FIBR’s Next Generation of Linkages to Financial Services: Betting on PAYGo

The Promise of Tangible, Flexible and Sustainable Services

FIBR is a learning-driven program that seeks to discover how digitizing micro, small & medium enterprises (MSME) and low-income households can increase their access to financial products and other services. Our hypothesis is that the digitizations of business ledgers and household usage of services can be used to demonstrate their trustworthiness and viability to financial service providers (FSPs). By digitizing these businesses and deriving insights from the generated data sets, FIBR can help build partnerships between fintech companies and FSPs to extend essential financial services such as credit, loans, savings and insurance, to underserved populations.

Through FIBR’s research we are specifically trying to answer:

- Digitization: What is the most effective way for local businesses to digitize their financial matters and operations?

- Challenges, Barriers & Opportunities: To what extent are digitized businesses ready to become an effective channel for delivering richer & more flexible financial options to their low-income users?

- Linkages & Partnerships: Can digitizing the operations of local businesses help convince financial service providers (FSPs) to want to offer, fund or underwrite financial services to low-income end users through the local businesses they are associated with?

Every year we evaluate FIBR’s progress and refine our approach to ensure that we are maximizing learning and impact. Reflecting on two years of strategic investments and technical assistance, FIBR is preparing to bet big on the PAYGo model as a way to expand and sustain access to services among low-income households in Africa.

Two Years of FIBR

Since we started the FIBR initiative in 2016, we have learned that the barriers to digitization, expansion, and upkeep of access to services for MSMEs and households, are both numerous and entrenched. While FIBR and many of our peers have made good progress on expanding last-mile sales, ensuring long-term, sustained access to services remains a challenge.

When it comes to the first step — digitizing small businesses in Africa — we have found that low-income MSMEs and households are rarely ready or able to adopt new, tech-driven ways of doing. More importantly, they are often not motivated to take on the challenge of going digital. While smartphone penetration is growing, access in rural areas is still extremely limited. For example, through FIBR partner Farmerline, we found that only 5 percent of cocoa purchasing clerks (buyers that aggregate cocoa from small farmers to resell on wholesale market) own a smartphone. Moreover, even when sales agents have smartphones, they do not use applications and struggle when forced to use them for work.

Insight 1: Fintech companies need to create incentives to digitize by providing immediate, tangible benefits

Even when our FIBR partners, often fintech companies that directly service low-income communities, help these touchpoints to digitize and begin collecting payment and transaction data, the second step — utilizing that data to build a case for offering additional financial services — remains a challenge. It may seem simple to layer credit onto a service that collects school payments, for example, but these providers are not set up to collate the data, analyze it, or use it to build the case for additional services.

Insight 2: Fintech companies need tools to analyze and derive insights from the data.

In those few instances where our partners attempted to use digitization to expand financial access, they struggled with the third step — designing compelling products and making the necessary operational changes. With a singular focus on their primary product, many providers do not have the processes or the finances to work beyond their core business. They have difficulty communicating with customers and setting up internal processes, especially given regulatory restrictions and the need for deeply entwined partnerships with financial service providers.

Insight 3: Fintech companies need assistance and tools to develop customer-centric, mobile-based apps with accessible user interfaces to expand their services.

The path to partnership is a long one that includes high perceived customer risk and a murky business case. While financial institutions we have spoken to have expressed an interest in the alternative data gathered through FIBR partners, they require robust data streams to complement their existing business processes, rather than reinvent them. Furthermore, fintech companies are increasingly offering financial services themselves driving a ground shift in role distribution among partners.

Insight 4: Fintech companies need support to develop relationships with FSPs to convince them to leverage their digitized channels to deploy digital financial services.

The Advantages of PAYGo

Among several engagements with FIBR partners, the PAYGo model is emerging as a promising way forward. We have found that the structure of PAYGo services allows it to sidestep many of the barriers that providers such as our FIBR partners face in reaching low-income customers.

Often, the motivation to digitize is low because the upside to digitization is distant and intangible (i.e., access to credit) so the user has little incentive to embark on the tedious process of learning and transitioning to digital. In the case of PAYGo, the asset — most often a solar home system— is immediate and tangible so the customer is motivated to transition to digital payments.

Moreover, PAYGo services are inherently flexible so customers can use them as they need and can afford, without having to adhere to arbitrary payment schedules that do not match their income streams. With PAYGo solar, customers pay according to their usage, allowing them to cut back in lean times so that variability in their ability to pay does not negatively impact their records.

These advantages have driven intense growth among PAYGo service providers. With over 1 million units sold in the last 5 years, and over 50,000 units installed each month, the PAYGo model makes solar affordable for end-customers and provides sufficient margins for providers to scale last-mile distribution. Relative to our experience with other FIBR partners, we are hopeful that PAYGo providers can serve as an effective conduit for a full suite of services.

Next Generation PAYGo Interventions

Even with these advantages, there are still many open questions and challenges to resolve in the PAYGo model.

To start, while PAYGo solar has effectively resolved the problem of motivating digitization, it has mainly been used to deliver products for home energy consumption. FIBR will be pioneering the use of PAYGo for productive assets through investigating PAYGo for solar irrigation assets. Through this project, FIBR aims to understand the risks in lending for productive-use assets, and the financial structures that maximize affordability and achieve acceptable repayment and risk levels.

