How Refugees Perceive and Cope with Risk

This is part two of an ongoing series of insights from a financial diaries study undertaken with refugees in Uganda, focused on their ability to cope with risks. The respondents are drawn from customers served by three financial service providers: Equity Bank Uganda, VisionFund Uganda, and the Rural Finance Initiative.

Refugees rely on cash transfers and income to pay for their expenses and save for future needs. Like other low-income people, refugees have limited capacity to cope with unexpected events and sometimes experience major setbacks when hit by seemingly small shocks that disrupt cash flows. The most common and impactful shocks are health-related. Even relatively moderate health shocks often have a significant economic impact as refugees are ill-prepared to manage.

Most refugee settlements in Uganda provide free healthcare to residents, but it is often inadequate, especially for cases that require specialized care.

Our community hospital has become empty of drugs, in most cases when we go there, medicine is not there and we end up spending a lot of money to buy from drug shops yet money is very scarce in the refugee community,” said Lilian.

With few formal financial resources and tools at their disposal, refugees often have to turn to alternative risk management strategies to manage such events. To better understand how refugees manage their income and expenses, FSD Uganda, FSD Africa and BFA Global have been conducting financial diaries with 48 refugee households in Uganda since August 2020. This second round of diaries explores how refugees perceive, plan for, experience, and cope with risks and shocks in their lives through a risk-related survey. The information collected provided powerful insights on perceived and actual risks that threaten to disrupt the lives of refugees. We sought to build evidence on existing gaps and opportunities in risk mitigation mechanisms and coping strategies available for refugees to help inform and catalyze the development of solutions that effectively help refugees address risk in their day-to-day lives.

Perception of risk

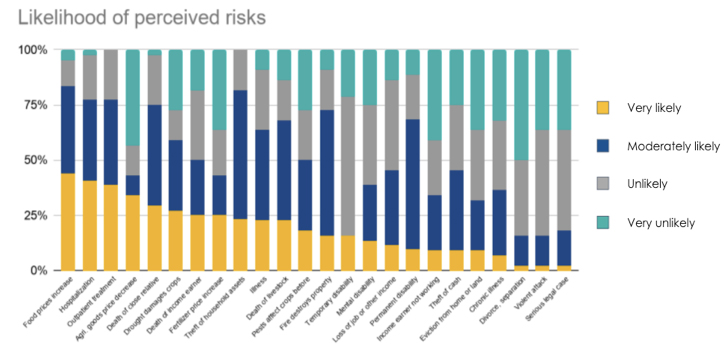

To learn about potential risks faced by these communities, we asked refugee households about the likelihood of specific events occurring, the costs associated with them, and how they would manage each risk. Figure 1 below visualizes the perceived likelihood of these events occurring.

Two of the top events considered most likely to occur were health-related. The most perceived risk likely to occur was an increase in food prices, a concern that became reality when the United Nations World Food Programme (WFP) reduced food rations to over 1.2 million refugees in Uganda by up to 40% owing to funding shortfalls. As a result, refugee households had to buy food to supplement the aid they were receiving. Food prices also went up because of lockdown restrictions.

Hospitalization was the second-highest concern among refugees. 43% of respondents confirmed that they had been hospitalized, with 19 households being hospitalized within the past five years. The median cost of hospitalization incidents is $26 – about 68% of the household median income. Despite anticipating such risk events, respondents feel that they are unprepared to manage should they occur.

Coping with risk

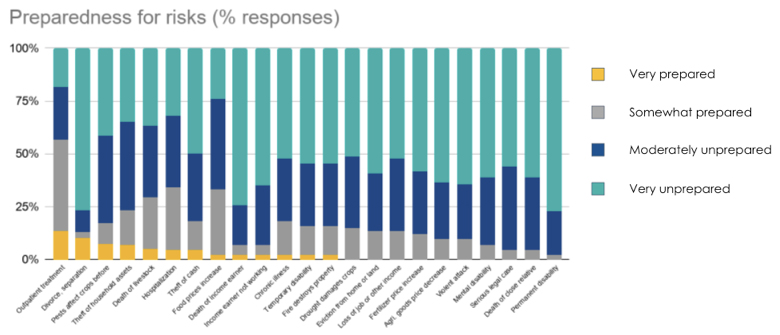

Refugee households feel very unprepared for most kinds of risks, especially because of their unpredictable and volatile incomes. Only a few have investments or money saved that could help with managing risks. Unfortunately for most, household income is committed to providing basic needs, like food. Other coping mechanisms include borrowing from their social networks, primarily family and friends or relying on contributions. On occasion, social networks do not provide the much-needed relief. Responses from the network might also come too late, or the size of the pool contributed might be too small to cover the cost of the event.

Figure 2 below shows how prepared respondents feel they are to face potential risks.

The households we interviewed depend either on aid from development agencies or the little they have saved up at home, to meet their needs. A few borrow from savings groups – Accumulating Savings and Credit Associations (ASCAs) – or sell their assets when all other avenues have been exhausted. In many cases, respondents depend on their social network and well-wishers to contribute, especially when faced with illnesses or death. Given the limitations of current coping mechanisms, refugees need quicker and more reliable solutions that can help them mitigate risks.

Mitigating risks

There is an opportunity for financial service providers to design, market, and distribute relevant financial risk management tools to refugees, including insurance, savings, and credit products. Insurance is critical to enable refugees to manage significant events, including hospitalization or death of the main income earner. There is an opportunity to bundle insurance with group savings products or even with cash transfers, to create awareness among refugees. It is important to note that financial service providers also need to build financial literacy into their product offering and communicate terms and conditions clearly, to avoid exposing refugees to additional vulnerabilities. For instance, our research shows that most refugees are illiterate and often don’t read the T&Cs. In savings groups, members depend on the group leaders or agents who do disbursements to explain to them.

Financial service providers should also consider offering short-term mobile loans as an alternative to current options that often have alarming interest rates, ranging from 22% to 30%. The loans would help refugees address shocks quickly when the need arises. Evidence from our ongoing financial interventions within West Nile refugee settlements attest to the responsible financial behavior of refugees, particularly when it comes to the timely repayment of their loans. Financial service providers can determine the creditworthiness and lending limits for refugees through mobile phone utilization records. Our baseline research in four settlements shows that 74% of refugees own or have access to a cell phone.

Previous research in the Kenya Financial diaries report proposes a risk management solution that combines savings and insurance products to provide a clean lump sum upon the occurrence of a verifiable trigger event. Such an option could boost existing savings and help families navigate hard times. Another solution could be remittance services linked to insurance. Currently, refugees have to ask for contributions or borrow from family and friends. A product that is distributed through remittance service providers through which remittance senders can purchase an insurance product for receivers can reduce the financial burden on them when recipients experience a shock that requires their financial support.

From the research, it is evident that refugees have limited capacity to cope with major setbacks and feel unprepared to deal with some shocks when they occur. Such shocks tend to throw the financial management of households into disarray. With existing gaps in risk mitigation, there is a clear need for financial products and services that can help reduce the vulnerability of refugees to shocks and help them cope with unexpected events. In the wake of a global pandemic that has disrupted the norms refugees relied on to manage unexpected events, new approaches that enable refugees to cope with and recover from unexpected events will be key to securing their livelihoods and enabling them to rebuild their lives.

You can access part 1 titled Linking refugees to formal financial services.

Read more insights from the diaries research here. Stay tuned in the months ahead for the results of the next rounds of diaries.