Are we there yet? The evolution of fintech regulation in Nigeria

Nigeria is a hotspot for fintech innovation in Africa as investors and startups respond to Nigeria’s positive environment for fintech adoption. However, even as authorities introduce new regulatory approaches, there are still open questions about the best approach to fintech regulation in Nigeria, which currently features a complex “quilt” of financial service providers.

According to the GSMA, mobile phone penetration in Nigeria is now at 49%, and the country features a fast-growing, youthful population (the median age in Nigeria is 17.9 years) with rising demand for digital financial services.

Investors are betting these factors will lead to rapid fintech adoption. Opay, Interswitch, and PalmPay raised $120 million, $200 million, and $40 million respectively in one month (November 2019) alone. This was the equivalent of one-third of all startup investment in Africa last year. Nigeria is also the biggest market for Africa’s first tech unicorn, Jumia, and with the recent $200 million investment by VISA, Nigeria-born Interswitch has also reached unicorn status.

Although the fintech sector is vibrant, 36.8% of the population still lacks access to financial services, and use of digital financial services is still marginal: the value of mobile money transfers was only 1.4% of GDP in Nigeria in 2018, compared to 44% of GDP in Kenya.

Why does vibrancy in fintech not translate into better inclusive outcomes? This may be because stakeholders disagree about how supportive Nigeria’s regulatory framework is in practice. In response to the low rate of financial inclusion, authorities have released a number of new regimes and initiatives. The Central Bank of Nigeria revised the National Financial Inclusion Strategy in late 2018. More recently, the CBN has released a draft framework for regulatory sandbox operations. According to the CBN, the sandbox is “a formal process for firms to conduct live tests of new, innovative products, services, delivery channels, or business models in a controlled environment, with regulatory oversight subject to appropriate conditions and safeguards.” In addition, the CBN has made the Payment System Department responsible for regulating the activities of fintech startups in the new sandbox.

Given that there are now new regulatory activities at play in Nigeria, it is worth reviewing how well past strategies have worked in enabling fintech innovation to empower people to improve their financial lives. At BFA Global, we have found that authorities typically take one of two main paths – either allowing regulatory grey areas to enable learning for a period, or else proactively creating enabling frameworks early-on. Experience has shown that both paths may be useful in generating greater inclusion and innovation, depending on the context and timing. We review the experience in Nigeria and also in other countries where fintech has already had significant traction.

Path 1: Leverage regulatory grey areas to learn

Regulators follow the first path when they use their regulatory discretion to allow innovation in grey areas of the law, either via a ‘wait and see’ approach or via a more proactive ‘test and learn’ approach. These approaches take advantage of gaps in which regulators’ powers are not specifically defined, even though they still have influence through other channels.

Leveraging grey areas can open the space for important growth and inclusion, especially when much remains unknown about the product and technology in question. However, the challenge for regulators on this path is timing: when is it necessary to step in and explicitly provide more oversight as a market scales? As innovations scale beyond their early stages, authorities need to protect consumers as well as the overall stability of the financial sector, and the timing is difficult to get right.

For example, authorities in China took a “wait and see” approach as the central bank and other regulators allowed innovative forms of what they called ‘internet finance’ (digital finance), such as mobile payment wallets and P2P lending, to launch and scale with little or no formal oversight. With few restrictions, these disruptors quickly emerged as serious challengers to incumbent financial institutions. However, Chinese regulators had to crack down on P2P lending in 2016 after an unchecked boom led to widespread abuse, insolvencies and even protests from disaffected lenders.

Kenyan authorities took a similar “wait and see” approach via formal waivers and no objection letters. In the case of M-Pesa, the Central Bank of Kenya issued a ‘no objection’ letter to allow the mobile money service to launch in 2007 in advance of any payment system law or regulations. As in China, the government had to introduce regulation starting in 2018 to temper the growth of certain digital lending solutions after they were found to have engaged in predatory lending. Rather than create the conditions for increased prosperity, this fintech-fuelled lending risked crushing users with unsustainable debt burdens.

In both examples, the “wait and see” approaches were extremely successful in supporting inclusive fintech. However, in both instances, these approaches worked in part because so little was known about fintech and financial innovation, and because authorities were able to step in in a timely fashion when risks were observed.

Another approach to this pathway is to test and learn via regulatory sandboxes. Such sandboxes allow innovation to be tested in targeted areas under relaxed oversight. Nigeria has recently introduced such a sandbox; the Central Bank and the Nigerian Interbank Settlement System (NIBSS) has partnered with the Financial Service Innovators Association (FSI), a community of fintech enthusiasts passionate about driving innovation in the financial services industry, to launch the Nigerian Industry Innovation Sandbox. The objective of the sandbox is to provide a low-risk environment for fintech startups and financial services innovators to build and test products layered on the technical infrastructure of NIBSS.

