SaaS startup Kwara is helping SACCOs deliver during COVID-19

Savings and Credit Co-operatives (SACCOs) are the financial service backbone of the unbanked population in Kenya. While SACCOs increasingly utilize a varied set of technologies and automations, customer-facing operations are largely still paper-based, and few have customer-facing applications. As such, members without computers, who are accustomed to transact via their phones, must instead transact in person. These manual processes, together with poor connectivity, have severely limited SACCO operations during COVID-19 as very little can be done remotely.

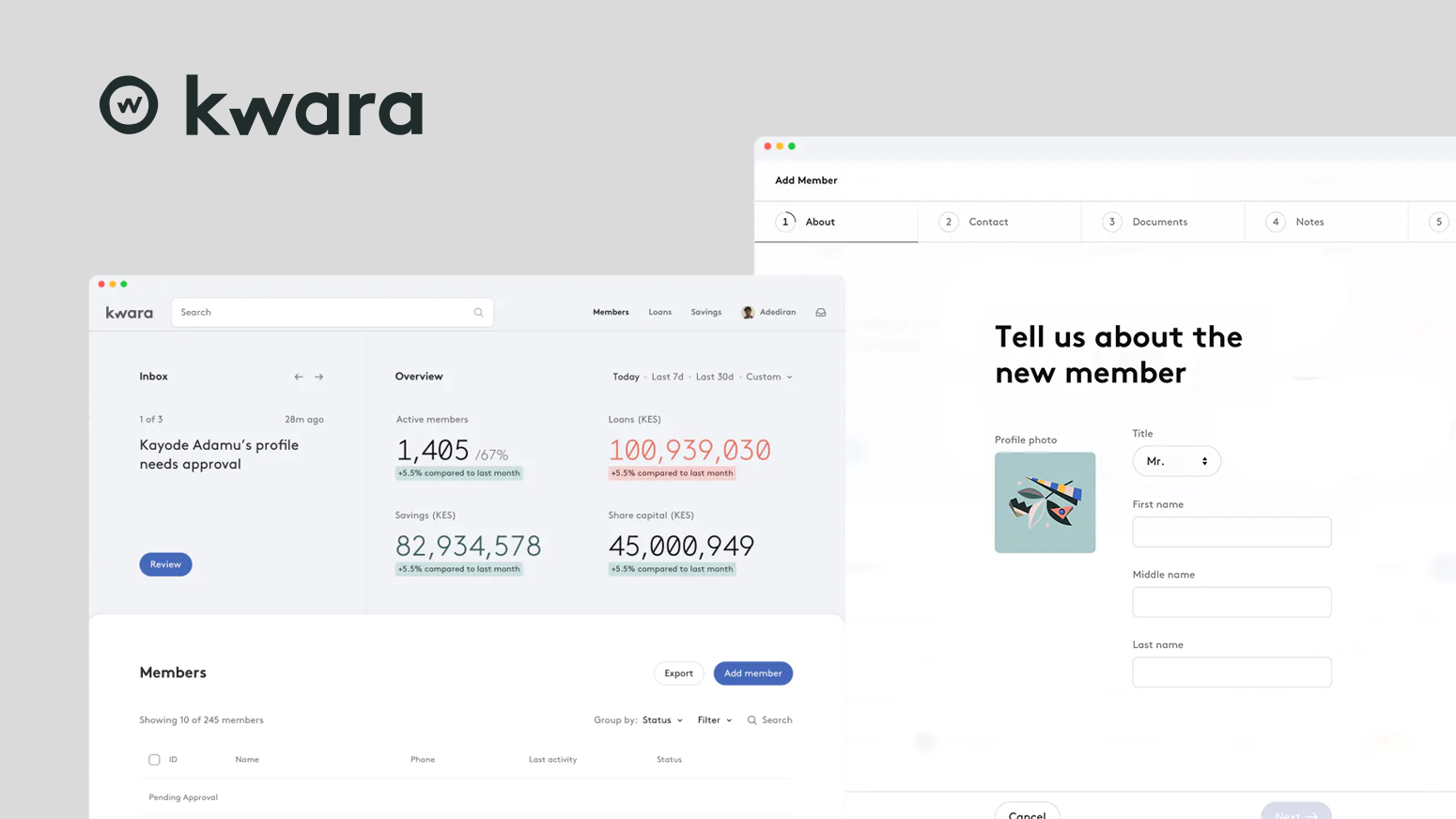

Catalyst Fund portfolio company Kwara has developed a software solution that can help SACCOs enable more remote functionalities by further digitizing their operations. Kwara’s software solution was developed especially for SACCOs and other community-based financial solutions, so it is carefully designed to address their needs and pain points.

To support Kwara’s growth and progress, Catalyst Fund conducted in-depth interviews and a survey of 116 SACCOs to better understand SACCOs’ particular tech needs, and then helped Kwara refine their product in light of the survey findings. The research also surfaced several barriers to adoption, which Kwara is now tackling in their sales and onboarding support processes.

3 opportunities to further digitize SACCOs

