How are inclusive fintech startups responding to COVID-19?

After ravaging China and developed economies – Spain, Italy, France, the United States – the novel coronavirus has begun spreading in emerging markets. The number of cases in Nigeria, Kenya, South Africa, India, and other markets is rising, and most governments have enacted lockdown measures, causing industries to halt and widespread supply chain disruption.

As a result, developing countries are already experiencing alarming signs of economic recession, with potentially catastrophic effects. According to a recent study by McKinsey, Africa’s economies could experience a loss of between US$90 billion and US$200 billion in 2020.

Undoubtedly, it will be the most vulnerable segments – those who are not financially healthy, without stable incomes, and without financial safety nets – that are going to suffer the most from the economic shock caused by the pandemic. Micro-entrepreneurs, gig workers, informal traders, food sellers, and low-income salaried employees who will be laid off will have to choose between the cost of falling sick from coronavirus and letting their families starve. Gallup research worldwide has pointed out that the percentage of people who are financially insecure in low-income countries – for example those whose savings would last less than one month if their income were to stop – is 53% in Kenya, 59% in Bangladesh and 58% in Colombia. This state of financial insecurity is always a reality for the vast majority of the global population. Coronavirus is only exacerbating it.

Inclusive fintech startups responding to COVID-19 and stepping up to fight the pandemic

As the impact of COVID-19 unfolds, many fintech companies are experiencing increased demand for solutions that can help individuals and small businesses weather the crisis.

In emerging economies, the importance of digital financial services has become front and center. The Central Bank of Kenya announced measures to facilitate mobile money transactions in the country in place of cash, by eliminating charges between banks and wallets, waiving fees for transactions below KShs 1000 and increasing daily transaction and mobile money wallet limits. Meanwhile, the Bank of Ghana eased KYC requirements on mobile money and are allowing citizens to use existing mobile phone registrations to open accounts with the major digital payment providers. Sonatel/Orange in Senegal and MTN in Zambia have followed Kenya’s lead, with similar fee-waiving measures and campaigns incentivizing people to go cashless.

Similarly, nimble and digital fintech startups are well-poised to help those hit the hardest. For inclusive fintech companies in emerging markets, the well-being and financial health of underserved communities is always top of mind. Their products were designed to be able to serve their customers precisely in their time of need, and are agile enough to adapt as needs change in this uncertain environment. This makes them better-positioned than ever to reach the most vulnerable with critical solutions in this time of crisis.

In Catalyst Fund’s portfolio alone, we see several early-stage fintech innovators playing a role at the frontlines, helping customers access critical health insurance, send money to their families, access essential goods and services, and better manage current finances via financial advice. They’re also helping small businesses access short-term financing. Others are tackling development of the critical infrastructure needed at this time: tools that can enable traditional financial service providers to go digital.

Below, we summarize examples of COVID-19 fintech solutions being deployed across emerging markets in five categories: insurtech, e-commerce and marketplaces, financing for small businesses, digital payments and remittances, and digital infrastructure.

COVID-19 insurtech covers hospitalization and life insurance

While Coronavirus is putting financial fragility front and center in people’s minds, insurers globally are dragging their feet and some nonetheless stated they will not pay out for COVID-19 related claims.

