Cowrywise inspires young Nigerians to save and invest

More than ever, it is clear that digital banking and app-based financial services are the way forward. Pandemic and social distancing concerns aside, young people prefer to interact digitally rather than over the phone or even in person. Moreover, younger generations are getting their information and cues from social media, rather than traditional print or other paid media.

Even with these insights and a slew of well-financed digital campaigns, banks and other financial service providers have struggled to acquire young users. Not only do young people distrust banks, messaging and product features from longstanding banks have not amounted to compelling value propositions. Millennial users have particular preferences, few of which align with traditional banking practices. That foundation, combined with the fact that young users are famously disloyal (in Asia, 33% of millennials would be willing to switch banks in the next 90 days), many banks have taken their poor success with youth as a given.

In this context, Nigerian digital wealth management platform Cowrywise is a model to note. Cowrywise has developed a sticky platform that combines youth-relevant messages, a compelling user interface, and appealing product features like low minimum deposits, to encourage young Nigerians to save and invest. Their unique recipe has amassed over 100,000 users in a few short years, 70% of whom are still active with Cowrywise two years later.

Value proposition and messaging

To start, most millennials globally do not trust banks. In light of the 2008 recession, Occupy Wall Street movement, and growing inequality, many young people no longer view banks as trustworthy members of the community, but rather corporate guardians of elite interests.

Similarly, this segment is skeptical of traditional marketing methods. A recent survey found that 84% of millennials don’t trust ads coming from traditional media campaigns, and instead depend more heavily on word-of-mouth from their network or from influencers for product recommendations (58% do not mind watching ads to support their favorite digital stars).

Finally, they are not familiar with financial products or vocabulary. When tested, only 24% of millenials have a basic understanding of core financial concepts. And addressing these gaps in knowledge is not easy, since 71% of millennials would rather go to the dentist than listen to financial institutions tell them what to do. With this segment, using industry language like “securities”, or “portfolio diversification” in marketing content may do more to deter, than to attract, new users.

In this environment, Cowrywise has crafted a brand that speaks to the hopes and concerns of the Nigerian youth they’re looking to reach. Cowrywise campaigns address their worries about social safety nets, retirement and economic volatility, using language they use themselves, which has allowed them to successfully position savings as a way they can feel empowered and take control of their lives.

Furthermore, the Cowrywise website features a well-written, informative blog authored by “Ope” – a friendly and trustworthy persona the Cowrywise team uses in all customer-facing communication as a trust-building mechanism. Ope provides clear explanations and advice to Cowrywise customers, in the voice of a trusted friend. Importantly, Ope also provides transparency into the operations and products at Cowrywise so that users feel they have visibility into the company’s decisions.

Overall communications from Ope and Cowrywise use informal, clear language that demystifies financial services and makes them feel relevant and appropriate for younger users. For example, the team recently launched the “Cowrywise Money Cruise” playlist on Spotify and Apple Music. The playlist features songs about money management and further strengthens the relevance of the brand with their users. Similarly, Instagram posts frequently feature quotes from actual users or popular song lyrics, providing social proof in layman’s terms that make Cowrywise relatable.

Furthermore, Cowrywise leverages brand advocates and influencers to market the brand for them. For example, the startup has partnered with local comedians and digital personalities who not only build trust in the brand, but also help explain the startup’s products to their followers.

Finally, Cowrywise also designs campaigns that empower users to share milestones and achievements on their own social platforms. These campaigns both reward user engagement and usage, and also promote the Cowrywise brand with social proof.

Pricing and product features

Perhaps most importantly, millennials seek clear, transparent pricing that is based on simple fees and payment structures. Ideally, fees should be oriented around actions, not latent, ongoing charges. Traditionally banking fee structures have been the opposite of clear and transparent. Various transactions have different costs; some may have a few free transactions but introduce fees without warning; overdraft fees may only be communicated after the fact, and it may take several working days to see updates to one’s account online.