Though many SACCOs have initiated work to digitize elements of their operations, most frontend aspects are still largely manual. SACCOs primarily interact with members manually and in-person, though our research found that many had started some initial efforts to digitize other areas of operations. For example, we found that SACCOs had generally made more progress digitizing back-end operations like processing loan applications, but that interactions with members were largely manual.

However, the COVID-19 pandemic has driven a “race to the bottom” of digitization, since SACCOs that are able to service clients remotely will be the most resilient through the pandemic and thereafter. In particular, SACCOs are now urgently looking for solutions in three areas: loan applications, communications with members and customer intelligence.

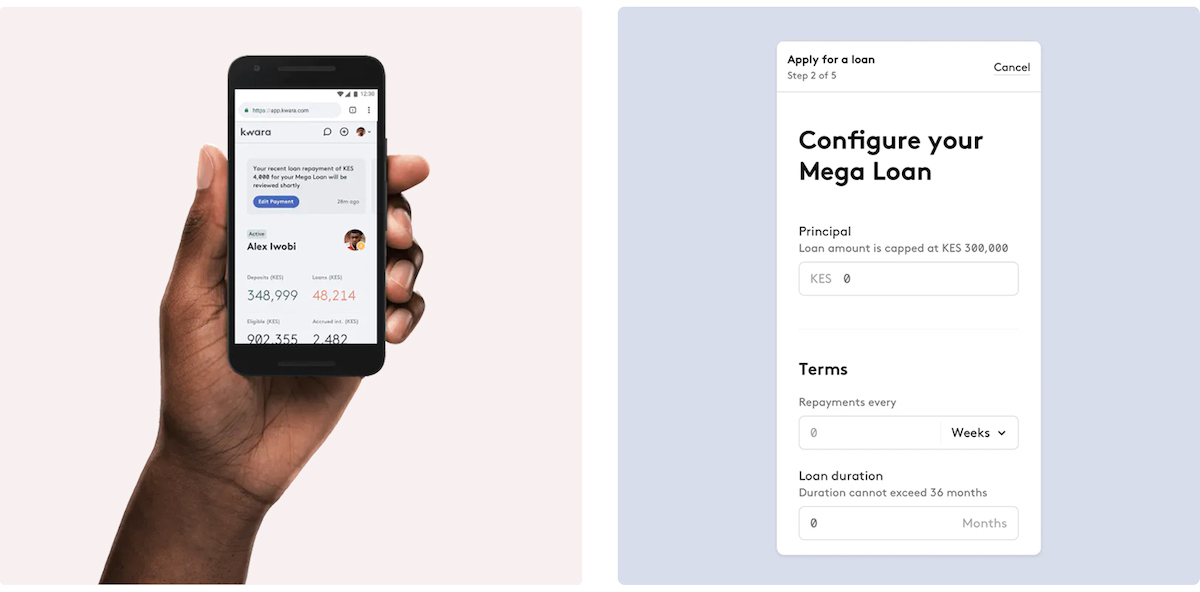

Loan applications are an area of opportunity for further digitization, as one IT manager noted, “To apply for loans, members have to come into the office to fill out physical forms – a challenge during COVID.” Members must first come into the office to apply for a loan. The loan is then assessed by a credit officer, and the guarantor listed on the form is verified and notified through a phone call. Even among those SACCOs that have automated some aspect of loan approval automation, the process of providing documents or identifying guarantors is completely paper-based.

