On April 27th, 2023, BFA Global convened 20 climate change experts in Santiago, Chile, as a part of its...

TECA (Triggering Exponential Climate Action), an initiative of BFA Global, has received a $100,000 grant from Climate Collective to...

Micro and small enterprises (MSEs) in Mexico deploy an array of actions to overcome shocks, including using savings, requesting...

Las MYPES en México emplean diversas acciones para sobreponerse de los choques, incluidas utilizar ahorros, solicitar préstamos, reducir gastos...

This report by the CIFAR Alliance Investors Working Group highlights 11 successful ventures that are building solutions to...

En México, las micro y pequeñas empresas (MYPES) juegan un papel importante en la economía, representan el 97%...

In Mexico, micro and small enterprises (MSEs) play an important role in the economy, accounting for 97% of all...

![[Press release] FSD Africa invests $3.5M in Catalyst Fund to accelerate and scale pre-seed impact ventures in Africa](https://bfaglobal.com/wp-content/uploads/2022/07/Announcement-Card-450x250.png)

LONDON, UK, July 14, 2022 – Global inclusive tech accelerator Catalyst Fund, managed by BFA Global, announced today that...

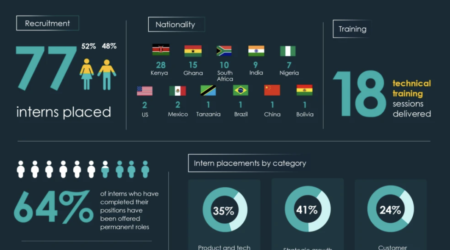

Download Infographic Learn about the Program

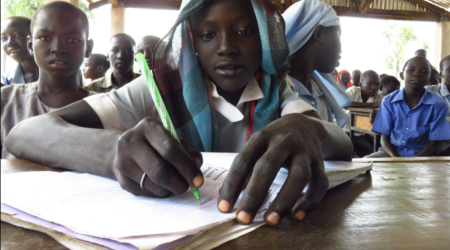

Research tracking the income, spending habits, and livelihoods of refugees in Uganda.

![[Press release] Four Ghanaian digital companies receive funding and acceleration support through the Catalyst Fund Inclusive Digital Commerce Accelerator program](https://bfaglobal.com/wp-content/uploads/2021/10/Customer-of-OZE-450x250.jpeg)

ACCRA, Ghana, 28 October, 2021 – Today, the Catalyst Fund Inclusive Digital Commerce Accelerator welcomed four...

How can digital finance build climate resilience among the world’s most vulnerable? To understand the opportunity for digital finance and fintech...

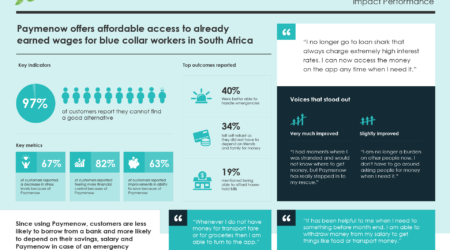

Download Infographic LEARN ABOUT PAYMENOW

![[Press release] Catalyst Fund announces its latest cohort of companies bringing inclusive fintech solutions to underserved communities](https://bfaglobal.com/wp-content/uploads/2021/07/Crop2Cash2-450x250.jpg)

NAIROBI, Kenya, August 2, 2021 – Global inclusive tech accelerator Catalyst Fund, managed by BFA Global, today announced its...

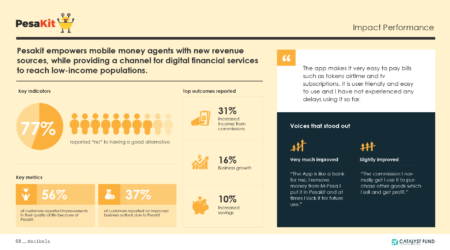

Download Infographic LEARN ABOUT PESAKIT

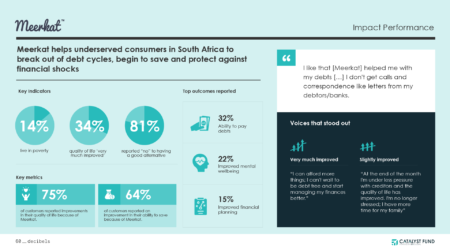

Download Infographic learn about meerkat

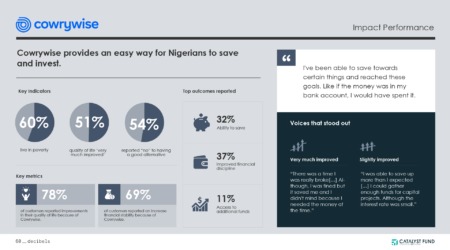

Download Infographic learn about cowrywise

Download Infographic learn about farmart

The past decade has seen mobile money providers worldwide achieve profitability at scale, enabling them to continue investing in...

The Catalyst Fund Inclusive Digital Commerce accelerator, managed by BFA Global, in partnership with the Mastercard Foundation COVID-19 Recovery...

