Meet the Five Startups Shaping the Future of Inclusive Fintech in Emerging Markets

Through Innovations in e-Commerce, Blockchain, Mobile Money Integrations, and Agrifintech

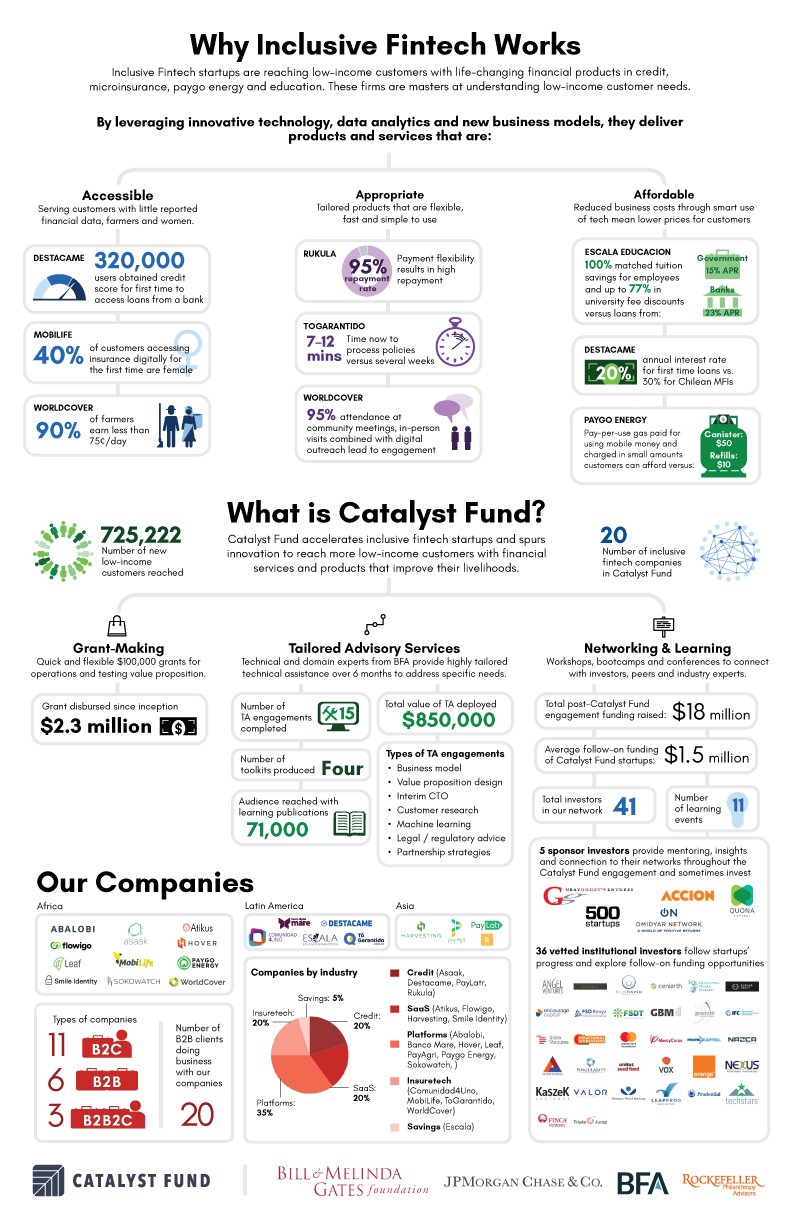

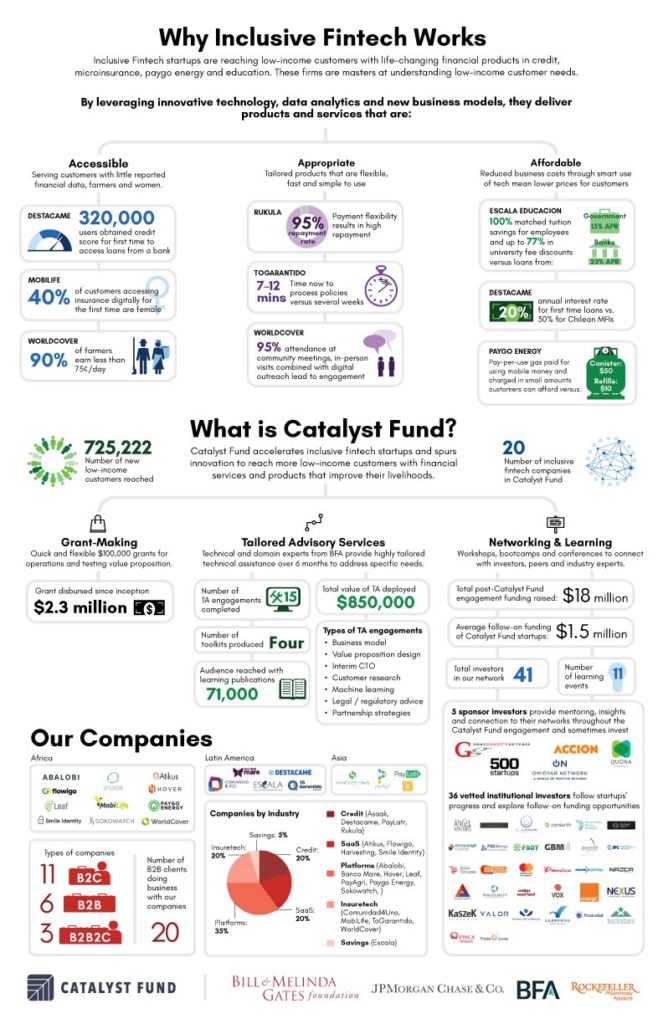

At Catalyst Fund, we have been working with a wide range of startup companies to bring much-needed essential financial products and services to improve the lives of people on low incomes. We are proud to announce the five latest “inclusive fintech” companies to join Catalyst Fund: BancoMare, Hover, Leaf, payAgri, and Sokowatch. These startups are tackling enormous challenges to bring more accessible, affordable, and appropriate financial services to the 1.7 billion underbanked customers in Africa, India, Brazil, and Southeast Asia.

