Scenario planning can help Mexican financial cooperatives prepare for COVID-19 impact

All opinions are BFA Global’s.

While the pandemic has caused simultaneous supply and demand shocks to economies around the world, response and recovery trajectories among individual countries seem to vary significantly. The uncertainty around how a specific country will rebound makes it difficult for organizations and businesses to plan and prepare. In these circumstances, institutions urgently need processes and strategies to plan for a set of potential futures, particularly financial institutions which underpin economic recovery and development efforts.

Scenario planning is a methodology that can help, but it needs to be adapted for lean, rapid approaches for today’s COVID-19 world. Scenario planning provides a way to explore how exogenous dynamics and future unknowns might impact internal questions. The idea is to combine known facts about the future, such as demographics and technology trends, with key driving trends – social, technical, economic, environmental, and political – to develop storylines for potential futures. These storylines give organizations a lens, or set of lenses, from which to construct strategic and operational options. Scenario planning works best with an inside-out approach, starting with important decisions that should or must be made and then progresses outward into the local, regional, national, and global environments. This can keep the process focused and prevent it from landing on speculation about future scenarios that are either infinite in number or irrelevant to the organization.

Scenario planning processes typically take 6+ months and involve dozens of people within an organization. Given today’s urgency and level of uncertainty, BFA Global has developed a rapid, lean approach to scenario planning. Through the FinnSalud program, funded by MetLife Foundation and fiscally sponsored by RPA, the team recently deployed the agile, accelerated version of scenario planning with Mexican financial cooperatives, given the key role that these socially-focused institutions play in the country’s financial inclusion landscape.

This blog shares a 6-step process of the scenario planning exercise so that it may serve as a model for other financial institutions struggling to manage today’s uncertainties. In particular, we hope it can serve other cooperatives and the broader Mexican non-bank financial services community in developing their own scenario planning process in a COVID-19 world.

Step 1: Have a clear driving question as the anchor

The first step in scenario planning is for the primary stakeholders to agree on a single strategic question to drive the entire exercise. To be effective, scenario planning exercises should focus on a substantive, consequential issue; one that could be specific and have a yes/no answer (e.g., Should we expand into other regions?), or one that is broader (e.g., What pieces of our business model should be digitized?).

For many cooperatives in Mexico, a scenario planning priority may be to inform an internal operational decision, while for others it may be to consider how they might best support their clients through the crisis. Given the program’s focus on financial health, we decided on the following driving question: “How could FinnSalud’s partners respond to the effects of the Covid-19 pandemic to improve the financial health of their clients through 2020?”, and have ensured that this effort looks beyond our current cooperative partners.

Step 2: Define key forces and uncertainties most relevant to your situation

With a clear target question in mind, the next step is to identify the most relevant forces, or big shifts in society, economics, politics, and technology, at work today. Prior to the COVID-19 pandemic, these might have included social trends such as changing demographics and globalization, technological changes such as smartphone adoption and increased connectivity, and environmental issues such as climate change; any overall trend that might shape the future.

The current pandemic requires a modified approach as the most relevant determining forces are the pandemic itself, and the policy response to it. Given the speed and depth of impact the virus is having on society and economies, it makes sense to zero in on it as the primary one to consider.