At BFA Global we regularly evaluate inclusiveness of programs and products via a gender lens, with an eye toward...

A country-first initiative to expand reach of digital commerce solutions to thousands of spaza shops over the next nine...

ACCRA, Ghana, 10th December, 2020 – The Catalyst Fund Inclusive Digital Commerce Accelerator, managed by BFA Global, in partnership...

ACCRA, Ghana, 19th October, 2020 – Catalyst Fund, managed by BFA Global, in partnership with the Mastercard Foundation and...

MTN Ghana launched a merchant payment service in January 2017 called MoMo Pay to increase mobile money use in...

This report commissioned by FSD Uganda and FSD Africa provides an in-depth analysis of a quantitative survey undertaken in...

Information for Study Participants This study is titled, Financial health of the customers of CEP at the time of...

This World Refugee Day, we take a moment to reflect on our work focused around making finance work for...

En esta página pueden encontrar una serie de tutoriales que pueden utilizar para poder instalar el modelo y utilizarlo...

Social distancing and lockdown measures have become the new reality for many across the globe in light of COVID-19....

Observations by BFA Global based on initial field research Access to financial services and a steady source of income...

MetLife Foundation and global financial consultancy BFA Global created the OPTIX program to help people living on low incomes...

This week at FLII 2020 the FinnSalud project hosted a session entitles – Data-driven strategies to catalyze financial...

iWorkers are a new category of workers – people whose livelihoods are enabled by digital commerce platforms where they...

How do you know if you are ready to start investing in growth or if you need continue pushing...

BFA Global conducted an assessment on how the implementation of a digital national ID system in the Philippines can...

Banco W is a financial institution in Colombia which OPTIX’s research discovered had a rapidly-changing client base. As a...

OPTIX worked with SAJIDA Foundation, a microfinance institution in Bangladesh, whose low-income customers were looking for a reliable credit...

FinnSalud is a 3.5-year project supported by MetLife Foundation, fiscally sponsored by RPA and managed by BFA Global in...

Data and digitization can be powerful tools for evaluating the business case of a potential change to operations. CEP...

The iWorker Project spoke with two entrepreneurs in Ghana, Rhoda and Erica, about their foodservice business, which they recently...

Illa is an artisan based in Ghana who sells his goods both in-person in an artisan marketplace, and online....

Joseph, an Accra, Ghana-based entrepreneur sat down with the iWorker Project to discuss why he decided to leave a...

Digital commerce, or e-commerce, is impacting employment opportunities in Africa by reshaping the nature of work through gig platforms,...

New models of aggregation are rapidly emerging within digital ecosystems that can connect both consumers and workers to a...

Digital commerce, or e-commerce, is impacting employment opportunities in Africa by reshaping the nature of work through gig platforms,...

“Change is a very difficult thing to do. Change is hard” – Evelyn Stark, MetLife Foundation Financial institutions really...

Financial institutions around the world are serving a new wave of customers, and serving the previously unserved and underserved...

SAJIDA Foundation is a non-profit providing microfinance services to low-income customers in Bangladesh. Customers are able to borrow from...

CEP, and microfinance institution in Vietnam, wanted to help its clients build resilience for the long-term future. Loan officers...

Acreimex is a cooperative serving low-income people in Mexico. The group credit loan is crucial to its success, but...

Acreimex is a financial institution serving low-income people in Mexico with a human touch. The OPTIX program worked with...

Starting in 2015, under the OPTIX project we worked with SAJIDA Foundation, an MFI-NGO in Bangladesh to identify and...

Authored by Sushmita Meka; Sally Ross, AKF; Daryl Collins The rapid growth of mobile money in some countries has...

In Rwanda, financial inclusion allows low-income households to build assets, mitigate shocks and make productive investments. It also stimulates...

Savings groups play an important role for individuals who lack options to save large amounts of money or have...

MobiLife believes that no family should go hungry due to the loss of a breadwinner. It is Africa’s first...

On average, a middle-income household in India spends about 7,000 – 9,000 rupees at any neighborhood store. More than...

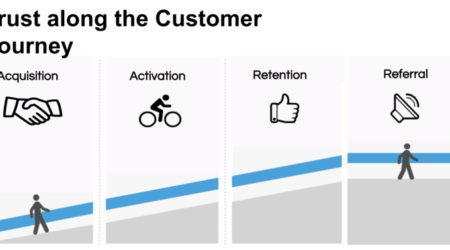

Trust plays one of the most crucial roles for a new venture in an emerging market. Building trust with...

Harvesting aims to be the Agriculture Intelligence Engine, which will help bring speed, accuracy and transparency across the agricultural...

Emerging market customers are often under-protected and have little to no access to traditional insurance distribution channels. ToGarantido was...

FIBR explored the potential of superplatforms, the major tech platforms such as Facebook, WhatsApp and others and their impact...

#InsurTech companies such as World Cover are serving customers with little reported financial data, farmers and women & providing...

