Why we invested: Ohm Mobility provides simple, affordable vehicle financing for India’s autorickshaw drivers

Over 10 million people drive autorickshaws in India. Unfortunately, these drivers struggle to find affordable ways to acquire autos for their livelihood because financiers find it difficult to serve them. Most lenders have high operational costs, lack data to determine driver creditworthiness, and lack convenient repayment options for drivers, meaning that financiers must spend significant effort chasing and managing repayments, thereby making it less attractive to serve them.

Ohm Mobility has created a platform that brings down operational costs for financiers and facilitates increased lending to autorickshaw drivers. To start, Ohm provides drivers with an app that enables them to make daily, digital, flexible loan payments for vehicles. This decreases cash management cost and effort for financiers, while also driving better repayment since daily payments are easier to adhere to than saving for big installments. Furthermore, Ohm provides financiers with a loan management system that enables them to easily track and manage their portfolios. Together, Ohm’s tools better meet the cash flow patterns of drivers, resulting in better repayment rates, lower costs for financiers and a better experience for both drivers and financiers.

Ohm’s vision is not simply to make autorickshaw and small vehicle financing more feasible for lenders, but to build a vehicle financing platform that can enable the transition to a green economy. Ohm realizes that challenges in vehicle financing are a key barrier to increasing the number of electric autos and rickshaws (called e-autos and e-rickshaws) on the road so Ohm aims to create a platform to facilitate moving transport towards electric vehicles.

Impact

India’s urban population is estimated at 391 million and projected to grow another 200 million by 2030. Mobility solutions are a critical enabler to the lives and livelihoods of city-dwellers, and in India autorickshaws play a particularly vital role in the transport economy. Autorickshaws are responsible for an estimated 10-20% of daily commuting trips in Indian cities, serve as a necessary link for shorter trips connecting homes with local rail and bus stations, and enable last-mile deliveries.

Driver incomes vary depending on where they are located and the number and types of trips they make in a day. They struggle to build their financial profile and get access to appropriate vehicle financing. This is partially because financiers face a number of challenges in serving them effectively and affordably. To start, financiers lending to rickshaw drivers often collect repayments in cash since drivers have largely earned in cash. That means collections are both high cost and high risk. Financiers that work with autorickshaw drivers are likely to be of small to medium size, rely on manual record-keeping and personal relationships, and are mostly unregulated and semi-formal.

Not only is lending to drivers difficult, the loans on offer are not well suited to their needs. Given the overhead cost and complexity of physical cash collection, financiers offer drivers monthly repayment schemes and ask that drivers physically travel to their office for repayment. This structure doesn’t match drivers’ income flows, which are daily, and implies significant time and travel costs. It also implies low transparency for drivers, who lack visibility into their loan cycle and outstanding balance.

MFIs may have looser lending requirements and their lending models are designed for people who lack credit history, but their loans max out at ₹60,000 in the first cycle (only about 30% of the cost of an autorickshaw). Informal “loan sharks” also have looser lending requirements but have an incredibly high cost of financing – up to 120% per year.

Ohm’s platform eases lending costs for vehicle financiers, who can then pass benefits on to drivers. Via Ohm’s platform, drivers can access finance from a formal institution, reducing their dependence on higher-cost finance like loan sharks. Ohm also provides drivers with transparency into their repayments and balance, increasing trust while also building a credit history. Finally, Ohm’s platform also allows drivers to make payments without traveling to the financier’s office and waiting in long lines thereby saving time and cost.

Innovation

Ohm Mobility solves the challenges vehicle financiers face in serving autorickshaw drivers by offering them an improved loan management system, and providing drivers a user-facing app to make digital payments.

Ohm’s loan management system transitions financiers to a modern digital platform, which reduces cost and complexity relative to a cash-based business. The platform also enables financiers to start receiving loan repayments earlier than the scheduled month-end final repayment date giving them better visibility into their cash inflows as well as more liquidity, which can help them offer more loans to drivers.

In addition to the platform, Ohm Mobility has created an app so that drivers can make daily, flexible digital payments. The app also uses an algorithm to calculate the daily repayment requirement for drivers, transforming the monthly loan offered by financiers into a daily payment that better aligns with the driver’s cash flow making it significantly easier for the driver to make a payment towards the loan.

Together, the app and LMS expand access to vehicle financing for drivers by making financing of autorickshaws more feasible and affordable for financiers.

Growth Potential

Autorickshaw financing alone presents an enormous opportunity for Ohm. However, in the longer term, the team is aiming higher; they hope to help all mobility entrepreneurs in India (any commercial vehicle) to switch to e-vehicles. Vehicle financing in India is a $100B/year market today, of which $40B is commercial vehicles. As these commercial ventures look to go green, Ohm wants to accelerate the transition to electric vehicles.

As part of climate action initiatives, the Indian national government is investing heavily in electric vehicles and in charging infrastructure, committing that electric vehicles will make up 100% of public transport vehicles and at least a third of all private vehicles by 2030. Following these legislative changes, as well as growing consumer preference for electric vehicles, the EV sector is growing rapidly in India. It is estimated that by 2025 the e-rickshaw market in India will reach $5 billion at a CAGR of 9%.

One critical barrier that Ohm aims to address is access to financing e-autos for drivers. They are doing this by embedding an EV module into their current management solution to help financiers gain visibility into their e-rickshaws’ performance along with the drivers’ loan repayment activity. The EV module will also provide financiers with remote lockout pay-as-you-go technology to help them track vehicles. This approach can significantly reduce the upfront costs that financiers would add as part of their lending risk. Ohm recently launched a new module for rental owners to use the platform to rent their vehicles to drivers. With this approach, Ohm aims to help drivers that may be hesitant in acquiring e-autos immediately to test the experience before applying for a loan. Ohm also plans to provide insights on e-auto usage and maintenance to those managing fleets of vehicles.

Ohm’s ability to increase the number of electric vehicles on the road will have a two-fold impact. First, for the millions of people who depend on driving autorickshaws for their livelihood, e-autos improve their income potential. E-autos are cheaper to maintain, the running costs are demonstrated to be less than 20% than that of a traditional autorickshaw, and have a longer lifespan, so drivers spend less money on maintenance and buy fewer vehicles over their lifetime. Second, EVs in general are better for the environment and for city dwellers. They offer reduced noise and particulate pollution for people living in cities.

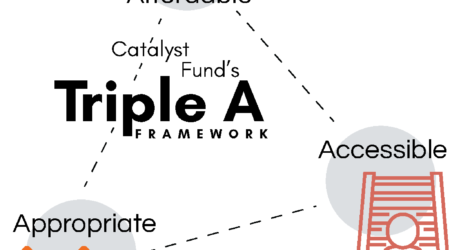

The Catalyst Fund model delivers outsized success compared with other accelerator programs. We accelerate startups that excel on three fronts:

- Impact: Catalyst Fund startups deliver (or, in the case of B2B firms, facilitate the delivery) of life-changing products and services to underserved populations. These can include financial services like loans, savings, insurance, and investment, but also access to productive inputs or essential services such as energy, sanitation, and water.

- Innovation: Our startups are pioneering game-changers that are innovating new products and business models. They drive the sector forward by demonstration effect and via the learning that Catalyst Fund documents and shares.

- Growth potential: Catalyst Fund startups are distinctively investment worthy, developing businesses that are scalable, with high growth potential. Our startups are selected by an Investor Advisory Committee, who have deep experience in emerging markets and nominate high-potential startups, and then sponsor and mentor them through Catalyst Fund. As a result, our startups raise more funding than startups from other accelerators.