Press release: Catalyst Fund announces seventh cohort of inclusive fintech startups

NAIROBI, Kenya, June 23, 2020 – Catalyst Fund, the global inclusive fintech accelerator managed by BFA Global, supported by UK aid and JPMorgan Chase & Co. and fiscally sponsored by Rockefeller Philanthropy Advisors, today announced that six new fintech startups, from Nigeria (WellaHealth, Flex Finance); Mexico (Mango Life, Graviti); South Africa (PayMeNow) and India (KarmaLife) are joining its existing portfolio of 31 companies and receiving £80,000 in grant capital, bespoke and expert-led venture building support for six months and 1:1 connections with investors and corporate innovators that can help them scale.

The COVID-19 pandemic and related economic crisis have disproportionately impacted low-income customers and MSMEs. Between 30% – 80% of respondents in a BFA Global survey conducted among vulnerable populations across 8 global markets anticipate significant adverse effects to their financial well-being. Many small businesses also indicated reduced incomes may lead them to close. In Nigeria, upwards of 16% reported already unbearable conditions in current lockdowns. Inclusive fintech solutions have the potential to significantly improve the financial health and resilience of these underserved and vulnerable populations, enable businesses to begin to recover, smooth cash flows and provide financial security. Catalyst Fund’s latest cohort includes fintech companies who are all developing solutions that equip households and businesses with financial tools that support their livelihoods and build financial resilience in the wake of the crisis.

“We believe we are facing a catalytic moment during which there is an opportunity to use technology to help low-income consumers and small businesses recover from the impact of COVID-19 and build greater financial resilience for the future,” said Maelis Carraro, Catalyst Fund Director. “If we support the right companies now – from those finding new ways to provide affordable health and life insurance, to tools that can digitize micro and small businesses and provide new income opportunities, to those that can enable affordable access to essential services – these innovations can grow to play a critical role in improving financial health globally.”

More on the startups:

- WellaHealth: Nigeria-based platform offering affordable healthcare coverage to protect families from the financial shock that comes from unexpected health emergencies, including hospital cash during COVID-19

- Flex Finance: Nigeria-based financial management tool that enables micro- and small businesses to digitize operations and establish a digital footprint that can enable them to improve operations, operate digitally, and become eligible for credit lines and other financial services

- Mango Life: Mexico-based digital insurance platform offering affordable and accessible health and life insurance plans for underserved individuals

