Catalyst Fund AAA Framework in Practice

Since its inception, Catalyst Fund has focused on investing and supporting inclusive tech companies. But what are the features that constitute a truly inclusive product or solution?

Tech companies we support leverage technology and user-centric product design to create solutions that are more accessible, affordable, and appropriate than existing alternatives for the end-customers, solving specific challenges those users are facing in a way that meets their needs. After years of creating and refining products designed for low-income and underserved people, Catalyst Fund has developed the AAA Framework as a way to better understand and gauge what makes a fintech product truly inclusive. The framework has also been adopted by the Center for Financial Inclusion/MIX Market and integrated into the Inclusivity Framework used to judge the InclusiveFintech50 competition.

Defining inclusivity

It may go without saying, but an overarching definitional feature of an inclusive product is that it provides value to users who would otherwise be un- or underserved by other alternatives in the market, thereby meeting their unaddressed needs. While this may seem simple to establish based on evidence of needs and gaps in the market, conclusively demonstrating that a product provides value or measuring the extent of that value is much more complicated and often involves parsing the meaning of “benefit”. This complexity aside, inclusive financial products should meet users’ needs or improve their financial or overall well being in some tangible way. Among underserved users this may mean enabling access to a service for the first time, expanding the range of services/tools a user has access to, improving opportunities for income-generation, facilitating healthy financial habits, or easing cost or effort of administration for a small business.

Focusing on value propositions that are relevant to underserved users shifts the focus away from expansion of traditional financial services, toward crafting financial services that are specific, tailored, and impactful for marginal, low-income, remote, or otherwise unserved users. For example, enabling access to insurance and risk coverage does mean giving low-income farmers and workers access to middle-class products that cover risks that are not relevant (e.g., auto or home insurance), but rather, it means innovating relevant products like crop coverage, or motorcycle policies to better serve them.

For instance, insurance coverage in Nigeria is extremely low at only 5%, and it remains so because few understand or can afford a traditional health insurance policy. Given these circumstances and the particular disease burden, companies like Wellahealth have innovated tailored, locally-relevant policies like malaria coverage and hospicash that are relevant to the population. By crafting policies that address the pains felt by Nigerias, the startup can create an appropriate approach to insurance.

Once the value of a solution is established, tech products that are inclusive excel on three dimensions: they are accessible, appropriate, and affordable for underserved segments.

Solutions that fit this definition differ from traditional financial products, for example, in that those products are typically too expensive for low-income people as they might have higher fees, minimum deposits, or set-up costs that are out of reach. They are also inappropriate, meaning the user experience isn’t right for users who have low digital literacy or unpredictable income flows. Finally, traditional products are typically inaccessible for remote, low-income users because they may depend on use of branches, ownership of smartphones, and constant connectivity.

Triple A in practice

Some examples of solutions that are affordable, accessible and appropriate include:

Affordable

Inclusive tech products that are affordable reduce costs for low-income and underserved users

- Goal: reduce the overall cost of service so that the cost to users is in line with their income flows and affordability thresholds.

- Examples:

- In South Africa, Paymenow offers low-income workers salary advances to meet unforeseen expenses or emergencies. Customers can access cash for approximately 5% of the value withdrawn from their future salary, as opposed to effective interest rates of over 25% offered by payday lenders.