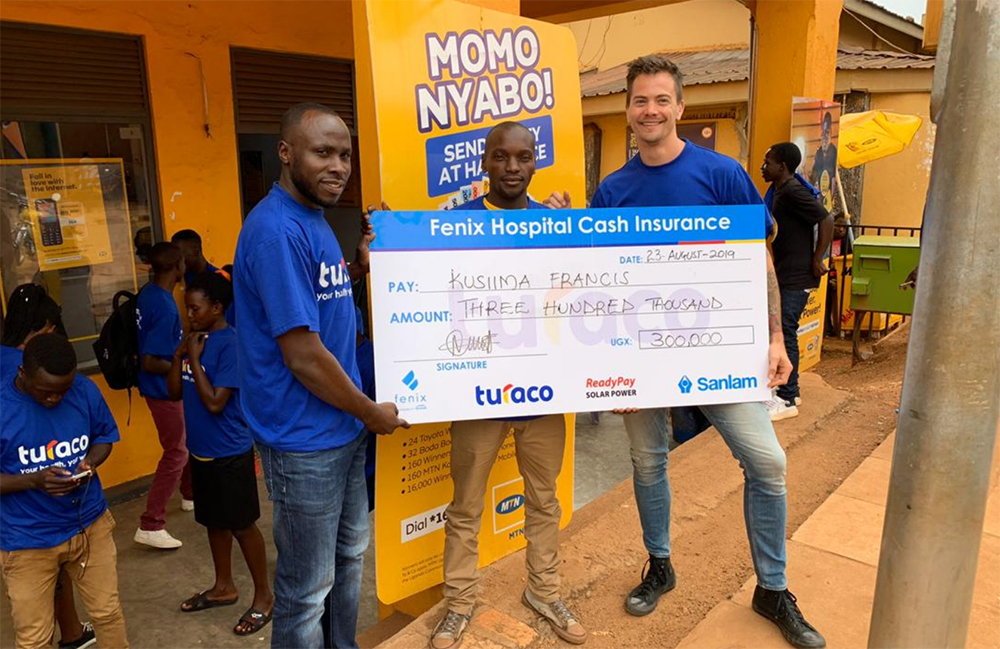

In Uganda, micro-insurance company Turaco is taking the opposite approach. The team mobilized quickly when the crisis took shape and put together a hospitalization and life insurance product that costs only $2/month, specifically for COVID-19 patients – staying true to their promise to free their customers from the fear of financial shock.

Turaco is offering the coverage that their customers will need at this time, and making it more accessible. Turaco will roll out its insurance offering through its existing partners, including SafeBoda in Uganda, and will also work with its partners to make it available directly to consumers online. Marketed via social media, sold online, and paid via mobile money, this new insurance product went live in just two weeks, just as cases in East Africa began to pick up.

E-commerce and marketplaces ensure the provision of essential goods

In developing countries, the impact of job loss and economic lockdown means that most families won’t be able to afford to buy food and other essential items. Sokowatch, an East Africa-based B2B e-commerce platform offering integrated financial services and logistics for informal merchants, has recognized this challenge and plans to leverage its retail distribution network and technology systems to help merchants and their customers cope. The startup intends to send out targeted SMS messages to individuals economically affected by the virus, which contain unique voucher codes they can redeem for a bundle of essential goods – food, soap, and other items – at Sokowatch-supplied small shops (dukas).

The Sokowatch app, already prolific among dukas in Sokowatch markets, can be used to verify the voucher codes for redemption. Retailers are then credited the balance of any goods issued via a special credit line offered by Sokowatch. Thanks to the credit line, small merchants can remain operational and supported through the crisis, just at a time when most other microlenders are pulling back. By acting as a delivery channel for essential goods, Sokowatch can provide safety nets for the most vulnerable, and it plans to expand the credit program to more merchants as well.

Other e-commerce startups like Copia in Kenya are leveraging their existing infrastructure to play a role in encouraging social distancing. Copia is offering free delivery to its e-commerce pickup points across Kenya, accepting digital payments via card or mobile money, for those looking to send items to family and friends upcountry.

In South Africa, Abalobi, an app for small-scale fishers that enables them to sell their daily catch directly to restaurants and access fair market prices via a marketplace, has quickly adapted to offer home delivery of fresh, local and sustainably-sourced fish, directly to consumers’ homes when they pay digitally via the app. As the restaurant industry has taken a significant hit, Abalobi is focused on keeping the fishermen afloat. With this shift, Abalobi is still able to guarantee income and financial stability for the fisher families.

Similarly, Chennai-based payAgri is seeing increased demand from farmers who rely on their digital platform to sell their produce directly to buyers. payAgri connects farmers with retail businesses and provides them financing with a goal of optimizing the agriculture value chain. Since the outbreak, farmer producer companies, government authorities, and e-commerce platforms have asked payAgri to step in to aggregate fresh produce from farmers and deliver it to consumers.

SME digital lenders fill the financing gap for small businesses

Crises like this one expose the fragility of credit systems and weaknesses in credit reporting more than ever. Creditworthiness is typically assessed by looking at an individual’s or a business’s credit history or other sources of alternative data, but algorithms don’t take into account the possibility of unpredictable events like a global pandemic. As loan recipients begin to miss payments, threatening lenders’ loan books, most financial service providers are pulling back from the market – right at the time when people need credit the most.

This is where fintech providers can make a significant difference. South Africa’s Lulalend recognizes the unprecedented and difficult times small businesses in South Africa are facing, and they are committed to supporting them through it. The lending platform will continue to extend credit and offer more flexibility in repayments to the small businesses they serve during these challenging times. Because they are an online digital lender, they can still process and issue business credit in minutes, using proprietary technology to assess an SME’s creditworthiness and combine this data with news risks due to coronavirus.

Similarly, in Mexico, fintech company Credijusto recently closed a US$100 million round of debt funding, enabling them to provide more loans to SMEs in Latin America in this time of crisis. According to Michael Sidgmore, a partner at venture capital firm Broadhaven Ventures, which invested in Credijusto, “Small- and medium-sized enterprises in Latin America are massively underserved, to begin with, and any shock like this tends to make banks retrench.” He foresees a significant opportunity for fintech companies like Credijusto to play a larger role in filling that gap.

