Early Insights on Incentivizing Indian Customers to Go Cashless

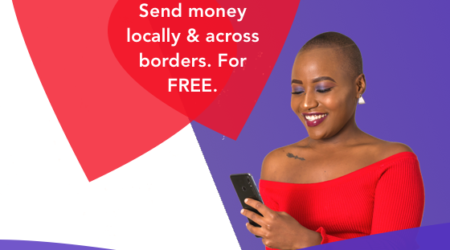

Early this year, Amitabh Kant, CEO of the National Institution for Transforming India (Niti Aayog), declared “Cards, ATMs, POS will all become redundant in India by 2020, and India will make this jump because every Indian will be doing his transaction just by using his thumb in thirty seconds….” Although evidence indicates that demonetization has moved India towards a digital economy, there is still much work to do before Kant’s vision becomes a reality.

In 2015, for example, Uber understood that its global business wouldn’t work in India unless it enabled cash as a mode of payment. After all, “Cash is king!” It’s easy to handle and to exchange.

Moreover, transitioning to digital money requires coordination and effort both in terms of consumer transactions and in terms of infrastructure. For example, if one party in a transaction, whether the consumer or the merchant, wants to use cash, the transaction is likely to go forward using cash as it remains the prevailing standard.

While Unified Payments Interface (UPI), the building block of India Stack, has promised to promote digitization by facilitating instant fund transfers between bank accounts on a mobile platform, the reality is still far behind the promises. As a result, individual banks are putting forth their own rules and conditions and absorbing large upfront costs, a prospect that is unaffordable for most early-stage innovators and entails extensive coordination costs down the road.

Carrots for Going Cashless

In this challenging environment, PayLatr, an early-stage startup in India, and a Catalyst Fund investee, is using cashless methods to offer interest-free credit to middle-income households on a monthly basis to help them pay for daily purchases like groceries, milk, vegetables and fruit. PayLatr designed and launched a “scalable” cashless lending business in a cash-based economy that is convenient for customers by giving customers a carrot! PayLatr convinced customers to go cashless by offering them higher loan amounts if they agreed to digital payments.

To make the system work, BFA and PayLatr designed and tested a credit-scoring algorithm based on customer’s usage of the service and repayment behavior called PayLatr Credit Rating and Risk. The algorithm rewards customers who use the loans and repay on time using a cashless solution with higher loan amounts.

Not as easy as it sounds

The design process wasn’t simple. PayLatr first offered customers access to a larger loans if they allowed the company to make automatic deductions from their bank account. However, Indian customers were hesitant to share their bank account information. Next, PayLatr tried using electronic transfers by allowing customers using online banking (NetBanking) to transfer funds to PayLatr. This option is working — 100% of borrowers are indeed using the option. But not necessarily because they like it! PayLatr also charges customers Rs 100 (about USD $1.50) if customers pay in cash. The additional small fee has helped encourage customers to go cashless.

While India has not yet achieved Amitabh Kant’s vision for 2020, there is no doubt that Indian customers are going cashless, gradually. In the meantime, fintech businesses need to innovate with the means available to them today by thoroughly understanding customers’ needs and offering them appropriate solutions as the economy moves to digital.