What will it take for Nigeria’s inclusive fintech sector to flourish?

Despite a notoriously challenging operating environment, there are signs of improvement for fintech startups in Nigeria. Financial inclusion rates are surprisingly low (41.6% remain excluded), but mobile penetration rates are high and rising (49% last year), and investment is growing rapidly. Regulation that excluded telcos from the digital finance ecosystem was recently adjusted so there is now more opportunity for fintech startups. Overall, Nigeria seems to be shaping up to be the perfect environment for inclusive fintech startups to prosper.

BFA Global’s Catalyst Fund launched our official presence in Nigeria during Nigeria Fintech Week in Lagos last year. At our launch, we sat down with key ecosystem players to get their take on what is needed to enable truly inclusive fintech solutions for the Nigerian market, as well as ways market facilitators can help the ecosystem flourish.

Opportunity for fintech: mobile penetration rising in low inclusion environment

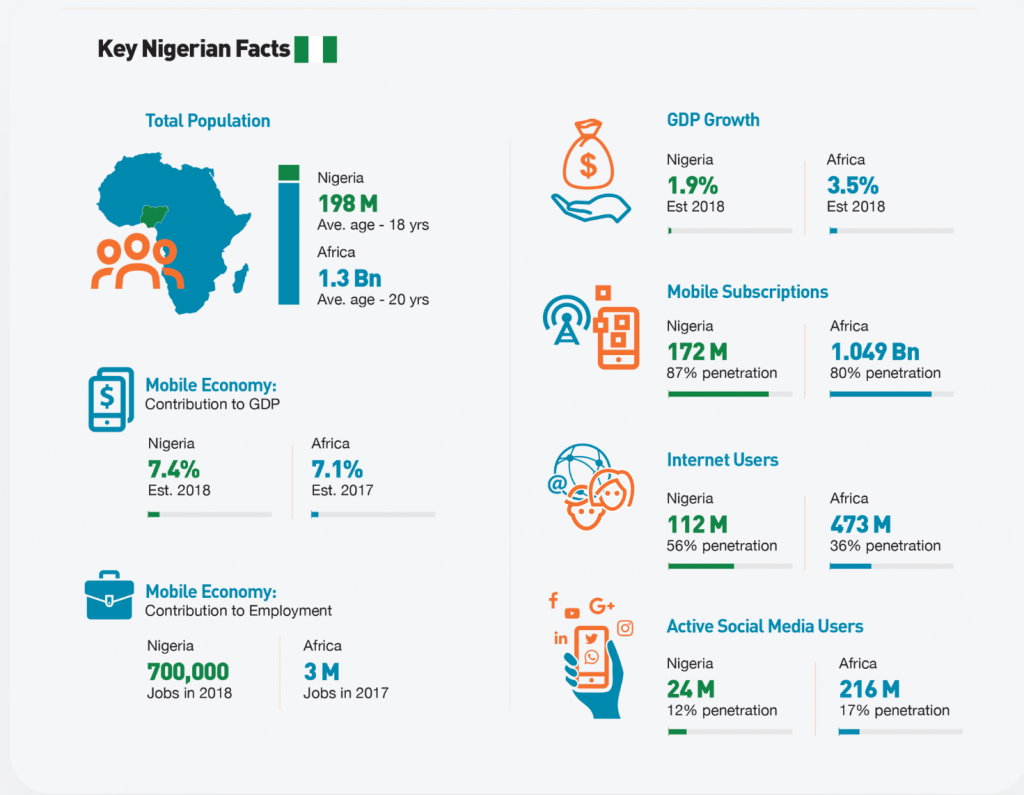

Although 60 million Nigerians are unbanked and lack access to digital financial services, access to mobile devices and to the internet is growing. Over 56% of the population, or 112 million Nigerians, reportedly had access to the internet in 2019.

Source: Jumia Nigeria Mobile Report 2019

Source: Jumia Nigeria Mobile Report 2019

Even as these numbers are growing, access to digital financial services is still limited. In contrast to Kenya, where mobile money accounts for 44% of GDP, that number stood at only 1.4% in Nigeria in 2018. The World Bank reports that just 6% of adults in Nigeria have a mobile money account, and this has remained virtually unchanged since 2014. Compare this with 73% of Kenyans who use their phone for mobile money transactions.

Regulatory barriers are getting addressed

These low numbers are at least partially explained by regulatory barriers and the influence of major banks, which have dominated mobile money platforms, rather than telcos, as is common in other countries. Only a few fintech companies, like Paga, have obtained licenses to offer the service in Nigeria.

Without active MNO and fintech offerings, digital financial services have been limited to those who have a bank account, which automatically excludes more than a third of Nigeria’s population. In contrast, Kenya’s telco-controlled mobile money sector has vastly expanded access, resulting in a financial inclusion rate of 82%.

Iyinoluwa Aboyeji, co-founder of Flutterwave and Andela, agrees that regulation has prohibited Nigeria’s mobile money industry from reaching the unbanked. “You need the telcos for a lot of things. If you want to reach the unbanked, you have to work with the telcos because they have better distribution networks.”

