Affordable and Accessible Remittance Services for Refugees: A Toolkit

BFA Global developed and piloted a tool to conduct a country assessment on demand, supply, and regulatory considerations for...

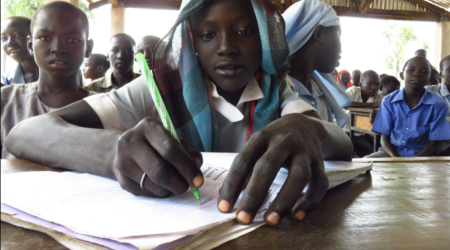

Uganda country assessment on affordable and accessible remittances for forcibly displaced persons and host communities

Although the market for providing remittance services to refugees is large, financial service providers have found it difficult to...

Mapping the financial-access journey of the refugee: Applying UX design to help financial service providers in Uganda better serve forcibly displaced people

In April 2018, BFA Global facilitated a series of workshops for six banks – Diamond Trust Bank, Equity Bank, FINCA, Opportunity International, Post Bank, Ugafode –...

How can financial services providers apply artificial intelligence to their businesses?

FIBR, a program of BFA in partnership with the Mastercard Foundation, explored how artificial intelligence and machine learning can...

What is the value of AI to financial services providers?

Matt Grasser describes the positive impact that artificial intelligence can have for financial services providers in Africa and more...

What is FIBR?

The FIBR Project was conceived as a research and development project funded by Mastercard Foundation that worked with small...

Know Your Customer Requirements for DFS in Uganda

The UNCDF MM4P program contracted BFA Global to conduct a Study on Know Your Customer (KYC) Requirements for Digital...

Alternative Delivery Channels for Financial Inclusion: Opportunities And Challenges In African Banks And Microfinance Institutions 2016

Financial inclusion rates in Africa are among the lowest in the world. Providing secure, affordable, and easy-to-use financial products...

Unlocking the Potential: Women and Mobile Financial Services in Emerging Markets

This report is based on research by BFA Global for GSMA in partnership with Visa Inc. It offers insights on...