Keeping the Lights On: How PAYGo Solar Can Offer Customer Relief During COVID-19

Originally posted on the NextBillion Website, May 1, 2020

Off-grid solar delivers essential energy services for millions of people, helping make households, businesses, farmers and institutions more resilient to the COVID-19 crisis. However, the pandemic also threatens the off-grid solar industry, particularly its very successful pay-as-you-go (PAYGo) business model, which allows low-income customers to buy a solar home system (SHS), then pay it off gradually while benefiting from the energy it provides.

The COVID-19 crisis has already hit PAYGo customers’ repayment rates, though the impact is not yet severe. However, there is a serious risk that PAYGo customers may soon need to dedicate limited resources to more urgent expenses, and will struggle to keep making PAYGo payments without support. Self-reported data shows that household incomes are already falling and expenses are increasing in key PAYGo markets, and this is expected to accelerate if lockdown measures extend.

GOGLA data indicates there are at least 2.5 million active PAYGo customers globally, making average payments of $0.40 to $0.50 per day over a period of one to three years. In a typical month, PAYGo operators realize 70-90% of total expected payments, and recoup any missing payments by pricing in nonpayment risk. But this makes products more expensive, and so PAYGo companies focus heavily on building a culture of payment discipline within their customer base. They do this, in part, by remotely disconnecting (or “locking”) the solar home systems of customers who fall behind on their scheduled payments – and in some cases repossessing the systems of customers who don’t re-start payments after several months.

The PAYGo model delivers an essential service tied to flexible loans. Unlike financial service providers or utilities, PAYGo providers heavily depend on the link between payments and service provision for their model to work. For them, providing service without customer payment entails foregoing revenue that might have been collected subsequent to the lockout, and risks undermining payment discipline. And as fast-growing companies with a thin-margin, capital-intensive business model, PAYGo operators do not have the liquidity to survive long without customer payments. Yet during a crisis like COVID-19, locking or repossessing the solar home systems of struggling customers risks depriving them of essential energy services right when they need them most.

Below, we’ll explore whether and how companies could enable customers to continue using their solar home systems during the pandemic, with reduced – or even in the absence of – customer payments.

WHAT PAYGO COMPANIES ARE DOING

Despite the considerable financial pressure they are under, PAYGo operators have already taken steps to make this crisis easier for customers. These actions include:

- Offering limited grace periods for reliable customers who are struggling to pay;

- Offering discounts or bonus energy days;

- Rescheduling payment plans to lower the payment amount and extend the term;

- Offering smaller/cheaper products to existing customers who can no longer afford larger products;

- Reducing the minimum payment amount;

- Reducing the amount payable to unlock the product for customers who have been disconnected;

- Imposing a moratorium on repossessions; and

- Buying back SHS that are not in use, or even swapping them for lanterns.

But these efforts, while helpful to customers, don’t solve the issues COVID-19 is causing for providers. When asked about their customer strategy during the pandemic, Mansoor Hamayun, CEO and co-founder of PAYGo solar provider BBOXX commented: “At BBOXX, we believe that energy access in the developing world has never been more important than during these uncertain times. That is why we are doing everything possible to keep the lights on for our customers and provide essential services to the communities we power. But we cannot do it alone: A coordinated approach from companies, development finance institutions, investors and governments is necessary to ensure customers can access the essential energy they need in this crisis.”

WHY IS CUSTOMER RELIEF IMPORTANT?

This crisis is forcing a rapid rethink of how companies should manage the competing priorities of liquidity, essential energy service, and commitments to employees, investors and creditors. But though solar providers’ business considerations are important, there are four main reasons why customer relief should come up high on this list – not just for the companies themselves, but also for their investors and donors:

Health. Clean, high-quality energy is important for health in the best of times. In these troubled times it is vital. Victoria Arch, the COO of PAYGo solar company Angaza, summed it up: “It’s critical that we keep kerosene use out of homes at a time when we have a respiratory virus pandemic.”

Reputation: Research from Hystra showed that 92% of all customers made SHS purchasing decisions based on recommendations from friends, relatives or neighbors. If companies want to grow again post-pandemic, they need to maintain their hard-earned goodwill. Turning off the lights on households that are struggling may hurt companies’ reputations, which could erode years of progress in building up the sector’s credibility.

Fairness: This crisis was not caused by anyone, certainly not by PAYGo customers or providers. For customers who have done nothing wrong, particularly customers who made reliable payment prior to the pandemic, denying service because of temporary, crisis-driven nonpayment is unwarranted. Energy companies are seeking debt reschedulings and public sector support, as well they should. But is it fair for companies, most of whom have been funded with concessional, impact-driven capital, to access relief funds if there is not similar relief available for customers? This burden should be shared, but the bulk of it should be carried by those who can absorb it best.

Safeguarding impact: Massive gains have been made in reaching millions of people with life-changing products and services, and getting people onto the energy ladder. Protecting these assets and relationships through this hardship is likely to prove more cost-effective than rebuilding from scratch after it’s over.

