Linking refugees to formal financial services

Financial services are an important avenue for refugees to save money, access loans, and manage life shocks. However, many of them struggle to access finance because of legal barriers, lack of identity documentation, lack of credit history in their new locations, or collateral as security. Despite the challenges they face in accessing formal finance, refugees have found ways around financial exclusion. They save in savings groups, borrow informally, and receive remittances. As part of a financial diaries [1] study started in September 2020 by BFA, we spoke to 48 refugee households in Uganda to understand their financial lives over the course of a year. This blog shares the initial insights from the financial diaries research in Nakivale and West Nile refugee settlements.

The insights that are being gathered from the financial diaries support the development and piloting of financial products and services offered by 3 implementing partners: Equity Bank Uganda, Vision Fund Uganda, and the Rural Finance Initiative who are currently providing financial services to refugees and host communities in Uganda. Prior to starting the diaries, we conducted a baseline survey in January 2020 to understand how the livelihoods of refugees have changed since they settled in Uganda, and the different ways they have adapted their financial behavior. The ongoing diaries research will provide information on the income levels, sources, and estimated flows that a broad range of households use. We share a few insights gathered from telephone interviews conducted with the respondents below.

Refugees households use a variety of financial instruments

Access to financial services that enable refugees to save, finance their income-generating activities, pay bills, cater for emergencies and meet their daily needs contribute to their inclusion in the social and economic activities of their host country. Our research sought to understand the different financial devices refugees use to manage their money.

We found that self-employment is the main source of income for 40% of households. This is in addition to humanitarian assistance received. Households also rely on other forms of livelihood activities such as casual work and part-time employment to generate additional income. On average, each household has 5 sources of income.

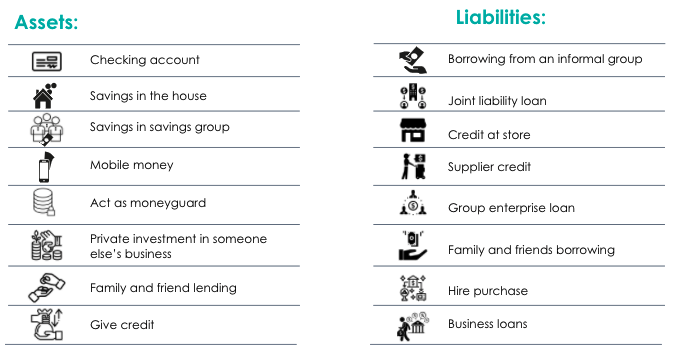

Each of these households uses an average of 7 financial devices including assets and liabilities to manage their money. Savings groups are the most frequently used instrument for savings. Followed by the use of savings at home and the use of checking accounts which is prevalent because of the cash transfers received from WFP and other development agencies. Generally, these two instruments (savings groups and checking accounts) are heavily promoted[2] and uptake has been high.

Figure 1: Financial instruments refugees use

Refugees are considered a high credit risk. They often have to rely on informal sources for loans. We asked selected refugee households regarding the liabilities they had. We found that refugees tend to borrow money from friends and family the most. Others relied on a moneyguard[3] especially women who used it as a way of saving for a rainy day. Savings groups were also a popular source for loans. The loans were mostly used for business purposes: to procure stock, expand businesses, or start additional businesses. In some cases, credit was used for shocks that unexpectedly happened such as health emergencies or funeral expenses. The multiple financial instruments that refugees use play a key role in making them more resilient to shocks and enabling them to build sustainable livelihoods.

The positive impact of saving groups

Refugees are often unable to access the financial tools they need to manage their money because they lack proper identification, credit history or collateral. This gap in access to financial service has led refugees to form their own savings groups where they have the option of saving and borrowing in the safety of savings groups.

These savings groups consist of several members who regularly contribute an agreed amount of money and save. Eventually, members can borrow the money and repay with interest. Within these savings groups, refugees are then able to apply for loans from formal financial service providers (FSPs) such as Rural Finance Initiative[4], which channels credit through existing VSLAs, and Vision Fund Uganda, which provides savings group loans to refugee populations both who lend to existing groups in settlements. FSPs offer loans to the savings groups at a 3% interest rate which is lower than commercial rates. The groups then lend to members at 3% -10% interest rate depending on the additional costs (transport, withdrawal fees, communication costs) incurred by the group. These groups enable their members to manage their expenditure, expand their businesses and weather economic shocks while also gaining financial literacy and business skills.

