Why we invested: Koa is bringing a seamless, hassle-free savings and investment experience to Kenyan youth

A survey conducted by FSD Kenya in 2019 indicates that the number of Kenyans saving in traditional bank accounts is on the decline. The reasons are multiple, from account features to income flows. “Of the 22 reasons surveyed for non-use of a bank account,…lack of money to save, inability to maintain an account, and lack of regular income were the top three[,] accounting for 70 percent of responses.”

Although formal account usage is dropping, many Kenyans are turning to informal financial institutions, such as the country’s 15,000 registered SACCOs and credit unions, to save. There are more than 10 million SACCO members today in Kenya, and they collectively control savings of KSh 501 billion (US$ 4.7 billion) and an asset base of KSh 694 billion (US$ 6.54 billion). However, at most SACCOs, processes remain largely manual, and they are not a good cultural fit for young, digitally-savvy Kenyans, who are seeking ways to more easily and conveniently protect and grow their money.

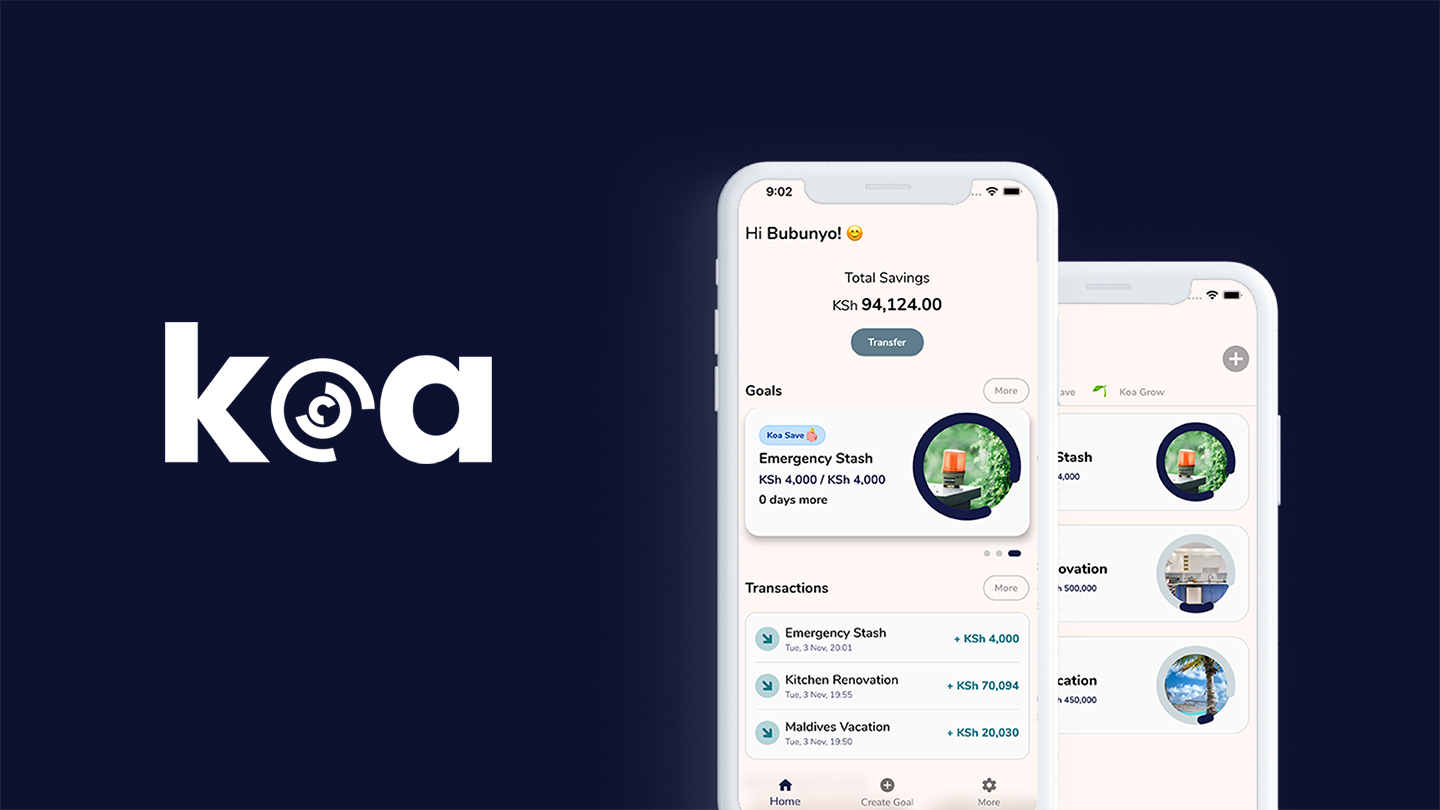

Fintech startup Koa is leveraging technology and existing customer behaviors to change the way Kenyans think about saving and investing. Koa offers easy, hassle-free savings and investment platform, with low deposit minimums, generous interest rates, and a user-friendly interface with goal-based savings, that can also be integrated with other tech solutions their customers know and trust.

Impact

According to the Central Bank of Kenya, in 2018, the number of savers with more than Ksh 100,000 (~US $1,000) in their bank account dropped to 1.45 million people. The World Bank reports that Kenyans save less than many of their peers; only 13-14 percent of GDP over the last five years, which is half the average for all low-income countries (26 percent of GDP).

One reason for this is that in 2016, the Kenyan government began capping interest rates at “no more than four percent above the Central Bank base rate; and the minimum interest rate granted on a deposit held in interest-earning accounts with commercial banks to at least 70 percent of the same rate”.

Low-interest rates, combined with high minimum-balance requirements and other barriers, have pushed more Kenyans towards informal mechanisms, especially since awareness and accessibility of alternatives options remain limited. While informal mechanisms are widespread, they require members to wait in long lines in-person to deposit or collect funds and to fill out swaths of paperwork to register. They are also subject to fraud and may lack proper vetting and regulation. In sum, low-income customers are left with few options for high-interest savings accounts and asset management tools, especially if they desire a better user experience.

Koa’s vision is to unlock access to savings and investment for a previously underserved segment of consumers through a user-friendly platform that can be integrated with other tech products these customers already use and trust. With low minimum-deposit thresholds and balance requirements, superior interest rates, and content designed to enable users to learn more about saving and investing, Koa provides safe, formal, high-interest savings accounts and mutual funds to underserved customers, many of whom are saving formally for the first time.