Digital payment and remittance platforms make moving funds smooth and immediate

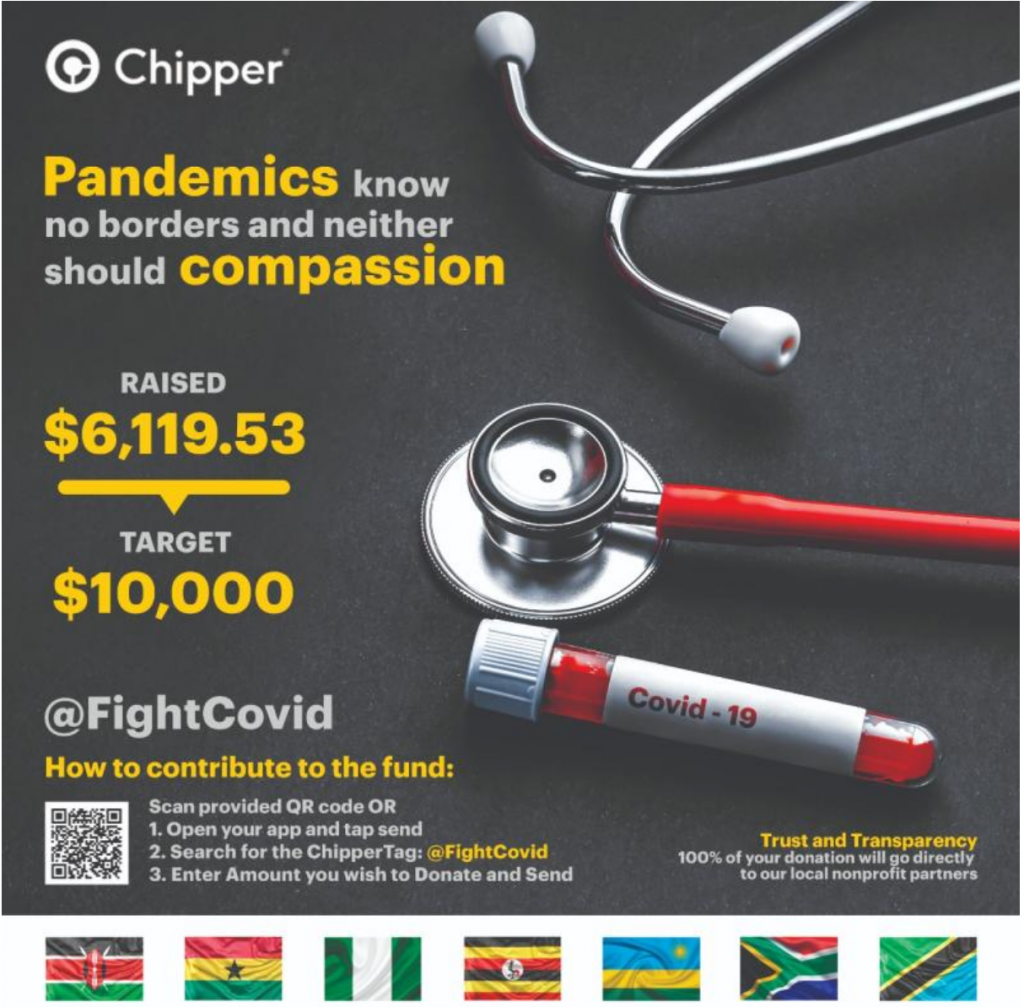

As mentioned, governments are already taking action to encourage people to avoid using hard currencies and switch to digital payments. Companies like Chipper Cash, who offer free digital payment services to individuals and small businesses via a simple and easy to use app, can be at the heart of COVID-19 response. Chipper Cash has put together a COVID-19 fund which will enable people to send support to the communities most affected by the crisis via their digital wallet. Anyone can contribute to the fund from around the world, and proceeds can be distributed via the app to the organizations at the frontline serving individuals and families in need. Contributions to Chipper’s COVID-19 Emergency fund reached almost US$10K in under a week.

In South Africa, digital payments platform Yoco Capital is stepping up in a big way, pushing forward products that had been in development but are now more relevant than ever. They will soon launch Payment Link, a remote payment offering that will enable transfers on their client network via a weblink. They’re also offering their card machines at 50% off to encourage digital payments, and continuing their cash advance offering from Yoco Capital, for small merchants impacted by the crisis.

Digital infrastructure helps traditional financial providers operate online

Fintech companies can also be critical in helping traditional financial service providers and other organizations to continue offering their services digitally.

