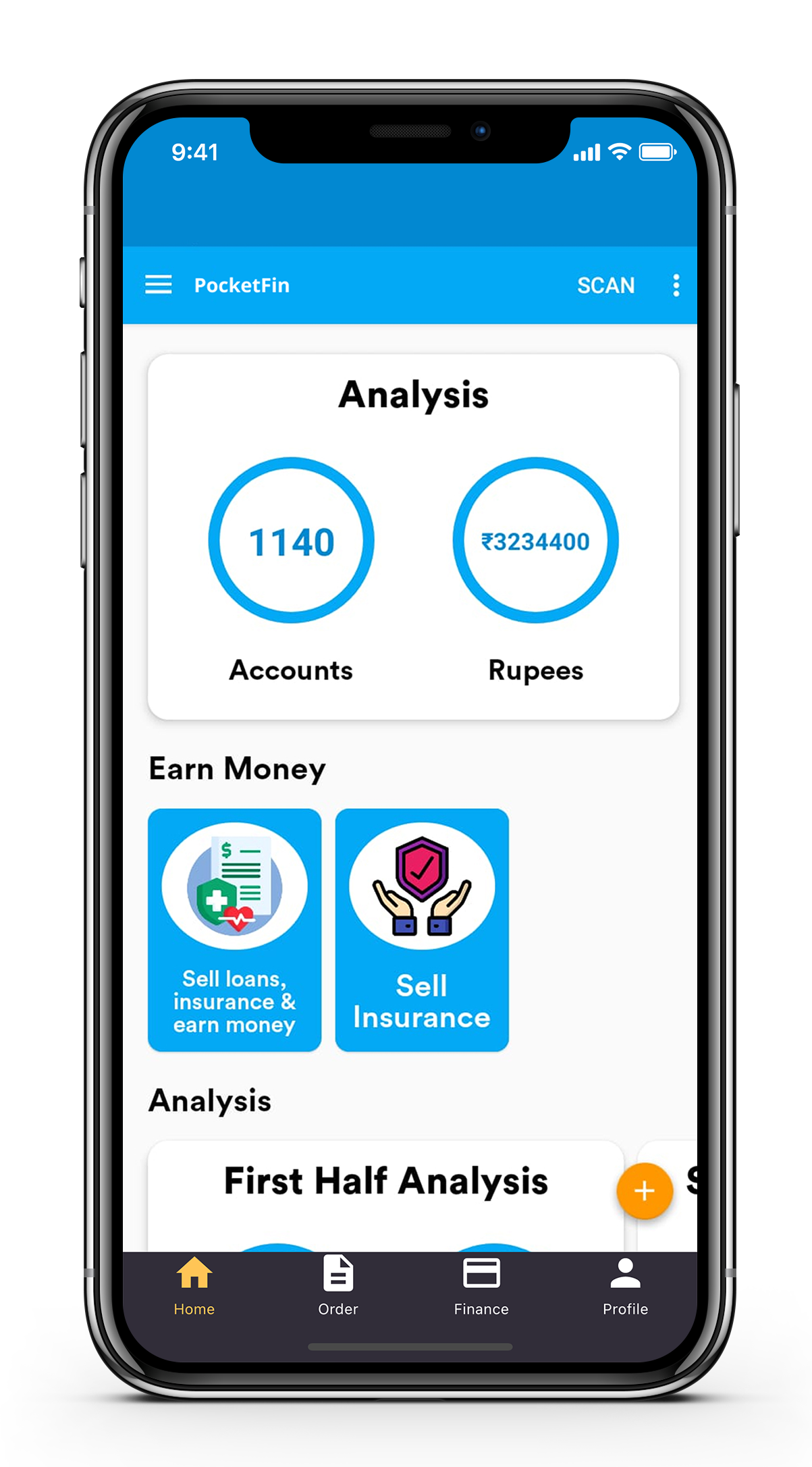

PocketFin’s fintech product helps protect these savings and enable households to access digital financial services by leveraging the country’s network of postal agents. The startup has created a digital CRM app that enables postal agents, who acquire users for the postal bank, to manage their customer accounts with ease, transparency and flexibility. It also allows agents to offer loans and insurance to their customers via the app, giving the agents additional sources of income so as to improve their own livelihoods, while providing holistic last-mile financial services to end-customers.

Impact

According to the latest data from the government’s Pradhan Mantri Jan Dhan Yojana (PMJDY) initiative, designed to open bank accounts and further financial inclusion, nearly 43 crore (430 million) Indians now have basic bank accounts and maintain an average balance of ₹3,000-3,500 (USD $40-45). This is “an indication that the scheme has now become a channel for savings for the low income families”.