Innovation

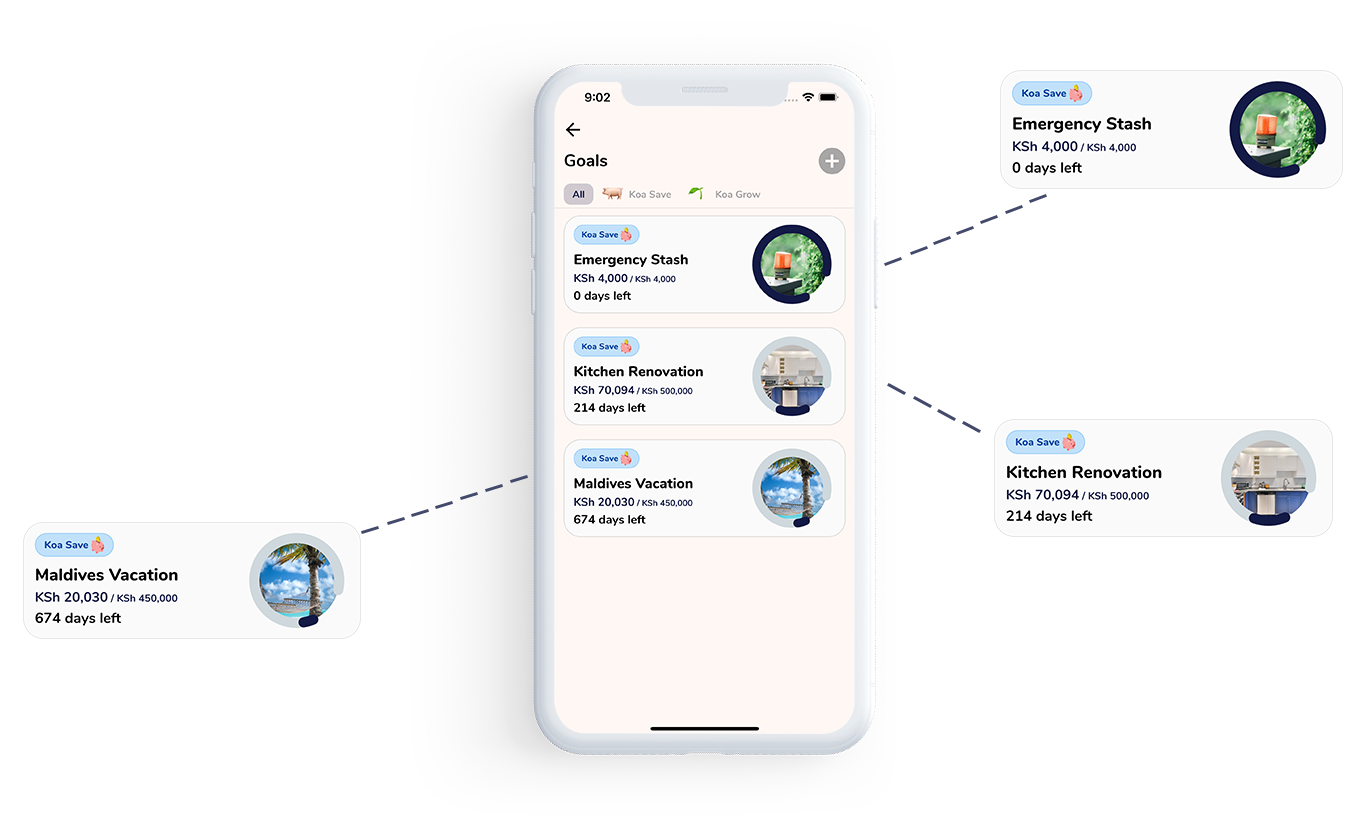

Koa offers a savings account with minimum balance requirements as low as Ksh 1,000 (US $10), as well as access to investment products. Depending on the savings goals they choose, users can earn interest up to 10% on the money they save.

The Koa platform includes a B2C app for users, as well as a “savings-as-a-service” API for business partners that can be embedded in other tech solutions and financial services apps, such as ride-sharing platforms. Koa’s API allows tech platforms to offer high-interest savings products to their customers, while acting as a distribution channel for financial institutions to easily reach customers via platforms they already know and trust. In either form, Koa helps customers save more easily and earn higher returns.

Koa’s innovations go beyond tech to include features that are compelling and sticky. The Koa app leverages informal network effects and behavioral economics to create savings habits in users. Through the app, customers set personalized savings goals and targets, such as school fees or a new appliance, and can begin saving immediately, without needing to set foot in a bank. They can share goals with the networks to increase commitment and improve compliance.

Growth Potential

According to the 2019 FinAccess Survey from KNBS, CBK and FSD Kenya, “formal financial inclusion [in Kenya] has risen to 82.9 percent, up from 26.7 percent in 2006.” Mobile money, led by Safaricom’s M-Pesa, has been a significant factor not only in enabling Kenya to reach these inclusion rates, but in helping customers to become more accustomed to managing their finances digitally. To date, much of this inclusion has taken place in payments and credit, paving the way for apps like Koa to dominate in untapped product areas like savings and investment.

