Making Business Work for Dukas

Understanding the Financial Health of Small Shops in Africa

Juma*, a small shop owner in Nairobi’s Kibera slum, is in a bind. Despite having run a business for the last five years, he is still unable to get a loan from a bank to grow his business to meet increasing customer demands and diversify his stock.

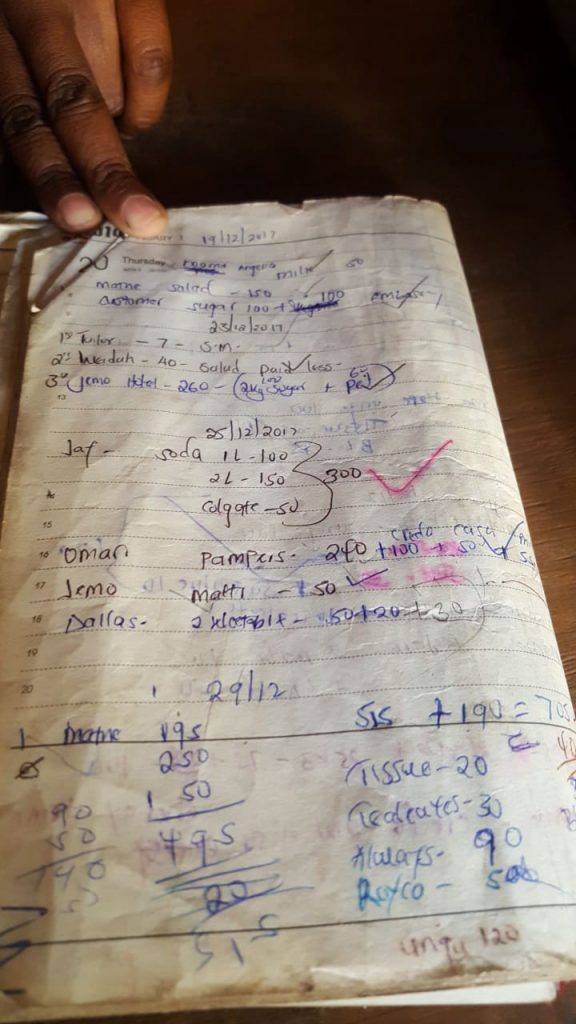

He opened his retail shop with the help of a US$250 loan from his sister. Juma, like many other shopkeepers, has to borrow from relatives and friends to finance his business because of limited cash flow. And like many other shopkeepers, Juma’s cash flow problems are a result of giving credit to shop customers to gain their loyalty, and relatives who hardly ever pay him back. Since he does not buy stock on credit and has never taken any formal loan, Juma is locked out of the formal financial system. He is neither able to access digital loans because he is not smartphone-ready. His only remaining option is to source cash from friends.

For decades, small, informal shops (also known as dukas) have been the cornerstone of many neighborhoods in Kenya. These shops supply about 70 percent of the products that Kenyans consume. But over the past several years, many of these shops have become too expensive to run because of competition from similar shops and supermarkets, lack of capital and credit, and inadequate business know-how. The shops that are able to survive can only access small amounts of capital, which restricts their ability to grow and expand. Financial institutions are unable to lend to these shopkeepers because the majority of them do not have bank accounts, lack a credit history or transactional data as proof of their business operations.

To better understand these dynamics and to better help shop owners like Juma, FIBR has been working with Sokowatch, an e-commerce platform for informal retailers in urban Africa.

Together, we want to better understand:

- What are the determinants of the financial health of shops?

- How do we better meet the needs of small merchants?

We are conducting a financial health diagnostic on a select group of Sokowatch customers in Nairobi to understand the specific needs of these shop owners and what makes them succeed or fail. The financial health diagnostic research involves monitoring the shops’ transactions, their access to working capital, inventory management, revenue and margins, customer retention and the overlap between professional and personal finance.

By better understanding Juma’s current needs, FIBR and Sokowatch hope to help him better manage his business and access the financial services he needs. We look forward to sharing insights from our field research on the financial lives of these shop owners, the health of their businesses, the challenges they encounter in their day-to-day operations, as well as the opportunities that can help drive the growth of their business. In our next blog, we will share the observations of these merchants, such as how they manage their businesses and financing over time.

Learn more about our ongoing MSME research by signing up for our “Hitting the Sweet Spot: What do small merchants need to survive and grow their business?” webinar and follow us on Twitter @FIBR_BFA.