Inclusion, Stability, Integrity, And Protection: Observations and Lessons for The I-Sip Methodology from Pakistan

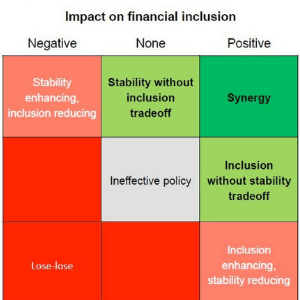

This Consultative Group to Assist the Poor (CGAP) study was conducted by a joint research team from CGAP, the consulting firm BFA Global, and the State Bank of Pakistan (SBP). The study analyzes the linkages between financial inclusion, stability, integrity, and protection in Pakistan using the I-SIP methodology developed by CGAP. It develops and refines the methodology and raises awareness of I-SIP linkages among relevant Pakistani regulators, supervisors, and policymakers in order to position them to better optimize policy objectives. The study also aims at enabling Pakistani policymakers to adopt the I-SIP methodology in their future policy-making efforts. For an assessment of the linkages, a research team visited Pakistan twice and conducted a detailed analysis of four policy interventions: the regulatory framework for microfinance banks, the microfinance credit guarantee facility, the branchless banking regulations, and the microfinance credit information bureau. The report covers the following sections in detail:

- Background of the I-SIP methodology and its application in Pakistan

- History and importance of financial inclusion in Pakistan policymaking over the past decade and a summary of the four policy interventions examined

- Main observations from applying an I-SIP lens to the four policy interventions, with a focus on those that are of potential broader relevance to similar policy interventions in other countries;

- Concept of identifying, managing, and optimizing linkages with a discussion on the importance of developing indicators and targets.