Here’s how Catalyst Fund, a program of BFA with the support of JPMorgan Chase & Co. and Bill &...

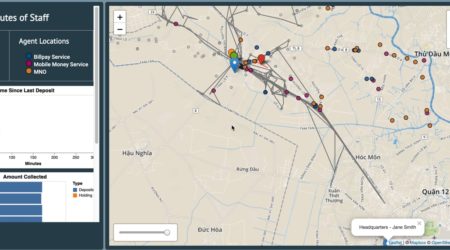

FIBR worked with PEGAfrica to develop an agent sales app to improve how they can target, manage and intervene...

Despite being one of the most dynamic economies in Latin America, Peru has relatively low levels of financial inclusion....

BFA Global developed and piloted a tool to conduct a country assessment on demand, supply, and regulatory considerations for...

Although the market for providing remittance services to refugees is large, financial service providers have found it difficult to...

As part of the OPTIX project, funded by MetLife Foundation and run by BFA Global, SAJIDA started exploring options...

By Maelis Carraro and Justin Grider What does a year’s worth of channel transactions tell us about a client’s...

Originating from of FIBR’s AI Gallery, this video describes how AI and machine learning can apply to PAYGo. Matt...

A FIBR Video Series We are pleased to share the recent videos of FIBR’s work this year focused on...

BFA Global supported by FSDA carried out a macro and microanalysis to build a better understanding of the financial...

This report by David Porteous (BFA Global Founder and Chair) from the FinMark Trust Digital Identity workshop sets out a...

2017 has been a busy and fruitful year for us here at Catalyst Fund. We’re excited to share the...

This second report by CGAP and FIBR seeks to understand the value that customers derived from PAYGo solar and...

By Innocent Ephraim (FSDT), Daniel Mhina (FSDT), Juliet Kiluwa (FSDT), Daryl Collins (BFA) Technology is an inevitability, it is...

This report by GSMA looks deep into how mobile money has shaped the Kenyan P2G payments journey, based on...

This Diagnostic Report by UN-based Better Than Cash Alliance and BFA Global, assesses Ghana’s progress to date, and sets out...

The UNCDF MM4P program contracted BFA Global to conduct a Study on Know Your Customer (KYC) Requirements for Digital...

The Rise of a New Asset Class Alternative lenders in East Africa are connecting underbanked consumers with affordable, asset-backed...

This report draws on Financial Diaries data from India, Kenya, and Mexico to enhance the field’s understanding of women’s...

The InFocus project examined the experiences of four developing country banks that have specific savings account offerings targeted toward...

BFA Global and MetLife Foundation created OPTIX to support financial institutions in building better portfolios of products for their low-income customers. OPTIX stands for...

Mexican Financial Diaries set out to obtain granular, long-term, provider-side data about the financial lives of low-income Mexicans. This...

A regulatory impact assessment (RIA) can assist in determining the change effected by regulation/policy (henceforth combined and referred to...

Flexipay is a blended financing concept, designed to help low-income families meet large financing needs, like school fees. Flexipay...

BFA Global, funded by FSD Kenya, undertook a comprehensive financial diaries study in Kenya. Over the course of one...

The Consultative Group to Assist the Poor (CGAP) contracted BFA Global to implement the year-long Financial Diaries with Smallholder...

The size and longevity of many refugee camps across the world are indicative of the permanent rather than transient...

In the GAFIS project funded by the Bill & Melinda Gates Foundation, BFA Global worked with bank executives and...

Financial inclusion rates in Africa are among the lowest in the world. Providing secure, affordable, and easy-to-use financial products...

In a previous blog post, we were introduced to how SAJIDA Foundation in Bangladesh is using evidence from...

African economies are currently undergoing dramatic changes, including a changing consumer base. Absolute poverty is reducing as a new...

FIBR will address the opportunities created by the rapid spread of smartphones in developing countries to harness this...

By Jamie M. Zimmerman Since the 2010 release of early speculation that applications and other tech development and programming...

The FIBR Launch will take place on Feb 25th, in Accra, Ghana. We will be joined by David Porteous,...

Open Application Programming Interfaces (APIs) are a necessary component of a robust digital ecosystem, and critical to the health...

Governments, the private sector, and the development community distribute billions in cash payments worldwide in the form of benefits,...

BFA Global co-authored this paper examines the use of technology in microinsurance and insurance sold through and with mobile...

How can we crack the nut of converting retail payments to digital form in Kenya? How might providers deliver...

This Consultative Group to Assist the Poor (CGAP) study was conducted by a joint research team from CGAP, the...

This CGAP Focus Note presents the evidence gained from a comprehensive study of the experiences in developing and implementing...

Since 2008, Bank of Tanzania has taken a progressive approach to designing a regulatory framework that has greatly contributed...

This paper studies the effect of payment digitization on the government-to-person (G2P) payment platform in Mexico. The main objective...

This report is based on research by BFA Global for GSMA in partnership with Visa Inc. It offers insights on...