In Digital Financial Services We Trust

As a customer these days, trust is probably on your mind. Whether you’re choosing on what airline to fly on next or sealing a deal on a handshake, trust is fundamental to our personal and business interactions. If your customer base is with a low-income person or in an emerging market, trust is essential to create from the get-go, especially you’re talking about managing one’s money. In digital financial services, trust is a huge competitive advantage.

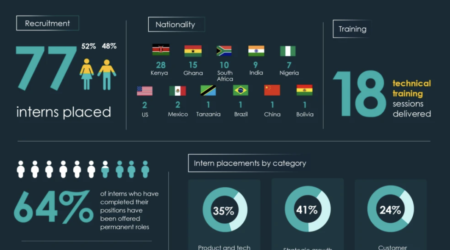

What we saw from our work at Catalyst Fund, providing tailored engagements to accelerate early-stage fintech startups in Mexico, Colombia, Ghana, Kenya and India, is that trust can be created and from the first interaction with the customer. We have been working with 10 startups in our inclusive fintech portfolio, in areas such as higher education, household workers, smallholder farmers, pay-as-you-go clean energy and microfinancing. From this perspective, we put together what we have learned and tested in the field into the Design for Trust Toolkit. Our hope is that this practical resource gives early-stage startups a way to tailor their customer and product strategies to maximize trust creation.

Who is the Design for Trust Toolkit for?

The Design for Trust Toolkit brings together the best startup-based practices from Silicon Valley and BFA’s own fintech and customer research expertise with low-income customers. Supported with some industry examples, this toolkit is customized for trust creation with the underserved population. If you are fintech CEO or are part of the management team, then this toolkit is a smart way to boost your team’s capacity in building trust creating features along the customer journey.

In digital financial services, trust is a huge competitive advantage.