Part of the country’s efforts to further financial inclusion includes the introduction of 5-year Post Office Recurring Deposit Accounts, which have mobilized local women to become postal bank agents, under the Mahila Pradhan Khestriya Bachat Yojana (MPKBY scheme). These women travel door-to-door to open savings accounts for small rural and semi-urban savers, most of whom are women managing their households’ budgets. India’s postal network is the largest in the world, with 155,618 post offices across the country, each with their own team of postal agents, allowing the program to deliver unparalleled reach.

This sort of agent banking has contributed to the rise of India’s financial inclusion score, which today stands at ~54, by enabling millions of Indians to access formal financial services for the first time. The agent model works for these end-customers, who are typically less digitally savvy and lack trust in digital transactions. They view banks as inaccessible, suitable only for larger transactions, and resort to saving at home or borrowing from an informal source for day-to-day needs. For these users, face-to-face interactions with DoP agents build trust and provide a bridge to digital financial services, like savings, loans, and insurance.

As promising as the model is, getting the logistics and user experience right for both users and agents is complicated. Despite innovations in agent banking services over the last several years, the day-to-day experience of participating agents is riddled with complicated and manual processes. A typical Department of Post (DoP) agent starts their day by taking stock of all the households they need to visit to collect deposits for their clients’ savings accounts. These savings accounts follow a bi-monthly deposit schedule, so the agents visit customers at the beginning and middle of each month for deposits. Once an agent collects the deposit from a customer, they log into their DoP web-based account and log the collection as complete. In case the deposit is not collected, the agent is required to flag that too. For each successful collection, the agent generates a receipt, which they must physically carry to the post office and submit along with the collected cash. This log-on and reporting process is repeated for every single customer, for each visit. As such, agents are not able to perform bulk actions or automate parts of the process. The current tasks are laborious and time-intensive, and prevent the agents from providing additional customer support, acquiring new customers, or delivering financial services to their existing clients.

Leveraging the existing network of women agents and the trust they hold in their communities, PocketFin has created a digital customer relationship management (CRM) app that enables DoP agents to automate common tasks, execute bulk actions, and access a digital overview of their customer base. PocketFin agents sync their Post Office agent accounts with PocketFin’s portal. Once an agent logs in and validates their account, they can start performing bulk actions on customer accounts, access detailed analytics that provide insights into pending and collected deposits, add new customers, track transactions and issue payment confirmations.

The result is that by PocketFin’s own estimates, the platform has so far saved women agents 150,000+ hours, which would have otherwise been spent performing manual operations, thereby also increasing the efficiency, reach and impact of each individual agent.

Innovation

PocketFin has designed an Android app to manage the everyday tasks of post office agents. These agents previously spent several hours everyday completing household visits to collect deposits and manually manage their client base. By accessing their customer accounts via mobile and automating common actions, agents claim PocketFin has resulted in 60-70% time saved. PocketFin has achieved this change in behavior by creating a user-centric app that improves upon existing processes in a seamless fashion.

Furthermore, PocketFin has partnered with other financial institutions to enable their agents to offer clients additional financial services, such as credit and insurance, in addition to savings offered by the Department of Post. These agents have undergone training from the DoP and understand the nuances of providing financial services. Coupled with their strong existing relationships with target users, this positions the agents well to bring additional services to their clients. These financial services generate an additional source of income for the agents, and end-customers benefit from doorstep access to a greater variety of financial tools and services.

Growth potential

With its agent banking model, PocketFin has the potential to reach last-mile customers in the most remote areas of India. The team is currently targeting users in tier 2-4 cities, which are underserved by mainstream banks. Currently, over 10,000 agents manage over 1.2 million savings accounts using PocketFin’s app, which is available in nine vernacular languages.

PocketFin already serves over 2,500 postal codes across the country. By leveraging the reach of India’s postal network, PocketFin has an opportunity to scale quickly. Moreover, with the introduction of additional financial services, the company has the potential to improve the financial health and resilience of customers through access to a more diverse suite of digital financial tools.

The Catalyst Fund model delivers outsized success compared with other accelerator programs. We accelerate startups that excel on three fronts:

- Impact: Catalyst Fund startups deliver (or, in the case of B2B firms, facilitate the delivery) of life-changing products and services to underserved populations. These can include financial services like loans, savings, insurance, and investment, but also access to productive inputs or essential services such as energy, sanitation, and water.

- Innovation: Our startups are pioneering game-changers that are innovating new products and business models. They drive the sector forward by demonstration effect and via the learning that Catalyst Fund documents and shares.

- Growth potential: Catalyst Fund startups are distinctively investment-worthy, developing businesses that are scalable, with high growth potential. Our startups are selected by an Investor Advisory Committee, who have deep experience in emerging markets and nominate high-potential startups, and then sponsor and mentor them through Catalyst Fund. As a result, our startups raise more funding than startups from other accelerators.