Oze is a startup in Ghana that we had the opportunity to work with through the Catalyst Inclusive Digital...

Startups and founders need to understand growth in order to navigate their company through the rough waters of the...

Context Stablecoins are an alternative means of storing and transferring value usually pegged to a fiat currency (or...

Running a business is complex; it includes managing inventory, conducting marketing, handling sales, executing fulfillment, delivering customer service, and...

Mobile money providers working with digital commerce platforms can empower MSEs with much-needed digital tools while growing new sources...

This is the second case study in our report, ‘Inclusion and Your Bottom Line’, which outlines a new mixed-method...

Alongside product-market fit and adequate control of data, underlying tech quality is a key determinant of whether a startup...

In India, we’ve seen a vast array of AI solutions deployed across all sorts of industries. Funding of AI...

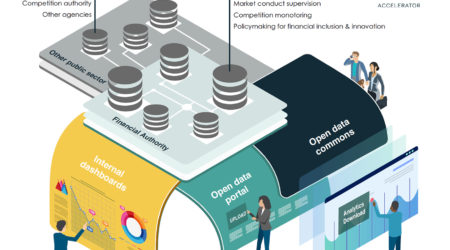

The DataStack, introduced below and elaborated on in our more detailed report, is both (a) a map...

Financial service providers are quickly adopting regulatory technology (RegTech) to ease the burden of compliance. This white paper shows...