What Banks Don’t Know is That I Do Pay My Bills

Catalyst Fund Learning Agenda Series #1, Destacame.cl

The Reality of the Low-Income Customer

Magaly struggles to take a loan from the bank to buy a new sewing machine for her tailoring business. Every bank she visits offers her high interest rates and inflexible terms based on her lack of a traditional credit history and score. She tries to explain she is a responsible shop owner who always pays her bills on time, but she doesn’t have any ways of proving that to the skeptical bank managers. Magaly is not alone in this situation. In Chile, Mexico, and throughout Latin America, many individuals do not have any reported information about their payment behavior, let alone a complete credit score that banks can access to lend more easily.

The Opportunity

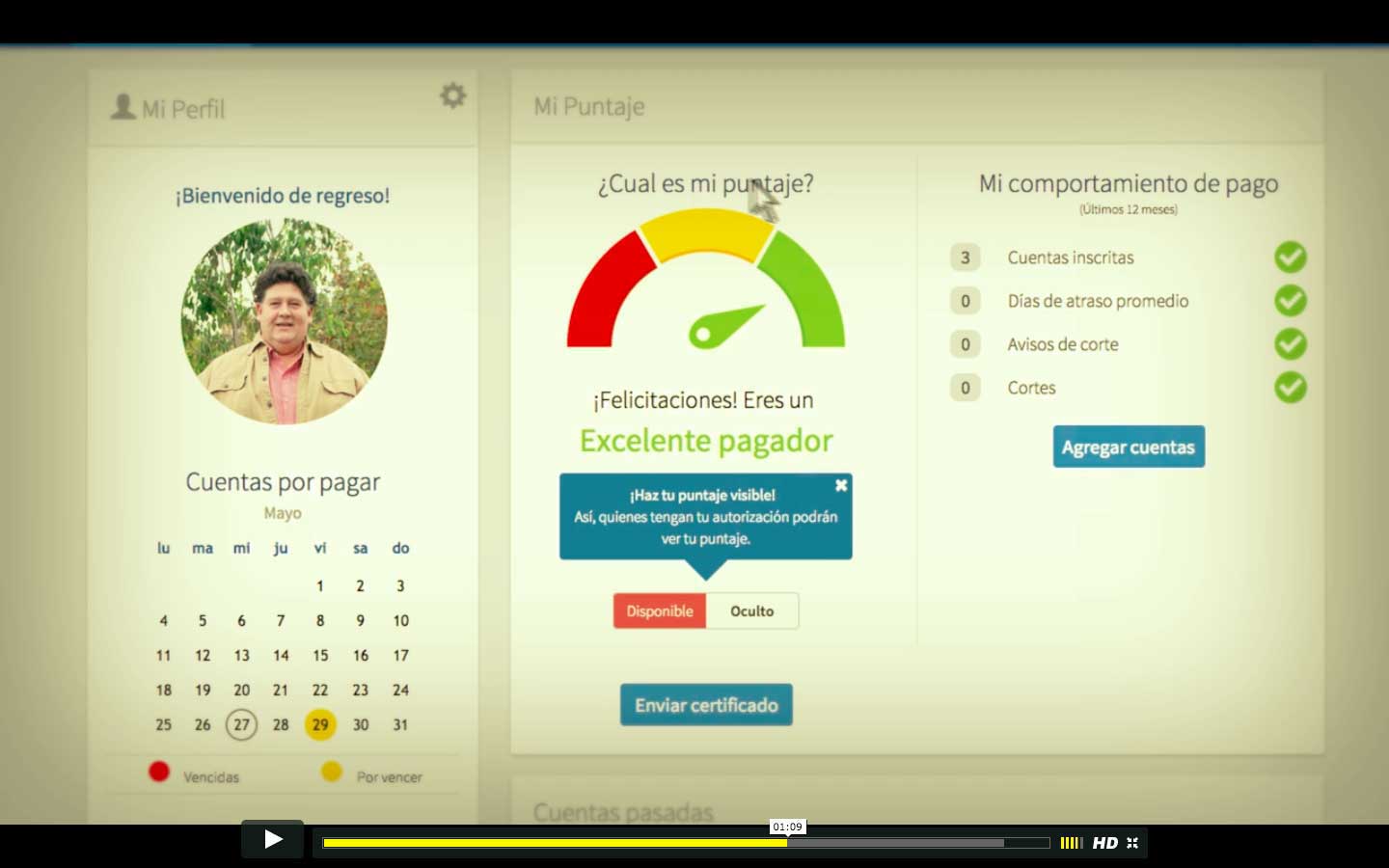

Destacame.cl, a Chilean startup, addresses this problem by aggregating and analyzing data from multiple existing sources such as an individual’s electricity or gas bills, cell phone data, and other socioeconomic information to create credit scores that users can use to prove they are dependable payers. Destacame.cl partners with financial institutions that are trying to find better, faster, and cheaper ways to extend credit to underbanked people. For example, they partner with BBVA to extend credit access to low income customers — a win-win for both the bank and the data analytics startup.

The Hypothesis

When Destacame.cl became a Catalyst Fund investee, we sought to answer two fundamental questions:

- To what extent is the Destacame.cl alternative credit scoring encouraging banks to lend cheaper, more flexible products to underserved segments?

- What is the value proposition for traditional banks to partner with fintech startups like Destacame.cl?

In order to answer these two fundamental questions, the CF team and Destacame.cl began exploring how Destacame.cl could improve the accuracy of the credit scoring model and show an even stronger value proposition for financial institutions. The team bounced ideas around how the Destacame.cl score could be even more accurate at predicting client risks or how machine learning could improve the way Destacame.cl identifies good and bad payers based on score.

Catalyst Fund has a dual mandate to (1) to help early stage inclusive fintech startups gain traction, offer seed capital and technical assistance, and (2) answer major questions that the industry has about whether fintech startups are leading to systemic change in the financial inclusion ecosystem.

The Test

Machine learning techniques can be very powerful for building forecasts that significantly improve the accuracy of predictions on whether a consumer will default on a loan. The CF team began exploring the initial assumptions about how Destacame.cl’s credit scoring numbers were produced, reproducing them and testing logistic regression. They explored several flavors of tree-based models to see if results would change and test the models with various datasets. Finally, the team decided to build a simple tool to show banks how their ROI could be tremendously improved if their portfolio of borrowers was chosen using the Destacame.cl’s score. We are now wrapping up this exploration phase and are excited to share the results of the research next month!

The Impact

Destacame.cl has the potential to truly reshape the credit scoring and lending sectors in Latin America. By becoming a “Credit Bureau of One”, individuals will actively manage their financial footprint and be empowered to take an active role in their credit report. Magaly will finally be able to rely on objective information when asking for loans, uncovering her true risk profile and her nature of a hard-working, deserving entrepreneur.

Follow Destacame.cl’s progress by signing up to the Catalyst Fund Newsletter. We’ll be sharing lessons learned from the ground in the coming weeks.

![[Press Release] Catalyst Fund announces $2 million investment into 10 startups accelerating Africa’s adaptation and resilience to climate change](https://bfaglobal.com/wp-content/uploads/2023/01/Featured-k11-450x250.png)