Sandboxes have become increasingly popular around the world: the DFS Observatory lists live sandboxes in at least 26 countries. However, CGAP recently questioned how effective the piloted approaches have been in leading to wider regulatory change and in creating inclusive products and services.

Path 2: Create enabling regulatory frameworks

Other regulators follow a different path in which they proactively create enabling frameworks to encourage fintech innovation and outline new approaches to financial services in advance of activity on the ground in the hope that said activity will follow. These jurisdictions are quick to implement laws or firm guidance at an early stage of market development, often with the hope that greater clarity will enable faster progress.

The European Union took this approach as one of the earliest jurisdictions to pass an explicit law licensing e-money issuers as a new category of player in the financial sector in 2005. The Bank of Ghana was similarly one of the first central banks to issue guidelines covering ‘branchless banking’, as it was then known in 2008 (now called agent banking or digital payments).

The challenge with this approach is that, even if the guidelines bring some certainty, they may prove restrictive if imposed too early, without the benefit of experience, and can be hard to change after the fact. For example, a formal review of the first EU E-Money Directive found that fewer firms than expected had entered the space, linked in part to requirements which were too onerous for the emerging business models to support. That review led to a revised second E-Money Directive in 2009, which inter alia reduced initial capital requirements.

Similarly, a few short years after the branchless banking guidelines were released in Ghana, a CGAP article concluded that the guidelines had not achieved their purpose because of being too prescriptive in their approach to interoperability; and they too have been revised, eventually culminating in a revised Payment Systems and Services Act being passed in 2019.

Implementing a formal review process for all new legislation within three to five years of promulgation, as the EU has or as Ghana did, can help to mitigate unintended consequences. However, such reviews can be costly and may imply frequent revision of frameworks.

Nigeria’s path

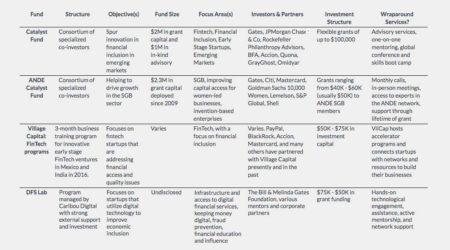

In past decades, the Central Bank of Nigeria (CBN) has favored the second path, but has recently veered into the first with the launch of the new regulatory sandbox. Since 2005, the Central Bank has created numerous frameworks to outline and accommodate different forms of innovation. It has been active in creating new categories both for lending and for payments, and for evolving these over time, creating a patchwork quilt of providers and regulatory categories outlined in the box below.

Nigeria’s patchwork of providersIn the first area, lending, CBN was among the early movers. When microcredit was showcased as an innovative development technology in the 2005 UN Year of Microcredit, CBN responded by revamping the guidelines for localized deposit-taking institutions, then known as community banks, to allow them to become microfinance banks (MFBs). Essentially, MFBs were permitted to undertake a range of local banking services with lower capital requirements than commercial banks because their activities were restricted to local or state levels. As of last year, there were around 900 MFBs of various types. While widespread, they appear to serve only a small minority of consumers. According to EFInA’s A2F2018 survey, only 3% of adults use microfinance banks, compared to 39% of adults who use one or more of the country’s 33 commercial banks. The latest iteration of the MFB guidelines were proposed in draft form in early March 2020. They further increase minimum capital requirements for the different types of MFBs to NGN50m (USD137,000) for the most restricted category (Unit Tier 2 MFBs). This move has elicited commentary and complaints from fintech companies that were using MFB licenses as a way to enter regulated financial services, saying that the higher requirements will further restrict inclusion. Following the impact of COVID-19, the CBN revised the deadlines for recapitalization of MFBs. In the second area, payments, the CBN has issued a series of frameworks in response to evolving technology-driven innovation. It has managed this under its general authority even without a Payment System Management Act in force. Starting in 2009, CBN proactively allowed certain types of mobile money operators early on in the mobile money sector (M-Pesa only launched in 2007). These operators were effectively e-money issuers allowed to operate agent networks, the framework for which also evolved to recognize categories of agents. However, they were not allowed to issue loans or earn money from intermediation. In 2018, the CBN went further in recognizing additional categories of payment system providers (PSPs) by introducing capital requirements starting at NGN50m (USD137,000) for the most restricted categories (akin to the smallest MFBs) up to NGN 5bn (USD13.7m) for ‘super licenses’. In 2018, following the precedent set in India in 2016, CBN announced a new category of provider called payment banks. These so-called ‘narrow banks’ can perform payment services, as long as they focus on underserved groups like customers in rural areas. However, they can not lend. This new category essentially widened the earlier framework mobile money operators by allowing them to become promoters and owners of these entities, provided they could contribute minimum capital of NGN5bn (USD13.7m, akin to the requirement for the largest PSPs). In early 2020, the CBN announced that the first 3 payment banks had been approved in principle under the new framework. |