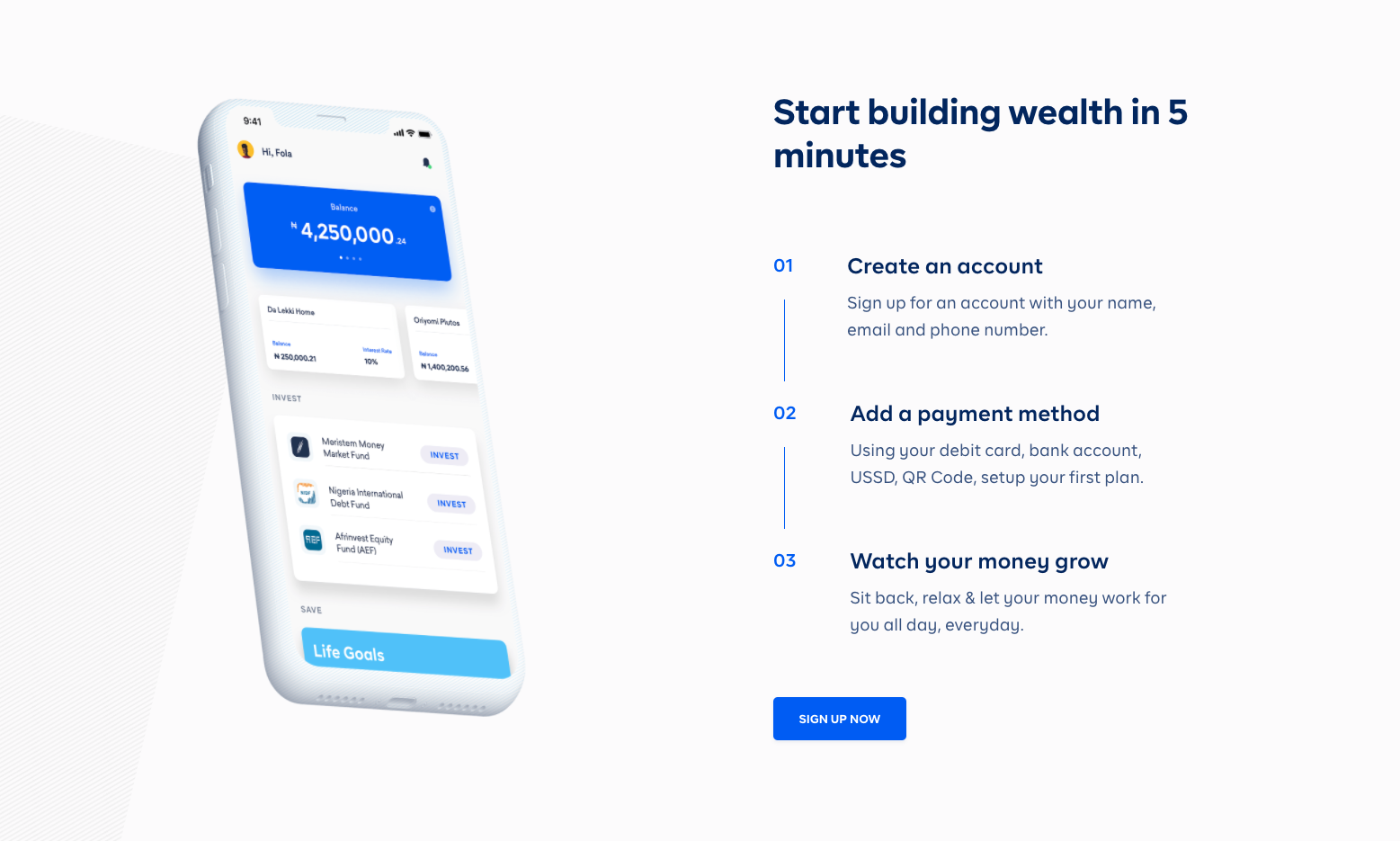

- In Nigeria, Cowrywise provides access to mutual funds and foreign-currency investment vehicles via a user-friendly app that features low minimum balances (100 Naira). Investment products like these were previously only available via investment managers, whose minimum balances start in the thousands of dollars. By enabling users to invest in “bite size” pieces, Cowrywise enables young, low-income people to begin to build assets and avoid depreciation from inflation.

- In Kenya, Sokowatch allows small shops to purchase more and more diverse inventory via simple, low-cost rotating credit. By connecting credit to inventory sold and keeping tenure to a week, Sokowatch is able to match credit income flows more precisely, thereby increasing affordability.

- Inclusive fintech strategies that improve affordability:

- Alternative data derived from utility payments and other sources can build or augment credit reports such that excluded or thin-file individuals can access credit more readily and at interest rates that better match their risk levels (instead of assuming high risk, and thereby high interest rates).

- Rising smartphone penetration means that financial services can be offered directly via applications, instead of via branches or agents. With essentially zero marginal costs, apps rapidly decrease the cost of outreach and costs of servicing, thereby bringing costs of financial services down to affordable levels.

- Digital accounts and rails serve as the underlying foundation for digital payments, transaction records, and automatic deposits. By easing and automating such transactions, providers can bring down service costs to affordable levels.

Appropriate

Inclusive tech products that are appropriate improve the user experience for low-income and underserved users

- Goal: provide customers with a user experience and customer journey that fits with their habits, preferences, abilities, and life circumstances. For example, methods might include customer-centric features like built-in flexibility, tech-and-touch models to ease usage and build trust with users, interfaces in local languages, use of graphics to improve comprehension and increased speed of delivery.

- Examples:

- In South Africa, Mobilife offers 100% mobile life insurance products to underserved customers. Given that low-income users experience volatile income flows, Mobilife developed a feature called NeverLapse, through which customers will retain access to coverage, even if they skip payments, which is more appropriate for their household finances. They remain covered even during missed installments and can pay back on the next monthly payment. Read more here.

- Also in South Africa, Meerkat helps over-indebted households consolidate their debt to better manage payments, ease their debt burden, and save money in the long run. The startup engages users via a website and chatbot, and also through a cell center, where users can speak to knowledgeable representatives in their language of preference.