Catalyst Fund is shining the light on the 20 companies — learn more at #CF20 on Twitter

There has been progress in financial inclusion over the past 5 years, with 515 million people gaining access to a bank or mobile money account, bringing the percent of adults globally with bank to 69 percent. However, too few people on low incomes actually use financial services, and we are yet to see the variety of products that can truly improve the financial health of these customers. We invested in these startups because their solutions can accelerate financial inclusion by: 1) overcoming infrastructure barriers currently limiting mobile money innovation; 2) facilitating partnerships among ecosystem players such as digitizing data for financial service provision; and 3) bringing tailored products to the most vulnerable people through advanced technology. Collectively, these five companies are:

1) Building the communication and commerce infrastructure for the next billion

According to GSMA, by 2020 there will be 3.3 billion smartphones and around 1 billion mobile money accounts in emerging markets. However, the current suite of solutions built on mobile money “rails” remains limited, often because it takes 6–18 months for a startup to integrate a single mobile money service with their app. Hover offers a technology solution that reduces development time to 1 hour for all mobile money services and it can be used as a lightweight version of the internet that could bring the next billion people online. Hover’s proprietary and patent-pending technology can allow in-app mobile payments even for customers without data plans as it enables mobile developers to turn an existing communications protocol, USSD, into an invisible transport layer.

2) Connecting ecosystem players by building a platform for financial services distribution

Informal, small merchants make up most of the economic activity in African countries. Yet they face enormous challenges to grow, due to low product availability, lack of connections, constrained access to capital, and poor data management systems. Sokowatch solves these problems by connecting East African informal retailers with fast moving consumer goods (FMCG) manufacturers, offering on-demand product supplies for in-store inventory and free delivery. In this way, it leverages alternative data (such as orders and payment history) and strong in-person relationships developed with the merchants to offer low-cost credit lines for a flat 2 percent fee to support merchants’ working capital and cash flow needs. Sokowatch strives to create the largest e-commerce network of goods and services for informal retailers across emerging markets.

India’s payAgri also facilitates partnerships to optimize the value chain and enable financial service delivery through a platform approach. This agri-fintech startup brings together key players in the Indian agriculture value chain — farmers, cooperatives, institutional buyers, and financial institutions — facilitating trade and funding flows to low-income farmers who struggle to access financial services and rarely get paid on time. Through their platform, payAgri collects verifiable and traceable data on every farmer to establish a credit history, connects buyers to cooperatives for bulk purchases of agricultural products, and links buyers to financial institutions to provide invoice financing and working capital loans. payAgri hopes to foster transparency and remove inefficiencies, such as middlemen, cash-based transactions, and misinformation.

3) Using advanced tech to serve the most vulnerable

Today’s most vulnerable populations are often those with the least opportunities to access appropriate financial services. Among them are the 65 million refugees worldwide lacking a safe way to transport their assets as they flee their home countries. Leaf helps refugees in Rwanda safely transfer their assets across borders and in multiple currencies, using blockchain technology that minimizes the attention of thieves and malicious border guards. Powered by Stellar, an open-source payment network, Leaf’s mobile platform enables refugees to deposit their money at a mobile money agent based in their home country, send funds to Leaf for safeguarding with a transparent rate, and retrieve the assets in a new mobile money wallet using a linked biometric identity once they settle into a new country, solving at least one of the many hurdles facing refugees today.

Banco Mare in Brazil reaches excluded communities in Rio de Janeiro’s largest favela via a blockchain-based digital platform.11M people in Brazil live in favelas and are currently overlooked or under-served by traditional financial service providers. Banco Maré offers bill payments, top-ups, P2P transfers, in store payments, TEM Saude, a health assistance plan, and debt payment assistance via a mobile app. Customers can make transactions with Banco Mare’s own cryptocurrency, Palafita, currently converted to Real by a 1 to 1 exchange rate. Of course, clients can also visit local agents called Kioscos, local shops that offer all of Banco Mare’s services and provide customer support. Banco Mare is bringing secured payments in a high-risk environment, eliminating the risks associated with carrying cash!

While at Catalyst Fund, these five companies will test and refine their value propositions to move closer to the product fit in their respective markets. Our work with them will focus on: understanding how to best retain customers in the absence of accurate engagement data; tailoring value propositions for early adopters and understanding multiple stakeholders’ pains and gains; sketching product architectures for mobile wallet integrations; and setting paths to artificial intelligence (AI) readiness by optimizing the way data is collected and organized. We’re thrilled to welcome them to the portfolio and help them push the boundaries of access and usage of digital financial services for inclusion. Learn more about the newest members as well as previous portfolio companies by visiting bfaglobal.com/project/catalyst-fund/portfolio/.