Similarly, smartphone penetration is on the rise across Africa – the fastest-growing mobile telcom market in the world. Customers increasingly leverage apps and digital services to meet needs across their day-to-day lives. By integrating with products customers are already using, Koa is tapping into existing distribution networks to infuse savings as a value-added offering, and to enable financial institutions to scale their financial products to currently underserved individuals in a way that meets their needs.

Finally, young people are also underserved. The average age of SACCO members is 48 years, meaning that large swathes of young people who are unbanked are looking for solutions.

Koa aims to become the ’financial rails’ that can enable individuals and savings groups to better access high-interest saving accounts and mutual funds across the continent.

The Catalyst Fund model delivers outsized success compared with other accelerator programs. We accelerate startups that excel on three fronts:

- Impact: Catalyst Fund startups deliver (or, in the case of B2B firms, facilitate the delivery) of life-changing products and services to underserved populations. These can include financial services like loans, savings, insurance, and investment, but also access to productive inputs or essential services such as energy, sanitation, and water.

- Innovation: Our startups are pioneering game-changers that are innovating new products and business models. They drive the sector forward by demonstration effect and via the learning that Catalyst Fund documents and shares.

- Growth potential: Catalyst Fund startups are distinctively investment worthy, developing businesses that are scalable, with high growth potential. Our startups are selected by an Investor Advisory Committee, who have deep experience in emerging markets and nominate high-potential startups, and then sponsor and mentor them through Catalyst Fund. As a result, our startups raise more funding than startups from other accelerators.