As of October 2018, however, the regulatory environment has taken a significant step toward providing new opportunities for growth. The government introduced reforms to allow mobile operators to obtain licences to operate payment service banks (PSBs) for the first time. MTN was the first major telco network to be granted a payment service bank license, followed by 9Mobile and Globacom, with Airtel expected to launch soon.

Authorities are also slowly encouraging more digital transactions in other ways. The Central Bank of Nigeria’s “Cash-less Nigeria” policy was introduced in 2012, and new regulation was announced in September 2019 that creates a cash-handling charge on daily cash withdrawals to encourage digital transactions.

Investors see the opportunity

Investors are responding to the perceived opportunity in Nigeria. In 2018, Nigeria was home to 58 fintech startups that raised a total of $94.9 million, the most for any country on the continent. 2019 far surpassed that record, with Opay, Interswitch, and PalmPay raising $120 million, $200 million, and $40 million respectively in the first two weeks of November 2019 alone, and lending startup Branch bringing in $170 million earlier in the year.

These investments have largely been concentrated in payment solutions (i.e., Payment Solution Service Providers (PSSP), Payment Gateway Providers, bill payments platforms, and e-wallets). These include Catalyst Fund portfolio company Chipper Cash, a cross-border payments company that launched in Nigeria; Opay, a payment platform that announced a $120M fundraise to expand their payments product into Kenya, Ghana, and South Africa; and Nigerian payments company Interswitch, which is the first African unicorn, with a valuation of $1 billion thanks to a capital injection from Visa.

There is a need to build trust between startups and banks to establish sustainable partnerships

To grow the fintech ecosystem beyond payments and include a diverse set of financial products and services, partnerships between startups and banks will be key. For fintech startups, partnerships will banks promise access to millions of customers to scale their businesses. For banks, partnering with customer-centric startups offers a way forward for expanding and refining their offerings using innovative products and business models.

However, such partnerships are not easy. Big banks in Nigeria have found it challenging to work with startups that may be ill-prepared to enter negotiations, and to handle the influx of customers they would need to manage if their product were to be offered to a bank’s significant base. Banks also have difficulty trusting startups will be able to execute on the partnership once agreed.

In order to build this trust, startup founders need to be confident in their product’s ability to execute. Ike Eze of Beta Ventures noted that if a startup’s technology is not equipped to withstand fast growth in users, it could mean disastrous results. A failed pilot run might ruin the startup’s reputation, for example, and that founder’s ability to work with similar institutions in the future. “What’s often overlooked by banks is scale risk. Once 10,000 people hit the product, will you find issues? It’s on the companies to overcome this.”

As a result, banks often want to see proof points and traction before coming to the table. Ann-Elise Francis of Catalyst Fund portfolio company Turaco noted, “We started trying to talk to banks and institutional partners early on. But banks want to see proof of concept, so we needed to be nimble and run pilots. Now that we have those pilots we’re able to come back and talk to bigger partners.”

However, these steps can be slow and costly to startups. UBA’s Austine Abolusoro noted that while banks want to innovate by working with fintech startups, internal risk management processes can inhibit them from moving quickly with a potential partnership. It can take a year or more for a partnership to be initiated, by which time, the startup may no longer be active.

Mary Joseph of Greenhouse Capital noted that market facilitators can act as “a guarantee for a bank and stand in the middle, because banks and startups often don’t know how to work together today. [Market builders] can help banks really understand what they need – this is a role we can play.”

One potential way to enable more successful relationships is for programs like Catalyst Fund to step in as facilitators and guide these partnerships and pilots from the beginning – both to de-risk and validate the startup approaching the bank, and to help the bank determine what makes sense for them when it comes to investing in innovation. This would mean an ecosystem level approach to partnerships.

Narrowing the talent gaps

Another key role that market enablers like Catalyst Fund can play is to help attract talent to the sector, which all stakeholders identified as a challenge. Catalyst Fund aims to help close the talent gap by partnering with local and international universities, coding bootcamps, entrepreneurial programs, and talent networks to discover talent who can fill much needed roles in fintech companies. In turn, this exposes more young people to the potential of fintech startups as a career opportunity.

In particular, Ashley Lewis of Accion Venture Lab noted a gap at the middle management level among startups in Nigeria. One of our key takeaways was a potential opportunity to explore ways of enabling middle managers working in corporate roles to be exposed to startups through short-term placements, and with this to bring their understanding of the landscape and expertise to the startup.

______

Overall, participants resoundingly reinforced the need for more conversations between stakeholders and actors in the sector. These parties don’t often sit together for open discussions to bring their needs to the table. That’s why Catalyst Fund is working to accelerate local ecosystems in each of our markets by building Circles of investors, corporates, ecosystem facilitators, and talent networks who are committed to moving the inclusive fintech space forward.

We intend to host more interactions like this in each of our markets moving forward, noting action points emerging from the conversations, as we work to strengthen the inclusive fintech ecosystem across our markets.

If you’re interested in joining us on our mission to develop inclusive fintech innovations which meet the needs of the 3 billion underserved, please fill our form here and indicate your interest in becoming part of our local and international Circles.