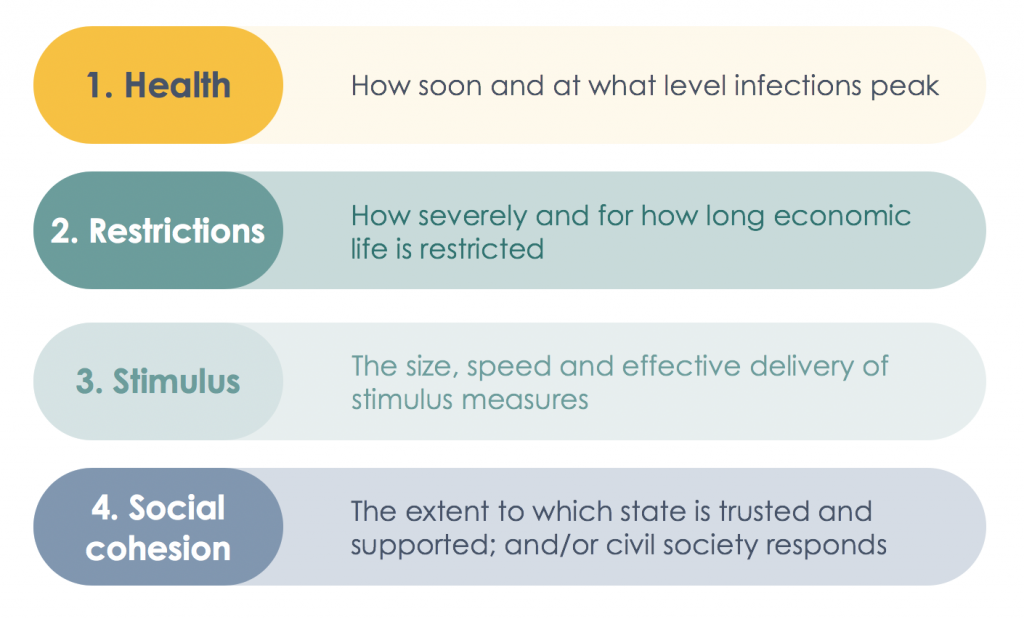

Centering on the pandemic as the primary force, the goal of this step is to focus the thinking on areas that could have a high impact on the organization and where there isn’t enough information to currently make a judgement call. For the purposes of our work with cooperatives in Mexico, we decided to focus on a set of four interdependent layers of uncertainties shown in Figure 1.

While there are certainly other potential uncertainties at work, we decided these four had the biggest potential influence on the economy, as well as the speed and rate of recovery.

Step 3: Collect and track uncertainty layer data

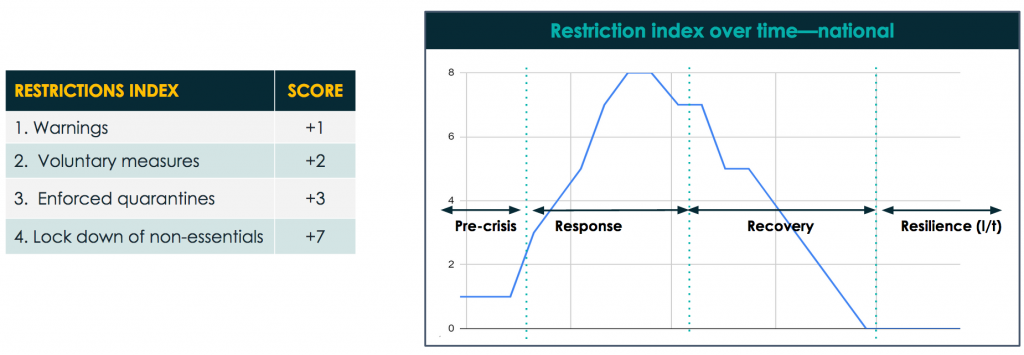

Next, we identified research and information – quantitative, qualitative, or expert opinion – to define metrics for measuring and tracking each of the uncertainty layers. By tracking a set of uncertainty metrics a financial institution can monitor wherein the response-recovery-resilience phases their national, regional, local, and organizational situation may be. We found that the length and movement between phases will be highly influenced by the health and response layers, and as such focused on identifying and measuring data related to both. Below is one example of how an organization might track movement between phases using restrictions data that is observable and closely proxies economic pain.

Since many organizations may be in a crisis response mode and may not have the bandwidth to do this research, here are a few objective indicators that we have found to be common across scenarios being developed during this time:

- Health — number and speed of increase/decrease of new COVID-19 cases and hospitalizations, proportion of hospital beds occupied, etc.

- Restrictions — location and duration of closures of schools, public gatherings, non-essential businesses, as well as shelter at home orders

- Stimulus — extended tax deadlines and rebates, suspension of retrenchments, direct benefit transfers and loan assistance programs, and interest rate changes

- Social cohesion — approval and public perception of local and national government-mandated restriction measures, crime rates, perception of transparency, and the speed and size of civil society and private sector responses

The health and restriction uncertainties are tightly linked, and have a significant impact on the time to a peak, and the height of the peak of infections, while the stimulus efforts and social cohesion uncertainties highly influence the depth of negative economic impact, and the length of time required to bring the economy back to normal (or a new normal). Again, while not exhaustive, this shortlist of examples is intended to provide readers with a set of initial indicators to review to inform their own thinking.