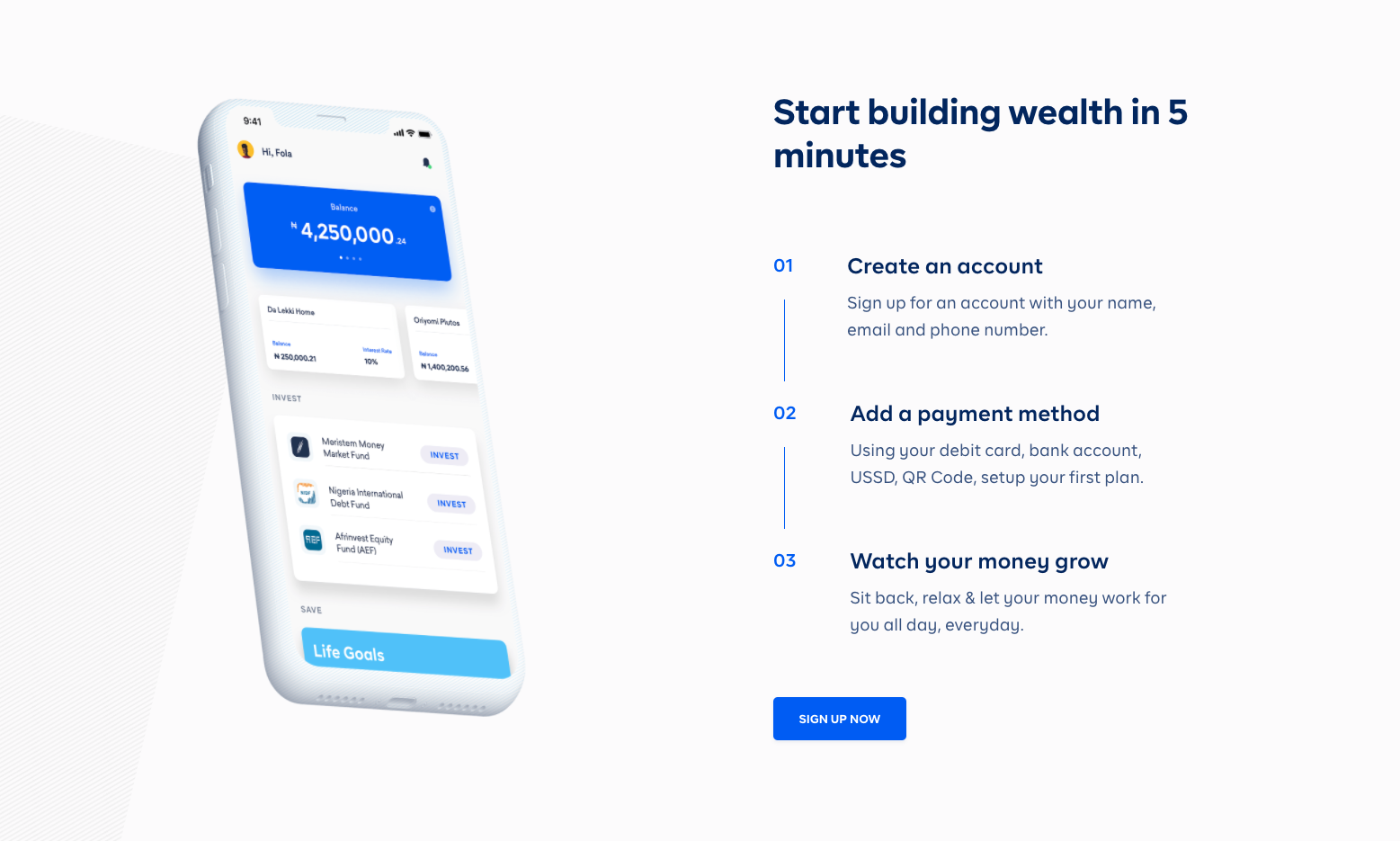

Cowrywise works hard to craft products and features that meet user’s needs and expectations, and don’t need explanations or excuses. The app allows for easy and automatic deposits, and makes withdrawal policies clear. For example, while investment managers traditionally have large minimum purchases, Cowrywise users can deposit as little as 100 naira to open an account.

Furthermore, given the volatility of the naira, many Nigerians value dollar-denominated investment vehicles. However, given the complexity of such products, they can be risky for users who do not understand them well. Cowrywise both empowers users to purchase such funds by making them easily available on the app, and also protects users by administering a financial literacy quiz before purchase so that only sophisticated users are recommended the product.

The team is constantly creating and refining features to help users save. Leveraging the highly social behavior characteristic of younger segments, for example, they’ve developed a new feature that allows users to challenge family members or friends in a group to meet a collective savings goal. Users can also allocate savings against various goals and to set commitment mechanisms.

User experience

Millennials are attracted by exceptional digital experiences, rewards and convenience. Marketers note that digital natives are accustomed to “products and services that are comprehensive, offer instant gratification and seamless payment options, and remember past transactions or preferences to make it easier to repeat a purchase”. They want services that are immediate and reliable, and depend on visual, rather than textual, cues. For example, infographics reach 54% more readers than blogs and have a 73% completion rate.

The Cowrywise app delivers on all these fronts. Users can track their investments in real time, processes are engineered to minimize steps and there are alerts and confirmations provided at all stages so users know exactly what is happening with their money. Again and again, users highlight the ease and clarity of Cowrywise’s app; they feel confident in their options and their ability to control what is happening with their money.