For example, identity verification company Smile Identity has made all its services free for healthcare providers and other organizations directly engaged in combating COVID-19. Their KYC and identity verification services are also fundamental in helping people to register for digital financial services and transact online. Smile Identity has worked with fintech companies like Chipper Cash, Kuda, Chaka, Paga, Kudi, Riby, and Cellulant – helping to power their onboarding experiences and KYC checks. As the crisis unfolds, traditional banks are considering ways to shift their business to virtual channels and can learn a lot from the fintech companies changing the face of financial services across Africa and beyond. Firms like Smile Identity can make this transition more seamless.

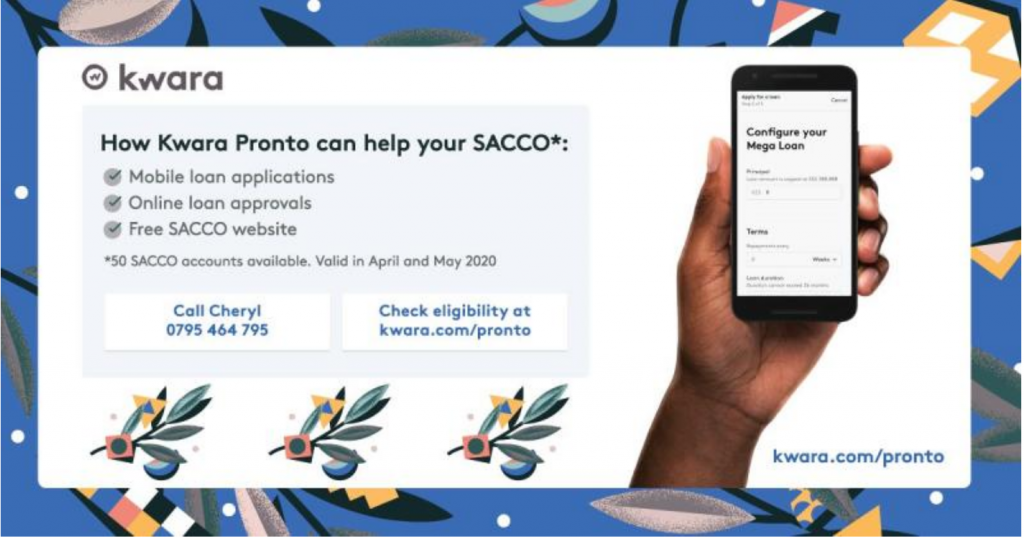

Additionally, startups like Kwara can offer essential digital infrastructure that can enable smaller non-bank financial institutions, like Savings and Credit Cooperatives (SACCOs) in Kenya, to move their operations online and keep serving the customers who rely on them. Kwara offers a secure online and mobile digital banking experience that can allow SACCOs to continue to quickly go digital and remain in operations. Kwara is working hard with these providers to offer a quick digital solution in these times of crisis and developed a new version of their platform called Kwara Pronto which will be offered free for three months. This is an effort to enable SACCOs and their members to keep transacting while observing social distancing. As CGAP pointed out, microfinance institutions should rapidly switch to digital channels to keep serving their customers.

Realizing fintech’s full potential during the crisis

Like other small businesses, fintech startups, especially at the early stage, are also vulnerable during this crisis, facing cash crunches, fundraising challenges, and – in the best case scenarios – resource shortages, as a result of increased demand. Inclusive fintech startups will also need support to stay in business and make sure they can keep providing their solutions to the most vulnerable individuals and small businesses during and after the pandemic.

At Catalyst Fund, we are actively seeking ways to help our portfolio companies and monitoring what governments and development organizations are putting forth to support small businesses. We hope investors will continue to find ways to invest, conduct remote due diligence and recapitalize startups in their existing portfolios. A general freeze of investment flows will pose enormous challenges across the industry.

We also encourage regulators and policymakers to relax regulation and allow fintech companies to operate and scale faster while being mindful of protecting consumers against fraud and other cyber risks that come with digital financial services. For example, CGAP also suggests governments can lift limits on mobile transactions and waive fees, as Kenya has demonstrated, ease KYC requirements such as allowing the use of digital signatures and biometrics and allow providers to approve credit rollovers remotely when possible.

Finally, we ask international donors and development financial institutions to consider novel ways to support innovators with liquidity facilities such as bridge grants or guarantees that can provide critical working capital to allow the companies to operate, as well as to de-risk them for commercial investments. Philanthropic capital has a major role to play in this time of crisis, and we hope to see many donors rising up to the challenge.

In order to realize fintech’s full potential during this unprecedented time, we must put resources behind the innovators at the frontlines. Many have argued that in the decade following the 2008 crisis, we have seen the emergence of some of the most innovative companies. This is the time to support the fintech companies innovating for the world’s most financially vulnerable. Only then will we fight this pandemic, while also building a better financial system for tomorrow.