Getting Early-Stage Fintech Startups Investment-Ready

When we met Miguel Duhalt, CEO of Comunidad4Uno in Mexico City, he was working day and night to launch a company that sought to change the financial lives of domestic workers. His goal was building a platform that could offer financial services such as insurance, direct payments, and bank account access to low-income domestic workers in Mexico. With Comunidad4Uno, people who employ domestic workers in their homes would be able to sign up for the service and, with a small annual fee, insure their domestic workers and give them access to medical check-ups. They would be able to pay their employees electronically via a smartphone app into a newly-opened bank account. Leveraging technology and the personal relationships between workers and employers, Miguel wanted to formalize access to insurance and other financial services for domestic workers in Mexico.

But to achieve his ambitions, Miguel needed two things: to raise enough capital to take his enterprise off the ground and to validate his idea in the market with more users. Like many other startup founders, he faced a Catch-22. Investors wanted to see traction and a proven business model before endorsing his company, but his small team had a hard time focusing on reaching proof points because they needed to raise capital to keep the lights on. Raising seed funding is particularly challenging in Mexico and many other emerging markets. Moreover, challenging regulatory environments, inefficient infrastructure and connectivity, costly supply chains, and consumer distrust add to the operational difficulties.

So Miguel, like other talented entrepreneurs, needed to find an aligned investor who could look beyond quick financial returns and help meet important milestones to attract institutional funding at a later stage.

Catalyst Fund: Catalyzing investments in inclusive fintech

This is where the Catalyst Fund came in. Catalyst Fund is a $2 million program of BFA, funded by the Bill & Melinda Gates Foundation and JPMorgan Chase & Co. Accion Venture Lab is a founding member of the Fund’s Investor Advisory Committee. It aims to help ‘pre-seed’ inclusive fintech startups like Comunidad4Uno address barriers to early venture development, while demonstrating how the financial products and services of these ventures can serve and benefit underbanked customers. Investees receive grants up to $100,000 (no strings attached), tailored technical assistance, and mentoring from a group of impact and mainstream investors.

One year down the road, Catalyst Fund has provided grant funding and technical advice to 10 investees. Investees’ innovative business models range from insurance and payment services in Mexico, to pay-as-you-go gas cooking stoves in Kenya, to a peer-to-peer lending insurance platform for low-income farmers in Ghana, mobile-based micro-credit for middle and low-income households in India, to alternative credit scoring in Chile.

What we learned about how Catalyst Fund best supports startups

We want to arm our Catalyst Fund investees with the data points they need to prove to their next round of investors that the risks they are being asked to take on are commensurate with potential returns. To do so, we help startups reduce a number of risks typical of early stage ventures, such as value proposition risks, execution risks, financing risks, and technology risks. Of course, developing our approach to technical assistance and mentoring has been a process. We built on initial ideas and continually refined what kind of support was most appropriate. Here is what we learned so far.

There are no cookie-cutter solutions to make startups investment-ready — tailor-made and hands-on support work best in the early days. At the outset, we run through a risk framework to identify which risks the company is facing and how we can best support them. Do they know their customers well enough? Is their technology solid? Is the team capable of executing and working efficiently together? Getting to “key milestones” and reaching proof points means different things for various startups and business models, and they uniquely require myriad resources and support to do so. Some examples of our tailored support include:

- Perfecting the startup’s technology by crafting product and service roadmaps and sometimes serving as interim CTOs

