Exploring refugees’ usage of financial services in Uganda

Florence is a single mother of two who lives in the Palorinya refugee settlement in Moyo district and is among the 1.5 million refugees being hosted in Uganda. She arrived in the settlement four years ago from South Sudan. She currently has a tailoring shop at the shopping center situated at the base camp and also sells clothing materials. She was able to start her tailoring business after receiving a payout at the end of the second cycle from one of her Accumulating Savings and Credit Association (ASCA) also referred to as savings groups in late 2020. She is currently in three ASCAs where she is saving between 4,000 UGX and 10,000 UGX weekly in each group.

Florence is one of many refugees who has benefited from the Financial Inclusion for Refugees (FI4R) project launched in 2019 by FSD Africa and Financial Sector Deepening Uganda (FSD Uganda). The project aimed to deepen and broaden access to and usage of formal financial services among refugee and host communities in Uganda, with a focus on the West Nile and South-West regions. The project’s theory of change was based on addressing several key market failures evident in both the demand and supply sides of the financial services market.

On the supply side, early studies revealed low appetite among financial service providers for serving refugees, mostly due to their perceived credit riskiness, the limited knowledge on their financial habits, and the perceived security risks of the segment. Market gaps on the demand side included a high reliance on informal financial vehicles such as Village Savings and Loan Associations (VSLA) and a limited awareness and adoption of formal financial services within the settlements. Together, these created an underdeveloped and unsupportive financial markets ecosystem, one that was incapable of financially empowering a 1.5 million-refugee population in Uganda.

Consequently, the project supported three financial institutions, Rural Finance Initiative (RUFI), VisionFund Uganda, and Equity Bank Uganda Limited to rectify this grim situation by enabling them to offer a variety of savings and credit products as well as financial literacy programmes to refugee groups across the West Nile and South-Western region. FSD Uganda and FSD Africa’s collective capital and convening power provided the funding, technical assistance and research required to achieve this.

As of December 2021, Vision Fund Uganda had mobilized 910 savings groups with 23,674 total members and had loaned over UGX 6.4 Bn (USD 1.8 Mn) in cumulative loans. RUFI had loaned out over UGX 908 Mn (USD 258,000) in cumulative loans to savings groups and over 1,000 youth businesses, of whom nearly 70% were female-owned. RUFI also opened 110 group savings accounts in Centenary Bank through their agency relationship with the bank. The savings groups had cumulatively saved UGX 10.35 million (USD 2,870). The portfolio at risk was less than 5% for both Vision Fund and RUFI by the end of the project. Equity Bank Uganda Limited enrolled over 73,000 households on their digital payments platform, provisioning over 63,000 households with savings accounts to which they paid over UGX 12 Bn (USD 3.4 Mn) during the quarter of October – December 2021. They also disbursed loans amounting to UGX 311million (USD 86,260) to their agents. Overall, the cumulative loan amount stood at over USD 2 million for all three partners.

Florence benefited from a RUFI loan through her savings group. She uses the loan as capital for her business and saves money together with her group in their Centenary bank account so that she can later purchase stock. Over the last year, she has increased her contributions to the savings group as she has realized saving diligently is essential for growing her business. BFA Global discovered in the endline research they conducted in late 2021 that savings groups are still heavily used after the COVID-19 pandemic: 46% of the refugees interviewed were part of an ASCA. Between the baseline survey undertaken in January 2020 and the endline in November 2021, there was a 20% increase in ASCAs in Bidi Bidi settlement and a 10% increase in Nakivale, with women making up most of the group membership.

