Micro-consulting: Using WhatsApp Groups to Support Agents

Tips for Communicating with and Helping Agents Through a Messaging Service

Agents serve as the face of PAYGo and mobile money companies and conduct many of their most important functions, but they are simultaneously removed from the companies. The first blog in this two-part series discussed the many challenges these merchants — specifically mobile money agents — face in running their businesses with limited external support. Here, we explore a new, effective way of supporting agents: WhatsApp micro-consulting groups.

We launched a Whatsapp group for 20 mobile money agents to boost their knowledge, confidence, and engagement. We believe this micro-consulting model is a promising way forward for financial service providers hoping to decrease churn and boost productivity among agents.

In our pilot project, 19 of the 20 merchants discussed a variety of issues and exchanged over 600 messages over a period of 6 weeks. Most importantly, the merchants felt that the WhatsApp advisory group was important to them. It achieved a 100 percent net promoter score, and zero attrition. At the end of the pilot, 90 percent of the group wanted the services to be continued and 85 percent said they preferred WhatsApp to other channels (e.g., Facebook). The survey also suggested clear impacts on business practices: 80 percent of the agents reported they actively incorporated advice they received from the group. For example, two agents repainted their shops based on a discussion in the group in which one of the merchants noted that her branding helped her attract more customers. Another merchant installed a CCTV camera after a participant shared that he was able to mitigate fraud and theft at his shop by installing a CCTV camera.

Given these promising results, we hope that other institutions that manage agent networks will try something similar. Here are some tips we learned along the way:

Use Visuals

Visuals can sometimes illustrate scenarios better than text explanations. For example, when the group started, participants complained that they had insufficient memory on their phones to participate. We obtained visuals online that illustrated simple steps for how to clear phone storage. At the end of project review, one of the participants said:

“When I saw the screenshots image on how to clear my storage I was so happy. It is good when you get such a screenshot — unlike images where you are required to download.”

We also used images of M-Pesa charts to help resolve uncertainties about particular compensation processes. Images helped them to digest information more easily than reading plain text.

Embed Experts

Having a subject-matter expert moderate the group was crucial. The expert lowered the barriers to participation because participants knew they would get accurate responses.

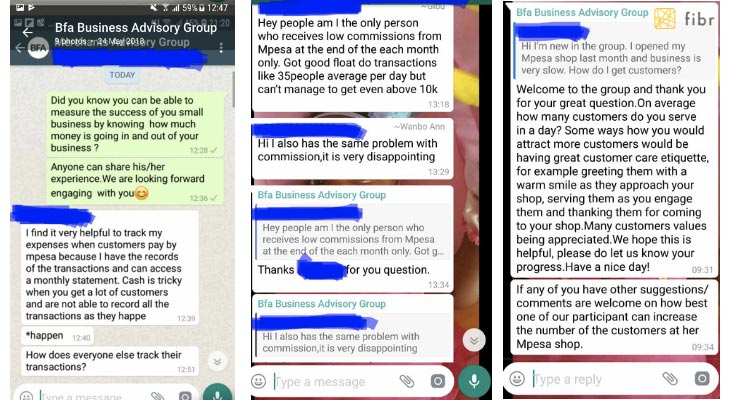

It also helped that the group was not public and that all the participants were strangers so they felt comfortable enough to ask “tough” questions without a fear of looking silly. For example, one participant asked:

“How come I have a good float and I serve on average about 30 customers in a day and my monthly commission has never gone beyond 10,000 KES [$100]?”

One of the other participants responded by sending a chart about how the commissions are calculated. When some of them didn’t still understand, our expert was able to explain how the M-Pesa model works, particularly the difference between an aggregated line and a non-aggregated line and how that impacts commission.

The expert also worked to coordinate and integrate the user experience. For example, she solicited individuals to participate in the discussion by name so that they felt their contributions to the group were valued. She also made one-on-one calls with the merchants: the first call was to build rapport and to encourage the merchants to participate; the second call was at the mid-point to see how the pilot was progressing and to check for any pivotal feedback, and the last call was at endpoint to get feedback on the entire pilot. We found that the phone calls were important to build trust between the respondents and the moderator, which resulted in greater group cohesion as well.

Set the Tone

When the group began, we laid out principles and guidelines for the participants including a list of topics by week and prohibitions on sharing content such as forwards, etc. This set of principles and guidelines created a good atmosphere for the participants because we made it clear what would be discussed every week and encouraged them to ask questions while also sharing their experiences.

However, we also found that participants felt that the language that we used was very formal and this made some of them hesitant to engage. One noted,

“I don’t want to write broken English”

The language used in these groups should be very simple. If the group feels it is too formal, it may make them feel uncomfortable.

Supply Insight and Plant Questions

The WhatsApp group had a theme for each of the six weeks for which we developed recommendations and questions to jumpstart the conversation. The themes were:

- Week 1-Business support (including operational management)

- Week 2-Customer management

- Week 3-Use of technology and innovation

- Week 4-Financial management

- Week 5-Risk management

- Week 6-Business growth

To maintain momentum in the group, we posted recommendation messages at least twice a week. The messages took the form of tips and tricks, i.e.,“Did you know?” For example, during Week 2 on customer management we shared the following tips:

1. Customers can be attracted just by the look of a shop — a clean looking shop wins more trust than a dirty disorganized one.

2. Customer loyalty can be won just by offering good service; a smile and simple question about how the customer is doing makes him/her feel good and want to work with you more.

We realized that everyone in the group read these types of messages and looked forward to more.

We also developed questions for each week that we would pose when activity was low. For example, during the week on customer management, we had brainstormed the following questions:

- What do customers approach you for most?

- How have you attracted customers so far?

- What makes people come to your shop and not other shops?

- What makes a repeat customer?

- What is a good day of customers?

- What do you struggle most with, when it comes to dealing with customers?

- What questions do you have about them for us?

- Do you have any fun or interesting stories about dealing with customers?

Two members of our team would use these questions to elicit discussion from the other participants. This strategy worked better when we personalized the messages, for example: “Joe, what do you think about this?” The other thing that worked was to make sure that when participants commented, the moderator would engage them to exchange a few messages to keep the conversation alive.

Since the participants in the group were business owners, we only sent messages at hours they had indicated business tended to be slow: between mid-morning to mid-afternoon.

In conclusion, the WhatsApp micro-consulting group proved to be an efficient channel for information dissemination and consumption. There were clear indicators of value-add to the merchants suggesting a big opportunity for FSPs, fintechs, and companies that want to better support their agent networks. The group was able to meaningful communicate information to the agents as well as troubleshoot operational problems.

Learn more about our ongoing MSME research by signing up for our “Hitting the Sweet Spot: What do small merchants need to survive and grow their business?” webinar and follow us on Twitter @FIBR_BFA.