“The loan has helped the group members to become more creative and also work hard because the loan has created a feeling of responsibility in the members. For the members to pay off their loan amounts, they have to be creative and set up different income sources and try to even save more so that they can pay their loan in time. Generally, my group members are working harder than they used to and I feel the loan has improved the group a lot since people are getting more incomes from their various businesses.” A respondent in Palorinya

Since the outbreak of COVID-19, savings groups’ contributions have doubled from UGX 5,000 ($1.36) to UGX 10,000 ($2.72) because of the involvement of the 2 implementing partners, Vision Fund and RUFI. The two implementing partners were able to lend groups large amounts motivating members to increase their savings to borrow bigger amounts. Some groups lent their members a loan equivalent to 3 times their savings

There has also been an increase in the number of new members. Initially, one group had about 25 members, now it has 30 members in the group. This was a result of the smooth running of the groups. The implementing partners usually have their field officers attend the group meetings, to provide support and also add value to the groups by educating them on financial literacy and business skills. Other savings groups that did not partner with financial institutions and did not receive similar support were negatively affected by the pandemic. Working in partnership with a financial institution builds the resilience of groups as they are able to access more funds, get longer loan repayment timelines, financial literacy training and support with group initiatives.

The use of debit cards as collateral

Access to credit in settlements is still quite limited. Many refugees rely on informal sources such as merchants to access credit in the form of goods. Merchants regularly extend credit to refugees by retaining their Equity Bank cards as collateral. Equity Bank provides refugees in Uganda with fully-fledged bank accounts and debit cards from which to access their humanitarian aid payments. 7 of the households we interviewed reported leaving their cards behind with merchants whenever they ran out of food items. They would wait until cash transfers had been disbursed into their bank accounts before collecting the cards.

Frida* a 33-year-old dressmaker and vegetable seller lives in Nakivale with her family. Her husband has been sick for a long time and she is the sole breadwinner. Her financial situation has been affected by the ongoing pandemic. She has not been able to replenish her stock because of movement restrictions. Her business has also been declining because of competition from similar businesses. Sometimes they don’t have food in the house and she has come to rely on the card as collateral in exchange for food.

“We can go to the shops and give them our cards as security and get food, when money is deposited on our accounts, we withdraw and pay, then get back our card.”

Refugees have limited assets to provide as collateral in exchange for goods. ATM cards are a guarantee that they will be back to pay their debt.

Early insights from our research show that refugees actively use formal and informal financial instruments. Savings groups are an important channel for refugees to access finance especially with the added benefit of financing from financial service providers. Savings groups have helped their members to overcome the economic shocks of the pandemic by providing credit, encouraging savings and teaching them new skills such as business skills and financial literacy.

We’ve also seen an appetite for credit evidenced by the lending in savings groups and the use of debit cards as collateral in shops. Refugees are repurposing the financial services and tools available to them to suit their needs. There is an opportunity for financial service providers to develop innovative financial products and services to cater to the financial needs of refugees.

A few financial service providers are currently on the ground providing financial services to refugees.

- VisionFund Uganda (VFU) is piloting a unique wholesale credit model within savings groups in the West Nile region through existing and stable NGO-supported groups and leveraging the repayment and share-out data from previous cycles to determine eligibility for additional loan capital.

- Equity Bank Uganda Limited (EBUL) provides refugees in Uganda with fully-fledged bank accounts from which to access their humanitarian aid payments. They are the key partners for the disbursement of cash transfers from several humanitarian aid agencies. EBUL has also extended their existing agent banking network to refugee settlements and within host communities.

- The Rural Finance Initiative (RUFI) uses the village savings and loan association (VSLA) model to aggregate groups using Ledger Links developed by Grameen Foundation. They channel credit through existing VSLAs and facilitate the formation of new groups. They are also doing linkage banking for VSLAs in partnership with Centenary Bank that allows for excess cash to be safely banked into group accounts.

The financial services provided by these three FSPs give us a glimpse of what is possible when financial services are extended to refugees.

Read more insights from the diaries research. Stay tuned in the months ahead for the results of the next rounds of diaries.

_____________________________________________________

[1] BFA’s Financial Diaries methodology involves interviewing families every fourteen days about all of their financial activity and events in their lives that affect their finances. Daryl Collins and co-authors developed this approach to track financial behavior quantitatively for the book Portfolios of the Poor.

[2] The Financial Inclusion for Refugees Project, in collaboration with FSD Uganda and FSD Africa, supports the development of financial products and services offered by Equity Bank Uganda, Vision Fund Uganda and the Rural Finance Initiative.

[3] Moneyguard – someone who keep money safe for individuals

[4] RUFI has 155 savings groups in different settlements. As of November 2020 111 were active. Vision Fund has 245 savings groups.