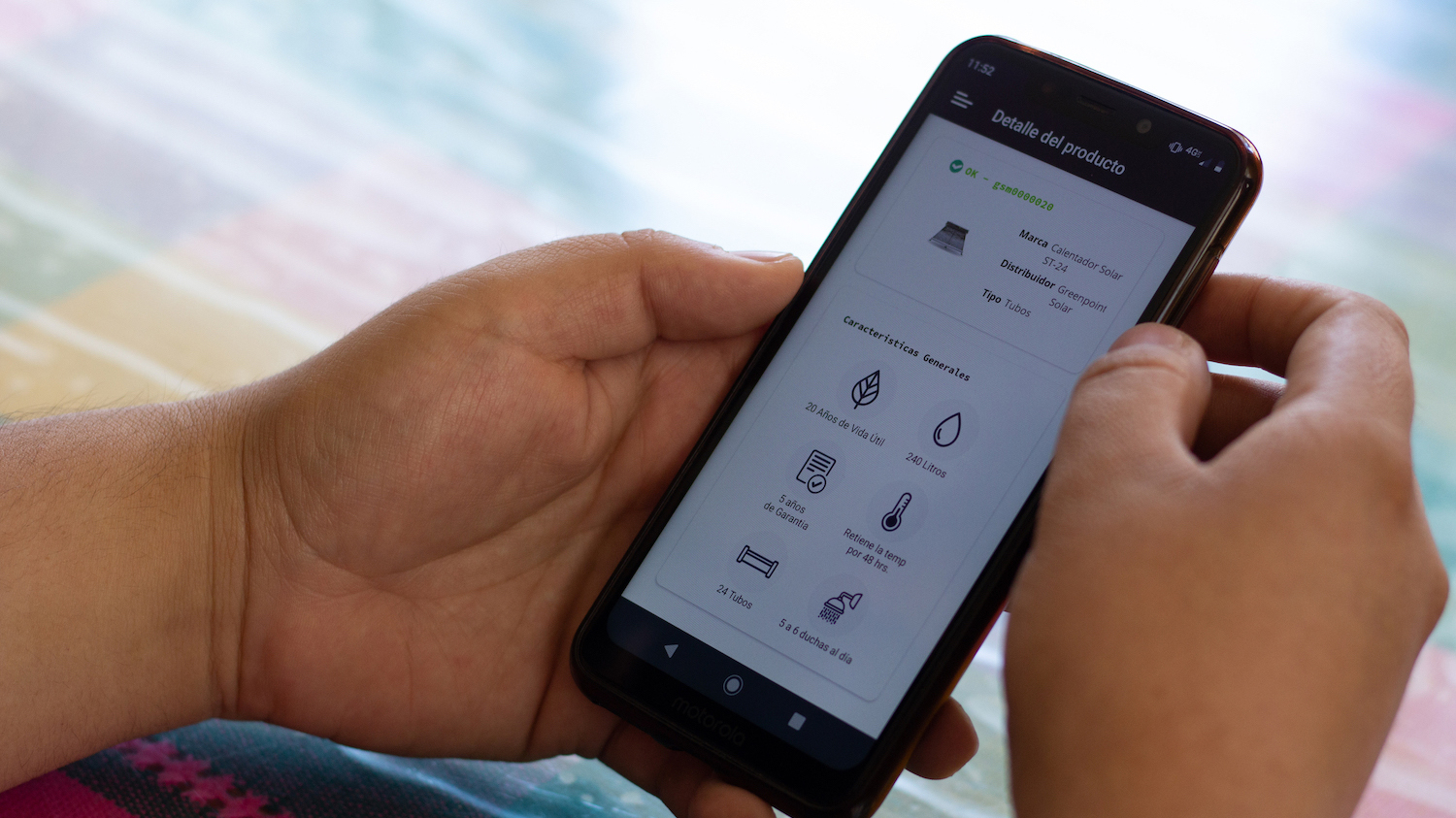

- Graviti: Mexico-based pay-as-you-go service which offers unbanked families access to sustainable household infrastructure appliances via affordable financing, so they can save money on essential services, stabilize earnings, and begin to rebuild after the COVID-19 crisis

- PayMeNow: South Africa-based financial wellness app that allows low-income workers to access part of their earned wages before payday, providing access to much-needed liquidity while empowering them to avoid the costs and dangers of debt

- KarmaLife: India-based financial services suite enabling India’s growing population of gig and essential services workers to smooth uneven cash flows, stabilize incomes and access savings and insurance

“The COVID-19 crisis has negatively impacted the health and financial stability of underserved workers and small businesses across the world,” said Colleen Briggs, Head of Financial Health and Community Development, JPMorgan Chase. “Helping ensure that people in hard-hit communities have access to fintech tools that can improve their financial health is a key prerequisite for an inclusive economic recovery.”

Kim Bromley, Head of Financial Services, DFID, said: “COVID-19 has highlighted fintech’s vital role in widening access to financial services to the most vulnerable people. Catalyst Fund support will help fintech companies improve their resilience to future crises enabling them to provide critical solutions to low-income customers through the COVID-19 crisis and beyond.”

Each startup in this cohort was sourced and approved by Catalyst Fund’s Investor Advisory Committee (IAC), comprising experienced fintech and emerging markets investors, including: Anthemis, Quona Capital, 500 Startups, Flourish Ventures, Accion Venture Lab and Gray Ghost Ventures.

In addition to supporting portfolio companies, the Catalyst Fund team is focused on strengthening local innovation ecosystems, including global and local investors and corporate innovators, through establishing “Circles”, or communities, of peer-investors and corporate innovators. Members range from Microtraction and Novastar Ventures, to Savannah Fund and VestedWorld. These firms share Catalyst Fund’s mission to support the growth of inclusive fintech startups in emerging markets to expand access to accessible, affordable, and appropriate products to the underserved.

In January, Catalyst Fund announced $15 million in additional funding from UK aid and JPMorgan Chase & Co., to accelerate 30 new inclusive fintech startups across Kenya, Nigeria, South Africa, Mexico, and India who are building affordable, appropriate and accessible solutions for underserved customers, by 2022. To date, Catalyst Fund has accelerated 31 portfolio companies that have gone on to raise more than $64M in follow-on funding and reach over 2 million low-income customers.

For further enquiries, contact Thea Sokolowski, Head of Marketing & Communications: tsokolowski@bfaglobal.com.

# # #

About Catalyst Fund

Catalyst Fund, managed by BFA Global, is an accelerator for inclusive fintech startups and innovation ecosystems, in emerging markets. Launched initially in 2016, with support from JPMorgan Chase & Co. and the Bill & Melinda Gates Foundation, today Catalyst Fund is supported by UK aid and JPMorgan Chase & Co., and fiscally sponsored by Rockefeller Philanthropy Advisors. The mission of Catalyst Fund is to accelerate the development of affordable, accessible, and appropriate digital financial solutions for the world’s 3 billion underserved.