Catalyst Fund announces expansion, $15 million in funding from UK aid, JPMorgan Chase & Co.

Global inclusive fintech accelerator Catalyst Fund announces new £12 million GBP ($15 million USD) commitment from UK aid and JPMorgan Chase & Co. to advance financial inclusion in emerging markets

New commitment to help fund the growth of 30 early-stage companies focused on advancing financial inclusion for underserved consumers

LONDON, UK, 20th January, 2020 – Catalyst Fund, managed by BFA Global and Rockefeller Philanthropy Advisors (RPA), today announced a new £12 million GBP ($15 million USD) commitment from UK aid and JPMorgan Chase & Co. to advance financial inclusion for underserved people across the world. Over the next three years, the inclusive fintech accelerator will support the growth of 30 additional startups across five key emerging markets for fintech innovation: Kenya, Nigeria, South Africa, India, and Mexico.

The announcement is taking place alongside the UK-Africa Investment Summit, which is being hosted by the Prime Minister and brings together businesses, governments and international institutions to showcase and promote the breadth and quality of investment opportunities across Africa. In addition to its expansion, Catalyst Fund is announcing its latest cohort of inclusive fintech startups, including:

- Pesakit – Kenya-based app for mobile money agents

- Kwara – Kenya-based online and mobile banking platform for Savings + Credit Cooperatives (SACCOs)

- Cowrywise – savings and investment tool targeted toward Nigerian youth

- Meerkat – South Africa-based debt counseling and savings product

- Farmart – India-based digital credit platform for farmers

- Spoon – South Africa-based savings and credit offering for women-owned, subsistence enterprises

“We’re thrilled to enter the next phase of this journey, building on lessons learned over the last four years, to position ourselves as the best partners for innovators building affordable, accessible and appropriate solutions designed to improve the financial health of underserved populations in emerging markets,” said Catalyst Fund Director Maelis Carraro. “The additional support from UK aid and continued support from JPMorgan Chase & Co. will enable us to deepen our local footprints and ecosystem development role in each of our key markets, as well as welcome new partners that can support our mission.”

£12 million GBP ($15 million USD) expansion

Despite marked progress on reducing poverty over the past decades, nearly half of the world’s population lives on less than $5.50 a day. With the additional investment from UK aid and JPMorgan Chase & Co., Catalyst Fund will support the development, growth and reach of 30 new fintech solutions to boost financial inclusion for an additional 1 million underserved people in Kenya, Nigeria, South Africa, India and Mexico.

Catalyst Fund is focusing on these markets because of their vibrant fintech industries which house a significant number of early-stage startups across Africa, Latin America and Asia, and the need to address critical challenges faced by local underserved consumers.

This new commitment will enable the program to apply lessons learned from accelerating startups in emerging markets over the past four years and focus on:

- Providing critical pre-seed capital and bespoke venture building support;

- Broadening the pool of investors who receive 1:1 connections with Catalyst Fund companies;

- Accelerating the innovation ecosystems in each market to improve startups’ access to capital, corporate partnerships and talent; and

- Sharing best practices toolkits, learnings and insights with the global fintech community to spur innovation across markets.

“With the support of UK aid, Catalyst Fund is connecting more fintech start-ups in emerging African markets with expertise and investment from the UK and around the world,” said UK Minister for Africa Andrew Stephenson. “This innovative work is crucial to changing the lives of people around the world by providing access to basic services like pensions, lending and health care. The UK-Africa Investment Summit will create more partnerships that will boost investment, jobs and growth to benefit both people and businesses across Africa and the UK.”

The new support from UK aid, in addition to the continued support from JPMorgan Chase & Co. and fiscal sponsor Rockefeller Philanthropy Advisors, will enable Catalyst Fund to build on learnings and insights from the organizations’ home markets in London and New York.

“Financial inclusion is the cornerstone of resilient communities and households,” said Carol Lake, Head of International Markets Philanthropy, J.P. Morgan. “At J.P. Morgan, as part of our $125 million global commitment to financial health, we are supporting the development and growth of innovative fintech solutions that can help underserved people across the world save, reduce their debt and improve their lives.”

A history of impact

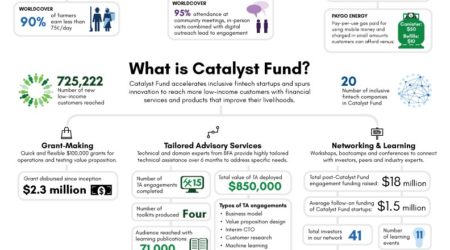

Catalyst Fund was created in 2016 with support from JPMorgan Chase & Co. and the Bill & Melinda Gates Foundation, to support entrepreneurs building solutions that improve the financial health of underserved communities.

To date, Catalyst Fund has accelerated 25 fintech startups, who have so far raised over 10x the amount of grant capital they received and are serving over 1.2 million customers globally. Based on learnings so far, in the next phase Catalyst Fund will focus more on businesses who are building solutions that go beyond financial access and inclusion, to improve the overall financial health of underserved consumers.

Early-stage fintech companies across all emerging markets struggle to raise the capital and access the talent they need to test their solutions in-market. Catalyst Fund’s approach has demonstrated that a combination of flexible grant capital, tailored venture building support and curated introductions to investors leads to better growth outcomes for startups designing solutions for the underserved.

“Catalyst Fund is itself an innovative example of collaboration across sectors and assets,” said Melissa Berman, President & CEO of Rockefeller Philanthropy Advisors. “We are proud to be a part of an initiative that combines mentoring from impact investors, grant capital from committed donors and advisory services from expert consulting firm BFA Global.”

# # #

About Catalyst Fund

Catalyst Fund, managed by BFA Global, is an accelerator for inclusive fintech startups and innovation ecosystems, in emerging markets. Launched initially in 2016, with support from J.P. Morgan and the Bill & Melinda Gates Foundation, today Catalyst Fund is supported by the Department for International Development (DFID) and JPMorgan Chase & Co., and fiscally sponsored by Rockefeller Philanthropy Advisors. The mission of Catalyst Fund is to accelerate the development of affordable, accessible, and appropriate financial solutions for the world’s 3 billion underserved.

About The Department for International Development (DFID)

The Department for International Development (DFID) leads the UK’s work to end extreme poverty. DFID is tackling the global challenges of our time including poverty and disease, mass migration, insecurity and conflict. Its work is building a safer, healthier, more prosperous world for people in developing countries and in the UK, too.

About JPMorgan Chase & Co.

JPMorgan Chase & Co. (NYSE: JPM) is a leading global financial services firm with assets of $2.8 trillion and operations worldwide. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, and asset management. A component of the Dow Jones Industrial Average, JPMorgan Chase & Co. serves millions of customers in the United States and many of the world’s most prominent corporate, institutional and government clients under its J.P. Morgan and Chase brands. Information about JPMorgan Chase & Co. is available at www.jpmorganchase.com.

About Rockefeller Philanthropy Advisors

Rockefeller Philanthropy Advisors (RPA) is a nonprofit organization that currently advises on and manages more than $200 million in annual giving by individuals, families, corporations and foundations. Continuing the Rockefeller family’s legacy of thoughtful, effective philanthropy, RPA remains at the forefront of philanthropic growth and innovation, with a diverse team led by experienced grant makers with significant depth of knowledge across the spectrum of issue areas. Founded in 2002, RPA has grown into one of the world’s largest philanthropic service organizations and has facilitated more than $3 billion in grantmaking to nearly 70 countries. RPA also serves as a fiscal sponsor for more than 40 projects, providing governance, management and operational infrastructure to support their charitable purposes. For more information, please visit www.rockpa.org.