To keep business moving, SACCOs are asking their members to fill out loan application forms, scan them, and send them to loan officers, or to send paper copies via motorcycle messengers. This process is cumbersome and error-prone, so SACCOs urgently need a digital solution.

The SACCOs we spoke to said they would like to digitize the loan application process so that members can apply via their phones or computers. They also want to integrate collateral management, additional credit scoring parameters/sources and notifications to alert members about the progress of their loan applications.

Another area of opportunity is communications with members. SACCOs previously relied on physical meetings with members at either branches or head offices to communicate information about products and policies. Without the ability to meet, SACCOs are now using bulk SMS to communicate. Members then have to call if they have a problem. According to a SACCO CEO, “There is only one-way communication – the members get our messages. But, if a member has a query, they call through the customer care number without a guarantee it will be picked up due to high call volumes.”

Finally, SACCOs highlighted customer intelligence as an area of opportunity as they want to track potential leads, member queries and analytics on dormant versus active accounts. Most SACCOs cannot easily see a customer’s information in one place, nor can they aggregate customer analytics. Much of this information is currently managed across various systems and record-keeping processes, so SACCOs cannot get a clear sense of how everything fits together.

Kwara is developing features to respond to these needs

In light of the needs surfaced during the user research, Kwara is now refining specific features to better serve SACCOs. For example, Kwara’s solution had already created a flow that allowed members to apply for loans online, and the team has now integrated an automatic credit bureau check to give SACCOs an additional credit scoring parameter. This integration makes Kwara the first software provider to link SACCOs to the credit bureau, both for checks during loan applications, but also for positive data submission. By enabling data submission about individual members Kwara further connects them to the formal financial system, allowing them to build positive credit scores that can be referenced by other financial service providers.

Kwara is also further enhancing features to manage communication with members within the solution. For example, the system can track overdue loans and will send an SMS to defaulters. SACCOs had noted the need for an EDMS (Electronic Document Management System) to track member information without the need of being in the office, so Kwara’s solution has an inbuilt EDMS that meets most of these needs. Those few SACCOs that need further integrations can leverage external EDMS systems via Kwara’s public API.

Given the demand for greater customer intelligence, Kwara is also adding aggregated customer data into dashboards. These combined functionalities will give even small SACCOs the intelligence of a Customer Relationship Management (CRM) software, without needing an additional tool. Kwara also has the capability to integrate with other CRM software for more advanced analytics and functionality.

Yet, there are barriers to adoption

Unfortunately, our survey work also identified barriers to adopting new digital solutions that have made SACCOs reluctant to try new systems. Kwara is developing responses and solutions to help bridge each of these barriers, thereby easing the sales and onboarding process.

Weak internal capabilities

Although the Kwara solution can be bought off the shelf, SACCOs often lack the internal resources needed to adopt new tools, from getting the system up and running to importing existing records, to training field staff, to troubleshooting implementation issues. As such, they tend to depend on external support from vendors, which can be highly tedious and expensive. Moreover, this reliance on vendors keeps them from identifying and trying new solutions as vendors promote the solutions they already know and use.

Kwara offers high-touch user support, especially during the first six months of transition to ensure that the SACCO’s team feels confident using and adjusting to the system. Kwara holds the hands of their clients through the onboarding and data migration phase through training, video demos and calls to ensure a smooth integration, and are subsequently available around the clock to support their clients. The team even handles data clean up and can provide specialized accounting support to set up a Chart of Accounts for smaller SACCOs unaccustomed to such systems.