A Peek into Design for Trust

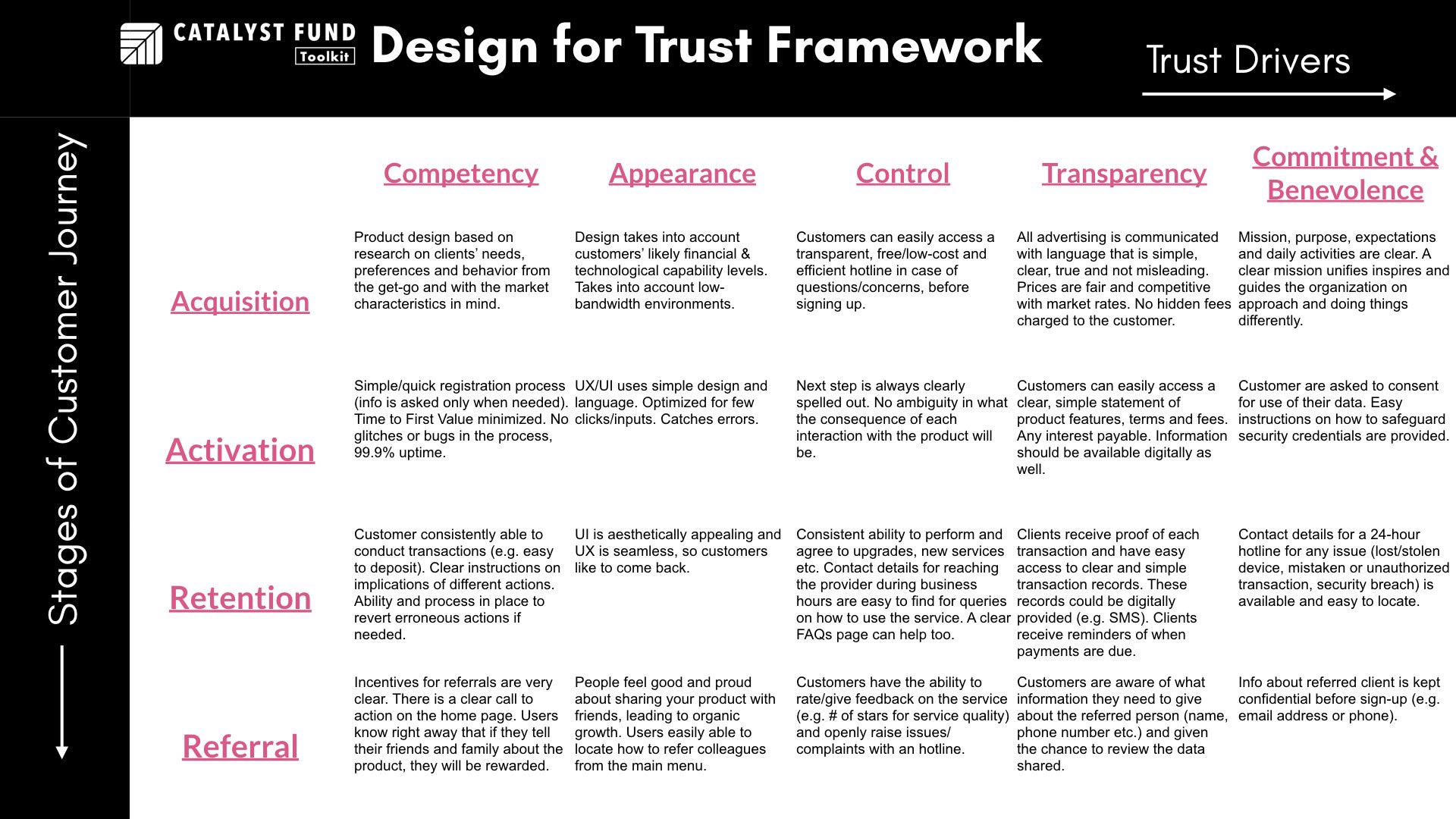

Building trust in markets where your customers are on the lower end of the income curve and where institutions are weak, is hard to do. It can also be eroded quickly. In the case of inclusive digital financial services, we believe there are five top drivers for startups to get right and that increase the perception of trust by the customer. These elements are competency, appearance, control, transparency and commitment & benevolence. By mapping out these drivers along your customer’s journey, you can intentionally minimize perceived risk and maximize sense of trust.

For example, when trying to acquire customers in low-income markets, are you competent at designing products based on customer research — their needs, preferences and behaviors? Are you thinking problem-first or solution-first? M-Shwari is a bank account with savings and loans features offered only through M-Pesa’s mobile money transfer service. Customers can open accounts in 30 seconds and apply for short-term loans in a matter of seconds. Take a cue from M-Shwari that demonstrates high competency by making it the registration process very seamless and quick to open an account through M-Pesa.

Think about trust creation as a framework and apply it to your organization or specific customer interactions to improve

Or consider the impact of appearance to activate clients from signups to usage. Founded by non-profit lending platform Kiva.org, Branch is the branchless bank for the next generation. The mobile app employs the user data stored in phones to learn about and predict good borrowers. Without the need for a credit history required by banks, Branch can offer credit lines of $2.50 to $500 in 10 seconds. Branch is especially popular with farmers, drivers and merchants in Kenya, and intends to expand in Sub-Saharan Africa.

Like Branch, remember that your customer still might be pretty new to digital financial services on their mobile phone. This is where a simple user interface with clear shapes, colors and text sizes are important for getting your customer to take action.

To retain customers, what level of control do you provide to the customer? Consistently offering users the ability to perform and agree to upgrades and new services and contact details and knowledge base on service use are great ways to give a sense of control. Branch manages a nice balance of the online and offline experiences through chat interfaces and immediate responses from humans to extend control to their clients.

These are a few examples we cover in the Design for Trust Toolkit. It is designed so you can think about trust creation as a framework and apply it to your organization or specific customer interactions to improve. Either way, the pointers and best practices are meant to be actionable and easy to map out as a process, perhaps to visit again after you’ve mastered a stage in the customer journey.

So, visit the Design for Trust Toolkit and leave a comment for us or provide examples of other firms you think do a great job at trust creation. If you do work through the entire toolkit, be sure to provide your feedback here.