CONSIDERATIONS FOR A CUSTOMER RELIEF MECHANISM

That’s not to say that providers should simply overlook all customer non-payment until the crisis has ended. Customer relief will need to be carefully structured, to maximize its effectiveness in helping customers, and minimize its impact on the sustainability of providers. Here are a few considerations the sector should keep in mind:

Market integrity: Poorly structured end-user subsidies can set bad precedents and create expectations of perpetual loan forgiveness. Interventions that provide relief while maintaining some level of customer repayment, even a nominal amount, are likely to be less distortionary. This also is an opportunity to learn more about demand-side subsidies that can be deployed in the long-term to address systemic issues of affordability and profitability.

Targeting: It’s challenging to decide who receives relief, when and how much. Even in a crisis some customers will still be able to pay, and companies should encourage them to do so. For the rest, simple rules based on location, prior payment behavior or other factors can help companies navigate borderline cases.

Transparency and trust: No relief will be effective if it is not understood. Customers need to understand how relief works, how long it will last, and what impact it will have on their outstanding balance and contract terms. When circumstances change, they’ll need updates. And long before “business as usual” resumes, customers should be aware of their provider’s timeline for returning to their regular payment plans. Customers are well aware that these are extraordinary times, and most are familiar with subsidies. We need to trust that they will be responsible and again respond to the incentives of the PAYGo model.

WHAT COULD CUSTOMER RELIEF LOOK LIKE?

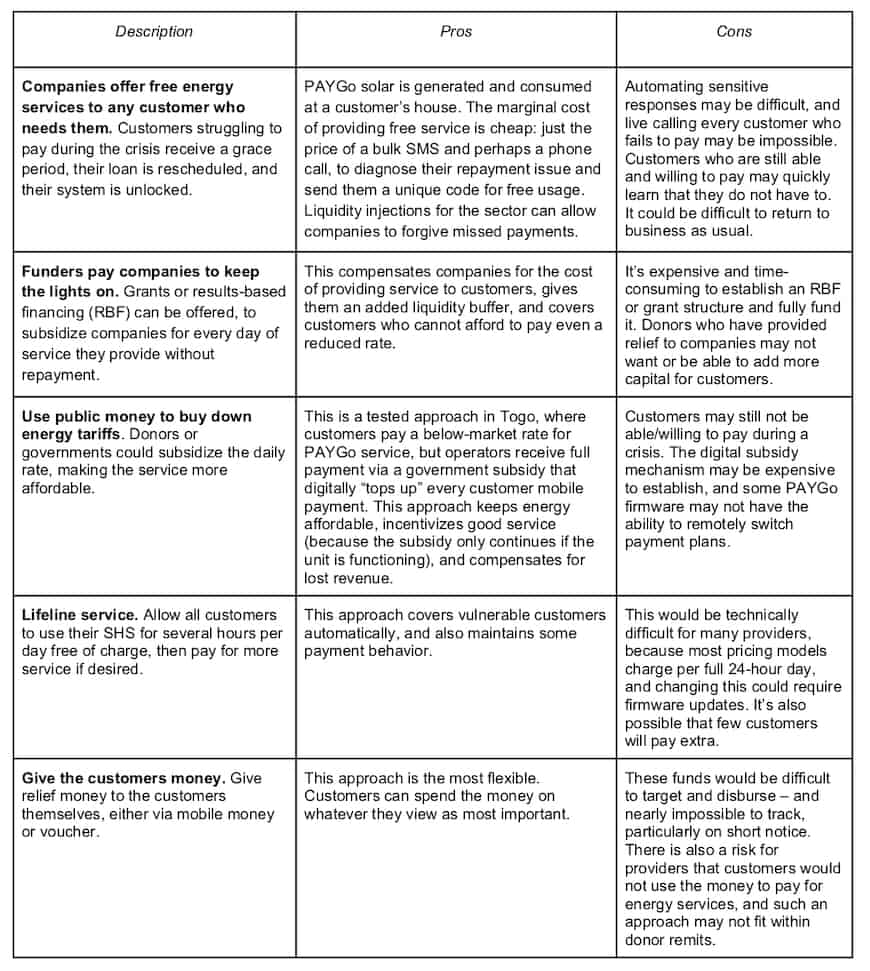

With these considerations in mind, we offer five possible forms of customer relief below – along with their pros and cons. A successful solution could feature a combination of these and other measures.

CONCLUSION

The inherent flexibility of the PAYGo business model and technology is already proving its worth in enhancing affordability during this crisis. Companies have the tools to offer additional forms of customer relief – but they cannot do it alone: Solidarity and support from investors, donors and governments is needed to strengthen their hand.

We are in a crisis of unknown length and severity. There are no perfect solutions. This is a time for compassion and commitment, for prudence – but also for action. Customer relief will have consequences, and we must do our utmost to reduce distortions and set positive precedents. But we must also be careful not to let tomorrow’s battles keep us from fighting today’s. We are in an unprecedented crisis right now, and no one should have to face that in the dark.

Koen Peters is the Executive Director of GOGLA.

Daniel Waldron is a financial inclusion specialist at the Consultative Group to Assist the Poor (CGAP).