Kwara’s support includes a Fast Learners Program to certify staff in Kwara proficiency via regular training, assignments and refresher courses that build skills and confidence among staff. One participant noted, “”The assignments are straightforward, challenging and informative. Learnings from this program are immediately applicable in my daily work, as the program is tailor-made to my role!”

The Kwara team is also developing a longer-term solution for customer support and success by laying the foundation for an entry-level training program that is completely focused on customer support, onboarding and engagement. This program creates a pipeline of future talent among young professionals. This customer support means that SACCOs have direct access to the help they need through Kwara’s team of experts, instead of needing to hire unvetted, expensive vendors. The added benefit is that SACCOs can not only troubleshoot issues, but also expand their usage of the system.

Bad experiences with other digital solutions

Many SACCOs are reluctant to try new digital solutions because they have had poor experiences with similar products in the past. For example, one CTO told us that their system tended to crash when too many staff members were using it at once. Others complained about lack of integrations.

Kwara’s system is completely cloud-based, thus, server crashes and lost work is not an issue. One of the biggest benefits of Kwara’s system is the ability to integrate with other software, so Kwara can seamlessly connect with the core banking system, CRM, etc. (if they have one already) and already has a built-in EDMS. Furthermore, Kwara has started some integrations with frequently-requested complementary systems like payment gateways (e.g., PesaLink, MPesa), advanced reporting, remittance services (e.g. Transferwise) and fraud reporting so that clients can easily add additional software without needing to figure out the integration themselves.

Concerns about cyber security

SACCOs worry that an all-digital system — without a paper back up — is vulnerable to cyber attacks, and they are therefore reluctant to make this shift. This concern is not ungrounded, as one CTO noted, “Our staff cannot work from home because our current system is prone to cyber crime. We have noticed several cyber crime attempts on our firewall.”

Kwara’s cloud-based servers provide “military-grade security” to help SACCOs protect themselves against these threats. Many SACCOs do not understand the security of a cloud-based system, so the team has revamped communication efforts around security to highlight the integrated system controls and data privacy measures. Furthermore, Kwara has received prominent certifications for compliance with strict security standards.

Digital illiteracy among members, especially for SACCOs with older members

Even when SACCOs make the switch to digital, they often find that members are not leveraging the digital channels available to them and continue to visit offices for inquiries/transactions. This is especially true for SACCOs with older members who are uncomfortable using these digital channels. According to one SACCO’s CTO, “Most of our members aren’t using mobile banking; they use the banks at the main office.”

However, with COVID-19 restrictions, members need to access their accounts remotely, SACCOs are more focused than ever on finding a member-facing digital solution that has a broad range of functionality and works.

To help SACCO members make the transition, Kwara has developed a staggered pathway for adopting the system, in the form of a new offering called Pronto. Kwara’s Pronto, with its sleek, simple interface and intuitive features, has resulted in positive member feedback. Kwara is constantly iterating on the offering to make it more accessible to less digitally-literate members.

Looking forward

Even as SACCOs digitize their processes, they will likely face solvency challenges during these times. Members have reduced their remittances due to COVID and been unable to pay – especially SACCOs with members who are not formally employed. This has negatively impacted their loan portfolios. Therefore, they have started to restructure their loan portfolios as well as stop long-term loans and business loans as they have a higher risk of default.

We’ve seen that an agile, dynamic company like Kwara can respond quickly to market conditions and client needs, thereby shoring up SACCOs to be able to deliver in these uncertain times. Kwara is offering Pronto for free to solve some immediate challenges brought on by the pandemic, and then offering a comprehensive ERP solution that solves all SACCOs’ major pain points, while also allowing integrations with other systems if more advanced functionality is needed. There is a long road to fully digitizing SACCOs in Kenya, but Kwara, the leading digital banking platform for SACCOs, is paving the way as the most comprehensive, flexible, dynamic, client-centric ERP replacement in the market.