Why we invested: OZE is equipping small businesses with digital tools and access to growth capital

Running a business is complex; it includes managing inventory, conducting marketing, handling sales, executing fulfillment, delivering customer service, and a myriad of other functions. And for 1.7 million microenterprises in Ghana, the smallest of the small businesses, most of the functions are conducted by a single person who lacks sophisticated equipment like computerized inventory and sales solutions, or even digital payments. These small businesses track their expenses with pen and paper, which makes it difficult to keep track of profitability.

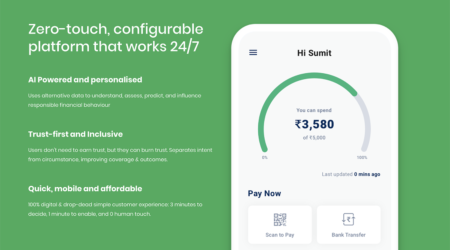

OZÉ provides small businesses in Ghana with a digital solution to manage business activity. Using a simple, intuitive app, users can enter business transactions, generate invoices, and (coming soon) manage inventory. The app then uses the data to provide business owners with a dashboard on their performance, reminders on payments to make and collect, and insights into where their business has or has not been successful. In addition, the app provides daily business tips and access to business coaches to help them grow. Using the information provided in the app, OZÉ also partners with banks to provide loans to help users grow their businesses.

Impact

Many micro, small, and medium enterprise (MSME) owners in Africa lack management skills and business training to support their business’s growth and increase productivity. Lack of management tools may be a significant barrier since most enterprise solutions do not make sense for microenterprises, which operate on pen and paper. With the onset of COVID, many small businesses have adopted digital ordering, marketplaces, and payments so there is greater acceptance of digital tools so the time is right for offering MSME’s tailored digital solutions. Such solutions could improve business profitability since studies have shown that digitizing finances has helped many small businesses mitigate some of the losses caused by the pandemic.

In Ghana, OZÉ has helped its customers on their journey towards digitization by modernizing the way MSME owners manage their records on a day-to-day basis. With digital records, owners with minimal financial literacy are better able to stay on top of their finances. The vast majority of OZÉ’s customers are sole proprietors, meaning OZÉ amplifies scarce management capacity. On top of that, OZÉ offers general business advice on a daily basis and personalized business coaching whenever the customer requests it, helping entrepreneurs grow their business in confidence.

Using OZÉ’s platform also helps these entrepreneurs grow by collecting and organizing their records in case they want to solicit financing from banks or from OZÉ directly. The cost for banks to generate loans to pen and paper customers is often too prohibitive. This has led to a credit gap of $4.8 million for MSMEs in Ghana alone. OZÉ’s help tracking sales and expenses can help expand access to credit and mitigate what 40% of SMEs in Africa identify as a key barrier to growth.

Innovation

The key innovation of OZÉ is how it meets its customers where they are. Ghana leads the rest of West Africa and sits above the average for the continent in smartphone adoption at 55%. That number is even higher for youth in Ghana, which represents 64% of OZÉ’s client base. Although MSME owners may lack financial literacy, they are digital literate.

OZÉ leverages that knowledge by creating an intuitive platform for entering and tracking sales and expenses as well as processing payments. Unlike traditional recordkeeping software, OZÉ is gamified, helping business owners learn to use the platform and form the habit of recordkeeping. With a simple but powerful dashboard, OZÉ users can easily gain insights from their business sales and expenses. From there, OZÉ offers useful business advice and coaching to leverage digital literacy for operational gains.

With users and their financial data already stored in its platform, OZÉ can capitalize on its other key innovation: providing access to capital to MSME owners. Before OZÉ, MSME owners struggled to secure financing to accelerate their growth with disorganized and inconsistent records. With a business’ information in one place, OZÉ’s partner banks can leverage OZÉ’s digital lending management platform and recommendation engine to offer loans to these entrepreneurs, a mutually beneficial outcome. Moreover, as OZÉ continues to grow, it will be able to glean insights from the data to identify which companies are more likely to accelerate their growth, repay their loans, and benefit from additional access to capital.

Growth potential

Users have already shown their satisfaction with how OZÉ has impacted their business for the better. OZÉ has over 16,000 active users benefitting from their platform in Ghana alone. Even better, 60% of users who have been onboarded remain active after six months. OZÉ’s onboarding method is also designed to prioritize user retention. OZÉ is commonly advertised through search and social media, and whenever someone downloads the app, a member of OZÉ’s activation team is ready to reach out and help orient new users.

OZÉ is already experienced at expanding into new markets and new countries. As a digital platform, OZÉ can continue to expand into new areas within Ghana and throughout Africa with minimal marginal costs. Their “plug and play” app is valid regardless of the local context of the MSME and business advice and coaching will always be of use to entrepreneurs, especially smartphone-savvy youth.

OZÉ has already successfully begun its expansion outside of Ghana where it is headquartered. In its early stages, OZÉ is up and running in Nigeria and has planned pilots in francophone Africa. In these countries, other entrepreneurship support organizations have seen the potential of OZÉ and are paying for MSMEs to subscribe to its platform. With this momentum, OZÉ is poised to exceed its goal of activating 140,000 MSMEs in Ghana by the end of next year.

The Catalyst Fund model delivers outsized success compared with other accelerator programs. We accelerate startups that excel on three fronts:

- Impact: Catalyst Fund startups deliver (or, in the case of B2B firms, facilitate the delivery) of life-changing products and services to underserved populations. These can include financial services like loans, savings, insurance, and investment, but also access to productive inputs or essential services such as energy, sanitation, and water.

- Innovation: Our startups are pioneering game-changers that are innovating new products and business models. They drive the sector forward by demonstration effect and via the learning that Catalyst Fund documents and shares.

- Growth potential: Catalyst Fund startups are distinctively investment worthy, developing businesses that are scalable, with high growth potential. Our startups are selected by an Investor Advisory Committee, who have deep experience in emerging markets and nominate high-potential startups, and then sponsor and mentor them through Catalyst Fund. As a result, our startups raise more funding than startups from other accelerators.