Step 4: Develop and test a few scenarios

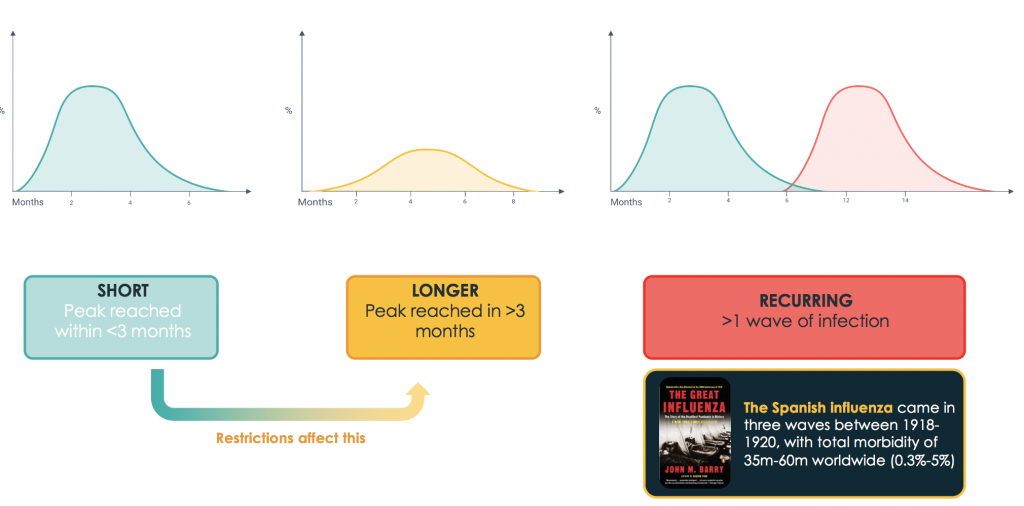

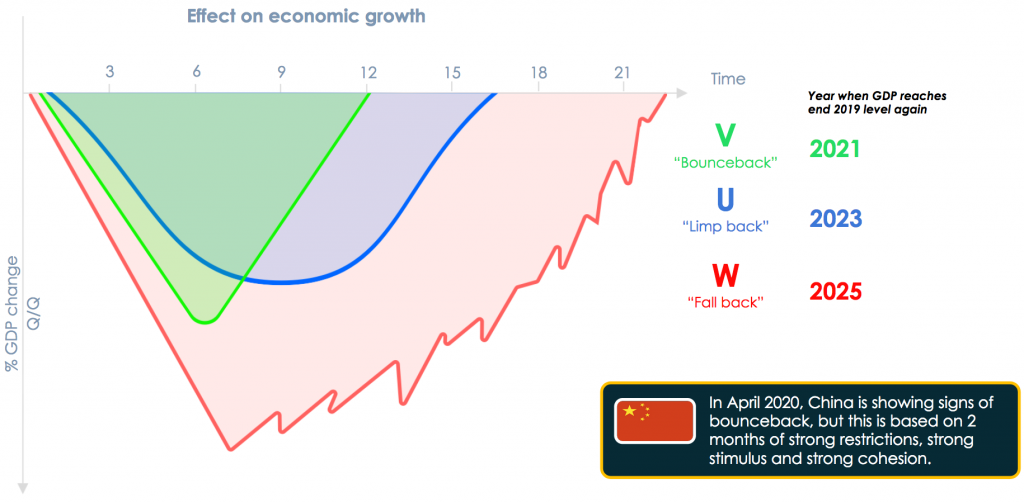

The next step would normally be to build a picture or scenario of the future using a combination of current trends, the uncertainties, and past experiences. However, the combination of a global virus pandemic and strict travel and economic activity restrictions has created a unique starting point from which drawing on past experiences, particularly those within the history of an organization, may not be of value. Given our focus on the pandemic as the primary driving force, we found it useful to begin with a spectrum approach, isolating that variable to view three potential future options (see Figure 3).

This sparked a discussion around which versions of the future are plausible within the international, Mexico, local/province, and financial institution contexts if the peak were reached within < 3 months, > 3 months, or if there would be recurring waves of infections, and provided a framework for considering the preconditions on which each would be based. As a next step we also found it useful to apply the same spectrum approach to the Restriction, Stimulus, and Social Cohesion uncertainty layers, creating three levels of intensity for each as well. For example, restrictions could be (a) quickly imposed and strictly enforced, (b) limited or not effectively enforced, and (c) mild or not enforced.

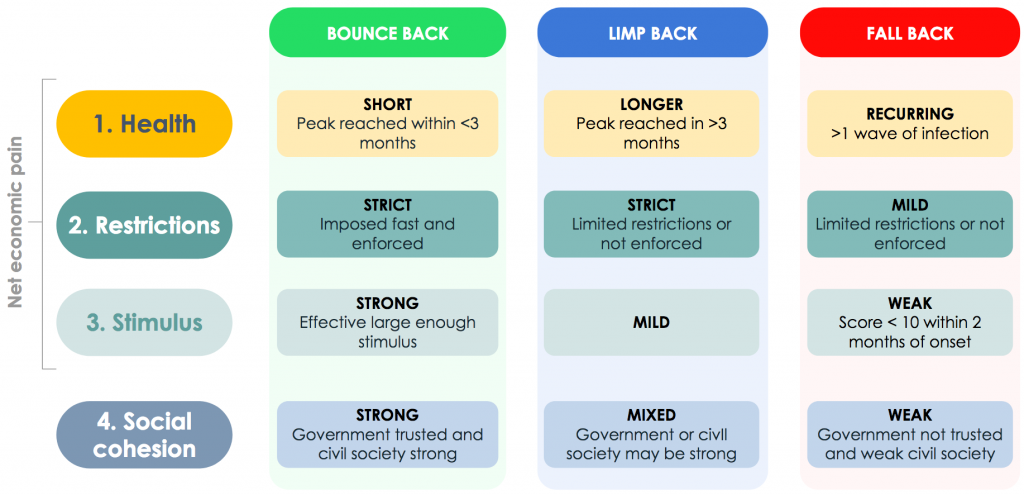

Three scenarios emerged from the combination of uncertainty spectrums, as Figure 4 shows:

- Bounce back — Under this scenario the wave of infection peaks and economic life returns quickly. Restrictions on movement (i.e. social distancing) and non-essential activity are strict and strongly enforced, economic stimulus measures are strong and effective, while social cohesion and government trust is maintained through the process.

- Limp back — If restriction measures are limited or not effectively enforced, the wave of infection may take much longer to peak. Under this scenario the economic stimulus measures would be mild or less efficient, and social cohesion would be mixed with a larger role for civil society.

- Fall back — The combination of extremely limited or non-existent restriction measures and a drop in social cohesion would extend the time to peak even longer and could result in multiple waves of infection. Under this scenario economic stimulus measures would be ineffective or take too long to execute.

Figure 5 shows that the interaction of severity in uncertainty layers creates different profiles of severity and timing of economic recovery.

We can see these scenarios reflected in practice. There is some indication through China’s recent experience that economic activity can restart within a few months of hitting the pandemic peak, but there are multiple circumstances in China (i.e., strong state response and execution, powerful fiscal and monetary stimulus) that make it difficult to replicate in other markets. While we are all hoping for a “bounce back” scenario for both the global and local economies, we must be prepared for alternative futures including the need for a prolonged period of restrictions.

Step 5: Align your stress testing, forecasting, and operational decisions against the most likely 2-3 scenarios

With a set of plausible and vetted scenarios in hand the team can now shift its attention to testing the sensitivity of operations, strategy, and financials in each by asking themselves “What will be the impact?” for each scenario. For example, if the economy is able to quickly bounce back, how will this impact our clients, employees, partners, and operations? In contrast, what would be the impact if there are disruptions in social cohesion, or a recurring wave of infections that require a second set of shutdowns? For cooperatives in the FinnSalud program, this step in the exercise includes incorporating assumptions related to:

- Length and breadth of economic and movement restrictions. For example, how severely physical movement is constrained in an area may prevent cooperative members from visiting a branch to conduct basic transactions or limit how often they make such a trip. These restrictions would also impact field activities and would likely impact the issuance of new loans.

- Income and other cash flow reductions may also lead members to withdraw from savings at a higher than normal rate. Cooperatives should consider modeling the average amount of withdrawal per client, the percentage of the client base making a withdrawal per week, and how those might change per scenario.

- Non-performing loans as a percentage of the total portfolio, and how that changes over time. In addition to movement restrictions, this would be influenced by how quickly clients may need to shift their resources toward meeting basic needs and deprioritize loan installments.

While not exhaustive, these questions are meant to introduce some of the ways in which financial institutions might adjust inputs into a set of financial models to imagine how key indicators might change under one or another scenario. (For more information on how financial institutions can respond, see BFA Global’s Operational Suggestions Guide).

Step 6: Identify implications that are common across each potential future

While these potential futures may each require a different response, we have found it valuable to also consolidate implications that are common across some or all scenarios. Below are three implication areas that emerged from our exercise within the context of financial cooperatives in Mexico:

- Digitization — Under all scenarios, digitization will advance driven by client demand and need; but the pace and degree of innovation will vary.

- Financial inclusion — Under all scenarios, the demand for basic financial inclusion (an account to receive and pay) will increase but use cases will vary.

- Financial health of clients — Under all scenarios, composite financial health will take time to recover; but focusing on a narrow measure of day-to-day management progress will help focus efforts initially.

Conclusion

This blog has introduced an agile scenario planning model as one tool to support cooperatives in making critical decisions during this pandemic. While a bounce-back scenario is what we all hope for, contingency plans need to be built around longer and more complex recovery scenarios, particularly for those cooperatives serving clients who operate in the informal economy or otherwise face barriers to accessing support through stimulus measures.

In addition to equipping cooperatives with a framework for their own scenario exercise, we would recommend as initial steps:

- Creating a crisis team that can centralize information and take swift decisions as the crisis unfolds and eventually recedes.

- Stress testing their financials to understand the leading indicators and potential outcomes for the institution. FinnSalud has produced a free stress testing tool that you can learn more about here and request a copy of here.

In an upcoming blog we will explore in more detail the next steps in the FinnSalud scenarios journey, with a particular focus on the potential of cooperatives and their clients to fuel an inclusive recovery phase.