- In Mexico and Chile, Destacame enables anyone to access their free credit score solution, with minimal requirements. Since the product uses alternative data to produce a credit score, customers do not need a history with formal financial institutions or to meet any particular requirements to access it. Read more here.

- Inclusive fintech strategies that improve appropriateness:

- Some fintech providers have found innovative ways to use data and digital payments to avoid rigid payment schedules typically associated with loans and insurance policies. Flexible payment schedules are a better match for income flows among low-income households that may depend on informal work, harvests, or daily wages.

- Marginal and remote people often lack access to formal identification or other types of paperwork like paystubs or transcripts that may be required for anyone to pass KYC requirements and access digital financial services. As such, solutions that incorporate digital ID infrastructure requiring simple photographs, face-to-ID matching, and location-based data to pass KYC checks can help providers onboard users that may otherwise be considered “invisible”.

- Since these populations have limited experience with institutions and governments, they are often slow to trust providers. In many instances, they may distrust formal institutions after experiences with unscrupulous players or politicians. In these instances, tech-and-touch models that blend human support via call centers, agents, and other familiar outreach with tech, like chatbots, applications, and digital interfaces, can help build trust in startup or digital providers.

- Intuitive graphical interfaces, voice recognition, and video can also be powerful tools for creating interfaces that are appropriate for users that may not be fully literate or numerate.

Accessible

Inclusive tech products that are accessible leverage channels and devices that can better reach excluded segments

- Goal: create or leverage channels and devices that allow excluded segments such as women, farmers, poor people, and thin-file customers to access financial products. As digital infrastructure, device quality, and connectivity improves, those who were previously out of reach can now be reached more easily. Even still, fintech startups often need to use these channels creatively to reach underserved users.

- Example:

- In Mexico, PAYGo provider Graviti is bringing solar water heaters to families that would otherwise struggle to access such assets and instead, rely on gas stoves to heat water. The startup uses WhatsApp, a communication tool already widely used by their target segment, to sell their product as well as to provide customer support after their product has been installed. In doing so, the startup leverages a channel that is trusted and accessible by underserved users to make the purchasing and use of their product easier for this segment.

- In Nigeria, Wellahealth has developed an entirely new insurance journey for their users that bypasses traditional claims, assessment, and payout policies. Instead of paying for services, submitting a claim, and waiting on the office to approve it and make a payout, Wellahealth users dial in to a call center, which connects them to a pharmacy in the WellaHealth network that can serve them. This better matches the way Nigerians already seek care for malaria and leverages channels and providers they already know. When users feel ill, they merely phone the call center for advice or diagnosis, thereby avoiding limitations with data and smartphone access. The call center then directs users to a local pharmacy where they receive tests and treatment without costs.

- In South African townships, women traders lack access to credit but are considered too risky and out of reach for most traditional providers. As well, smartphones are not widely used, and even those who have them tend to change numbers often, so even for those who do have access to financial services, reaching them regarding repayments is a significant challenge. Fintech startup Spoon Money found that asking women to form groups, or stokvels, as is already common in South Africa, and providing loans and savings tools to the group rather than to individuals alleviated the problem as at least one member is always reachable, and members of the group will likely hold one another accountable.

- Inclusive fintech strategies that improve accessibility:

- Embedded models allow financial services to be integrated with services and products that underserved people already access. For example, by offering products like insurance alongside platform work opportunities via the same platform, users can access financial services seamlessly without straying from their existing behaviors and digital tools.

- Inclusive fintech startups need to design applications that are sensitive to low bandwidth and low connectivity constraints faced in many emerging markets. Features such as offline capability, appropriate caching, etc. can all be critical to enabling access.

- Even as smartphone penetration is increasing, many poor and underserved users still use feature phones, so providers should consider creating USSD interfaces, enabling callbacks or sending IVR messages that can improve comprehension and responsiveness.

More examples of AAA products can be found throughout our portfolio and the metrics that we track to assess each element of the Framework:

A final consideration for tech innovators, beyond ensuring that products meet the needs of and can be used by end consumers, is the consideration of profitability. Products that are inclusive should also contribute toward the company’s bottom line in order to remain sustainable. A case study from BFA Global looks at inclusive transaction accounts as an example, leveraging a unit costing analysis to illustrate how efforts to improve inclusiveness on the demand side can also impact the bottom line on the supply side.

Ultimately, the key question for a provider as it considers underserved and low-income customers is whether it can develop a fintech product that is significantly more AAA than the existing alternatives for low-income customers and do so in a cost-effective way. If so, they are likely to acquire and retain users who are currently excluded, and create a durable and sustainable business in the process.