Inclusive Fintech: Four Lessons for Optimizing Customer and Tech Journeys

At Catalyst Fund, we spent the past year working directly with early-stage fintech startups in emerging markets. Run by BFA, Catalyst Fund is a unique accelerator model. Rather than providing traditional “startup 101” courses and mentorship programs, we provide direct and tailored technical assistance to complement a startup’s skill sets. This means that our specialists can parachute in as, let’s say, the interim CTO or an ad-hoc UX researcher, depending on what help is needed. Startups also benefit from a $100,000 seed grant without an equity ask.

But what is unique about inclusive fintech, and why do these early-stage companies need our support? On the tech side, serving the underbanked and low-income customer often necessitates lowering costs and reaching as many users as possible, given lower price points. Therefore, optimal use of tech including software, machine learning (ML) and artificial intelligence (AI) is a key factor in becoming profitable in emerging markets. And on the customer side, our startups aim to provide financial products or services that serve and benefit previously underbanked customer segments. This is not an easy task, given formidable barriers like lack of customer trust, perception problems and illiteracy. Understanding the customer base and engendering trust are necessary for product success.

As Catalyst Fund investees, our startups can access specialists who can work alongside them to tackle important barriers and make strategic decisions about the trajectory of their company. Here are a few lessons we have learned and gathered about optimizing the customer and tech journeys in particular.

INCLUSIVE FINTECH AND THE TECH JOURNEY

Inclusive fintech players can cover a wide range, from low tech to high tech. But they all need to get the right feedback and accurately define their technical requirements at different growth stages. Catalyst Fund has helped startups prioritize and find lean tech solutions that are most appropriate for the early stages of the startups, while positioning them for growth in the near future. Here are two examples:

1) Leveraging the latest tech for product design

We’ve learned that there’s a big opportunity to bring ML tools into the hands of startups. For our investee Destacame.cl, tech forms their core business proposition. Their proprietary algorithm builds credit scores for underbanked customers, and banks can then use these to on-lend to a new consumer base. We helped Destacame.cl improve its core credit scoring algorithm by introducing machine learning into the equation, leading to anticipated benefits for the whole value chain. Our new batch of investees includes two companies that are already using ML. We’ll be working with them on taking machine learning to the next level for product design, and we look forward to sharing the results soon.

