Lean user research: How Diin sequenced data analysis and user interviews to generate insights

Startups typically chase growth by acquiring more and more customers. It is tempting to interpret more customers as a signal that your product is working. But, as we have discussed before, startups need to be more deliberate about how they collect and interpret customer acquisition rates. Acquiring customers, only to lose them after one purchase, is not a recipe for sustained growth, but rather a costly way to build a community of dissatisfied users. If you’re a startup facing this situation, a pause to conduct quantitative and qualitative lean user research to understand how and why users are coming and going can be the key to unlocking sustained growth.

Catalyst Fund portfolio company Diin found itself in a similar situation upon joining the program in early 2019. Diin, a savings app in Brazil, was experiencing rapid growth with 30,000 sign-ups in just six months. An excellent user experience along with good programming and solid tech, fueled customer acquisition out of the gate. The founders were obviously thrilled to see such growth and had their hands full managing operations.

However, a closer look at customer sales and usage data revealed a troubling trend: significant numbers of customers were abandoning the service after using it just once or twice. This type of churn is not uncommon among startups searching for product-market fit.

In the past, Catalyst Fund Venture Builders have used a dashboard to evaluate this issue. For Diin, the Catalyst Fund team stepped in with two interventions: first, they dug into the data to distinguish the different groups of customers using the product. Second, the team went into the field to conduct lean user research by speaking with users from each of the groups to understand the hows and whys of their behaviors. Finally, combining the insights from this work, the Venture Builders suggested tweaks to improve the products.

By sequencing quantitative and qualitative analysis, the team was able to quickly segment and generate insights around Diin’s key users for use in product development, customer engagement, and other business areas.

Data analysis to segment users

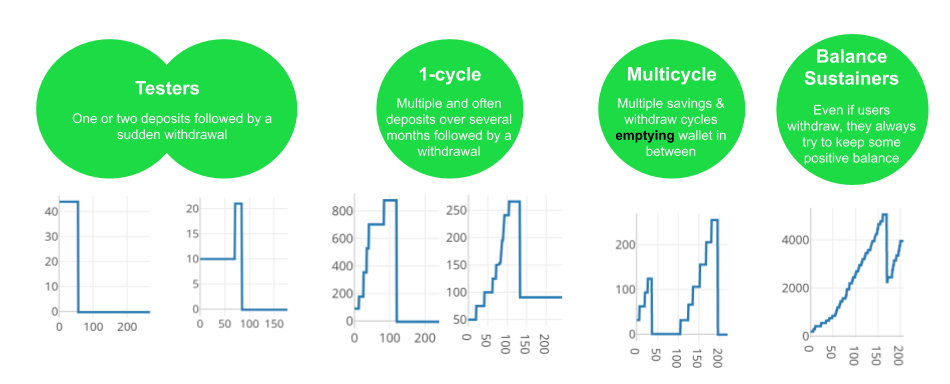

The team’s first step was to analyze transaction data to study retention, e.g., the percentage of users who find value in the product and come back over time. Several days of analysis revealed a handful of user segments, each characterized by the frequency and volume of their deposits, as well as withdrawal patterns.

After excluding those who only lasted one cycle (aka testers), regular users were divided into those who sustained balances and those who would deposit a few times but then periodically empty the account. The graphs below show examples (using dummy data) of the most common savings patterns over time. Some users were using Diin as a wallet while others were saving funds for emergencies.

This segmentation helped the leadership team understand the trends and patterns behind the aggregated monthly figures they considered on a normal basis. Seeing the clients as different kinds of users also gave them new ideas for additional products and offers.

Learn how to make data work for you

Lean user research to build personas

With these data-informed customer segments in hand, the team spent about three weeks in the field speaking with users to understand what was working about the product and what needed improvement. The team targeted the conversations to speak with several people in each user group, and tailored the questions as needed. For example, “testers” were asked questions about what drew them to the product and what deterred them from using it again. Similarly, with single-cycle users, the team delved into why they withdrew and what prevented them from starting to save again.

The persona-driven interviews revealed why different user groups use the product and what value it provides them. The team is now using this information to improve product features, tailor marketing materials, and target offers.

For example, those who lack financial stability and healthy incomes are vulnerable to impulses and unforeseen pressures, and use Diin like a digital wallet. These households may have previously saved in cash in their mattresses or through informal savings groups. Unfortunately, cash around the house has the habit of getting spent, so using a digital wallet can ring-fence liquidity from spontaneous spending and requests from family and friends. These fences make regular expenses like restocking, tuition, and household supplies easier to manage. The ease of using Diin has given them access to financial services they have never had before.

On the other side, balance sustainers see Diin as a tool used to make saving on a weekly or monthly basis more of a habit. These consumers may be contemplating larger expenses like buying a house or taking a vacation.

Others may use Diin to make better use of their excess income. For example, we met women who liked using Diin to cordon off a few extra real on days when their daily expenses were less than expected. This windfall would come in handy when they faced unexpected expenses.

Making improvements and next steps

Making improvements and next steps

The data deep-dive and user research have proved useful to the Diin team, as they learned that acquiring customers quickly was not enough to know that their products were working. Their sizable customer base gave them precious data to work with – a goldmine for startups that can be used to gather important insights and wisdom about their customers’ preference and their product performance. Diin is now exploring new product features and value propositions for its users based on these findings.

Pro-tip for startups: It is better to really know your fundamentals and tighten your product-market fit early on so that you can build a base of loyal customers whose behavior you truly understand. Then, you can invest in growth with more confidence, assured that you will not leak wisdom or capital pursuing the wrong strategy for the wrong customer segment.