- Identifying opportunities for behavioral nudges in their customer journeys

- Testing the performance of machine learning algorithms

- Building customer service blueprints

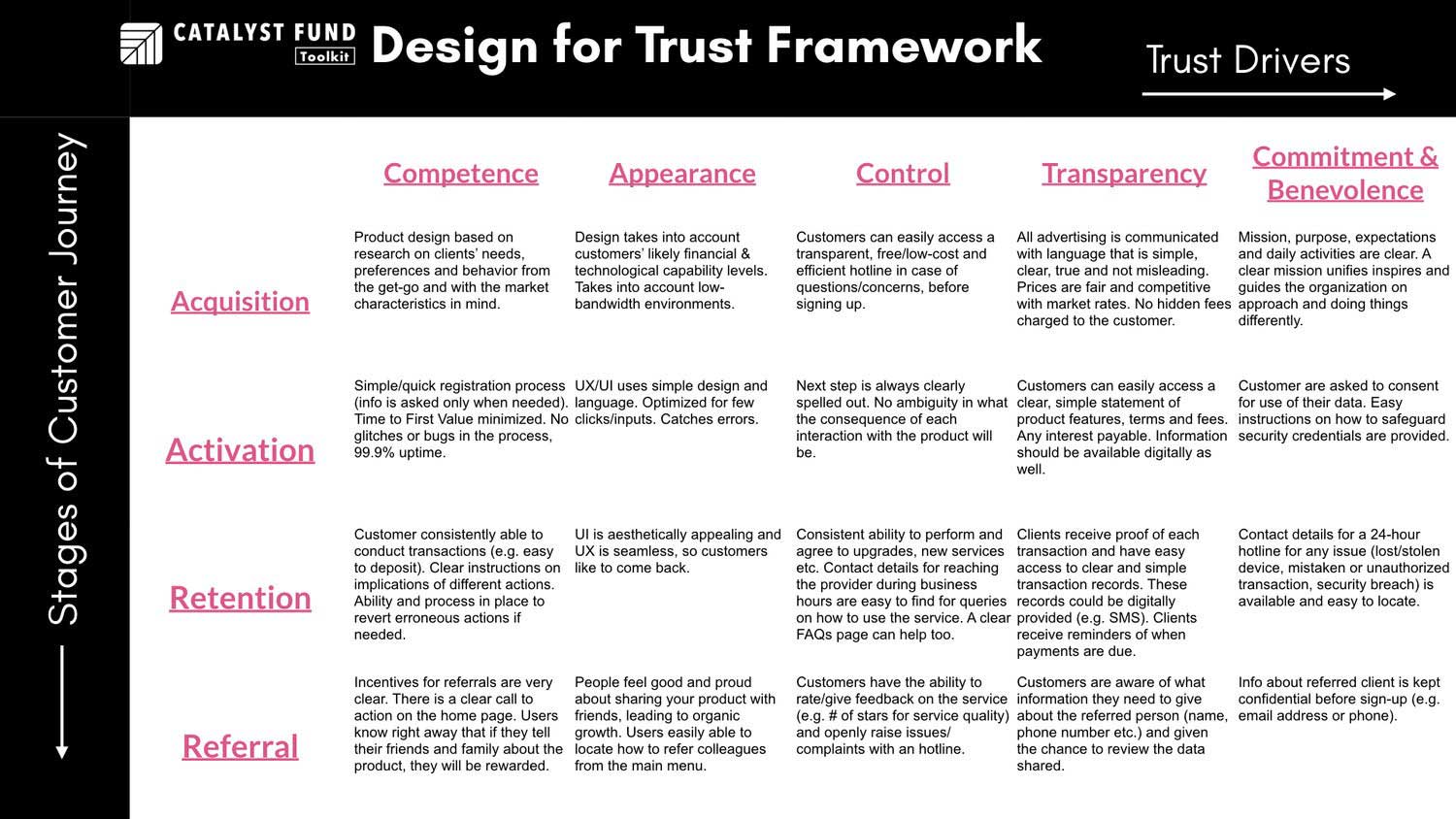

- Engendering customer trust by integrating elements like transparency and proper data management

Startups are better positioned to take advantage of Catalyst if they have already piloted with at least one client and generated initial data for analysis. We help startups run lean startup experiments as early as possible to validate learning, even with very rudimentary value propositions. We’ve worked with companies to identify best market fit for their product or conduct early customer discovery to refine their core offering and communication strategy. With Comunidad4Uno, for example, we visualized core customer personas, building each customer journey and tweaking the product, marketing, and user experience for each persona.

B2C and B2B startups exhibit different operational models, requiring different technical support and knowledge resources. Creative partnerships are emerging that leverage the respective strengths of incumbents and innovators. But companies need support on how to best forge successful partnerships. Accion Venture Lab created a primer to advise B2B startups on forming partnerships with banks (see “Enterprise Sales for Fintech Products and Services”). For investee Escala Educación, which provides long-term savings plans for higher education tailored to lower and middle income individuals in Colombia, we helped think through what financial services partner would be best for a painless customer experience and for their long-term business goals. For Atikus, we helped build an ROI simulator to show microfinance banks in Rwanda the value of using the Atikus loan management platform and worked on KPIs to track bank performance over time.

Given the common challenges faced by many of our startups, we are now also packaging what we learned into practical toolkits designed for early-stage companies. These toolkits help management teams think through how to build trust with low-income customers, how to manage their internal and external risks and how to achieve product-market fit in emerging markets.

So, has it worked? Has Catalyst Fund’s combination of philanthropic capital and TA been enough to make our startups investment-ready?

The $100,000 grant seed funding, coupled with the tailored technical support, makes a big difference in the trajectory of a startup at this early stage. It helps keep the lights on and allows the management team to focus on running the startup and gaining traction. Catalyst Fund’s investees have been using the capital to reach important milestones, ranging from hiring a capable sales team to financing data collection efforts or pilot projects. While we’re flexible about how the funding is spent, we fully expect each investee to have a clear, transparent plan on the use of the grant capital. Moreover, funding is connected to certain milestone achievements, in conjunction with the TA plan.

And some startups have quickly received follow-on investments. Destácame’s successful achievement of milestones through Catalyst Fund eventually convinced Accion Venture Lab to invest in a seed round. ESCALA Educación was able to close a seed round led by Mountain Nazca, a prominent Latin American venture capital firm. PayGo Energy closed a round with a key investor in Kenya.

“Catalyst Fund came in with deep domain expertise in Software and Fintech; spent a significant amount of time understanding our business first as well as the near and long term challenges… prior to building a solution that… met our immediate needs… through to the next inflection point as a business. It was a very clever solution, at the right time, and it resulted in a huge growth spurt for our business and follow-on investment.” — PayGo Energy, Catalyst Fund investee

However, there is still a persistent gap in the funding continuum for these startups after they graduate from Catalyst Fund. Currently only a limited number of seed stage fintech investors exist, underlining the need for more creative ways to bring funding into this space. Commercial investors often wait until they can make bigger ticket investments and startups, quickly find themselves back in a dire funding environment. To help address this issue, Catalyst Fund has created the Circle of Investors, a group of investors who follow the startups’ progress and are matched with firms that fit their investment criteria. Some 19 mainstream (e.g., Index Ventures) and impact investors (e.g., Goodwell) have already joined this group and we hope to see many introductions turn into real investments.

Measuring the impact of our kind of model on a startup’s trajectory is not easy. Catalyst Fund is not a typical accelerator and there are no directly relevant benchmarks. While Catalyst Fund can certainly reduce a number of risks for a company on its growth journey, we don’t solve all of them. But after over a year, we are ever more convinced that against the backdrop of an investment continuum, de-risking early-stage startup trajectories is critical for attracting investors and capital to inclusive fintech. For now, we’ll continue to unpack the indicators and feedback sessions about how Catalyst Fund makes a difference in the life of the startup and their likelihood to thrive.

Originally published at cfi-blog.org on August 28, 2017.