With regard to deriving insights from data, we have found that PAYGo providers have been historically focused on the initial sale and on expanding scale. Once customers, providers have applied the same treatment, a “one-size-fits-all” journey and have struggled with low customer engagement. If the asset is subsequently withdrawn, access to a life-changing service is reversed.

Although there is vast potential for the PAYGo model to use data to offer increased flexibility, data and business insights teams are small and have limited bandwidth to: think strategically about what data to collect from customers at the point of sale, analyze existing data to customize payment plans, identify churn and repayment delays, or customize post-sale interventions.

Providers need to move beyond “access” to “sustained access” so that the marker of success is not just an initial sale, but long-term service provision and customer engagement. Data will be critical to making this shift to identify churn patterns, evaluate intervention efficacy, and design service add-ons to minimize drop offs and withdrawals. Once harnessed, data can be used to improve service delivery, reduce churn, and increase margins by helping to tailor post-sale interventions such as offerings and payment plans so as to reduce costs and increase customer retention.

In the last year, investors have put pressure on these operators to focus on solid unit economics and operational profitability. The trend across the industry is to invest in data and operational processes to improve customer selection and repayment. Although churn was quite the headache for providers, our data shows that 30–40 percent of customers take significantly longer to repay — rather than outright churn or default — a risk that providers are also willing to absorb.

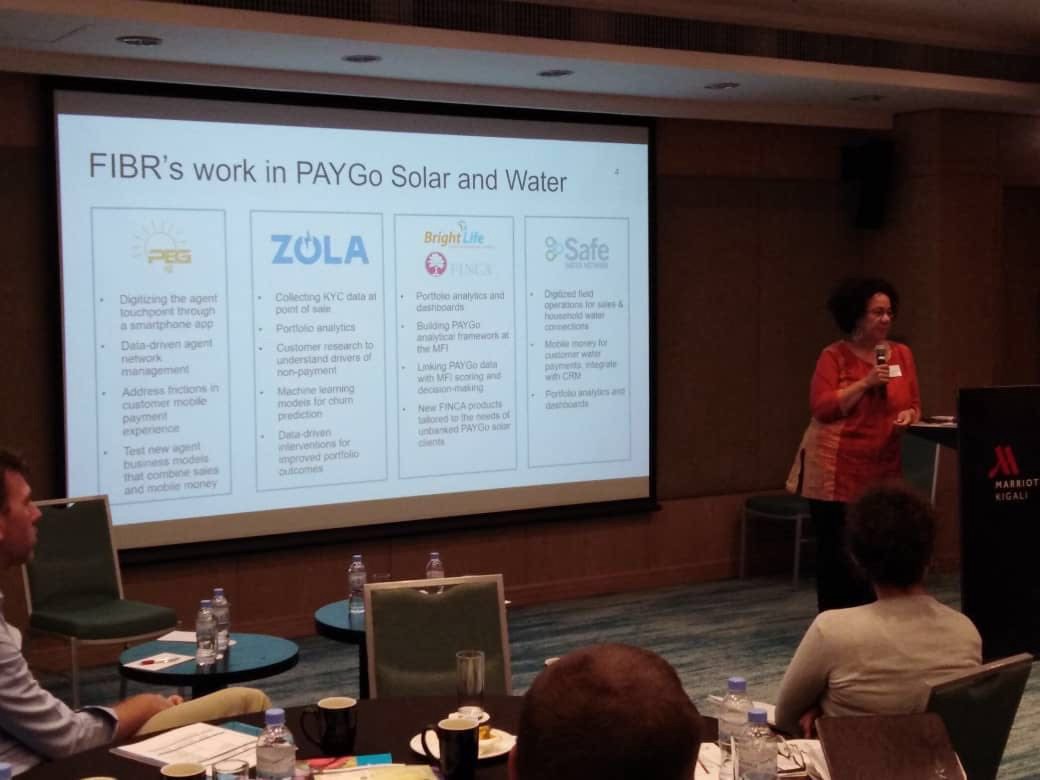

FIBR worked with PEG Africa in Ghana to support their agent network with insights into their sales, customers, and commissions to reduce agent churn and improve visibility into client behavior. ZOLA Electric is benefiting from FIBR interventions to predict customer churn and target post-sale interventions based on payment data and segmentation. These two interventions will allow FIBR to develop practical tools for data analysis and insights that we look forward to sharing.

In this next phase, FIBR will also begin work on the third step — of using these insights to unlock access to financial services — to create linkages to FSPs. In collaboration with BrightLife, a PAYGo distributor, and FINCA Uganda, a regulated FSP, we are designing a set of product offerings that give PAYGo clients a path to credit and savings products. By ensuring the initial PAYGo asset lease originated by BrightLife includes all the data necessary to open an account at FINCA, this model helps move clients from PAYGo towards additional financial services. The customer journey is designed to be fully digital — starting from PAYGo solar and moving to credit and savings at a regulated financial institution.

In this next phase of FIBR, we are committed to continuing to build on our experience to maximize learning and impact. In addition PAYGo, we are also expanding our work on the MSME sector to unpack their financing needs and what conditions will help small merchants survive and grow. Explore our PAYGo and MSME workstreams at https://bfaglobal.com/project/fibr/