The Nigerian financial services ‘quilt’, made up of these different guidelines and providers, is now extensive and accommodates a range of different business models focused on lending (MFBs) and payments (PSPs and payment banks). Supervising compliance within these complex and evolving requirements certainly involves considerable effort and supervisory resources from CBN, but is still failing to produce the desired inclusion and innovation results.

What next?

Nigeria’s approach thus far seems to have been premised on a “more is better” approach that promotes a multiplicity of regulatory categories while using capital requirements like a ‘tap’ to regulate the flow of players into a particular category. However, this approach may sidestep a real question about what type of categories the financial sector Nigeria needs to meet its overall development and inclusion objectives. Establishing this vision first would allow CBN to work back to how many players may be needed in each category (i.e., payment banks, commercial banks), and thereby consider whether the current requirements are appropriate or not. Establishing such a vision would help to prioritize the categories most needed and inform strategies for how to enable their growth.

In this regard, the approach of the Monetary Authority of Singapore (MAS) serves as an illustration of how to create ‘onramps’ rather than new categories of financial institutions to supervise. MAS has, in general, adopted an enabling stance towards fintech innovation, including establishing its own regulatory sandbox. In 2019, the MAS announced that it would award five digital banking licenses to new applicants. It arrived at the number five by considering the size of the addressable market and the need for greater competition. These licenses fell under general ambit of existing banking law, but MAS provided special conditions for this new subset of ‘branchless banks’ that amounted to an ‘onramp’ for them to provide banking services, rather a whole new category of financial institution. The conditions included an initial period in which the maximum deposit base and the extent of activities were limited, and then extended lower capital requirements at ~US$10.6 million (less than Nigerian payment banks and some PSPs) once activities were more established. The ‘onramp’ forces new licensees to prove themselves before initial restrictions progressively phase out, after which capital requirements increase until they reach the minimum level of around US$1 billion.

MAS announced in January 2020 that it had received 21 applications for the five licenses on offer, from which it would select in the second half of 2020. This oversubscription has been in itself a promising indicator that the license is appealing to new entrants. The whole licensing process is dynamic, rather than static; it seeks to attract good-quality applicants that have the capital and expertise to be able first to start up, and then to scale up as they demonstrate expertise and market traction, with the expectation that they could in time become large-scale players competing with existing banks.

Singapore, of course, is a very different context from Nigeria. But perhaps like MAS, the Central Bank of Nigeria could start by identifying the missing elements in the market structure given its national goals and then award licenses or set requirements accordingly. What does a healthy fintech ecosystem look like? For example, are new digital-only banks needed in Nigeria, rather than more payment banks or MFBs? On what basis would Nigeria welcome a Bigtech player like Ant Financial or Amazon into its financial sector? When a Payments Act is passed, what categories of players are really needed for digital payment success? For example, should the Central Bank of Nigeria distinguish between payment aggregators and payment gateways, as the Reserve Bank of India has in allowing Google Pay and Whatsapp to participate in the payment system without direct licensing?

This analysis is not easy to do since no one has a crystal ball, especially in a COVID-19 world. However, the process is not one of forecasting, but rather engaging in an ongoing structured consultation with stakeholders who may have different and conflicting interests. Using scenario logic, as BFA Global has recently done to help co-ops in Mexico consider potential COVID-19 outcomes, can help discipline and structure these consultations to make them more fruitful. Countries like Canada have taken this much further by appointing a Taskforce for the Payments System, which consulted widely and even created scenarios of possible futures, before recommending substantial changes to the framework in that country back in 2011.

Healthy market development that leads to financial inclusion and inclusive economic growth requires financial regulation that is both open enough to innovation (as the first path seeks to be) and clear enough to provide certainty (as prioritized in the second path). Judging the right balance between the two at any point in time requires several things. First, that policymakers consult and engage widely with the sector on an ongoing basis. Second, that regulators understand the business models and incentives of different providers during different stages of market evolution. And finally, since the policy issues at stake extend beyond the financial sector only, into new realms of digital policy and data protection law, financial regulators must engage with policymakers beyond their own sector. As the CBN refreshes its overall payment strategy for the next five years, Vision 2025, we hope that it will lead to substantial progress in these directions, enabling inclusive development and recovery for Nigerians.