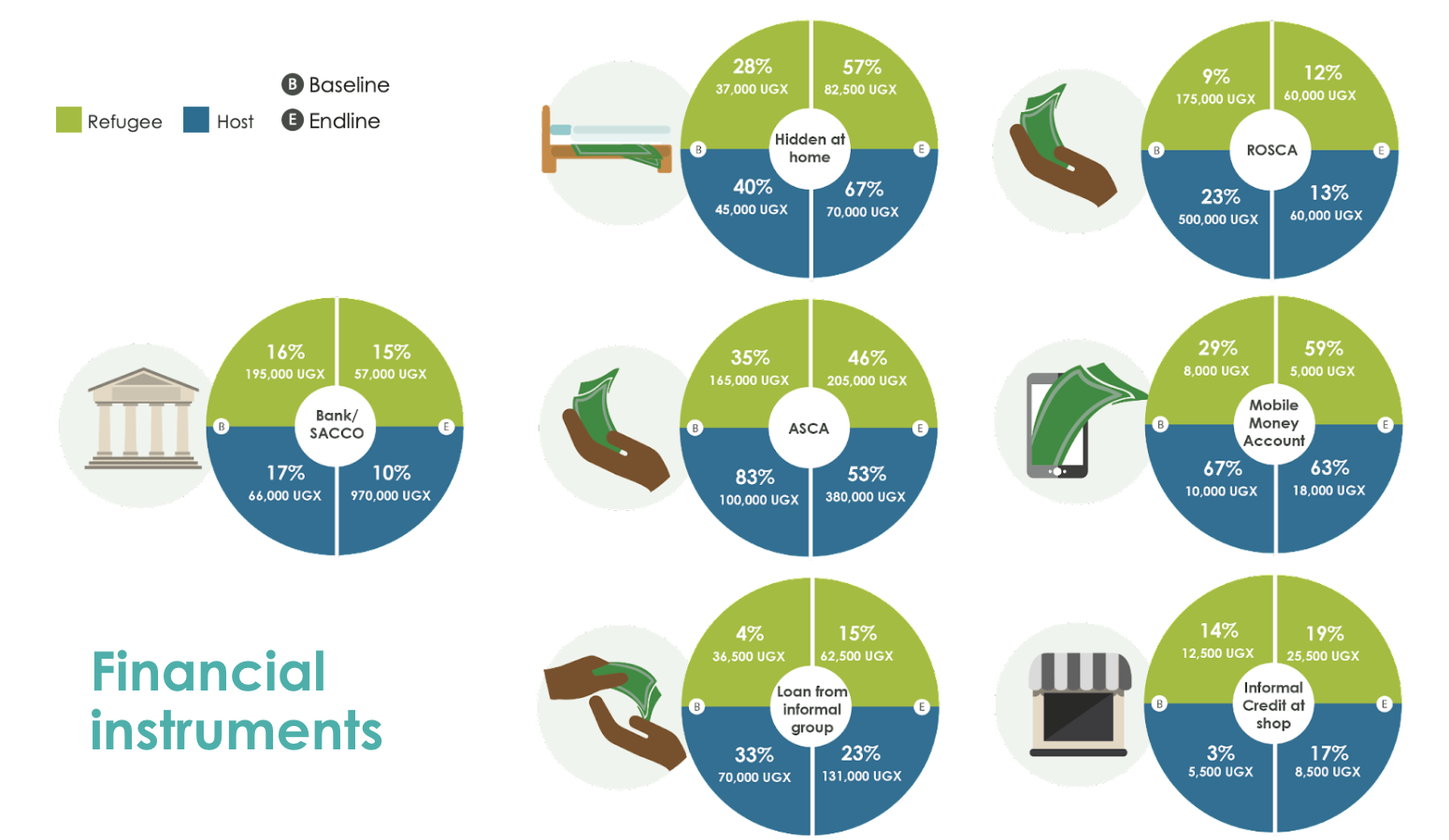

Despite increased usage of digital financial services, not all are favorable; most refugees still prefer to keep cash at home. There was a 30% increase in refugees keeping cash at home for emergencies, particularly for health emergencies, during the endline survey. This is especially true during the last two years of the COVID-19 pandemic. Refugees wanted more accessible access to their money in case of emergencies, especially in the West Nile region, and the digital financial services ecosystem is still too nascent to fully support their needs. Below is a comparison of different financial services for refugees and host communities during the baseline and endline.

However, there is still hesitation in using formal financial services. One key challenge is access to financial touchpoints. Even though agent banking has improved over the last two years, most agents are situated at the main center or the base camp of the settlement, e.g., Nakivale. These locations are still far from some of the refugees and pose a significant challenge for women who tend to face more mobility restrictions than their male counterparts. During the qualitative interviews in West Nile, some of the respondents stated that they still do not have access to a bank, and when they do, they have to travel to the nearest town (Moyo), which costs them between UGX 15,000-25,000 (USD 4-7) for a return trip. Some have had to walk for almost two hours each way to access banking or agent services. This demoralized some of them, and they did not want to use formal financial services. Transaction cost for mobile banking is also a hindrance. Refugees stated that it still costs the same amount as the travel to access their money through mobile banking costing between UGX 7,500 (USD 2) to move money from bank to mobile money and another UGX 7,500 to cash out the money.

Across the settlements, there was either little or no knowledge or understanding of the terms and conditions for different financial products offered by formal financial service providers (FSPs). Notably, most of the respondents with bank accounts opened their bank accounts because the organizations they worked for required them to have one, such as teachers and NGO workers. Many refugees still do not understand some of the information, especially those regarding fees. Concerns highlighted included account opening fees and maintenance fees, which can go up to UGX 3,000 (USD 0.80).

To improve access to formal financial services, interested commercial banks and MFIs should consider the following:

- Deploying more agents on the ground, especially in the different villages of the settlement, as this would reduce both the time and cost incurred to access financial services. The agents should be able to speak the local language and must be knowledgeable enough to respond to questions posed to them by refugees.

- Being intentional about communicating the product details of loans and savings offerings, including the fees, interest rates, and prerequisites. They must make every effort to ensure that their clients understand the products’ terms and conditions. Sharing information through agents would be ideal, as the customers would have someone to ask questions. Secondly, the information could be shared through flyers and handouts in the local languages to make it easy for refugees to understand what they are signing up for.

- Addressing digital literacy is complex; one needs to understand the challenges. From the research, refugees gradually acquire digital technology, primarily through their savings group members or their children. As financial institutions think about digital literacy, they will need to put the user at the center of the implementation, focusing on how the language used is understood, ensuring that the language is simple, comprehendible and easy to navigate.

- The endline study has shown an increase in mobile money transactions, indicating refugees’ desire and potential readiness to explore digital financial solutions. There is an opportunity to reduce the transaction fees for both mobile money and mobile banking to encourage more transactions. As refugees continue to be able to use digital financial services, this would help support a digital ecosystem, including paying for goods using mobile money or bank cards. For example, RUFI and Vision Fund allow payment of loans using mobile money, while Vision Fund disburses cash through mobile money.

The project has helped demonstrate that refugees are a viable market segment, and the three partners we worked with are continuing to expand their operations to serve more refugees. Financial service providers can adapt and should adapt their products and services to meet the needs of refugees. It is our hope that our research will be useful to FSPs, policymakers and stakeholders serving refugees.