The future for Cowrywise is bright

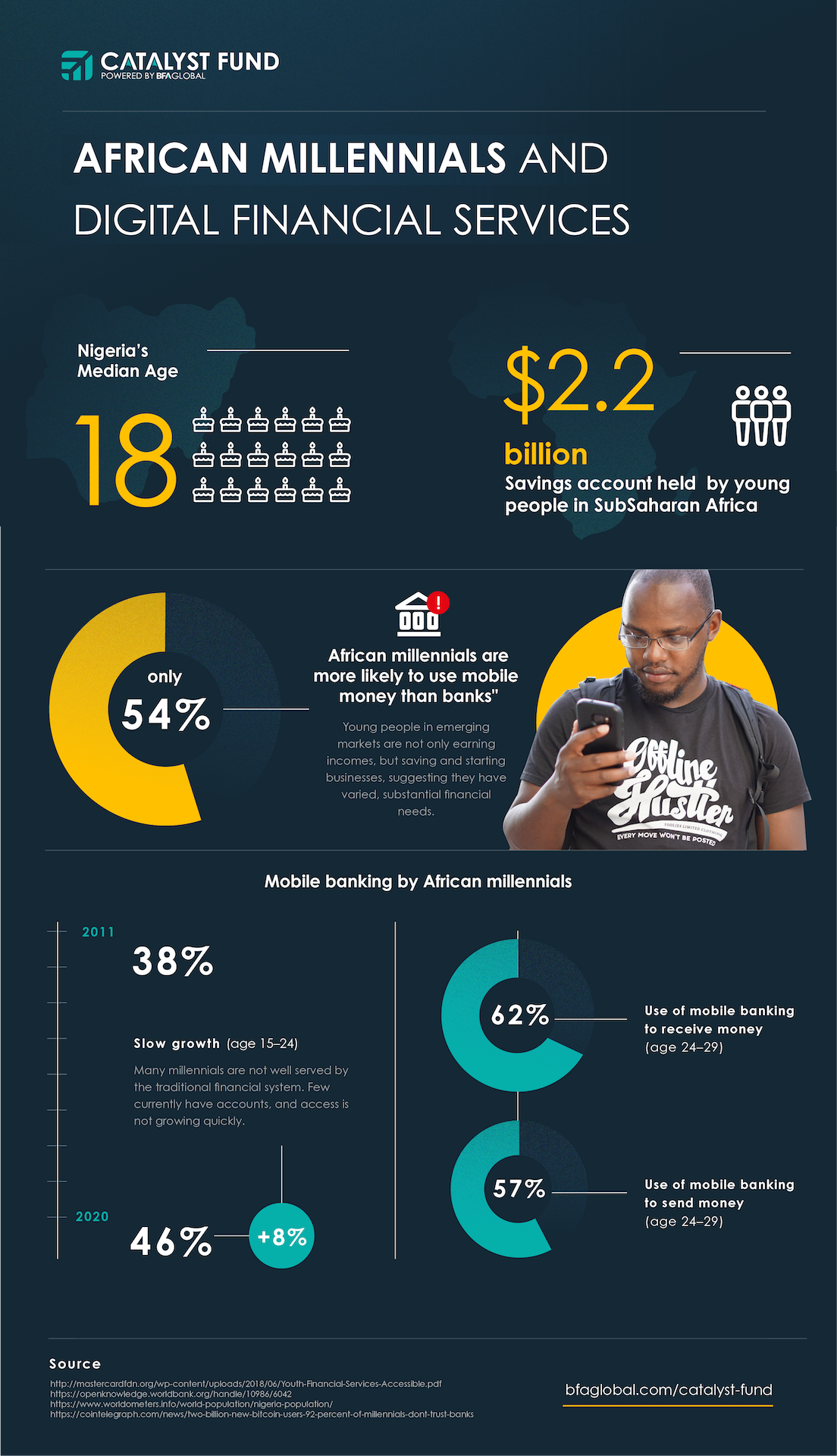

Particularly in emerging markets, youth bulges mean that the majority of the population is below the age of 40. The median age in Nigeria is only 18 years, and the Nigerian youth bulge is predicted to persist (while it will diminish in most other emerging markets). As Cowrywise looks to expand throughout Africa, targeting a young and digitally savvy user base will serve them well, since 75% of Africa’s population is under the age of 35.

Young people in emerging markets are not only earning incomes, but saving and starting businesses, suggesting they have varied, substantial financial needs. CGAP notes that “low-income youth in developing countries begin earning income at a younger age, and they engage in complex financial transactions early on”. BCG estimates that young people in sub-Saharan Africa hold $2.2 billion in savings accounts and that low-income young people account for almost half of this total. Many have substantial ambition; when surveyed, 54% of millennials had started or planned to start their own businesses.

While their needs are significant, millennials are not well served by the traditional financial system. Few currently have accounts, and access is not growing quickly. Only 46% of youth aged 15–24 have accounts at formal financial institutions, up from 38% in 2011. Where mobile money is an option, access is somewhat better (62% of older youth ages 24 to 29 use mobile banking to receive money, and 57% used it to send money), but there is still a way to go to consider youth financially included.

In all, Cowrywise is well positioned to be the provider of choice for young people in Nigeria and across Africa when it comes to saving and investing. As these young people develop financial habits and relationships, they will look to savvy, sophisticated providers that can offer seamless, compelling digital experiences. At Catalyst Fund, we believe Cowrywise is one to watch!