2) Optimizing internal tech investments

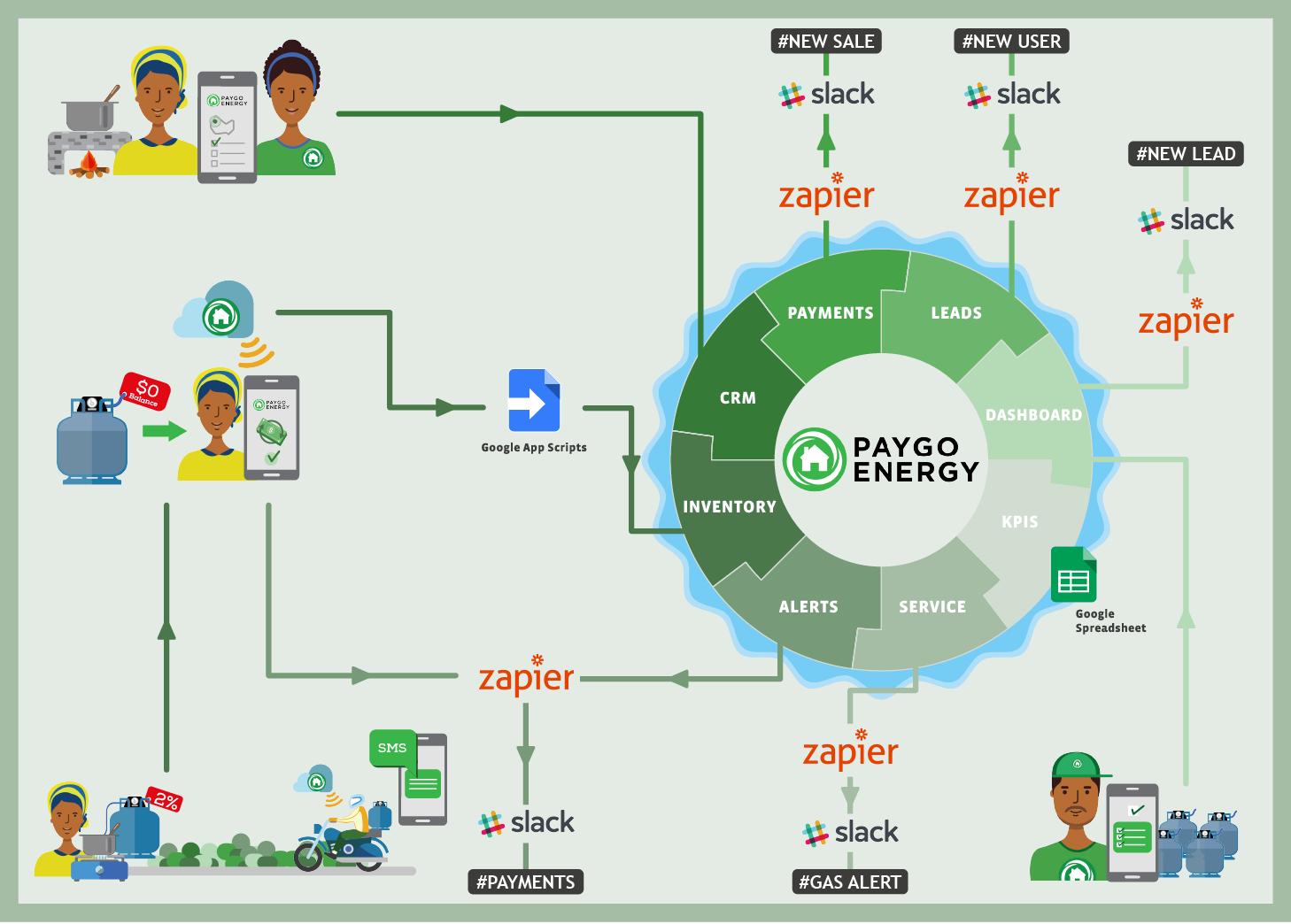

We’ve also learned that startups can use many existing free/freemium tools (e.g. Google Sheets, AppSheets, Zapier, Slack) to find out — very quickly, at low cost and risk which software tools work for them and which ones don’t. For example, our fintech experts worked with PayGo Energy, a pay-as-you-go solution for cooking gas in Kenya, to find tools that met their needs in a lean way, rather than spending time and money on a system upfront that may or may not have been appropriate.

INCLUSIVE FINTECH AND THE CUSTOMER JOURNEY

In inclusive fintech in particular, companies need to translate their tech to customers in low income markets. In our technical assistance engagements, we ended up offering user research components more than we thought we would. What we’ve learned is that early-stage fintech operators in emerging markets need to cultivate a deep understanding of low income customer segments and quickly. Customer experience can be a key differentiator at this early stage, especially if the startup is trying to overcome big behavioral barriers. Thus, ensuring a great first impression and continued experience is key. Below are some highlights of what we’ve learned so far:

1) Generating trust from the start and along the customer journey

In pretty much all sectors, building trust with customers early on is fundamental, as trust is slowly built but easily destroyed. But inclusive fintech anywhere, whether in sub-Saharan Africa or Latin America, has to contend with a customer base that can be very skeptical of financial services to begin with. In this context, generating trust is not a simple matter of creating a shiny new app. In fact, 100 percent of our startups identified building trust with customers as a critical skill for which they they needed support. As a result of our direct work with our investees and BFA’s fintech and customer research experts, we built a a tool tailored to early stage inclusive fintechs. The Design for Trust toolkit examines the customer acquisition funnel and a series of trust points, including competence, appearance, transparency, control and consumer protection. This practical framework helps management teams assess and build trust creating features into their product and services.

WorldCover, a peer-to-peer lending insurance platform for low income farmers in Ghana, showcases a good example of trust generation at the acquisition phase of the customer journey. We know that a company’s reputation can affect potential customers well before activation. Farmers told us that they first learned to trust WorldCover after hearing about it either from the agriculture ministry, the radio, or other trusted sources, even before they met a single staff member.

For customer retention, PayGo Energy makes sure to give in person product demos to households and sends SMS messages with balance updates that clients love. Destacame.cl is always very transparent about how credit scores are computed and offers hotlines to explain the scores further, building credibility with users. ESCALA, a higher education savings program for lower and middle income families in Colombia, also emphasizes the importance of educating customers about the data that made its offering possible, thereby engendering trust.

2) Know when to opt for costly but warm human interaction over cheap but cold digital interaction

Fintech promises to reach more customers cheaply through social media and AI technology, such as chatbots. However, we are starting to note regional differences in approach. In Chile, where the literacy rate is 98 percent, Destacame.cl is using Facebook ads as an extremely affordable means to acquire users. But while digital acquisition strategies and communication interfaces may work in some contexts, in sub-Saharan Africa and Asia a good chunk of the user base is illiterate, prefers verbal communication and may very well require human interaction. WorldCover’s farmers in Ghana, for example, appreciated repeated visits by staff and said they then knew they could rely on the company.

These are some of the lessons we’ve gathered in the past year on the customer and tech fronts. While we’re continuing to add to these two knowledge buckets, we’ve added ecosystem and partnership strategies as our next learning frontier. As our startups partner with banks, corporations or distributors along their respective value chains, they need help to identify which asymmetries they can leverage to build and strengthen their value proposition.